Case Law Details

In re Saddles International (GST AAR Andhra Pradesh)

In a pivotal ruling by the Authority for Advance Ruling (AAR) in Andhra Pradesh, the classification and GST rate of original car seat covers designed for permanent integration with vehicle seats have been decisively addressed. This determination stemmed from an application by Saddles International Automotive & Aviation Interiors Private Limited, which sought clarity on the GST implications for their OEM-designed car seat covers.

The Context and Inquiry

Saddles International, a manufacturer supplying original car seat covers to OEMs (Original Equipment Manufacturers) and seat manufacturers, raised a query regarding the GST classification of their products. These covers, made from fabric or Polyurethane (PU), are specifically designed to fit over the raw foam of vehicle seats, becoming an inseparable part of the car upon installation. The question posed was whether such products should be classified under HSN 9401, attracting a GST rate of 18%, or under a different heading.

The AAR’s Analysis and Conclusion

Upon thorough examination, the AAR concluded that the original car seat covers in question, being indispensable to the vehicle’s functionality and sale, should not be classified under HSN 9401. Instead, they are more aptly classified under HSN 8708, which encompasses parts and accessories of motor vehicles. Consequently, these products are subject to a GST rate of 28%.

This ruling underscores the intricate considerations involved in classifying goods within the GST framework, particularly for items integral to the manufacturing of vehicles. The decision highlights the significance of the product’s functional integration with the vehicle, dictating its classification and the applicable GST rate.

Implications for the Industry

The AAR’s ruling carries profound implications for manufacturers and suppliers within the automotive sector. It delineates a clear distinction between general accessories and components that are fundamental to a vehicle’s operation and marketability. For businesses like Saddles International, this classification under HSN 8708 at a 28% GST rate necessitates careful consideration in pricing strategies and supply chain management to accommodate the higher tax burden.

Furthermore, this decision provides valuable guidance for other entities in similar manufacturing domains, ensuring a better understanding of the tax implications of their products. By clarifying the classification of integral car seat covers, the AAR has contributed to a more predictable and transparent tax environment for the automotive accessories industry.

Conclusion

The AAR’s determination serves as a crucial reference point for automotive component manufacturers, emphasizing the importance of the functional role of a product in determining its GST classification. This ruling not only impacts Saddles International but also sets a precedent for how similar products are viewed in the context of GST, fostering a clearer understanding of tax liabilities for businesses involved in the production and supply of vehicle components.

FULL TEXT OF THE ORDER OF AUTHORITY FOR ADVANCE RULING, ANDHRA PRADESH

1. At the outset we would like to make it clear that the provisions of CGST Act, 2017 and SGST Act, 2017 are In parimateria and have the same provisions in like matter and differ from each other only on a few specific provisions. Therefore, unless a mention is particularly made to such dissimilar provisions, a reference to the CGST Act would also mean reference to the corresponding similar provisions in the APGST Act.

2. The present application has been filed u/s 97 of the Central Goods & Services Tax Act, 2017 and AP Goods & Services Tax Act, 2017 (hereinafter referred to CGST Act and APGST Act respectively) by M/s. Saddles International Automotive & Aviation Interiors Private Limited(hereinafter referred to as applicant), registered under the AP Goods & Services Tax Act, 2017.

3. Brief Facts of the case:

3.1 M/s Saddles International Automotive & Aviation Interiors Private Limited (hereinafter referred to as applicant”) is engaged in manufacturing and supplies original car seat covers made from fabric that are designed to fit permanently over the raw foam seat installed in the vehicle, to original equipment manufacturers (‘OEMs) as well as to seat manufactures who further sell it to OEMs and is sold with the vehicle. Applicant is having GST Registration number37ABBCS7194N1ZK.

3.2 The Applicant has been engaged by various OEMs for supply of primary original seat covers manufactured from fabric or Polyutherane (PU) which are designed to permanently fit over the raw foam seat installed in the car and becomes an integral part of car seats. The Applicant also supplies these primary seat covers to the seat manufacturers, on contract basis, who further supply it to OEMs for permanent affixation over the raw foam seat.

3.3 The manufacturing process of such seat covers involves cutting and stitching of the fabric as per the specifications and measurements of the automobile seats provided by the OEMs/seat manufacturers depending on the make and model of each vehicle. In certain cases. mould or template are provided to the Applicant to ensure permanent and perfect affixation of the cover on the raw foam seat.

