CA Sanjeev Singhal

Article explains Legal provisions of GST Annual Returns, Points to Note on Annual GST Returns, Consequences of failure to submit the annual GST return and not getting the accounts audited (Notice to defaulters, Late Fee for delayed filing, General Penalty for Contravention of Provisions) and How to File the GST Form GSTR 9 Annual Return with Latest Format.

Page Contents

Legal provisions of GST Annual Returns

In order to understand the gamut of the GST Annual Returns and its requirement, it would be relevant for us to understand the legal provisions relevant for GST Annual Returns. Two important provisions which are relevant and important in this context are Section 35(5) and Section 44(1) of CGST Act, 2017.

In terms of section 35(5) “every registered person whose turnover during a financial year exceeds the prescribed limit shall get his accounts audited by a chartered accountant or a cost accountant

Means thereby that GST audit can be done by Chartered Accountants or Cost Accountants independent of Statutory Auditors or Retainer.

And shall submit a copy of the audited annual accounts, the reconciliation statement under sub-section (2) of section 44 and such other documents in such form and manner as may be prescribed

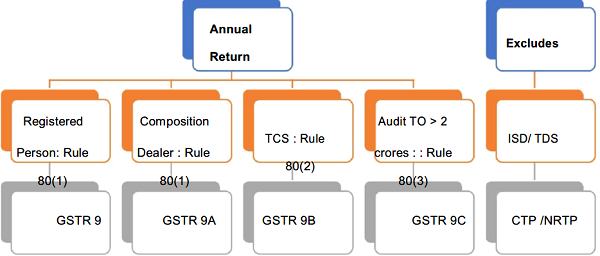

Section 44(1) requires that every registered person, other than an Input Service Distributor, a person paying tax under section 51 or section 52, a casual taxable person and a non-resident taxable person, shall furnish an annual return for every financial year electronically in such form and manner as may be prescribed on or before the thirty -first day of December following the end of such financial year. This form is notified by the government vide Notification 39/2018 on 4th September 2018.

In terms of Rule 80(1) of the CGST Rules, 2017 “Every registered person, other than an Input Service Distributor, a person paying tax under section 51 or section 52, a casual taxable person and a non-resident taxable person, shall furnish an annual return as specified under sub –section.

Further, Section 44(2) mandates every registered person who is required to get his accounts audited in accordance with Section 35(5) to furnish the copy of audited annual accounts and a reconciliation statement reconciling the value of supplies declared in the annual return with such audited annual financial statements.

In terms of Section 44(2), Rule 80(3) requires every registered person whose aggregate turnover during a financial year exceeds two crore rupees shall get his accounts audited as specified under sub-section (5) of section 35 and he shall furnish a copy of audited annual accounts and a reconciliation statement, duly certified, in FORM GSTR-9C.

Points to Note on Annual GST Returns

1. Every registered person is required to file annual return on or before 31st December of the year succeeding the financial year in form GSTR-9. Example – For F.Y 2017-18 annual return would be filed on 31st December 2018

2. Person paying tax under composition scheme is required to file annual return in form GSTR – 9A – Proviso to Sub Rule (1) of Rule 80.

3. Every electronic commerce operator who is required to collect tax at source under section 52 shall furnish annual statement in form GSTR – 9B – Sub Rule 2 of Rule 80.

4. Nil Annual Return- A person registered under GST but having no transactions during the year is still required to file a Nil Annual Return. A person who has got his registration cancelled during the year is also required to file the respective Annual returns.

5. A Registered person who has opted in or opted out of composition is required to file both GSTR 9 & GSTR 9A for the relevant periods.

6. The exceptions to filing of the Annual return applies to the following category of registered persons

- Input Service Distributor

- A person required to deduct TDS

- Casual Taxable Person

- Non-Resident Taxable Person

In case of the regular registered persons whose aggregate turnover exceeds Rs. 2 Crore, they are required to furnish the following

- GSTR 9 – The Annual Return

- Audited Annual Accounts

- GSTR 9C – A reconciliation statement mapping the annual returns Vs. the Audited Annual Accounts.

