Case Law Details

Krishna Das Agarwal Vs DDIT/ADIT (Inv.) (ITAT Jaipur)

Black Money Act – Company Is a Separate Legal Entity and The Assessee Cannot Be Held to Be Beneficial Owner Ipso-Facto Due to Majority Shareholding / Directorship.-

FULL TEXT OF THE ORDER OF ITAT JAIPUR

These bunch of five appeals consist of one appeal filed by the assessee and other four filed by the revenue. These appeals are directed against the order of ld. Commissioner of Income Tax, Appeals-4, Jaipur [ Here in after referred as Ld. CIT(A) ] for the assessment year 2016-17, 2017-18, 2018-19 for all these years the order is dated 23.09.2022 and for A. Y. 2019-20 the order appealed is dated 31.08.2022. All these appeals are filed by the parties under the provision of section 18(1)/(2) of Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 [ here in after referred as “BMA” for short].

2. The issues involved in these appeals for all the years are almost identical, common and related one assessee. Therefore, all these appeals were heard together with the agreement of both the parties and are being disposed off by this consolidated order.

3. First of all, we take up the appeal of the revenue in appeal number BMA No. 03, 04 & 05/JP/2022 related to Assessment Year 2016-17, 2017-18 and 2018-19 respectively. In this three-appeal revenue has taken all most similar grounds except the figures changed in the others years. Therefore, to avoid the repetition we reiterated the ground taken by revenue in appeal number BMA No. 03/JP/2022 here in below so as to decide these three appeals of the revenue. The grounds raised by the revenue in BMA No 03/JP/2022 are as under:

“1. The learned CIT Appeal has erred in law and on facts in granting relief to the taxpayer.

2. The learned CIT Appeal has erred in law and on facts in granting relief to the taxpayer by deleting the addition amounting to Rs 69,78,53,383/- which was made by the AO on protective basis in A.Y. 2016-17 on account of credits in the bank accounts of the assessee and foreign company M/s Agrasen Polymers FZE. The assessment for the A.Y. 2019-20 stands completed on income of Rs.1,46,42,44,881/- (this includes addition of Rs.69.78 crore) u/s 10(3) of the Black Money Act on a substantive basis. Second appeal before the Hon’ble ITAT has already been filed against deletion of substantive addition made by the AO, which is pending for adjudication.

3. The learned CIT Appeal has erred in granting relief to the taxpayer by admitting additional evidence, even though the additional evidence could not have been admitted as per stipulations laid down under Rule 46A of the Income Tax Rules 1962. Further, since the additional evidence itself was not to be admitted, and has been incorrectly admitted, relief (even otherwise contested by revenue), could not have been available to the assessee.

4. The learned CIT appeal has erred in law in not exercising powers granted to her within the meaning of provisions of 17(1)(c) of BMA(UFIA) and Imposition of tax Act, 2015 whereby the learned Commissioner Appeal was mandated to do inquiries herself or to get carried out further inquiries. Instead of doing the same, the learned CIT appeal chose to grant relief to the taxpayer.

5. The Appellant craves leave or reserves the right to amend, modify, alter, add or forego any ground(s) of appeal at any time before or during the hearing of this appeal.”

6. The facts related to these years that the ld. AO has made the substantive addition in the A. Y. 2019-20 and protective addition as tabulated here in below in the following years, as the transactions are related / pertains that year:

|

Sr. No. |

A.Y. | Date of Order |

Amount of Tax Rs. | Amount of Addition Rs. |

| 1. | 2016 – 17 | 31.03.2021 | 20,93,56,020/- | 69,78,53,383/- |

| 2. | 2017 – 18 | 10,93,08,670/- | 36,43,62,230/- | |

| 3. | 2018 – 19 | 2,57,30,120/- | 8,57,67,060/- | |

| TOTAL | 1,14,79,82,673/- | |||

5. Aggrieved from the order of the assessing officer making such protective addition the assessee preferred an appeal before the ld. CIT(A) for all these three years who allowed the appeal of the assessee stating that once the substantive addition made no protective addition sustained.

6. Revenue being not satisfied with the findings of the ld. CIT(A) has raised these appeals before us on the ground as raised here in above.

7. Apropos for these three appeal No. BMA No. 03, 04 & 05/JP/2022 filed by the revenue, the ld. AR of the assessee submitted that all these appeals filed by the revenue are infructuous and are required to be dismissed, if not withdraw the same at this stage. The reason placed by the ld. AR of the assessee that there is no concept of the protective addition and substantive addition qua assessee and assessment year. The revenue has to take a stand that in which year the income is chargeable to tax and accordingly the same can be charged to tax but the revenue cannot take a dual stand to charge income / assets in the different assessment year qua same assessee. Once the substantive addition is made in the case of the assessee same cannot be made in different year on protective basis. This is nothing but futile exercise. The ld. AR of the assessee submitted that the action of the ld. AO is under uncertainty and he cannot blow the hot and cold air on the same breath. The ld. AR of the assessee submitted that the provision of section 3 is very clear as regards the chargeability of the foreign assets. He has relied and read the provision of the Act and the same is haul out here in below:

Charge of tax

3. (1) There shall be charged on every assessee for every assessment year commencing on or after the 1st day of April, 2016, subject to the provisions of this Act, a tax in respect of his total undisclosed foreign income and asset of the previous year at the rate of thirty per cent of such undisclosed income and asset:

Provided that an undisclosed asset located outside India shall be charged to tax on its value in the previous year in which such asset comes to the notice of the Assessing Officer.

(2) For the purposes of this section, “value of an undisclosed asset” means the fair market value of an asset (including financial interest in any entity) determined in such manner as may be prescribed.

8. Based on the search conducted on 09.07.2018 the assets in dispute comes to the notices of the assessing officer in the financial year 2018-19 relevant to A. Y. 2019-20. The ld. AO based on that provision of section 3 has already charged foreign assets/income in A. Y. 2019-20 on substantive basis, then making the addition in A. Y. 2016-17, 2017-18 and 2018-19 on protective basis is against the provision law and judicial precedent. In addition to the above oral arguments the ld. AR of the assessee has relied upon the following written submission and the same is reproduced here in below:

A. Sh. K.D. Agrawal (hereinafter referred to as the “Appellant”) is a senior citizen, aged 84 years and is presently enjoying a retired life. He is a regular taxpayer and has been awarded in past certificates of Appreciation from the Income Tax Department.

PB 216 – 217 are the copies of Certificate of Appreciation issued by the Income Tax Department for A.Y. 2016 – 17 & 2017 – 18

B. In the earlier years, viz. 2015, the Appellant along with a group of persons came together and incorporated a company in the Free Trade Zone of Ras-Al-Khaimah (UAE) – Agrasen Polymers FZE, to deal in masterbatches / polymers.

C. However, after a while, prices of the masterbatches in Indian markets became more competitive than UAE and because of this, the foreign company, M/s Agrasen Polymers FZE could not continue its business in UAE, as it became less profitable. Accordingly, it started to invest its funds in some investment products in UAE.