3.4 The seat covers are affixed by the OEMs on the metal welded frame and polyurethane pads / foam with the help of rubber catches and metal c-rings (which is a type of fastener). This cover serves as a primary layer of textile fabric. Of the car seat which is permanently affixed over the raw seat after the foam cushion pad that is fastened or attached to the frame of seat assembly. Without mounting such permanent covers over the raw foam seat, the seat is incomplete, and in turn vehicle is incomplete and thus cannot be sold to the customers in the same manner. The price of seat covers forms part of the cost of the car / vehicle sold by the automobile manufacturer as a part of original equipment.

3.5 The above seat covers manufactured by Applicant adheres to the safety standards and are designed keeping in mind the airbag compatibility. Therefore, the original primary seat covers which are permanently fitted / installed to the seat in the vehicle at the time of sale, is an essential and integral part of the seat.

3.6 The applicant wishes to know whether the goods, namely “original car seat covers” which are permanently attached to the raw foam seat of vehicles are classifiable under HSN 9401 as “Seats (other than those of heading 9402) used for aircraft and liable to GST 0 18 % vide SI.No. 435A under Schedule III, of notification no.1/2017- Central tax (rate) dated 28.06.2017 as amended by notification no.41/2017- Central tax (rate) dated 14.11.2011.

4. Questions raised before the authority:

The applicant seeks advance ruling on the following:

1. Whether original car seat, covers which arc manufactured and designed to permanently fit over the raw foam seat of the vehicle by the OEMs as well as the scat manufactures who further sell to OEMs and arc sold with me vehicle as an essential and integral of part of seat is classifiable under HSN 9401 as ” Scats (other than those of heading 9402) whether or not convertible into beds, and parts thereof other than seats of kind used for aircraft” and is liable to GST @ 18 % vide SI. No. 435Aunder Schedule III of Notification No.1/2017- Central tax (rate) dt.28.06.2017 as amended by Notification no.41/2017 Central Tax (rate) dt.14.11.2017

On Verification of basic information of the applicant, it is observed that the applicant is under Central jurisdiction i.e,Hindupur-2 Range, Anantapur Division. Accordingly, the application has been forwarded to the jurisdictional officer and a copy marked to the Central Tax authorities to offer their remarks as per Sec. 98(1) of CGST /APGST Act 2017.

In response, remarks are received from the Central jurisdictional officer concerned stating that no proceedings lying pending with the issue, for which the advance ruling sought by the applicant.

5. Applicant’s Interpretation of Law:

5.1 The applicant submits that pertinent to mention here that earlier, a ruling was sought by applicant from the Hon’ble Authority for Advance Ruling, Andhra Pradesh, reported as In Re: Saddles International Automotive & Aviation interiors Pvt. Ltd., 2021 (54) G.S.T.L. 464 (A.A.R- GST- AP) where they sold the manufactured sear covers to car scat makers who affix the scat covers into the seat covers to car seat makers who affix the seat covers into the scats and thereafter the seat was affixed to the motor vehicle. The applicant approached the Hon’ble Authority seeking classification of such car seat covers which performed the functions to help the driver and co-passenger to get into the most comfortable seating Inside the car as per their convenience, which does not absorb heat; for protection of scats; and further covers do not absorb heat and hence, keep the car cool and user comfortable.

5.2 The applicant while concluding the classification under HSN 8708, the Hon’ble Authority relied upon the decision of Hon’ble Tribunal in Guru Overseas Private Limited vs Commissioner of Central Excise [2001 (132) E.L.T. 60 (Tri.- Del,)], which had relied on the decision passed in the appellant- assessee’s own case reported in Guru Overseas Pvt Ltd. Vs. Collector of Central Excise, New Delhi, [200 (120) E.L.T. 209 (Tribunal)] where it was admittedly claimed by appellant assesse that the leather and textile car seats covers manufactured by them were not integral part of car seats but were sold separately as additional covers for seats of cars which are commonly known and traded in the market as accessories of cars used for comfort, convenience and sleek look of the seats and therefore would not fall under Chapter Heading 94.01. In this matrix, the Hon’ble Court held that such additional covers are not integral part of car seats but are in the nature of accessories and would be classifiable under Chapter sub- heading 87.08 instead of 94.01

5.3 In view of the above, it transpires that the aforesaid ruling was passed by the Hon’ble Authority of Advance Ruling in the context where seat covers were meant and used as additional / secondary covers over the original seat cover of car for enhanced comfort, convenience. Upgraded look of car interior, and was not an integral part of the seat.

5.4 However, in the instant case, the Applicant is manufacturing and supplying the cover seats of car which are designed for permanent fit over the raw foam seat installed by the OEMs in the vehicle and thus becomes an inseparable part of the seat, without which the vehicle is incomplete and cannot be sold. These seat covers supplied by Applicant to the OEMs are neither additional covers to the original seat covers nor sold as aftermarket product but is an integral part of the car seats installed in the vehicle sold to the customer.