Summary

Consequences of failure to submit the annual GST return and not getting the accounts audited

1. Notice to defaulters

Section 46 of the CGST Act provides where a registered person fails to furnish a return under section 39 or section 44 or section 45, a notice shall be issued requiring him to furnish such return within fifteen days in such form and manner as may be prescribed.

2. Late Fee for delayed filing –

Section 47(2) of the CGST Act provides for levy of a late fee of Rs. 100/ – per day for delay in furnishing annual return in Form GSTR 9, subject to a maximum amount of quarter percent (0.25%) of the turnover in the State or Union Territory. Similar provisions for levy of late fee exist under the State / Union Territory GST Act, 2017.

On a combined reading of Section 47(2) and Section 44 (1) of the CGST Act, 2017 and State / Union Territory GST Act, 2017 a late fee of Rs.200/- per day (Rs. 100 +Rs.100 amount of half percent (0.25% under the CGST Law + 0.25% under the SGST / UTGST Law) of turnover in the State or Union Territory.

3. General Penalty for Contravention of Provisions –

Any person, who contravenes any of the provisions of this Act or any rules made there under for which no penalty is separately provided for in this Act, shall be liable to a penalty which may extend to twenty-five thousand rupees. An equal amount of penalty under the SGST/UTGST Act would also be applicable. Total penalty shall be Rs. 50,000.

GSTR 9 attempts to capture all the relevant transactions of the Registered Person for the relevant Financial year. From the headings and instructions given in the form, the Annual return merely summarizes the data for the relevant financial year based on the disclosure made in the relevant Form GSTR 1 and Form GSTR 3B. The data to be filled up in the annual return should be done on ‘as is’ basis. This means that even if one realizes that the data fed in the returns are incorrect, still that same data is to be taken for reporting in annual return. The actual data present in the financial statements and the books of accounts of the entity filling up the annual return is not to be considered at all for the purpose of reporting in annual return. So, the intent of the form is not to allow rectification of data filed in the monthly returns but only aggregation of such data in respect of the financial year.

How to File the GST Form GSTR 9 Annual Return with Latest Format

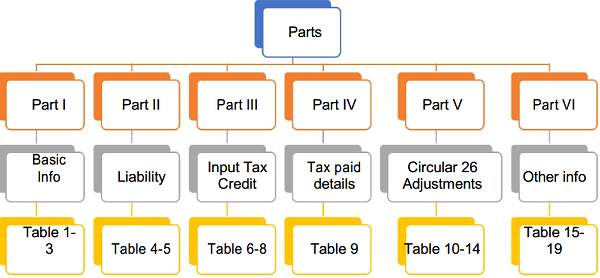

The GSTR-9 is divided into six parts and 19 tables. Here you go:

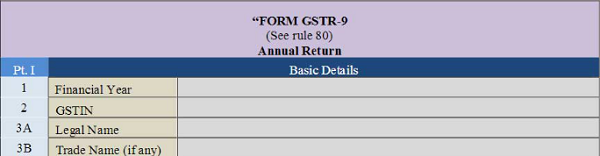

Part I: Basic Details has the following three sections and four tables:

- Financial Year for which return is being filed.

Note: For FY 2017-18, it will contain details for July 2017 to March 2018 period. - GSTIN of the taxpayer