D. That however, it is pertinent to mention that all the assets belong to the company and the Appellant-assessee does not own any foreign asset in his individual capacity and has neither has any personal undisclosed foreign income and assets, in his individual capacity, nor is a beneficial owner of the assets of the company. Therefore, the taxability in the hands of the Appellant is wholly illegal and unjust.

PROCEEDINGS BY THE INCOME TAX AUTHORITIES

E. A Search action was conducted at the premises of Sh. K.D. Agrawal in July 2018 (F.Y. 2018 – 19) whereby certain documents concerning the transactions of a non-resident foreign company, viz. M/s Agrasen Polymers FZE were found.

F. Based on the same, additions to the tune of Rs. Rs. 1,14,79,82,673/- pertaining to the transactions undertaken by the foreign company from A.Y. 2016 – 17 to 2018-19 were added in the hands of the Assessee for these years on PROTECTIVE BASIS, vide Assessment Orders dated 31.03.2021, passed u/s 10(3) of the Black Money (Undisclosed Foreign Income & Assets) & Imposition of Tax Act, 2015 (hereinafter referred to as the “Black Money Act” or “The Act”).

|

Sr. No. |

A.Y. | Date of Order | Amount of Tax Rs. | Amount of Addition Rs. |

| 1. | 2016 – 17 | 31.03.2021 | 20,93,56,020/- | 69,78,53,383/- |

| 2. | 2017 – 18 | 10,93,08,670/- | 36,43,62,230/- | |

| 3. | 2018 – 19 | 2,57,30,120/- | 8,57,67,060/- | |

| TOTAL | 1,14,79,82,673/- | |||

G. With regard to the above additions, it is also submitted that the same additions aggregating to Rs. Rs. 1,14,79,82,673/- form a part of the additions made SUBSTANTIVELY BASIS for AY 2019-20.

H. Appeals were filed by the Assessee before the Ld. CIT(A) for all the above years. In the impugned orders passed by the Ld. CIT(A), the above-said additions made on PROTECTIVE BASIS for the first three years i.e., AY 201617, 2017-18 & 2018-19 were deleted by the Ld. CIT(A) on following two grounds:

i. On the ground that chargeability of tax on the impugned amounts could only arise in the previous year in which the information came to the knowledge of the Ld. Assessing Officer i.e., F.Y. 2018 – 19, relevant to A.Y. 2019 – 20.

ii. Further, as all these additions for A.Y. 2016 – 17 to 2018 – 19 had already been made and confirmed in the A.Y. 2019 – 20 that too on SUBSTANTIVE BASIS, upholding the addition in first three years also, would tantamount to double addition.

I. Against the deletion of additions by the Ld. CIT(A), in first three years the Department is now in appeal before your honours.

SUBMISSIONS:

1. It is submitted that no case for A.Y. 2016 – 17 to A.Y. 2018 – 19, could’ve been made in the first place, as the chargeability of tax under section 3 of the Black Money (UFIA) & imposition of Tax Act, 2015 can only be examined under the law in the previous year in which the information comes to the notice of the Ld. AO. For ready reference, the provision of Section 3 is reproduced for your kind perusal:

Charge of tax

3. (1) There shall be charged on every assessee for every assessment year commencing on or after the 1st day of April, 2016, subject to the provisions of this Act, a tax in respect of his total undisclosed foreign income and asset of the previous year at the rate of thirty per cent o f such undisclosed income and asset:

Provided that an undisclosed asset located outside India shall be charged to tax on its value in the previous year in which such asset comes to the notice of the Assessing Officer.

(2) For the purposes of this section, “value of an undisclosed asset ” means the fair market value of an asset (including financial interest in any entity) determined in such manner as may be prescribed.

2. In the present case, the own assertion of the Ld. Assessing Officer is that the alleged information qua the foreign assets admittedly came to the notice of the Ld. Assessing Officer at the time of search which was conducted on 09.07.2018 i.e., AY 2019-20, which is evident from the following findings available at Page 2 of the respective Assessment Orders reproduced as under:

“On 09.07.2018, a search & seizure action was conducted u/s 132(1) of the Income-Tax Act in the case of the assessee at his residence B-302, Aurum Trimurti, Tilak Marg, C-Scheme, Jaipur. During the course of search, evidences in the form of excel files were recovered from the e-mail account and personal Macbook of the assessee….. ”

Therefore, as per Section 3, assessment was bound to be made only for the AY 2019-20 and could not have been made for any other year, viz. A.Y. 2016 – 17, 2017 – 18 and/or 2018 – 19. However, on perusal of the assessment order, it is clearly evident that the Ld. AO has made assessment not just in AY 2019-20 only but also made assessment for AY 2016-17, 2017-18 and 201819 on PROTECTIVE BASIS which came to be deleted by the Ld. CIT(A). Therefore, the department appeals filed qua A.Y. 2016 – 17 to A.Y. 2018 – 19 are liable to be quashed outrightly.

3. Without prejudice, it is to be noted that the department has filed appeal regarding the same issues for A.Y. 2016 – 17 to 2018 – 19 & also independently for A.Y. 2019 – 20, which tantamounts to a double addition and double proceedings regarding the same issues, which is impermissible in the eyes of law.

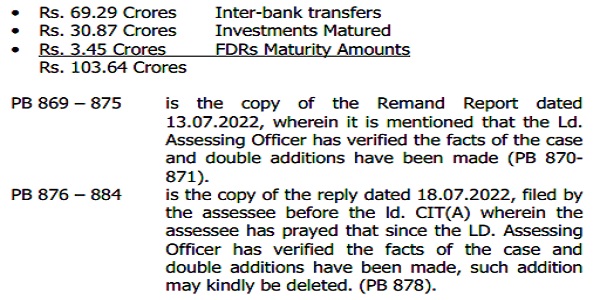

It is worth noting that the taxability of all the above impugned amounts which are subject matter of assessment have been assessed by the Ld. Assessing Officer, examined by the Ld. CIT(A) and not disputed as such by the Ld. Assessing Officer in the remand report dated 13.07.2022 for the A.Y. 2016-17 to A.Y. 2019-20. Therefore, it is prayed that the Appeals for A.Y. 2016 – 17 to A.Y. 2018 – 19 be quashed as the same is not in sustainable in the eyes of law.”

9. On these three appeals the ld. DR relied upon the order of the assessing officer and grounds so raised and fairly admitted not to controvert the arguments of the ld. AR on merits.