5.5 In the aforesaid facts of the case, the Applicant submits that the issue on which the present advance ruling is sought is whether the supply of original seat covers manufactured by Applicant for the OEMs which are designed to permanently fit over the raw foam seat installed in the vehicle falls under FISN 9401 as Seats ((other than those of hearing 9402) whether or not convertible into beds.. and parts thereof [other than seats of a kind used for aircraft]’ and is liable to GST 18% vide I. No. 435A under Schedule III of Notification No. 1/2017 as amended. That the question relating to classification of any goods and/ or services is eligible to be posed for advance ruling before the Advance Ruling Authority in terms of Section 97(2)(a) of the CGST Act. Further. the question raised in the present Applicant is in respect of different product and In the facts which are different from the earlier Ruling. Hence, the present advance ruling application is maintainable before the Hon’ble Authority of Advance Ruling, Andhra Pradesh.

APPLICANTS UNDERSTANDING:

5.6 Applicant’s interpretation that the original seat cover manufactured by it, is the first primary layer (cover) of textile fabric of the car seat which is permanently fixed by the OEMs over the seal foam cushion, which is attached to the frame of the scat of car and thereafter the entire seal assembly is mounted installed in the vehicle. Thus, the original primary seat cover Is an Integral and essential part of the scat without which the seat is incomplete and in turn, vehicle is incomplete and cannot be sold to the customers. Hence, the goods fall under HSN 9101 as “Seats (other than those of hearing 9402) whether or not convertible into beds.. and parts thereof father than seats of a kind used for aircraft!’ and is liable to GST © 18% vide SI. No. 435A under Schedule K of Notification No. 1/2017 as amended. The submissions in support of the aforesaid interpretation hay been enunciated in the ensuing paragraphs:

5.7 The primary original cover which is designed to permanently fir over the raw foam seat is an integral and essential part of the car seat, installed in the vehicle. Therefore, the same is classifiable under HSN 9401 and liable to GST © 18 % under SI.No. 435A of Notification No. 1/2017 as amended. Section 9 of CGST Act, is the charging section for levy of GST and provides that GST shall be levied on all inter-state supply of goods or services, at the rates notified by the Government on the recommendations of the GST Council.

5.8 In terms of the power conferred under the aforesaid provision, the Central Government vide Notification no. 1/2017-Central Tax (Rate) dated 28.06.2017, has notified the rate of tax on supply of goods. Similar notifications have been issued under APGST Act and IGST Act, prescribing the applicable rate for APGST and IGST, respectively_ The Notification No. 1/2017 as amended contains six schedules attracting different rates of tax as mentioned in the table below_ Each schedule contains entries having the description of goods along with their Chapter Number / Chapter Heading / Sub-heading / Tariff Item.

| Schedule No, | Rate of GST for Goods |

| I | 5 % |

| II | 12 % |

| III | 18 % |

| IV | 28 % |

| V | 3 % |

| VI | 0.25 % |

Further, Explanation (III) and (iv) appended to Notification No. 1/2017 as amended are relevant for Interpretation of entries given in Notification No. 11/2017 as amended:

(i) ‘Tariff item”, “sub-heading” “heading” and ‘Chapter shall mean respectively a tariff item, sub-heading, heading and chapter as specified in the first Schedule to the Customs Tariff Act, 1975 (51 of 1975).

(iv) The rules for the interepretation of the, first Schedule to the Customs Tariiff Act, 1975 (51 of 1975), including the Section and Chapter Notes and the General Explanatory Notes of (ho First Schedule shall, so far as may be, apply to the interpretation of this notification

5.9 Thus, in terms of Explanation wherever any tariff item, sub-heading, heading or Chapter is mentioned in the Notification No. 1/2017 as amended, the same has to be given the meaning as given to it under Customs Tariff. Further, the Notification No. 1/2017 as amended has to be interpreted as per the General Rules of Interpretation (hereinafter referred to as ‘Interpretative Rules’) given in First Schedule to Customs Tariff, including the Section Notes, Chapter Notes and the General Explanatory Notes of the First Schedule of Customs Tariff.