- 3A Legal Name of the registered person

- 3B Trade Name (if any) of the registered business

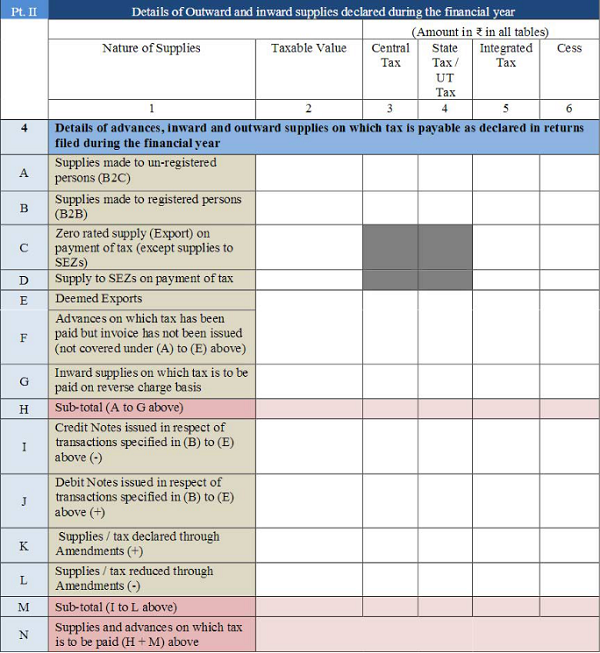

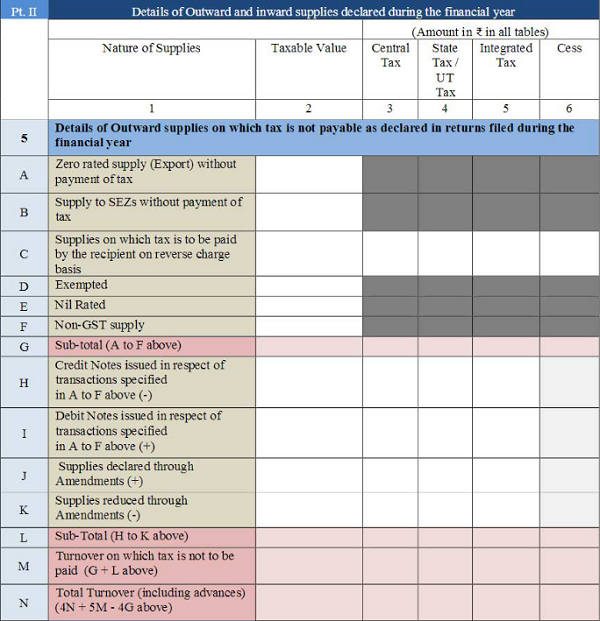

Part II: It consists of details of Inward and Outward supplies made during the particular financial year for which the return is being filed. In short, this part contains a consolidated data of all the supplies reported by the taxpayer in all his/her returns filed during that year. It has been divided into the following sections and tables.

- This section will contain the details of advances, inward and outward supplies on which tax is payable as declared in returns filed during the financial year.

- 4A Supplies made to un-registered persons (B2C): The table will contain the aggregate value of supplies made to unregistered persons such as consumers, including the supplies made via e-commerce means, on which the supplier paid tax.

- 4B Supplies made to registered persons (B2B): The table will contain the aggregate value of supplies made to registered persons, including the supplies made to UINs, on which the supplier paid tax. It will also contain details of the supplies made through e-commerce websites on which tax was paid by the supplier.

- 4C Zero rated supply (Export) on payment of tax (except supplies to SEZs): This field will contain details of zero-rated supplies such as exports on which tax has already been paid.

- 4D Supply to SEZs on payment of tax: The supplier will declare an aggregate value of supplies made to SEZ units on which tax has been paid.

- 4E Deemed Exports: Provide the aggregate value of supplies of deemed exports nature on which the supplier has paid the tax.

- 4F Advances on which tax has been paid but invoice has not been issued (not covered under (A) to (E) above): Mention details of unadjusted advances on which tax has been paid but invoices are not issued in this financial year.

- 4G Inward supplies on which tax is to be paid on reverse charge basis: It will contain an aggregate value of all input supplies (purchases), including supplies made by registered and unregistered persons and import of services, on which tax is to be paid by the recipient on the reverse charge basis.

- 4H Sub-total (A to G above)

- 4I Credit Notes issued in respect of transactions specified in (B) to (E) above (-): the Consolidated value of credit notes issued in respect of transactions mentioned in the above fields (4B to 4E) goes here.

- 4J Debit Notes issued in respect of transactions specified in (B) to (E) above (+): the Consolidated value of debit notes issued in respect of transactions mentioned in the above fields (4B to 4E) goes here.

- 4K Supplies/tax declared through Amendments (+): Details of tax added through amendments in the above-mentioned details.

- 4L Supplies/tax reduced through Amendments (-): Details of tax reduced through amendments in the above-mentioned details.