10. We have elaborately heard the representative of both the parties for these appeals, persuaded the orders of the lower authorities and written submission of the ld. AR of the assessee. Thus, to adjudicate these appeals of the revenue only limited issue is before us whether the appeal of the revenue for the same assessee be challenged both count first when the addition is made substantively for one year and protective on the other years. The calculation of the amount is not under dispute or not under challenged before us. We are in agreement with the arguments of the ld. AR of the assessee that once the revenue is under appeal on the substantive addition and the assessee is not disputing the year of its chargeability there is no grievance left of the revenue and therefore, these appeals are not maintainable. The bench noted that the for all these years the grievance of the revenue in all the appeals are admitting the additional evidence, deleting the protective addition and not making any further enquiry and granted the relief without conducting the enquiry in accordance with the provision section 17(1)(c) of BMA by ld. CIT(A). The bench has further noted that for all these years the amount in dispute is as under:

| Sr. No. | Assessment year | Amount of protectively Rs. | Addition made |

| 1. | 2016 – 17 | 69,78,53,383/- | |

| 2. | 2017 – 18 | 36,43,62,230/- | |

| 3. | 2018 – 19 | 8,57,67,060/- |

11. On examination of the order of the assessment year 2019-20 we find that the similar addition form part of the addition made by the AO in accordance with the provision of section 3 of BMA in this case on substantive basis and all the grounds raised in these appeals are equally challenged by the revenue on substantive basis and therefore, we feel that the same are not required to be adjudicated under these appeals on protective additions deleted by the ld. CIT(A). The appeal for the assessment year 2019-20 is under adjudication before us and therefore, we are of the considered view that the appeal of the revenue on the same very addition on protective addition cannot be litigated once the issue of substantive addition is not disputed by the assessee and its year of chargeability.

12. Based on this observation we are of the considered view that once the substantive addition has been made in the year in which such assets come to the notice of the Assessing Officer that can be charged to tax in the year as per clear mandate of provision of law and since the matter is already under consideration for assessment year 2019-20. The separate addition made in the respective years on protective basis and the appeal filed by the department against the finding of the ld. CIT(A) for these years is not maintainable and has rightly held by the ld. CIT(A) that the protective addition for the year under consideration is not warranted as the same is entirely contrary to the provision of section 3 of the Black money Act. The finding of the ld. CIT(A) for all the three are almost similar and therefore, her finding for the assessment year 2016-17 extracted for the sake of brevity.

“(xxv) As regards the addition of Rs.69,78,53,383/- made by the AO in the year under consideration i.e. A.Y.2016-17, and in view of the aforesaid observations of the AO and submissions of the appellant, it transpires that it is an undisputed fact that the addition of Rs. 69,78,53,383/- for the year under consideration has been made on protective basis as mentioned by AO himself in Para 2.5 & 2.6 (Page 75 & 76) of the Assessment Order. The addition of the said amount has already been made for A.Y. 2019-20 on substantive basis in accordance with the provisions of Section 3 of the Black Money Act. The said section 3 of Black Money Act being the charging section is reproduced herein under:

“… Charge of tax

3. (1) There shall be charged on every assessee for every assessment year commencing on or after the 1st day of April, 2016, subject to the provisions of this Act, a tax in respect of his total undisclosed foreign income and asset of the previous year at the rate of thirty per cent of such undisclosed income and asset:

Provided that an undisclosed asset located outside India shall be charged to tax on its value in the previous year in which such asset comes to the notice of the Assessing Officer.

(2) For the purposes of this section, “value of an undisclosed asset” means the fair market value of an asset (including financial interest in any entity) determined in such manner as may be prescribed…. “

(xxvi) On perusal of the above, it is evident that an undisclosed asset located outside India shall be charged to tax on its value in the previous year in which such asset comes to the notice of the Assessing Officer. In respect of the case on hand, it is an undisputed fact that the credit of Rs. 69,78,53,383/-appearing in foreign bank accounts located outside India during F.Y. 2015-16 relevant to A.Y. 2016-17 came to the notice of the AO during F.Y. 2018-19 relevant to A.Y. 2019-20 only and the substantive addition of the same has also been made by AO for A.Y. 2019-20.

(xxvii) In view of the above facts of the case and Section 3 of the Black Money Act, the contentions of the appellant as presented in Ground of Appeal No. 13 that under the facts and the circumstances of the case and in law, protective assessment for the assessment year under consideration is not warranted as the same is entirely contrary to the provisions of Section 3 of the Black Money Act is found acceptable.

(xxviii) Similarly, Ground of Appeal No. 14 wherein the appellant has contended that the concerned addition of Rs. 69,78,53,383/-in F.Y. 2015-16 relevant to A.Y. 2016-17 results in double taxation of the same amount also finds favour with this office. As the said addition of Rs. 69,78,53,383/- is contrary to the provisions of charging section of Black Money Act and as the said amount has already been added to the Total Income of appellant for A.Y. 2019-20, being the year in which the undisclosed asset came to the notice of the AO, the addition Rs. 69,78,53,383/- is not sustainable in the year under consideration, being made on protective basis, and is deleted in the A.Y.2016-17.

(xxix) In view of the aforesaid discussion, the grounds of appeal no. 1,5 to 14 raised by the Ld.A.R. of the appellant for the A.Y. 2016-17 are treated as allowed.

6. Based on the above discussion and as per provisions of Section 3 of Black Money Act, it is abundantly clear that answer to the question as to whether the addition of Rs. 69,78,53,383/- is legally sustainable or not shall have effect on determination of Total for A.Y. 2019-20 and not concerned A.Y. 2016-17. The appellant has also challenged the addition of Rs. 146,42,44,881 made on substantive basis for A.Y. 2019- 20 wherein the concerned amount of addition of Rs. 69,78,53,383 is also included. Therefore, the discussion on legal validity and sustainability of the said addition of Rs. 69,78,53,383/- on merits has been made while finalizing the Appellate Order for A.Y. 2019-20. Therefore, the other grounds of appeal, for the sake of brevity, are not discussed here in this Appellate Order and are accordingly, treated as disposed off.”

13. On perusal of the above finding of the ld. CIT(A) we do not find any error in these cases. Even the ld. DR did not controvert the finding of ld. CIT(A) either by filing the submission or by way of oral argument in the proceedings before us. Therefore, in terms of these observations of facts, the appeal filed by the Revenue for these 3 years are become infructuous and required to be dismissed. Thus, the appeal of the revenue in BMA No. 03, 04 & 05/JP/2022 related to Assessment Year 2016-17, 2017-18 and 2018-19 has no merits and thus, the same are dismissed.

14. Now we take up the appeal of the assessee in appeal number BMA No. 01/JP/2022 related to Assessment Year 2019-20. The assessee has raised the following grounds :-

“The Appellant respectively craves leave to prefer an appeal under Section 18(1) of the Black Money (Undisclosed Income & Assets) and Imposition of Tax Act, 2015 the Black Money Act”) against the Order dated 31.08.2022 passed by the Ld. CIT(A)4, Jaipur [CIT(A) received by the Appellant on 05.09.2022. Based on the facts and circumstances of the case, the Appellant respectfully submits that the Ld. CIT(A), while passing the Appellate Order, has erred on the following grounds, each of which is independent and without prejudice to each other.

1. Under the facts and the circumstances of the case and in law, the order dated 31.08.2022 passed by the Ld. CIT(A) under the Black Money Act, by sustaining the addition in the hands of the Appellant on account of the value of the alleged undisclosed foreign assets amounting to Rs. 23,74,26,443/-, is perverse, incorrect, non-speaking, arbitrary and bad in law.

2. Under the facts and circumstances of the case and in law, the Ld. CIT(A) has grossly erred in sustaining the addition of Rs. 19,68,01,923/(18,56,28,608+ 1.11.73,315) on account of credits in the bank accounts of Agrasen Polymers FZE (Foreign Company”) which do not belong to the Appellant.