The relevant entry pertaining to HSN 9401 of Notification No. 1/2017 as amended; is reproduced below for ease of reference:

|

SI.No |

Relevant Schedule | Chapter Heading/ Sub-Heading | Description of Goods | Description of Goods |

| 435A | Schedule-III

|

9401 (other than 9401 10 00) | Seats (other than those of heading 9402), whether or not convertible into beds, and parts thereof (other than seats of a kind used for aircraft) | 18% |

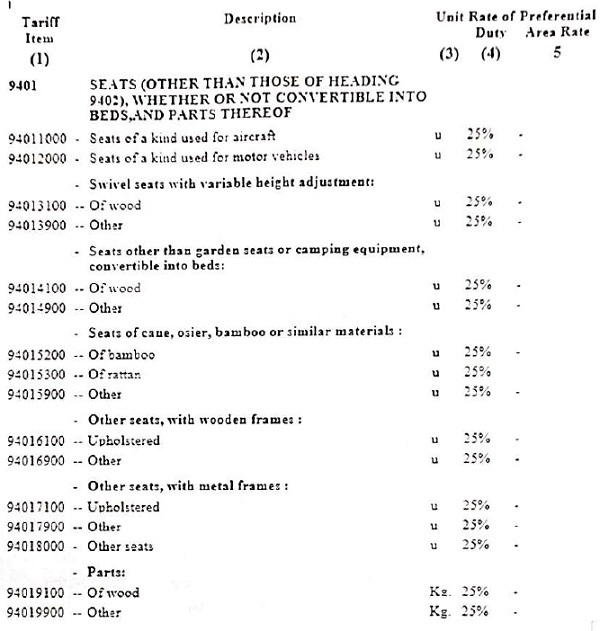

Customs Tariff Heading (“CTFI”) 9401 of the Custom Tariff Act, 1975 (“CTA”) also has same description- Seats (other than those of heading 9402), whether or not convertible into beds, and parts thereof, other than seats of a kind used for aircraft’ The said Chapter heading of CTA is extracted below:

In order to understand the scope of headings 9401 to 9403, it is imperative to refer to Note 2 and 3 to Chapter 94 of CTA, which explains as follows:

“2. The articles (other than parts) referred to in headings 9401 to 9403 are to be classified in those headings only if they are designed for placing on the floor or ground.

The following are, however, to be classified in the above-mentioned headings even if they are designed to be hung, to be fixed to the wall or to stand one on the other

(a) Cupboards, bookcases, other shelved furniture (including single shelves presented with supports for fixing them to the wall) and unit furniture;

(b) seats and beds.

3. (A) In headings 9401 to 9403 references to parts of goods do not include references to sheets or slabs (whether or not cut to shape but not combined with other parts) of glass (including mirrors), marble or other stone or of any other material referred to in Chapter 68 or 69.

(B) Goods described in heading 9404, presented separately, are not to be classified in heading 9401, 9402 or 9403 as parts of goods.”

In view of the above, It can be said that a soot will be classifiable under CTH 9401 only if satisfies the condition specified under Chapter Note 2 of Chapter 94 i.e., the seat should be designed for placing on the floor or the ground.

It may be noted that CTH 9401 inter-alia covers seats, CTH 9402 inter-alia covers medical, surgical, dental or veterinary furniture etc. and CTH 9403 covers other furniture. The aforesaid Chapter Note is applicable to CTH 9401 to CTH 9403. Though the term “seats” has not been defined in the HSN Explanatory Notes, the term “furniture” is defined in the HSN Explanatory Notes as under:

”GENERAL

This Chapter covers, subject to the exclusions listed in the Explanatory Notes to this Chapter:

(1) All furniture and parts thereof (headings 94.01 to 94.03).

(2) Mattress supports, mattresses and other articles of bedding or similar furnishing, sprung, stuffed or internally fitted with any material, or of cellular rubber or plastics, whether or not covered (heading 94.04).

(3) Lamps and lighting fittings and parts thereof, not elsewhere specified or included, of any material (excluding those of materials described in Note 1 to Chapter 71), and illuminated signs, illuminated nameplates and the like, having a permanently fixed light source, and parts thereof not elsewhere specified or included (heading 94.05).

(4) Prefabricated buildings (heading 94.06).

For the purposes of this Chapter, the term “furniture” means:

(A) Any “movable” articles (not included under other more specific headings of the Nomenclature), which have the essential characteristic that they are constructed for placing on the floor or ground, and which are used, mainly with a utilitarian purpose, to equip private dwellings, hotels, theatres, cinemas, offices, churches, schools, cafes, restaurants, laboratories, hospitals, dentists’ surgeries, etc., or ships, aircraft, railway coaches, motor vehicles, caravan-trailers or similar means of transport. (It should be noted that, for the purposes of this Chapter, articles are considered to be “movable” furniture even if they are designed for bolting, etc., to the floor, e.g., chairs for use on ships). Similar articles (seats, chairs, etc.) for use in gardens, squares, promenades, etc., are also included in this category.”