- 4M Sub-total (I to L above)

- 4N Supplies and advances on which tax is to be paid: 4H + 4M (above)

- Details of Outward supplies on which tax is not payable as declared in returns filed during the financial year

- 5A Zero rated supply (Export) without payment of tax: This field will contain details of zero-rated supplies such as exports on which tax has not been paid.

- 5B Supply to SEZs without payment of tax: Contains details of supplies made to SEZ units on which tax has not been paid.

- 5C Supplies on which tax is to be paid by the recipient on reverse charge basis: Mention here the total value of supplies made to registered persons on which GST was paid by the recipient on RCM basis.

- 5D (Exempted)/ 5E (Nil Rated)/ 5F (Non-GST supply): an Aggregate value of exempted, Nil Rated and Non-GST supplies shall be declared here. Table 8 of FORM GSTR-1 may be used for filling up these details. The value of “no supply” shall also be declared here.

- 5G Sub-total (A to F above)

- 5H Credit Notes issued in respect of transactions specified in A to F above (-): an Aggregate value of credit notes issued in respect of supplies declared in 5A,5B,5C, 5D, 5E and 5F shall be declared here. Table 9B of FORM GSTR-1 may be used for filling up these details

- 5I Debit Notes issued in respect of transactions specified in A to F above (+): an Aggregate value of debit notes issued in respect of supplies declared in 5A,5B,5C, 5D, 5E and 5F shall be declared here. Table 9B of FORM GSTR-1 may be used for filling up these details.

- 5J and 5K Supplies declared through Amendments (+), Supplies reduced through Amendments (-): Details of amendments made to exports (except supplies to SEZs) and supplies to SEZs on which tax has not been paid shall be declared here. Table 9A and 14 Table 9C of FORM GSTR-1 may be used for filling up these details.

- 5L Sub-Total (H to K above)

- 5M Turnover on which tax is not to be paid (G + L above)

- 5N Total Turnover (including advances) (4N + 5M – 4G above): Total turnover including the sum of all the supplies (with additional supplies and amendments) on which tax is payable and tax is not payable shall be declared here. This shall also include a number of advances on which tax is paid but invoices have not been issued in the current year. However, this shall not include the aggregate value of inward supplies on which tax is paid by the recipient (i.e. by the person filing the annual return) on the reverse charge basis.

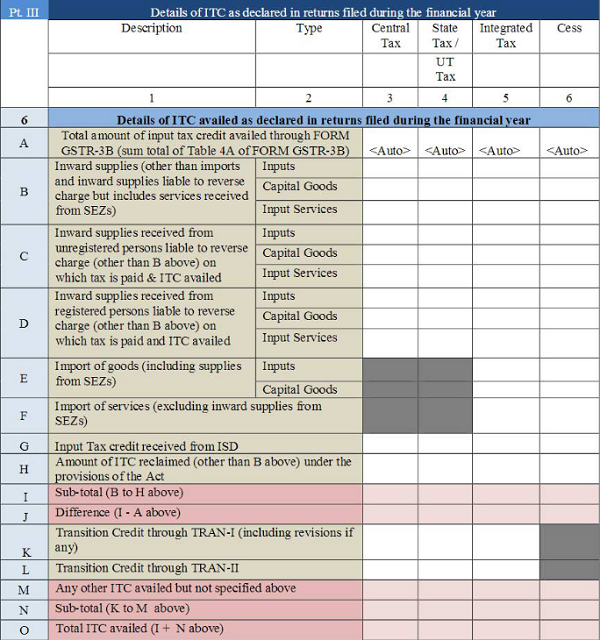

Part III: It consists of details of ITC as declared in returns filed during the financial year

- 6.This section will contain the details of ITC availed as declared in returns filed during the financial year:

- 6A Total amount of input tax credit availed through FORM GSTR-3B (the sum total of Table 4A of FORM GSTR-3B): Total input tax credit availed in Table 4A of FORM GSTR-3B for the taxpayer would be auto-populated here.