3. Under the facts and circumstances of the case and in law, the Ld. CIT(A) has erred in sustaining the addition of Rs. 2,34,26,056/- made by the Ld. AO, which pertains to the dividend earned by the Foreign Company on the investments made. Under the facts and circumstances of the case and in law, the Ld. CIT(A) has erred in sustaining the addition of Rs. 16,76,574/- made by the Ld. AO that pertains to the interest earned by the Foreign Company.

5. Under the facts and circumstances of the case and in law, the Ld. CIT(A) has erred in sustaining the addition of Rs. 1,42,67,290/- on account of cash deposits in the foreign bank accounts without considering that the cash deposits were made out of the withdrawals made from the said accounts.

6. Under the facts and circumstances of the case and in law, the Ld. CIT(A) has erred in sustaining the addition of Rs. 12,54,600/- on account of repayments received from the staff of the Foreign Company to whom the said company gave loans.

7. Under the facts and circumstances of the case and in law, the Ld. CIT(A) and Ld. AO have failed to consider the transfer of funds from the bank accounts of the Foreign Company to the Appellant and vice-versa, which clearly establishes that the money in foreign bank accounts and investments (foreign assets) were owned by the foreign company.

8. Under the facts and the circumstances of the case and in law, the Ld. CIT(A) has grossly erred in passing the order without considering the detailed submissions, Paper Book, assessment records and documents in relation to the Foreign Company placed on record by the Appellant during the course of appellate proceedings.

9. Under the facts and the circumstances of the case and in law, the Ld. CIT(A) has vehemently erred in not appreciating that the AO had incorrectly treated the foreign company’s assets as the Appellant’s assets without considering that a company has a separate legal identity from its shareholders and is separately assessed to tax

10. Under the facts and the circumstances of the case and in law, the Ld. CIT(A) has grossly erred in alleging that the Appellant is the beneficial owner and sole signatory in the Foreign Company.

11. Under the facts and the circumstances of the case and in law, the Ld. CIT(A) has erred in observing that the Appellant was statutorily bound to not only disclose the complete details of the Foreign Company in his ITR but is also mandatorily bound to provide the source of funds in the hands of the said company.

12. Under the facts and the circumstances of the case and in law, the Ld. CIT(A) has grossly erred in alleging that the Appellant admitted to have received commission income from companies/ persons of UAE and Turkey directly in his UAE-based bank accounts without appreciating the correct facts on record.

13. Under the facts and the circumstances of the case and in law, the Ld. CIT(A) and Ld. AO have failed to properly consider Rule 3(1)(e) of the Black Money Rules, as per which while computing the value of bank accounts, only ‘deposits’ have to be considered and not “loans”.

14. Under the facts and the circumstances of the case and in law, the Ld. CIT(A) and the Ld. AO have failed to consider the original returns of income for AY 2018-19 and AY 2019-20 and the revised return of income for AY 2017-18, wherein due disclosures with respect to foreign assets were made by the Appellant.

15. Under the facts and circumstances of the case and in law, the Ld. AO has not given due consideration to the fact that the Appellant is above 84 years of age and has not been given due opportunity of being heard to present his case before launching the Prosecution proceedings, which is against the principles of natural justice.

16. The Appellant craves leave to add, amend, and modify all or any grounds of appeal on or before the hearing date.”

15. The brief facts of the case are that Shri K.D. Agrawal (hereinafter referred to as the “Appellant”) is a senior citizen, aged 84 years and is presently enjoying a retired life. He is a regular taxpayer and has been awarded Certificates of Appreciation from the Income Tax Department.

PB 216 – 217 are the copies of Certificate of Appreciation issued by the Income Tax Department for A.Y. 2016 – 17 & 2017 – 18.

15.1. In the earlier years, the appellant along with a group of persons came together and incorporated a company in the Free Trade Zone of Ras-Al-Khaimah (UAE) – Agrasen Polymers FZE, in order to deal in master batches / polymers. That, however, after a while, prices of the master batches in Indian markets became more competitive than UAE and because of this, the foreign company, M/s Agrasen Polymers FZE could not continue its business in UAE. Accordingly, it started to invest its surplus funds in some investment products in UAE.

15.2. That however, it is pertinent to mention, at the very outset that all the assets belong to the company and the appellant-assessee does not own any foreign asset in his individual / personal capacity, nor is a beneficial owner of the assets of the company. Therefore, the taxability in the hands of the Appellant is wholly illegal and unjust.

15.3. A Search action was conducted at the premises of Shri K.D. Agrawal in July 2018 (F.Y. 2018 – 19) whereby certain documents concerning the banking transactions of the foreign company, viz. M/s Agrasen Polymers FZE were found. Based on the search, a high-pitched addition to the tune of Rs. 146,42,44,881/-including to the transactions undertaken by the non-resident foreign company from A.Y. 2016 – 17 to 2018-19 & A.Y. 2019 – 20 were added in the hands of the assessee in the Assessment Year 2019 – 20 on Substantive Basis, vide an Assessment Order dated 31.03.2021, passed u/s 10(3) of the Black Money (Undisclosed Foreign Income & Assets) & Imposition of Tax Act, 2015 (hereinafter referred to as the “Black Money Act” or “The Act”). Aggrieved by the assessment order, an Appeal was filed before the Ld. CIT(A) whereby the claims of the Appellant were substantially accepted; however, additions to the tune of Rs. 23,74,26,443/-were sustained.

16. Being aggrieved, now the assessee is in appeal before us against the sustenance of the above-said amount of Rs. 23,74,26,443/-, which belonged to the company and the taxability thereof in the hands of the Appellant. For ready reference, the breakup of the additions so made, and the corresponding decision of the Ld. CIT(A) is tabulated as under:

Sr. No. |

Particulars |

Addition made

|

Additions

|

Amount

|

|

1. |

Addition made on account of the following Bank Accounts of Polymers FZE and the accounts Appellant in fiduciary capacity company during F.Y. 2015 – 2018 – 19 AE470271226001850542017 |

the credits in

|

INR136,73,10,855 |

INR23,74,26,443 |

INR1,12,98,84,412 |

AE410271226001850542028 |

Appellant –Fiduciary Capacity |

||||

AE920271161201822102010 |

Company |

||||

AE610271161371822102026 |

Company |

||||

AE060276031498079255014 |

Appellant

|

||||

AE550271031591850542039 |

Belongs neither to the company, nor to the Appellant in fiduciary/ individual capacity |

||||

2. |

Income Allegedly earned on Investments in OMI |

INR 9,69,34,026 |

– |

INR 9,69,34,026 |

|

TOTAL |

INR 146,42,44,881 |

INR 23,74,26,443 |

INR 1,22,68,18,438 |

||

17. Before us, the ld. A/R of the assessee has submitted his ground-wise written submissions as under :-

“GROUND NOS. 1, 8, 11, 15 & 16 ARE GENERAL AND INCIDENTAL TO THE OTHER GROUNDS OF APPEAL AND THEREFORE, BE READ IN CONJUNCTION.

