Case Law Details

Aravindan Vedhavaththiyar Singarachari Vs DCIT (ITAT Bangalore)

In the case of Aravindan Vedhavaththiyar Singarachari vs. DCIT, the Income Tax Appellate Tribunal (ITAT) Bangalore addressed the importance of issuing a notice under Section 143(2) of the Income Tax Act for a valid assessment. The assessee’s returns for the assessment years 2016-17 and 2018-19 were reopened due to discrepancies in declared capital gains from property sales. The Assessing Officer (AO) issued a notice under Section 148, assuming jurisdiction, but failed to issue the required notice under Section 143(2). The assessee challenged this, arguing that without the notice, the reassessment proceedings were void. The ITAT ruled in favor of the assessee, emphasizing that the issuance and service of a notice under Section 143(2) after the filing of the return of income (ROI) is essential for completing a valid reassessment. The Tribunal noted that the AO’s failure to issue this notice rendered the reassessment invalid, as it violated procedural requirements. The ruling reinforces the legal principle that proper procedural adherence is crucial in income tax assessments.

FULL TEXT OF THE ORDER OF ITAT BANGALORE

These two appeals of the assessee are arising from the orders passed by the NFAC, Delhi dated 08/03/2024 in DIN No. ITBA/NFAC/S/250/2023-24/1062260533(1) for the Assessment Year (AY) 2016-17 & DIN No. ITBA/NFAC/S/250/2023-24/106226258(1) for AY 2018-19. Since issues involved in both the appeals are akin, we are deciding these appeals by common order. We will take AY 2016-17 as lead case and discussed the facts of the same for the sake of brevity.

2. The assessee is an individual, filed his return of income (ROI) originally on 04/08/2016 declaring an income of Rs.3260471/-. The same was processed u/s 143(1) of the Income Tax Act, 1961 (hereinafter called ‘the Act’) and thereafter the case of the assessee for the impugned year was reopened by the Department on the basis of following reasons :-

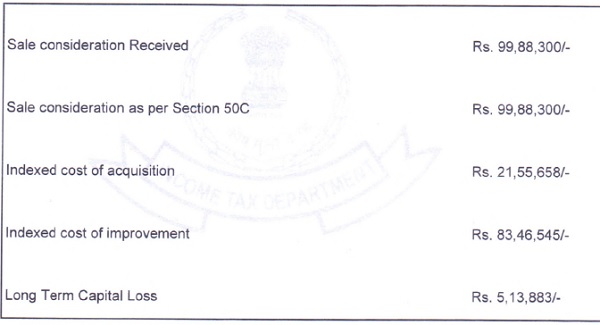

“In this case, information has been received from the Office of the Joint Director of Income Tax (I&CI), Bangalore regarding that the assessee had sols eight immovable properties during the year, but, disclosed capital gains only for one property. Further, the information was also received that the stamp duty value of all the eight properties has been assessed at Rs. 27,89,88,000/-. On receipt of the information, independent enquiries have been made and it is seen that the assessee has furnished ITR for A.Y. 2016-17 on 04/08/2016 declaring gross total income at Rs. 32.60,471/-and total income of Rs. 31,10,470/- after claiming deduction of Rs. 1.50,000/- under Chapter- VIA of the Income Tax Act, 1961. In this ITR, the assessee has declared income from Salary Rs. 32,60,471/-and carry forward of current year loss from long term capital gains at Rs. 5,13,883/. Further, on perusal of the Schedule of Capital Gains, it is seen that the assessee has declared long term capital loss as under:-

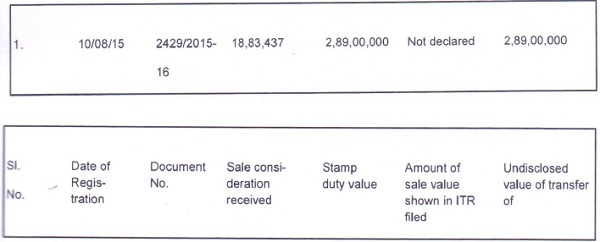

The copies of sale deeds of eight properties is available on records. The details of sale transactions carried out by the assessee and guidance value of the property and amounts forming part of computation of income shown in the Income Tax Return filed for AY. 2016-17 are tabulated as under:

Thus, it can be seen that the assessee had received sale consideration on sale of eight properties amounting to Rs. 2,90,19,392/-, but, declared sale consideration on sale of property at Rs. 99,83,300/- only, which is pertaining to sale of only one property sold vide sale deed registered as document number 2633/201516 dated 21/08/2015 and the assessee has failed to disclosed capital gains on sale of remaining seven properties. In this case, the stamp duty value of all eight properties have been assessed by the Stamp and Registration Authority at Rs.26,89,99,677/-. Therefore, as per the provisions of Section 50C of the Income Tax Act, 1961, the assessee is liable to declared long term capital gains by adopting deemed sale consideration at Rs. 26,89,99,677/-. However, the assessee has failed to do so. It has also been seen that the assessee has furnished incorrect details regarding sale consideration of one property sold and declared in the ITR as per the provisions of section 50C of the Income Tax Act, 1961 at Rs. 99,88,323/- as against the actual value assessed at Rs. 2,46,91,677/-. In view of these facts, the deemed sale consideration of the properties at Rs. 27,89,88,000/- has escaped assessment. It is seen from the ITR that the assessee has declared only income under the head Income from Salary. However, it is seen from the 26AS that the assessee has received taxable interest income on fixed deposits amounting to Rs. 138,478/- from Andhra Bank and the assessee has failed to declare the same to tax in the ITR filed, thus, the taxable interest income received on fixed deposits has also escaped assessment.”

3. After recording the above reasons, the AO issued 148 notice and assumed jurisdiction over the assessee. Thereafter, the AO completed the assessment u/s 147 r.w.s 143(3) of the Act determining total income of the assessee to the tune of Rs.27, 22,48,625/-. Here it is pertinent to note that in none of AYs the AO has issued notice of 143(2) of the Act at all before completing the assessments and disposed off the objections filed by the assessee challenging the assumption of jurisdiction by AO u/s 148 of the Act.

4. Aggrieved with the order of the AO, the assessee preferred appeals before the CIT(A) and assailed the Order of the AO both on merits as well as on legal grounds. However, the CIT (A) could not find any force in the arguments of the assessee and hence dismissed the appeals.

5. Feeling aggrieved by the order of the CIT(A), assessee is in appeal before us.

6. The assessee has raised 9 grounds of appeal; ground No.1 is general in nature. In ground Nos.3 and 4, assessee has challenged the jurisdiction of the AO u/s 148 of the Act. In the rest of the grounds, assessee has challenged the action of the AO on merits of the additions.

7. So far as ground Nos.2 and 2.1 relating to limitation issue in respect of impugned reassessments is concerned, the AR, on instructions, has not pressed these grounds. The learned Counsel for the assessee pressing ground number 3 and 4 vehemently argued that the present reassessment proceedings are void ab initio for the following reasons:

i) The AO failed to issue any notice under section 143(2) of the Act after the filing ROI by the assessee in response to notice under section 148 of the Act.

ii) The AO has failed to dispose-off the objections filed by the assessee in pursuance to the notice issued under section 148 of the Act by way of separate order as per the guidelines of Hon’ble Supreme Court in the case of GKN Drive Shaft reported in 259 ITR 119(SC).

iii) Learned AR has relied upon various decisions to buttress his arguments which are discussed in this order in subsequent Para(s).

8. The learned DR, appearing virtually, vehemently contented that since assessee has not filed ROI in response to the notice of 148 of the Act within the time prescribed in notice issued under section 148 of the Act, the return so filed was an invalid/ defective ROI, hence there was no need for the AO to issue notice under section143 (2) of the Act. The Ld. DR painstakingly, filed written submissions and vehemently argued that the AO has rightly assumed the jurisdiction over the assessee and the order passed is legally tenable. She also relied on various decisions (discussed in later part of the order) and has filed written submissions also.

9. In rejoinder on the issue of notice issued under section 143(2) of the Act, the counsel for the assessee has drawn the attention of Bench towards Page Number-10 of the Paper Book & page numbers 35 and 36 of the Paper Book (item number-4 Annexure-3 Pg. 36).Ld AR averted that the contention of the DR that assessee has not filed any return of Income in pursuance to the notice issued under section 148 of the Act, is factually incorrect. He pointed out that in fact the assessee has filed ROI twice in 148 proceedings, one on 28.02.2022, when the assessee uploaded the copy of the original return as Annexure-3 (page numbers 35 and 36 of Paper Book) and one 10.03.2022, when assessee filed a return under protest of 148 declaring same income as declared originally.