- 6B Inward supplies (other than imports and inward supplies liable to reverse charge but includes services received from SEZs): an Aggregate value of input tax credit availed on all inward supplies except those on which tax is payable on reverse charge basis but includes the supply of services received from SEZs shall be declared here. It may be noted that the total ITC availed is to be classified as ITC on inputs, capital goods and input services. Table 4(A)(5) of FORM GSTR-3B may be used for filling up these details. This shall not include ITC which was availed, reversed and then reclaimed in the ITC ledger. This is to be declared separately under 6(H) below.

- 6C Inward supplies received from unregistered persons liable to reverse charge (other than B above) on which tax is paid & ITC availed: Aggregate value of input tax credit availed on all inward supplies received from unregistered persons (other than import of services) on which tax is payable on reverse charge basis shall be declared here. It may be noted that the total ITC availed is to be classified as ITC on inputs, capital goods and input services. Table 4(A)(3) of FORM GSTR-3B may be used for filling up these details

- 6D Inward supplies received from registered persons liable to reverse charge (other than B above) on which tax is paid and ITC availed: an Aggregate value of input tax credit availed on all inward supplies received from registered persons on which tax is payable on reverse charge basis shall be declared here. It may be noted that the total ITC availed is to be classified as ITC on inputs, capital goods and input services. Table 4(A)(3) of FORM GSTR-3B may be used for filling up these details.

- 6E Import of goods (including supplies from SEZs): Details of input tax credit availed on the import of goods including the supply of goods received from SEZs shall be declared here. It may be noted at the total ITC availed is to be classified as ITC on inputs and capital goods. Table 4(A)(1) of FORM GSTR-3B may be used for filling up these details.

- 6F Import of services (excluding inward supplies from SEZs): Details of input tax credit availed on the import of services (excluding inward supplies from SEZs) shall be declared here. Table 4(A)(2) of FORM GSTR- 15 3B may be used for filling up these details.

- 6G Input Tax credit received from ISD: an Aggregate value of input tax credit received from input service distributor shall be declared here. Table 4(A)(4) of FORM GSTR-3B may be used for filling up these details.

- 6H Amount of ITC reclaimed (other than B above) under the provisions of the Act: an Aggregate value of input tax credit availed, reversed and reclaimed under the provisions of the Act shall be declared here.

- 6I Sub-total (B to H above):

6J Difference (I – A above): The difference between the total amount of input tax credit availed through FORM GSTR-3B and input tax credit declared in row B to H shall be declared here. Ideally, this amount should be zero. - 6K Transition Credit through TRAN-I (including revisions if any): Details of transition credit received in the electronic credit ledger on the filing of FORM GST TRAN-I including revision of TRAN-I (whether upwards or downwards), if any shall be declared here.

- 6L Transition Credit through TRAN-II: Details of transition credit received in the electronic credit ledger after the filing of FORM GST TRAN-II shall be declared here

- 6M Any other ITC availed but not specified above: Details of ITC availed but not covered in any of heads specified under 6B to 6L above shall be declared here. Details of ITC availed through FORM ITC01 and FORM ITC-02 in the financial year shall be declared here.

- 6N Sub-total (K to M above)

- 6O Total ITC availed (I + N above)

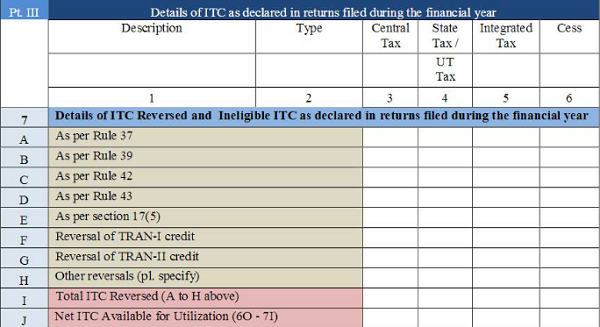

- 7. It consists of details of ITC Reversed and Ineligible ITC as declared in returns filed during the financial year.