The HSN Explanatory Notes under heading 9401, further states:

“Subject to the exclusions mentioned below, this heading covers all seats (including those for vehicles, provided that they comply with the conditions proscribed in Note 2 to this Chapter), for example:”

Specifically on the question of classification of parts of the furniture of Chapter 94, the HSN explanatory notes state as under:

“PARTS

This Chapter only covers parts, whether or not in the rough, of the goods of headings 94.01 to 94.03 and 94.05, when identifiable by their shape or other specific features as parts designed solely or principally for an article of those headings. They are classified in this Chapter when not more specifically covered elsewhere.”

Further, the HSN Explanatory Notes under heading 9401 (as amended in 2022) extended the scope of ‘parts’ to include seat covers for permanent attachment to a seat. The relevant portion of the excerpt is reproduced below:

“PARTS

The heading also covers identifiable parts of chairs or other seats, such as backs, bottoms and arm-rests (whether or not upholstered with straw or cane, stuffed or sprung), seat or backrest covers for permanent attachment to a seat, and spiral springs assembled for seat upholstery.”

It is well settled that the explanatory notes have persuasive value and in the event of disputes, various Courts have upheld seeking recourse to the explanatory notes while determining classification of products.

Reliance in this regard is placed on the decision of Hon’ble Supreme Court in L.M.L. Limited vs. Commissioner of Customs (2010 (258) ELT 321 (SC)), in which it was held that in order to resolve a dispute on tariff classification, internationally accepted nomenclature emerging from HSN explanatory notes, is a safe guide for classification.

The above principle was also recognised in the following rulings of the Apex Court:

- CCE v. Wood Craft Products Ltd. [1995 (77) ELT 23 (SC)]

- Collector of Central Excise v. Bakelite Hylam (1997 (91) ELT 13 (SC)]

- Collector of Customs v. Business Forms Ltd. [2002 (142) ELT 18 (SC)]

- Holostick India Ltd. v. Commissioner of Central Excise (2015 (318) ELT 529 (SC)]

The Applicant also submits that the amendment in HSN explanatory notes is being done with a particular intent to cover seat or backrest covers for permanent attachment to a seat within Its ambit. Thus, basis this interpretation also, permanent seat covers should he considered as part of seat classifiable under HSN 9401.

In the light of the above Chapter notes and HSN explanatory notes to Chapter 94 as well as to CTH 9401 elaborated above, it is apparent that the identifiable parts of motor vehicle seats would be classifiable under CTH 9401.

Meaning of Parts:

It is further submitted that the term “Part / Parts” has neither been defined in GST law nor was defined in the erstwhile Central Excise Regime. As such the understanding of the term “parts” must be drawn from the general meaning of the term which is of relevance to the present case.

The meaning of the term “part” as per various dictionary meaning is extracted hereunder:

(i) As per Cambridge English Dictionary, part is defined as:

“Part as a noun – a separate piece of something or a piece that combines with other pieces to form the whole of something:

One of the pieces that together form a machine or some type of equipment.”

(ii) The meaning of “part” as per the Black’s Law Dictionary is:

‘an integral portion, something essentially belonging to a larger whole, that which together with another or others makes up a whole.’

(iii) Merriam Webster dictionary, “part’ is defined as:

A constituent member of a machine or other apparatus; an essential portion or integral element.

1. Thus, perusal of the above definitions, categorically express that the term “part” would refer to a thing or item which essentially belongs to a distinct larger whole, which is necessary for the constitution of the whole and without which the whole cannot be constituted.

2. The Supreme Court, in the case of Pragati Silicon Pvt. Ltd. vs. CCE, Delhi [2007 (211) ELT 534 (SC)J, has held that for an item to qualify as a “part,” it must be an essential component of a machine or a larger assembly, without which the intended use of the finished product cannot be achieved. Such a “part” is not normally used independently and is not easily disassembled for maintenance purposes.

3. The Hon’ble Supreme Court in CCE v. Insulation Electrical (P) Ltd., 2009 (224) ELT 512 (SC) analysed the term “part” and held that “part” is an essential component of the whole without which the whole cannot function.