GROUND NO. 9 – THAT THE LD. CIT(A) ERRED IN NOT RECOGNIZING THAT THE COMPANY VIZ. AGRASEN POLYMERS FZE HAS SEPARATE LEGAL ENTITY AND THAT ALL THE FUNDS / INVESTMENTS ETC. BELONGED TO THE COMPANY ALONE. THEREFORE, THE TAXABILITY LEVIED IN THE HANDS OF THE APPELANTS IS WHOLLY UNJUST, ILLEGAL AND LIABLE TO BE QUASHED OUTRIGHTLY

1. The said issue has not been addressed by the Ld. Assessing Officer, nor by the Ld. CIT(A), as the appellant and M/s Agrasen Polymers FZE have been considered as one, and all transactions solely belonging to the company have illegally been taxed in the hands of the Appellant.

2. At the very outset, the entire proceedings have been made out against the assets of a company, viz. Agrasen Polymers FZE, which is undeniably a separate legal entity, having an independent identity, capable of holding assets in its own name for the furtherance of its own objectives and purposes. Therefore, the claim of taxing the Appellant in his individual capacity of the assets of the company is wholly illegal and unsustainable, by any stretch of imagination.

3. It is pertinent to note that the company, viz. Agrasen Polymers FZE has also disclosed the transactions/bank accounts in its Audited Financial Statements, submitted to the Authorities of the Free Trade Zone of Ras Al Khaimah.

AY 2015 – 16 (01.01.2015 – 31.12.2015)

|

PB 286-299 |

Copy of Auditors Report, Director’s Report & the Financial Statements of M/s Agrasen Polymers FZE audited & approved by M/s Ramesh Ramu & Audit Associates, UAE on 07.04.2016 which was even submitted to the authorities of the Free Trade Zone of Ras Al Khaimah. |

| PB 288 | is the copy of the Director’s Report prepared by the directors of the company. |

| PB 289 | is the independent Auditor’s Report prepared by M/s Ramesh Ramu & Audit Associates, UAE on 07.04.2016 |

| PB 29 | is the copy of the Statement of Financial Position of M/s Agrasen Polymers FZE akin to a Balance Sheet. |

| PB 291 | is the copy of the Statement of Comprehensive Income audited & approved by the Auditors Ramesh Ramu & Audit Associates on 07.04.2016 whereby the Net Revenue, Expenses, Net Income/Loss is duly mentioned. |

| PB 294 | is the copy of notes to Financial Statements of M/s Agrasen Polymers FZE where at point 1 (b), the factum of the company being duly registered and undertaking activities of trading Plastic and Nylon raw materials and also the fact that the company has invested its own resources to earn dividend/interest/gains has duly been mentioned. |

| PB 296 | is the copy of the Notes to Financial Statements whereby at point no. 4, Investments to the tune of AED 7,457,719 made by the Company are mentioned. |

| PB 297 | Copy of the Notes to Financial Statements for year ending 31st December 2015 whereby at point number 6, the bank accounts held by the company in its own name and also that of the two bank accounts held by the manager (Appellant) maintained for making investment and to take benefit of Leverage from banks. |

| PB 297 & 298 | is the copy of the Notes to Financial Statements of M/s Agrasen Polymers FZE whereby at point no. 8 (PB 297) & point 12 (PB 298), the Financial Liabilities – in the form of Trade and Other Payables to the tune of 9,976,302/- (18.6 Cr INR) is duly mentioned to be belonging to the company. |

AY 2016 – 17 (01.01.2016 -31.12.2016)

|

PB 422-438 |

Copy of Auditors Report, Director’s Report & the Financial Statements of M/s Agrasen Polymers FZE audited & approved by M/s Ramesh Ramu & Audit Associates, UAE on 10.04.2017 which was even submitted to the authorities of the Free Trade Zone of Ras Al Khaimah |

| PB 425 | is the copy of the Director’s Report prepared by the directors of the company. |

| PB 426-428 | is the independent Auditor’s Report prepared by M/s Ramesh Ramu & Audit Associates, UAE on 10.04.2017. |

| PB 429 | is the copy of Statement of Financial Position of M/s Agrasen Polymers FZE akin to a Balance Sheet. |

| PB 430 | is the Copy of the Statement of Comprehensive Income audited by the Auditors M/s Ramesh Ramu & Audit Associates on 10.04.2017 whereby the Net Revenue, Expenses, Net Income/Loss is duly mentioned. |

| PB 433 | is the copy of notes to Financial Statements of M/s Agrasen Polymers FZE where at point 1 (b), the factum of the company being duly registered and undertaking activities of trading Plastic and Nylon raw materials and also the fact that the company has invested its own resources to earn dividend/interest/gains has duly been mentioned. |

| PB 435 | is the copy of the Notes to Financial Statements whereby at point no. 4, Investments to the tune of AED 8,233,239/- made by the Company are mentioned. |

| PB 436 | Copy of the Notes to Financial Statements for year ending 31st December 2016 whereby at point number 6, the bank accounts held by the company in its own name and also that of the two bank accounts held by the manager (Appellant) maintained for making investment and to take benefit of Leverage from banks, in fiduciary capacity on behalf of the company. |

| PB 436 & 437 | is the copy of the Notes to Financial Statements of M/s Agrasen Polymers FZE whereby at point no. 8 (PB 436) & point 12 (PB 437), the Financial Liabilities – in the form of Trade and Other Payables to the tune of 9,579,750/- is duly mentioned to be belonging to the company. |

AY 2017 – 18 (01.01.2017 -31.12.2017)

|

PB 588-603 |

Copy of Auditors Report, Director’s Report & the Financial Statements of M/s Agrasen Polymers FZE audited & approved by M/s Ramesh Ramu & Audit Associates, UAE on 13.05.2018 which was even submitted to the authorities of the Free Trade Zone of Ras Al Khaimah |

| PB 591 | is the copy of the Director’s Report prepared by the directors of the company. |

| PB592-593 | is the independent Auditor’s Report prepared by M/s Ramesh Ramu & Audit Associates, UAE on 13.05.2018. |

| PB 594 | is the copy of Statement of Financial Position of M/s Agrasen Polymers FZE akin to a Balance Sheet. |

| PB 595 | is the Copy of the Statement of Comprehensive Income audited by the Auditors M/s Ramesh Ramu & Audit Associates on 13.05.2018 whereby the Net Revenue, Expenses, Net Income/Loss is duly mentioned. |

| PB 598 | is the copy of notes to Financial Statements of M/s Agrasen Polymers FZE where at point 1 (b), the factum of the company being duly registered and undertaking activities of trading Plastic and Nylon raw materials and also the fact that the company has invested its own resources to earn dividend/interest/gains has duly been mentioned. |

| PB 600 | is the copy of the Notes to Financial Statements whereby at point no. 4, Investments to the tune of AED 5,530,785/- made by the Company are mentioned. |

| PB 601 | Copy of the Notes to Financial Statements for year ending 31st December 2017 whereby at point number 6, the bank accounts held by the company in its own name and also that of the two bank accounts held by the manager (Appellant) maintained for making investment and to take benefit of Leverage from banks, in fiduciary capacity on behalf of the company. |

| PB 601 & 602 | is the copy of the Notes to Financial Statements of M/s Agrasen Polymers FZE whereby at point no. 8 (PB 601) & point 12 (PB 602), the Financial Liabilities – in the form of Trade and Other Payables to the tune of 9,840,450/- is duly mentioned to be belonging to the company. |