- 7A As per Rule 37

- 7B As per Rule 39

- 7C As per Rule 42

- 7D As per Rule 43

- 7E As per section 17(5)

- 7F Reversal of TRAN-I credit

- 7G Reversal of TRAN-II credit

- 7H Other reversals (pl. specify)

- 7I Total ITC Reversed (A to H above)

- 7J Net ITC Available for Utilization (6O – 7I)

Details of input tax credit reversed due to ineligibility or reversals required under rule 37, 39,42 and 43 of the CGST Rules, 2017 shall be declared here. This column should also contain details of any input tax credit reversed under section 17(5) of the CGST Act, 2017 and details of ineligible transition credit claimed under FORM GST TRAN-I or FORM GST TRAN-II and then subsequently reversed. Table 4(B) of FORM GSTR-3B may be used for filling up these details. Any ITC reversed through FORM ITC -03 shall be declared in 7H.

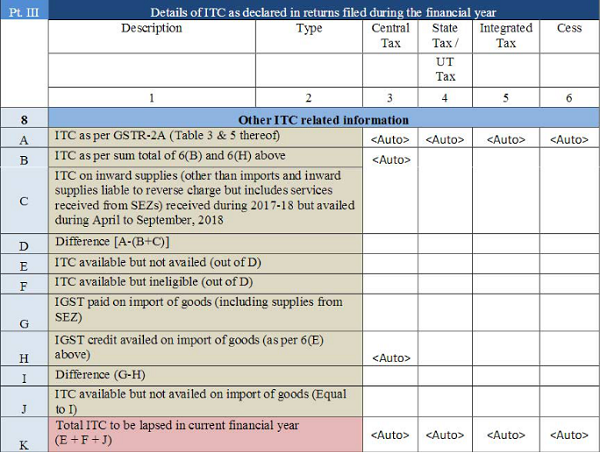

- 8. Other ITC related information will be provided in this section.

- 8A ITC as per GSTR-2A (Table 3 & 5 thereof: The total credit available for inwards supplies (other than imports and inwards supplies liable to reverse charge but includes services received from SEZs) received during 2017-18 and reflected in FORM GSTR-2A (table 3 & 5 only) shall be auto-populated in this table. This would be the aggregate of all the input tax credit that has been declared by the corresponding suppliers in their FORM GSTR-I.

- 8B ITC as per sum total of 6(B) and 6(H) above: The input tax credit as declared in Table 6B and 6H shall be auto-populated here.

8C ITC on inward supplies (other than imports and inward supplies liable to reverse charge but includes services received from SEZs) received during 2017-18 but availed during April to September, 2018: Aggregate value of input tax credit availed on all inward supplies (except those on which tax is payable on reverse charge basis but includes supply of services received from SEZs) received during July 2017 to March 2018 but credit on which was availed between April to September 2018 shall be declared here. Table 4(A)(5) of FORM GSTR-3B may be used for filling up these details. - 8D Difference [A-(B+C)]

- 8E ITC available but not availed (out of D) and 8F ITC available but ineligible (out of D): an Aggregate value of the input tax credit which was available in FORM GSTR2A (table 3 & 5 only) but not availed in any of the FORM GSTR-3B returns shall be declared here. The credit shall be classified as credit which was available and not availed or the credit was not availed as the same was ineligible. The sum total of both the rows should be equal to the difference in 8D.

- 8G IGST paid on import of goods (including supplies from SEZ): an Aggregate value of IGST paid at the time of imports (including imports from SEZs) during the financial year shall be declared here.

- 8H IGST credit availed on the import of goods (as per 6(E) above): The input tax credit as declared in Table 6E shall be auto-populated here

- 8I Difference (G-H)

- 8J ITC available but not availed on the import of goods (Equal to I)

- 8K Total ITC to lapse in the current financial year (E + F + J): The total input tax credit which shall lapse for the current financial year shall be computed in this row.