4. Further, in CC v. Hydranautics Membrane India Ltd., 1994 (71) ELT 711 (Tri.-Del), the Hon’ble Tribunal construed the meaning of “part” as:

“part as something essentially belonging to a larger whole, an integral portion”. On a cumulative analysis of the above judicial precedents, the point which crystallizes is that “part” per so means a portion of equipment or machinery which is essentially linked to the functioning of that particular equipment or machinery. In other words, “part” is an integral element of machinery or equipment without which the specific product cannot function. The “part” in question should he so inextricably be linked to the product that the same cannot be brought into any form without the “part” in question. The Applicant, as stated above, is engaged in manufacture of the primary layer of textile fabric of the car seat which is permanently fitted as a first or original cover over the raw foam scat /cushion that is attached to the frame of the car seat and thereafter, the entire seat assembly is mounted / installed in the vehicle. In other words, the original permanent cover is attached to the car seat assembly as a primary layer of fabric before mounting of the car seat on the car floor, without which, the car seats are incomplete and the vehicle cannot be sold to the customers.

Meaninq of “Part of seat”

The crux of the instant application is to determine that whether the permanent seat covers manufactured by the Applicant would be considered as a “part of seat” The primary original seat cover manufactured by the Applicant is an inseparable and essential part of car seats. They are identifiable parts of motor vehicle seats and would remain classifiable under CTH 9401. The HSN explanatory notes under Chapter 94 state that “parts” of goods of the heading 9401 would remain under this heading, “when identifiable by their shape or other specific features as parts designed solely or principally for an article of those headings. They are classified in this Chapter when not more specifically covered elsewhere’. While these parts are identifiable with the car seats, they are not more specifically covered elsewhere. Also, the HSN explanatory notes to CTH 9401, expanded the scope of “parts” to include seat covers for permanent attachment to a seat, thus, such seat covers would be classifiable under CTH 9401, as parts of the seat.

Judicial Precedents:

In support of the aforesaid submission, reliance is placed on the judgment of Supreme Court in CCE, Kanpur vs. Matador Foam, 2005 (179) E.L.T. 257 (S.C.), wherein while construing Chapter Note 2 of Chapter 94, it was held that the term ‘floor or ground’ would also include floor of the car or vehicle. Seats made for vehicles are placed on the floor of the car or vehicle. Therefore, Chapter Note 2 would not exclude seats of vehicles from Chapter 94.

5. Significantly, it was also held by the 1–lon’ble Supreme Court in Matador Foam case(supra) that foam used as cushion which is affixed to frame of the automobile seat during manufacture of seat assembly would fall under CTH 9401 as a part of the automobile seat. Therefore, in the present matter, the original car seat cover that is attached to the car seat assembly as a primary layer of fabric before mounting of the car seat on the car floor, would also qualify as an integral part of such car seat and classifiable under CTH 9401.

6. Further, in the case of Shiroki Auto Components India Pvt. Ltd., 2020 (374) E.L.T. 433 (Tri. – Ahmd.), the Hon’ble Tribunal held that the imported child parts were used by assessee In the manufacture of another parts i.e. Round Recliner which is an integral part of motor vehicle seats and thus would fall under tariff Item 9401 90 00 of Customs Tariff Act, as parts of seat of a motor vehicle, and not as parts of motor vehicle under Heading 8708 as the goods imported were not directly used in manufacture of motor vehicle parts. The relevant portion of the decision is reproduced below:

5…..The limited issue to be decided is whether the child parts imported by the appellant from Japan is classifiable under CTH 9401 90 00 as parts of vehicle seats as declared by the appellant or under CM 8708 99 00 as parts and accessories of motor vehicles of heading 8701 to 8705 as assessed by the Customs.

8…..It is undisputed that child parts used for making parts which are subsequently used in the complete assembly of vehicle seat and the vehicle seat has been classified under [Heading] 9401, then how part of seat can be classified under [Heading] 8708. If Revenue’s contention is accepted then the tariff entry i.e. seats of a kind used for motor vehicles under [Tariff Item] 9401 20 00 will become redundant.

9. As regards judgments relied by the Learned Counsel for the appellant, we find that in the case of JTEKT Sona Automotive India Limited (supra) the Principal Bench of this Tribunal, after analyzing legal provisions of customs tariff, HSN, drawing a similar interpretation, decided that the assessee imported ‘gear reduction blank’ is correctly classifiable under 8483 40 00 as gear and gearing, other than toothed wheel, chain sprockets and other transmission elements presented separately as against Revenue’s contention to classify under 8708 94 00. It is pertinent to mention that in the above case, the goods imported were directly used in the manufacture of motor vehicle parts whereas, in the present case, child parts were admittedly used in the vehicle seat parts. Therefore, the appellant’s case is on the better footing. In identical issue, in the case of Uni Products India Limited (supra) the Hon’ble Supreme Court, after considering various provisions of HSN and explanatory notes, General Rules for interpretation held that car mating which is used in the motor vehicle is classifiable under Chapter 57 and not under Chapter 87. In this case, the assessee was manufacturing car mating which was directly used in the motor vehicle and despite this the Hon’ble Supreme Court held the classification under Chapter 57 whereas in the present case, child parts were not used in the motor vehicle but were used in the manufacture of another parts i.e. Round Recliner which is an integral part of motor vehicle seats. Therefore, Apex Court judgment is applicable in the facts of the present case.