10. Learned Counsel for the assessee further contented that after the receipt of notice under section 148 of the Act, assessee filed a letter dated 03.04.2021 and requested for some time to comply with the directions of the AO. (Pg-9 of Paper Book). He pointed out that assessee had also filed reply somewhere in June 2023(fact note by AO in assessment order)

11. Ld Counsel further argued that the AO has not treated the ROI filed in response to notice issued under section 148 of the Act, as defective as evident from the fact that the AO has neither issued any notice as per the mandate of Section 139(9) of the Act, for treating a ROI as defective, nor launched any prosecution against the assessee in terms of the provisions of section 276CC of the Act. Which provisions empower an AO, to launch prosecution in cases, where no return is furnished in due time, in response to the notice of 148 of the Act. Lastly the AR drew the attention of the Bench towards the final computation of Income made by the AO and submitted that the AO has, in fact, considered the same income as has been declared by assessee in his ROI and hence the AO has impliedly accepted the ROI as valid not defective. He concluded by saying that in such circumstances, it was incumbent on the AO to issue notice under section 143(2) of the Act before tinkering the returned income.

12. We have given thoughtful consideration to the facts and circumstances of the present case. We have seen the sequence of events and provisions of law as applicable to re-assessment proceedings under the Act.

13. Learned DR basically argued that assessee has not filed ROI in the stipulated time and therefore AO was correct in law in framing the assessment without issuance of any notice under section 143(2) of the Act and framing the assessment under section 144 of the Act.

14. The above arguments of learned DR look attractive. However, the arguments failed when examined on the touch stone of admitted facts of the present case. Perusal of Para 10 of Assessment Order for AY 2016-17 and Para 6 of Assessment order for AY 2018-19 would clearly show that the AO has framed the assessment under section 143(3) of the Act and not under section 144 of the Act. For the sake of convenience, the observations of the AO in Para 10 (AY 2016-17) & Para 6(AY2018-19) of the Assessment Order are reproduced hereunder:

“This order is being passed under section 143(3) r.w.s. 147r.w.s. 144B of the Act”

15. Perusal of lines of the Assessment Orders along with other events happened at the time of assessment would show clearly that Assessment Order was passed under section 143(3) of the Act and not under section 144 of the Act as contended by learned DR.

16. We also wish to quote expression used in provisions of section 148 of the Act, “provisions of this Act shall, so far as may be, apply accordingly as if such return were a return required to be furnished under section 139” which means provisions of section 139 of the Act have to complied in toto as whole while framing an assessment under section 148 of the Act mandatorily.

17. Perusal of sub-section (9) of 139 of the Act would show that if a return filed by an assessee is defective, then the AO has to intimate the assessee about such defect and in case an assessee would fail to remove the defect so pointed out then such return would be treated as invalid return. However, in the case at hand, perusal of records would show that no such defect notice has been issued by the AO. On the contrary, while finalizing the Assessment, the AO has adopted the same figures as disclosed by assessee in its original return and return filed in pursuance to notice issued under section 148 of the Act meaning thereby the AO has not treated the return filed as defective and has taken the ROI in cognizance while passing the reassessment order. Neither the AO has launched prosecution u/s 276CC, which empowers an AO to launch prosecution against an assessee who could not file ROI in pursuance to the notice of 148. All these events would show that the AO has impliedly condoned the delay happened in filing of ROI and has not treated the ROI as an invalid ROI. Therefore, the arguments of learned DR would be of no help to the Department.

18. We would also like to quote here the recent decision of the Hon’ble Patna High Court in the case of CIT Vs Nagendra Parasad 156 Taxman.19(Pat), in which case also the return was filed after the expiry of eight and half months after the expiry of time prescribed in 148 notice, the observations of the Hon’ble High Court are as under:-

“The Tribunal found, relying on the decision in Hotel Blue Moon (supra) that the proceedings are liable to be struck down. It was held that the return was filed by the assessee in response to the notice under section 148 though delayed and in such circumstance, there should have been a notice issued under section 143(2) as has been held in Hotel Blue Moon (supra). 4. The only question of law arising in the facts and circumstances of the case is whether notice should have been issued under section 143(2) of the Income-tax Act? 5. Admittedly, the notice was issued by the Assessing Officer under section 148 of the Act on 14-7-2008 requiring the assessee to file a return within thirty days. A return was filed much later on 31-3-2009, after eight and a half months.