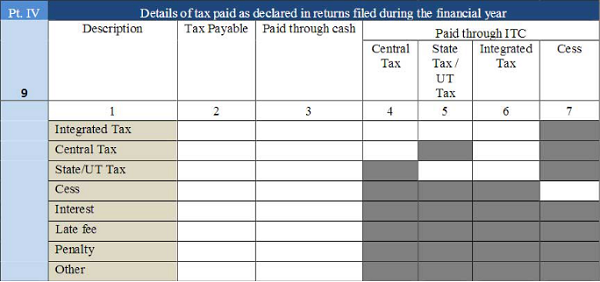

Part IV: Details of tax paid as declared in returns filed during the financial year

- 9. Details of tax paid as declared in returns filed during the financial year

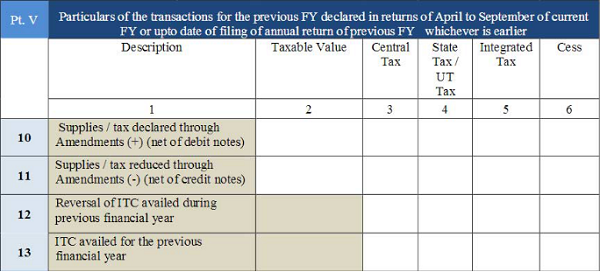

Part V: Particulars of the transactions for the previous FY declared in returns of April to September of current FY or up to date of filing of annual return of previous FY whichever is earlier

- 10 Supplies / tax declared through Amendments (+) (net of debit notes) and 11 Supplies / tax reduced through Amendments (-) (net of credit notes): Details of additions or amendments to any of the supplies already declared in the returns of the previous financial year but such amendments were furnished in Table 9A, Table 9B and Table 9C of FORM GSTR-1 of April to September of the current financial year or date of filing of Annual Return for the previous financial year, whichever is earlier shall be declared here.

- 12 Reversal of ITC availed during the previous financial year: an Aggregate value of reversal of ITC which was availed in the previous financial year but reversed in returns filed for the months of April to September of the current financial year or date of filing of Annual Return for previous financial year, whichever is earlier shall be declared here. Table 4(B) of FORM GSTR-3B may be used for filling up these details.

- 13 ITC availed for the previous financial year: Details of ITC for goods or services received in the previous financial year but ITC for the same was availed in returns filed for the months of April to September of the current financial year or date of filing of Annual Return for the previous financial year whichever is earlier shall be declared here. Table 4(A) of FORM GSTR-3B may be used for filling up these details.

- 14 Differential tax paid on account of declaration in 10 & 11 above

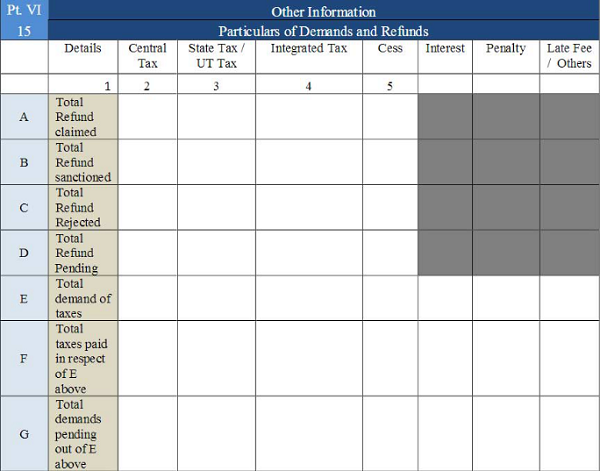

Part VI: Other Information

- 15A, 15B, 15C and 15D: Particulars of Demands and Refunds: an Aggregate value of refunds claimed, sanctioned, rejected and pending for processing shall be declared here. Refund claimed will be the aggregate value of all the refund claims filed in the financial year and will include refunds which have been sanctioned, rejected or are pending for processing. Refund sanctioned means the aggregate value of all refund sanction orders. Refund pending will be the aggregate amount in all refund application for which acknowledgment has been received and will exclude provisional refunds received. These will not include details of non-GST refund claims.

- 15E, 15F and 15G: Total demand of taxes, Total taxes paid in respect of above, Total demands pending out of E above: an Aggregate value of demands of taxes for which an order confirming the demand has been issued by the adjudicating authority shall be declared here. an Aggregate value of taxes paid out of the total value of confirmed demand as declared in 15E above shall be declared here. an Aggregate value of demands pending recovery out of 15E above shall be declared here.