AY 2018 – 19 (01.01.2018 -31.12.2018)

|

PB 710-725 |

Copy of Auditors Report, Director’s Report & the Financial Statements of M/s Agrasen Polymers FZE audited & approved by M/s Ramesh Ramu & Audit Associates, UAE on 22.01.2019 which was even submitted to the authorities of the Free Trade Zone of Ras Al Khaimah |

| PB 713 | is the copy of the Director’s Report prepared by the directors of the company. |

| PB 714-715 | is the independent Auditor’s Report prepared by M/s Ramesh Ramu & Audit Associates, UAE on 22.01.2019. |

| PB 716 | is the copy of Statement of Financial Position of M/s Agrasen Polymers FZE akin to a Balance Sheet. |

| PB 717 | is the Copy of the Statement of Comprehensive Income audited by the Auditors M/s Ramesh Ramu & Audit Associates on 22.01.2019 whereby the Net Revenue, Expenses, Net Income/Loss is duly mentioned. |

| PB 720 | is the copy of notes to Financial Statements of M/s Agrasen Polymers FZE where at point 1 (b), the factum of the company being duly registered and undertaking activities of trading Plastic and Nylon raw materials and also the fact that the company has invested its own resources to earn dividend/interest/gains has duly been mentioned. |

| PB 722 | is the copy of the Notes to Financial Statements whereby at point no. 4, Investments to the tune of AED 3,195,075/- made by the Company are mentioned. |

| PB 723 | Copy of the Notes to Financial Statements for year ending 31st December 2018 whereby at point number 6, the bank accounts held by the company in its own name and also that of the two bank accounts held by the manager (Appellant) maintained for making investment and to take benefit of Leverage from banks, in fiduciary capacity on behalf of the company. |

| PB 723 & 724 | is the copy of the Notes to Financial Statements of M/s Agrasen Polymers FZE whereby at point no. 8 (PB 723) & point 12 (PB 724), the Financial Liabilities – in the form of Trade and Other Payables to the tune of 3,358,200/- is duly mentioned to be belonging to the company. |

4. That the concept of a separate legal entity has been a time old principle, which rather forms the backbone of legal jurisprudence. For ready reference reliance is placed on the following judicial precedents as under:

MRS. BACHA F. GUZDAR vs. CIT SUPREME COURT OF INDIA (1955) 27 ITR 0001

Agricultural income—Dividend from tea companies—Assessee, a shareholder in a company engaged in manufacture of tea whose income was exempt to the extent of 60 per cent, receiving dividends from such company—Dividends arose to the shareholder due to investment in the company—Shareholder has no direct relationship with land as the same belongs only to the company, nor to its shareholders, nor directors

BHARAT HARI SINGHANIA & ORS. ETC. vs. COMMISSIONER OF WEALTH TAX & ORSSUPREME COURT OF INDIA (1994) 207 ITR 0001

Held : Wealth being assessed is that of the shareholder and not of the company. The company may own agricultural assets and if company were to be liable to wealth tax, the said assets may be excludible in its hands. But that has no relevance to the case of a shareholder. The shareholder does not own and cannot claim any portion of the property held by the company of which he is a shareholder. The company is an independent juristic entity. An assessee holding shares in a company whose assets comprise wholly or partly of agricultural land, is not entitled to exclude such shares from his wealth.—Bacha F. Guzdar vs. CIT (1955) 27 ITR 1 (SC) : 1955 (1) SCR 876

SALOMON V SALOMON & CO LTD (1897)

Mr. Salomon had a boot manufacturing business which he decided to incorporate into a private limited company. He sold his business to the newly formed company, A Salomon & Co Ltd, and took his payment by shares and a debenture or debt of £10,000. Mr Salomon owned 20,000 £1 shares, and his wife and five children owned one share each. Some years later the company went into liquidation, and Mr Salomon claimed to be entitled to be paid first as a secured debenture holder. The liquidator and the other creditors objected to this, claiming that it was unfair for the person who formed and ran the company to get paid first. However, the House of Lords held that the company was a different legal person from the shareholders, and thus Mr Salomon, as a shareholder and creditor, was totally separate in law from the company A Salomon & Co Ltd. The result was that Mr Salomon was entitled to be repaid the debt as the first secured creditor.

In this case, Mr Salomon was the major shareholder, a director, an employee and a creditor of the company he created. It is quite common in Ireland for one person to have such a variety of roles and still be a different legal entity from the company.

LEE V LEE`S AIR FARMING LTD (1961)

In this case, Mr. Lee formed his crop spraying business into a limited company in which he was director, shareholder and employee. When he was killed in a flying accident, his widow sought social welfare compensation from the State, arguing that Mr. Lee was a workman under the law. The State argued that Mr. Lee was self-employed and thus not covered by the legislation. The court held that Mr. Lee and the company he had formed were separate entities, and it was possible for Mr. Lee to be employed by Lee`s Air Farming.

STATE TRADING CORPORATION OF INDIA LTD. AIR (1963) SC 1811

It was held that as soon as citizens form a company, the rights guaranteed to them by article 19(1)c has been exercised and no restraint has been placed on the right and no infringement of that right is made. Once a company or corporation is formed, the business which is carried on by the such company or corporation is the business o f that company or corporation and is not the business of the citizens who get the company or corporation incorporated and the rights of the incorporated body must be judged on that footing and cannot be judged on the assumption that they are the rights attributed to the business of individual citizens.

5. Even as per the Income Tax Act, 1961 and for all purposes of the assessment, a company is treated to be a separate ‘person’ within the meaning of section 2(31) read with 2(17) of the Income Tax Act. In the present case, Company invested its own money and resources in the UAE to earn dividends, interest, gains, which cannot be taxed in the hands of the Appellant in any manner. The taxability thereof in the hands of the Appellant is not in consonance with the Black Money (Undisclosed Foreign Income and Asset) & Imposition of Tax Act, 2015. More so when, there is no iota of evidence that any funds belonged to and/or pertained to the Appellant in his individual capacity. Nor is there any evidence to show that any income of the Appellant was taken abroad and was omitted to be taxed in India. Therefore, the taxability of any amount in the hands of the Appellant will be unconstitutional and hence illegal.

6. That not just a company, even a partnership firm has a separate legal entity. In light of the same, reliance is placed on the judgment of the Hon’ble Delhi High Court in CIT vs. Nagpur Golden Transport Co., [1998] 233 ITR 389 (Delhi) has held as under:

Whether while framing an order of assessment under provisions of Act, firm and its partners are to be treated as two separate legal entities and payment of interest to a firm cannot be treated in tax law as payment of interest to its partners – Held, yes – Whether, Therefore, payment of interest by assessee firm to another firm could not be treated as payment of interest to partners of that firm within meaning of section 40(b) even though partners in two firms were common – Held, yes

7. Without prejudice to the above, the comparison in the present case, is that of a non-resident foreign company and not an Indian company. The said vital fact has been accepted and never been disputed by the Ld. AO in the Assessment Order dated 31.03.2021 and/or in the Remand Report dated 13.07.2022.