6. On identical facts, in M.A. No. 239 of 2011 titled as Chand Bihari Agrawal v. Commissioner Of Income Tax, Central, Patna decided on 257-2023, this Court considered the issue and held against the revenue. 7. We find that the question of law has to be answered in favour of the assesee and against the revenue. Hotel Blue Moon (supra) governs the issue which has been followed in Chand Bihari Agrawal (supra).”

19. Reliance placed by learned DR in the decision rendered by Hyderabad Bench of the Tribunal is misplaced because in that case, assessee has not filed any return. For the sake of clarity, we would like to quote the observations of the Hon’ble Bench :

“8. We have gone through the record in the light of the submissions made on either side. We shall look at the allegation as to filing of return of income in the light of the facts available on record. It could be seen from the assessment order that notice under section 148 of the Act was issued on 28/03/2019 and the same was served on the assessee, but there was no response from the assessee. Likewise, when the case was posted for hearing on 24/06/2019, notice dated 12/04/2019 calling for the details was issued, it was served on the assessee on 13/06/2019, but again there was no response from the assessee. Notice granting another opportunity was issued on 24/10/2019 fixing the date of hearing on 06/11/2019 and served on the assessee on 25/10/2019. Still there was no response from the assessee. Lastly, there was appearing for the assessee before the AO after 29/11/2019

11. We agree with the observations of both the authorities that there is no return of income filed pursuant to the notice issued under section 148 of the Act. In the case of Hotel Blue Moon(supra) the Hon’ble Apex Court held that section 143(2) of the Act itself becomes necessary when it becomes necessary to check the return. In the case of Oberoi Hotels (P.) Ltd (supra) the Hon’ble Calcutta High Court held that the dictum of the Hon’ble Supreme Court in the case of Hotel Blue Moon(supra) is that a notice issued under section 143(2) of the Act is mandatory if the return as filed, is not accepted and an assessment order is to be made at variance with the return filed by the assessee. It, therefore, goes without saying that non-issuance of notice under section 143(2) of the Act vitiates the proceedings if the assessee filed the return of income, such a return as filed was not acceptable to the AO and the assessment has to be made at variance with the return filed by the assessee. If no return of income is filed by the assessee, such allegation does not arise.

12. We have gone through the various decisions relied upon by the assessee and in all the cases invariably within the time stipulated in the notice issued under section 148 of the Act, either the assessee or the authorized representative either filed the return of income or submitted that the original return of income may be treated as the return of income filed pursuant to the notice under section 148 of the Act. Here in this case no return of income was filed within the time, and no return of income was filed till the commencement of hearing. It was only when the proceedings are going on, that too without obtaining the permission of the AO, the return was filed online and on the next day the AO was informed of such online filing.

13. For these reasons, we brush aside the contention of the assessee that for want of issuance of notice under section 143(2) of the Act, the assessment is bad under law. Next contention of the assessee is that assessment is bad for want of sanction of the learned PCIT before issuance of notice under section 148 of the Act.”

20. Perusal of the above observations of the Hyderabad Bench would clearly show that in that case the assessee failed to file any return of income in response to the notice under section 148 of the Act. The assessee has filed only his submissions on merits of the addition and that too during the course of reassessment proceedings, in that case the AR of the assessee contend that submissions made by assessee would be considered as ROI in response to 148 notice. However, in the case at hand the assessee has filed a specific uploaded the copy of ROI vide his reply dated 28.02.2022( Pg. No-35&36 of PB), and subsequently has also filed the ROI specifically during reassessment proceedings. Further no one from the side of assessee has brought to the notice of Hyderabad Bench the case of Hon’ble Patna High Court reported in 156 taxman.com 19(Pat) in the case of CIT Vs Nagender Parsad(Supra), in which case also the assessee has filed return after the expiry of eight months from the time prescribed in notice issued under section 148 of the Act.