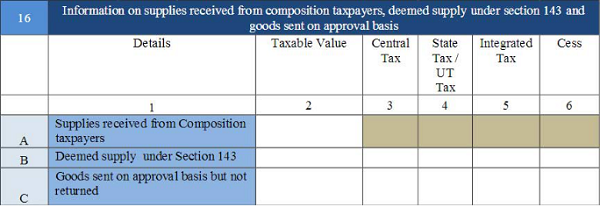

- Information on supplies received from composition taxpayers, deemed supply under section 143 and goods sent on the approval basis

- 16A Supplies received from Composition taxpayers: an Aggregate value of supplies received from composition taxpayers shall be declared here. Table 5 of FORM GSTR-3B may be used for filling up these details.

- 16B Deemed supply under Section 143: an Aggregate value of all deemed supplies from the principal to the job-worker in terms of sub-section (3) and sub-section (4) of Section 143 of the CGST Act shall be declared here.

- 16C Goods sent on approval basis but not returned: an Aggregate value of all deemed supplies for goods which were sent on approval basis but were not returned to the principal supplier within one eighty days of such supply shall be declared here.

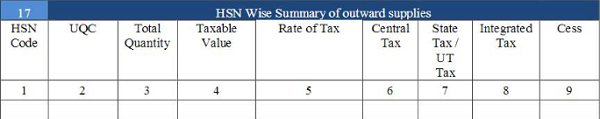

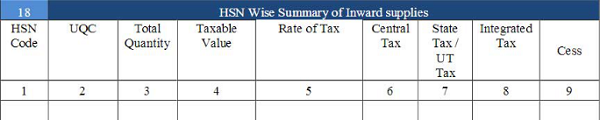

- 17. HSN Wise Summary of outward supplies and 18. HSN Wise Summary of Inward supplies: Summary of supplies effected and received against a particular HSN code to be reported only in this table. It will be optional for taxpayers having annual turnover up to ₹ 1.50 Cr. It will be mandatory to report HSN code at two digits level for taxpayers having an annual turnover in the preceding year above ₹ 1.50 Cr but upto ₹ 5.00 Cr and at four digits’ level for taxpayers having an annual turnover above ₹ 5.00 Cr. UQC details to be furnished only for the supply of goods. Quantity is to be reported net of returns. Table 12 of FORM GSTR1 may be used for filling up details in Table 17.

….

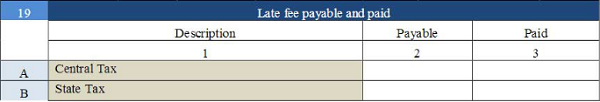

- 19. Late fee payable and paid: Late fee will be payable if annual return is filed after the due date.

Disclaimer :

The contents of this article are solely for information and knowledge and does not constitute any professional advice or recommendation. Author does not accept any liability for any loss or damage of any kind arising out of this information set out in the article and any action taken based thereon.

About the Author:

Author is Founder Partner of G R A N D M A R K & ASSOCIATES LLP and Domain Head of Goods and Service Tax. He can be reached at sanjeev.singhal@grandmarkca.com.

I have claimed some ITC of 2017-18 in the GSTR-3B of March 2019. Should I have to declare this in the annual return GSTR-9 of 2017-18? If yes then where?

vary nice explain sir.Thank You

Great explanation, thanks

SIR, YOU HAVE DONE A VERY GOOD FANTASTIC JOB TO EDUCATE AND LEARNING MORE ABOUT GSTR 9 AND 9 C FOR EVERY BODY

Very useful explanations. Thank you…!

Thank you very much Sir

vary nice explain sir.

is the form available in gst site ?

Hello sir!! very detailed and useful information.Thanks for writing this article.

If I have filed GSTR 10 then also Filing of GSTR 9 is compulsory or not ?

perfect explanation in simple way.Thanks

Sir,

one of my client HSN code wise inward and outward details not noted. if there any alternative my problem sir.

VERY NICELY NARRATED AND EXPLAINED, THAN EVER READ.

THANKS A TON FOR SHARING YOUR KNOWLEDGE.