8. Further, without prejudice to the above, the Place of Effective Management of the said foreign company is also situated outside India because of which, the company is a non-resident in India within the meaning of section 6 of the income tax act and none of the assets were liable to be taxed in India. A Ready reference can be made to the CBDT circular dated 23.02.2017 bearing Circular No. 08/2017. Therefore, in no view of the manner can taxability arise in the present case proving that the entire edifice of the case is wholly unjust and illegal.

GROUND NO. 14 – THE ASSESSEE MADE DUE DISCLOSURES AS ALLOWABLE IN LAW, THAT TOO PRIOR TO THE ISSUANCE OF NOTICES UNDER THE BLACK MONEY (UFIA) & IMPOSITION OF TAX ACT, 2015, PROVING THAT THE ENTIRE CASE IS BASED ON A PRE-CONCEIVED NOTION.

9. It is to be noted that the alleged information admittedly came to the notice of the Ld. Assessing Officer during the course of search proceedings conducted in July 2018, i.e., during F.Y. 2018 – 19 relevant to A.Y. 2019 – 20, therefore, taxability if any, can only be made for the year under consideration, viz. A.Y. 2019 – 20.

10. In this regard, it is pertinent to note that the Appellant made due disclosures in his Original Return filed u/s 139(1) of the Income Tax Act, 1961 for A.Y. 2018 – 19 & 2019 – 20 regarding having financial interest (in a fiduciary capacity) and a signing authority for and on behalf of the company. Therefore, even the case of non-disclosure cannot be made out against the Appellant.

|

PB 542 – 543 |

is the copy of the return filed by A.Y. 2018 – 19 whereby due disclosures regarding the Financial Interest & Signing Authority had been made by the Appellant. |

| PB 605 | is the copy of the ITR Acknowledgement of the ITR filed u/s 139(1), viz. on or before due date. |

| PB 606 – 640 | is the copy of the ITR Form filed by the Appellant for A.Y. 2019 – 20, whereby in schedule FA (Pg. 628 & 629-630), due disclosure has been made by the Appellant in his return. |

Thus, no tax liability, let alone even penalty, can be imposed on the Appellant as the entire edifice of the case, built solely on suspicion and surmises, deserves to be quashed and no amount can be taxed in the hands of the Appellant, as the same in no manner, can be called as the income of the Appellant.

Further, any incorrect allegation on the part of the Department with respect to Non-Disclosure in the return for the A.Y. 2017 – 18 to 2018 –19 is unjustifiable as the Appellant, after coming to be aware of the legal compliances, i.e., requirement of disclosures, even amended / revised his previous returns for A.Y. 2017 – 18 and made due disclosures about the bank accounts which he held on behalf of the company and also the financial interest in the company.

|

PB 303 |

is the copy of the ITR Acknowledgement of the ITR filed u/s 139(5) for AY 2017-18. |

| PB 304-329 | is the copy of the ITR Form filed by the Appellant for A.Y. 2017-18, whereby in schedule FA (Pg. 326, & 327), due disclosure has been made by the Appellant in his return. |

| PB 376 – 377 | is the copy of the revised return filed for A.Y. 2017 – 18 whereby due disclosures regarding the Financial Interest & Signing Authority had been made by the Appellant. |

| PB 844 | is the copy of chart of dates of return filed original and revised. |

Without prejudice, even if the Appellant wouldn’t have taken above-mentioned steps, even then penalty / assessment / addition in the hands of the Appellant cannot be made solely because of mere non-disclosure. In this regard reliance is placed on the order, as under:

ACIT vs. Leena Gandhi Tiwari, [2022] 96 ITR(T) 384 (Mumbai – Trib.)[29-03-2022]

Where assessee was a signatory in a foreign bank account owned by her mother and she failed to disclose same while filing her income-tax return, however disclosure was made while filing return under section 153A, since such non-disclosure of a foreign asset was a bona fide mistake, penalty could not be imposed under section 43 of Black Money Act.

Therefore, the additions of transactions in the hands of the Appellant which solely belong to the non-resident foreign company cannot be added in the hands of the Appellant.

GROUND NO. 10 – THE LD. ASSESSING OFFICER AND THE LD.CIT(A) ERRED IN HOLDING THE APPELLANT TO BE A BENEFICIAL OWNER OF THE ALLEGED UNDISCLOSED ASSETS AND THE INCOME THEREFROM, WHICH SOLELY AND INDEPNDENTLY BELONGS ONLY TO THE NON-RESIDENT FOREIGN COMPANY, M/S AGRASEN POLYMERS FZE.

11. The said issue has been addressed by the Ld. Assessing Officer at Para 5.12 Page 56 of his order.

12. On Appeal, the Ld. CIT(A) has placed blind reliance on the version of the Ld. Assessing Officer the said issue has been dealt by the Ld. CIT(A) at Para 6.2 (xiii) Page 37 of his order, whereby, without considering the basic tenets / provisions of law, the Appellant has erroneously been held to be the ‘beneficial owner’ qua the assets of the non-resident foreign company.

13. It is submitted that the Appellant has been illegally deemed to be the beneficial owner of the assets of the company, viz. M/s Agrasen Polymers FZE, whereas as mentioned above, there is no income of the Appellant, which remained untaxed. Therefore, in the absence of any investment / withdrawal / benefit derived by the Appellant, there remains no taxability of any sum in the hands of the Appellant.

14. In this regard, reliance is placed on the judgment of ACIT vs. Jatinder Mehra, [2021] 190 ITD 611 (Delhi – Trib.) rendered in the context of ‘beneficia l ownership’under the Black Money Act, wherein it was held that:

To identify a beneficial owner of an asset, said person should have nexus, direct or indirect to source of asset and he must have provided funds for said asset; mere account opening form of an overseas bank account where assessee was mentioned as beneficial owner o f account, mentioning details of his passport as an identification document, did not necessarily, in absence of any other corroborative evidence of beneficial ownership of assessee over asset, lead to taxability in hands of assessee under Black Money Act.

15. It is submitted that the Appellant has been subjected to tax in respect of the bank account of the Foreign Company by treating him to be the ‘beneficial owner’. The term “beneficial owner” is not defined in the Black Money Act but is defined in Explanation 4 to Section 139(1) of the IT Act, 1961.

16. On perusal of the definition of the term “Beneficial owner”, it is evident that a beneficial owner in respect of an asset would be a person who provides consideration for the asset for the immediate or future benefit of himself or any other person. Thus, it is relevant to understand the meaning of term ‘beneficial owner’ by making reference to Income Tax Act, 1961, wherein the said term has been defined in Explanation to Section 139(1) of the Income Tax Act, 1961.

Explanation 4.-For the purposes of this section “beneficial owner” in respect of an asset means an individual who has provided, directly or indirectly, consideration for the asset for the immediate or future benefit, direct or indirect, of himself or any other person.

17. That in the present case, the assets, i.e., the foreign bank accounts and foreign investments, were solely the assets of the foreign company and consideration for the said assets, i.e., the money flew from the bank account of the Foreign Company itself. The Foreign company deposited or made investments out of its own funds in the bank accounts in question. Thus, the Appellant clearly does not fall in the ambit of the term “beneficial owner” as he is not the provider of the consideration of the asset. Hence, the allegation of the Ld. Assessing Officer confirmed by the Ld. CIT(A) that the Appellant is the” beneficial owner” of the assets of the Foreign Company is misconceived, against the law and deserves to be annulled.