10……….. .As regards the judgment in the case of Insulation Electricals Pvt. Limited (supra) relied upon by the Revenue, we find that in the said judgment motor vehicle parts and accessories involved was rail assembly front seat adjuster/assembly slider seat and rear back seat lock assembly, all those items are not part of seat but accessories which is fitted in the motor vehicle. Whereas, as per facts in the present case child parts are used to make Round Recliner which is used for manufacturing of Recliner Assembly and the Recliner Assembly is fitted inside the seat at the time of assembling of complete seat Therefore, the child parts are integral parts of seat and not like accessories which is fitted in the motor vehicle. Hence, the facts of the case in Insulation Electricals Pvt. Limited (supra) and in the present case are entirely different.

7. The aforesaid decision was affirmed by the Hon’ble Supreme Court in Commissioner vs. Shiroki Auto Components India Pvt. Ltd. – 2021 (378) E.L.T. A145 (S.C.), wherein the appeal filed by department (Civil Appeal No. 1623 of 2021)was dismissed and classification of child parts used in seat of vehicles under Tariff item 9401 90 00 instead of tariff item 8708 99 00 was upheld.

8. In view of the above, it is humbly submitted that the product in question in the instant case is the primary/original layer(cover) of fabric which is permanently attached over the raw foam/cushion and becomes an inseparable and integral part of the car seat. The seat assembly is thereafter mounted/installed on the floor of the car. Thus, without such layer of fabric or cover, the car seat will be incomplete and be in a functional/ marketable state or condition to a prospective customer of the car. Hence, the aforesaid decision of Shiroki Auto(supra)squarely applies to the present case.

9. Reliance is also placed on the advance ruling passed by the Customs Authority for Advance Rulings, Mumbai in the case of Steel case Asia Pacific Holdings India Private Limited (2022 (380) ELT 103 (AAR-Cus.-Mum.)], where it was held that the components of swivel seats or chairs imported in disassembled form shall be classified under HSN 94019000 only.

International rulings/ memorandums on classification of permanent seat covers

10. It is further submitted that the Customs Rulings of US Customs and Border Protection (CROSS Rulings), relating to the classification of the subject permanent seat covers imported into USA based on the HSN Notes, also have persuasive value in determining the classification of the goods.

11. In US Ruling NY 320628 dated July 26, 2021, the permanent seat covers were held to be classifiable under HSN 9401. The relevant extract is reproduced below:

“Unlike a slip cover which is placed over a finished seat providing protection against wear and tear, the subject seat shell is a permanent component to a seat as a seat will not be complete without it. The seat base, the backrest, and the armrests comprising the seat shell are sewn together as a unified article and will take the shape of a sloth once filled with polyester fill.

……..

Further, the ENs to Heading 9401 “Parts,” state: “This heading also coversidentifiable parts of chairs or other seats, such as backs, bottoms, and arm-rests (whether or not upholstered with straw or cane, stuffed or sprung), seat or backrest covers for permanent attachment to a seat, and spiral springs assembled for seat upholstery.”

The unstuffed seat shell is a dedicated part of an incomplete child seat and is not more specifically provided for elsewhere in the tariff schedule.

The applicable subheading for the subject merchandise will be 9401.90.5021, HTSUS, which provides for “Seats (other than those of heading 9402), whether or not convertible into beds, and parts thereof: Parts: Other: Other: Other of textile material, cut to shape.” The rate of duty will be free.”

12. Further, the Canada Border Services Agency (CBSA) issued Memorandum D10-15-31 providing guidelines on tariff classification of permanent car seat covers under the Customs Tariff. The same is extracted for ease of reference: “DEFINITIONS

Permanent car seat covers: These are covers for the permanent attachment to the backs, bottoms and frames of seats of automobiles and other motor vehicles. Permanent car seat covers may be equipped with elements and cutouts for fixing and adapting them to seats and their frames. They can be made of different materials, and can consist of more than one piece for assembly to constitute a complete seat cover. After the seats are installed in the vehicle, the covers cannot generally be removed without first removing the seat from the vehicle.