21. Next case relied on by the learned DR is the decision of Hon’ble Madras High Court in the case of Areva T and D India Ltd Vs ACIT reported in 294 ITR 233(Mad) (order dated 06th August 2008). That decision is not applicable to the facts of the present case. Further the decision of Hon’ble Madras High Court is prior to the judgment of Hon’ble Apex Court in the case of Hotel Blue moon reported in 319 ITR 326(SC) decided by Apex Court in 2010. After the arrival of Hon’ble Apex Court judgment in the case of Hotel Blue moon, this issue is no more res-intigra.

22. It is pertinent to note the latest decisions of Hon’ble Madrass High Court in the case of Sapthagiri Finance & Investments v. ITO (2013) 90 DTR 289 (Mad). Relevant facts of the case are as under:-

21. In that case the notice under section 148 was issued on 20.05.2002. Assessee could not file any return in response to that notice. Then notice u/s 142(1) was issued and in response to that assessee filed ROI on 18.12.2002. And finally assessment was completed on 31.12.2002. In the back drop of these facts the ITAT has decided the matter against the assessee holding that noncompliance of issuance of 143(2) provision would not fatal to the reassessment proceedings. ITAT further observed that since assessee has duly participated in reassessment proceedings he had wavied his right for issuance of 143(2) proceedings. Matter reached to the Hon’ble High Court and following questions of laws inter alia were formulated by the Hon’ble High Court :

(i) ……..

(ii) ……….

(iii) Whether on the facts and in the circumstances of the case the Tribunal was right in holding that the appellant has requested the Assessing Officer to complete the assessment, which amounts to waiver of notice under Section 143(2)?

(iv) Whether on the facts and in the circumstances of the case the Tribunal was right in holding that the appellant has requested the Assessing Officer to complete the assessment, which amounts to waiver of notice under Section 143(2)?

Hon’ble High Court while deciding the above questions of law has observed as under:-

“Merely because the matter was discussed with the Assessee and the signature is affixed it does not mean the rest of the procedure of notice under Section 143(2) of the Act was complied with or that on placing the objection the Assessee had waived the notice for further processing of the reassessment proceedings. The fact that on the notice issued u/s 143(2) of the Act, the assessee had placed its objection and reiterated its earlier return filed as one filed in response to the notice issued u/s 148 of the Act and the Officer had also noted that the same would be considered for completing of assessment, would show that the AO has the duty of issuing the notice under Section 143(2) to lead on to the passing of the assessment. In the circumstances, with no notice issued u/s 143(3) and there being no waiver, there is no justifiable ground to accept the view of the Tribunal that there was a waiver of right of notice to be issued u/s 143(2) of the Act.”

23. Further, a reference can be made to the following decisions of Co-ordinate Benches of the Banglore ITAT, wherein after following the mandate of Hon’ble Apex Court in the case of Hotel Blue Moon reported in 321 ITR 362(SC) the Bangalore Benches have held that issuance of notice under section 143(2) of the Act, is a condition precedent for framing an assessment/ reassessment.

i) Shri Banglore Narayan Das in ITA Nos.120 &121/Bang/2022 order dated 17.03.2023

ii) Smt Arwa Harawala in ITA No. 01/Bang/202 order dated 20.12.2021

24. In all above decisions the courts have unanimously held that issuance and service of notice under section 143(2) of the Act after the filing of the ROI is sine-qua-non for framing the assessment. Therefore, following the view of Hon’ble Patna High court, the Co-ordinate Benches of the Tribunal and of the Hon’ble Apex Court in the case of Hotel Blue Moon (Supra) we hold that the AO has erred in framing the assessments without issuing any notice under section 143(2) and hence the present orders are void-ab-initio.

25. In view of the above position of facts and law, we are of the view that the reassessments (for both years in appeal before us) framed in the present case without issuance of notice under section 143(2) of the Act is bad in law and void-ab-initio.

26. Since we have already quashed the reassessment proceedings on the basis of above grounds, we deem it appropriate not to deal with other grounds related to merits and assumption of jurisdiction u/s 148 of the Act. Therefore, they remained open.

27. Facts of AY 2018-19 are verbatim except the date of filing of ROI in pursuance to notice issued under section 148 of the Act. Here also the AO has not issued any notice under section 143(2) of the Act. Therefore, the observations made in appeal for AY 2016-17 would apply mutatis muntadis here and decided accordingly.

35. In the result, the appeals of the assessee are partly allowed.

Pronounced in the open court on the date mentioned on the caption page.