For purposes of this administrative policy, it is understood that these covers are presented separately from the seats, and that “permanent attachment” means at least one of the following:

i. the covers are physically incorporated into the seats, for instance, by being attached by an adhesive, stitching or the like;

ii, the covers are so affixed to the seats that they become practically inseparable, for instance by being attached by staples, bolts, screws or the like that would, at a minimum, require tools to remove the covers; or,

iii. the covers are so attached to seats that removal of the covers would cause substantial damage to the seats from which they are removed.

……………… ………………”

13. Perusal of the aforesaid Guidelines clearly reveal that the original seat covers are the ones which are permanently affixed to the raw foam seat and becomes an inseparable and integral part of the car seat without which seat is incomplete and consequently, the vehicle cannot be sold to the buyer.

14. Hence, the original and primary car seat cover designed to permanently fit over the raw foam seat of the car manufactured and supplied by the Applicant would thus fall under CTH 9401 as parts of seats and shall be classified under Tariff Item 9401 99 00 and liable to GST @ 18% vide SI. No. 435A under Schedule III of Notification No. 1/2017 as amended.

6. Personal Hearing:

The proceedings of Personal Hearing were conducted on 03.08.2023, for which the authorized representative, Gaurav Narula, Director attended and reiterated the submissions already made.

7. Discussion and Findings:

We have examined the issues raised in the application in light of the facts and arguments submitted by the applicant. We have considered the submissions made by the applicant in their application for Advance Ruling. We have considered the issues involved from which advance ruling is sought by the applicant and the relevant facts along with arguments made by the applicant and also their submissions made during the time of the personal hearing.

On the basis of foregoing the following discussion ensues:

Permanent Seats, herein referred to as such, are explicitly designated for exclusive utilization within a specified motor vehicle, thereby serving a specialized function meticulously aligned with the precise design and manufacturing specifications of said particular vehicle. The nomenclature “permanent seat cover” is employed to underscore the highly specialized nature of these seating arrangements, exemplifying a bespoke creation characterized by an assiduous focus on detail, ensuring seamless integration with the intended motor vehicle.

It is imperative to underscore and reiterate that Permanent Seats are expressly proscribed from being employed or promoted for general purposes beyond the specific application intended for the correlated motor vehicle. The distinctive design and the bespoke manufacturing process undertaken for these seats render them an intrinsic and indispensable component of the comprehensive motor vehicle structure. Absent the presence of these highly specialized seating units, the motor vehicle in question would be rendered non-operational and ineligible for lawful sale.

In summation, it is paramount to recognize that Permanent Seats transcend mere functional contributions to the overall operation of the motor vehicle; they assume a pivotal role in guaranteeing that each seat is purposefully tailored for the precise vehicle with which it is affiliated. This meticulous alignment serves as a safeguard, preserving the structural Integrity and performance parameters of the motor vehicle In Its entirety.

It Is pertinent to note that the Issue had been already covered In the Advance Ruling flied by the same applicant before the same authority subject however minor modification that the earlier ruling was with regard to seat covers where as the present one is to the sheet shell which will form an Integral part, of the car itself.

In the earlier ruling Itself It has been held that the scat covers shall be treated as falling under HSN 8708 under schedule IV as parts and accessories of motor vehicles of headings 8701 to 8705 (other than specified parts of tractors) therefore without any doubt it is evident that the “seats” which are being supplied along with the original car itself shall be held as part and accessories of the motor vehicle and shall b classified under HSN code 8705.

As per section 103(2) of CGST Act, The advance ruling referred to in subsection (1) shall be binding unless the law, facts or circumstances supporting the original advance ruling have changed. Thus unless there is substantial change in the facts or circumstances, it does not warrant a new ruling and it will only result in multiple ruling on the same subject.

RULING

(Under Section 98 of Central Goods and Services Tax Act, 2017 and the Andhra Pradesh Goods and Services Tax Act, 2017)

Question: Whether the original car seat covers which are manufactured and designed to permanently fit over the raw foam seat of the vehicles by the OEMs as well as the seat manufacturers who further sell to OEMs and are sold with the vehicle as an essential and integral part of seat is classifiable under HSN 9401 as Seats (other than those of heading 9402)whether or not convertible into beds, and parts there of (other than seats of a kind used for aircraft) and is liable to GST©18% vide Sl.No 435A under schedule III of Notification No. 1/2017 Central Tax(Rate) dated 28 June 2017 as amended by notification No 41/2017-Central Tax(Rate) dated 14November 2017?

Answer :No, original car seat covers which are manufactured and designed to permanently fit over the raw foam seat of the vehicles by the OEMs as well as the seat manufacturers who further sell to OEMs and are sold with the vehicle as an essential and integral part of seat is classifiable under HSN 8708 and is liable to pay @28% (CGST@14%+SGST @14%).