Reliance is placed on the following judgments:

ITO v. Electro Ferro Alloys Ltd. [2012] 25 taxmann.com 458 (Ahd. – Trib.) where the relevant finding of the coordinate bench reads as under:

“5. 2. On consideration of the facts of the appellant’s case it is noticed that the motor car was purchased, though in the name of the appellant’s director, it was purchased out of the funds of the appellant-company and it is also not in dispute that the motor car was purchased for the purpose of business of the appellant. Thus the motor car being, business asset of the appellant and purchased for the purpose of business and used as such by the appellant, in view of the decision in the case of Mysore Minerals Ltd. [1999] 239 ITR 775 (SC) referred to above and other decisions cited by the learned authorised representative, I hold that the disallowance made by the Assessing Officer on this ground is not justified and hence the same is directed to be deleted.

18. We further state that there were three directors in the Foreign Company viz. M/s Agrasen Polymers FZE. The company is established in the Free Trade Zone in UAE and two directors, who are locals, stay in Dubai. The Appellant was one of the Directors and the signing authority on behalf of the Company, and cannot be termed as a beneficiary as no amount has been received by the Appellant from the company in the form of remuneration or commission or profit or in any manner and neither is there any evidence suggesting the same, in the absence of which, the additions made in the hands of the Appellant by holding him to be a beneficial owner, is unjust, illegal, notional and not grounded on actual facts and/or law.

| PB 889 – 894 | is the copy of the submissions dated 18.07.2022 filed before the Commissioner of Income Tax (Appeals)-3, Jaipur regarding the issue of no ‘beneficial ownership’ of the Appellant. |

19. In light of the above, it is most respectfully submitted that the Ld. Assessing Officer as well the Ld. CIT(A) erred in holding the Appellant to be the ‘Beneficial Owner’ without there being any iota of evidence to justify any benefit or even any contribution made by the Appellant.

GROUND NO. 3 – DIVIDEND OF RS. 2,34,26,056/- PERTAINS TO THE COMPANY AND DOES NOT BELONG OR BENEFIT THE APPELLANT THEREFORE CANNOT BE TAXED IN THE HANDS OF THE APPELLANT

20. The said amount formed a part of the total credits, hence has not been expressly discussed by the Ld. Assessing Officer. Even, the Ld. CIT(A) has also not recorded his findings qua this issue in the Appellate Order.

21. It is to be noted that the non-resident foreign company viz. M/s Agrasen Polymers FZE had made investments which are duly disclosed in its Financial Statements

|

PB 296 |

is the copy of the Financial Statement of M/s Agrasen Polymers FZE for the period ending on 31st December 2015 audited & approved M/s Ramesh Ramu & Audit Associates, wherein the investments have duly been disclosed. |

| PB 435-436 | is the copy of the Financial Statement of M/s Agrasen Polymers FZE for the period ending on 31st December 2016 audited & approved by M/s Ramesh Ramu & Audit Associates, wherein the investments have been disclosed and dividends received thereon have also been disclosed. |

| PB 600-601 | is the copy of the Financial Statement of M/s Agrasen Polymers FZE for the period ending on 31st December 2017 audited & approved by M/s Ramesh Ramu & Audit Associates, wherein the investments have been disclosed and dividends received thereon have also been disclosed. |

| PB 722-723 | is the copy of the Financial Statement of M/s Agrasen Polymers FZE for the period ending on 31st December 2018 audited & approved by M/s Ramesh Ramu & Audit Associates, wherein the investments have been disclosed and dividends received thereon have also been disclosed. |

| PB 885-888 | is the copy of the Reply dated 08.08.2022 filed before the Ld. CIT(A) whereby the Appellant duly explained the transactions of credits in the bank accounts of the non-resident foreign company. |

22. That from these investments, the company, viz. M/s Agrasen Polymers FZE earned dividend income of Rs. 2.34 Crores during F.Y. 2016 – 17 to 2018 – 19 which has incorrectly been added as the income of the Appellant, whereas, the investments and the benefits therefrom, solely pertain to the Company, in its individual capacity. It is pertinent to note that not even an iota of any amount from the above-said amount has ever been received by the Assessee, nor is there any such allegation made by the Ld. AO in the Assessment Order dated 31.03.2021 nor in the Remand Report dated 13.07.2022, nor the Ld. CIT(A) brought out any adverse evidence in this regard on record. Therefore, taxing the same, in the hands of the Appellant is wholly incorrect and illegal, as the same is not in the nature of income of the Assessee and is not an asset belonging or pertaining to the assessee.

GROUND NO. 4 – THE AMOUNT OF RS. 16,76,574/- PERTAINS TO THE INTEREST EARNED BY THE NON-RESIDENT COMPANY ALONE AND CANNOT BE TAXED IN THE HANDS OF THE APPELLANT

23. The said amount formed a part of the total credits, hence has not been expressly discussed by the Ld. Assessing Officer, however, the Ld. CIT(A) has also not recorded his findings qua this issue in the Appellate Order.

24. That as mentioned above, the bank account pertained to the non-resident company, the interest earned from the bank has been credited in the bank account held by the company, or on behalf of the company, can only be income of the company. Therefore, taxing the same in the hands of the Appellant is wholly illegal and liable to be quashed.

PB 436 is the copy of the Financial Statement of M/s Agrasen Polymers FZE for the period ending on 31st December 2016 audited & approved by M/s Ramesh Ramu & Audit Associates, wherein the interest income has been disclosed.

PB 601 is the copy of the Financial Statement of M/s Agrasen Polymers FZE for the period ending on 31st December 2017 audited & approved by M/s Ramesh Ramu & Audit Associates, wherein the interest income has been disclosed.

PB 723 is the copy of the Financial Statement of M/s Agrasen Polymers FZE for the period ending on 31st December 2018 audited & approved by M/s Ramesh Ramu & Audit Associates, wherein the interest income has been disclosed.

PB 773 is the copy of Annexure 8 of Reply dated 12.07.2022 filed before the Ld. CIT(A) wherein the details of the Interest Received by M/s Agrasen Polymers FZE was categorically provided. (Also see PB 755)

PB 883 is the copy of the Reply to the Remand Report filed before the Ld. CIT(A).

25. That however, no specific adjudication has been done by the Ld. CIT(A) and this amount has been sustained from the general pool of additions, which is evident from Page 43 of the Order of the Ld. CIT(A). Therefore, as due submissions backed up by clinching evidence, the impugned addition sustained by the Ld. CIT(A) deserves to be quashed.

GROUND NO.5 – THE ADDITION OF RS. 1,42,67,290/- IS ILLEGAL AS THE SAME WERE MERE DEPOSITS MADE OUT OF THE WITHDRAWLS FROM THE BANK ACCOUNTS AND THEREFORE CANNOT BE ADDED AGAIN

26. The said amount formed a part of the total credits, hence has not been expressly discussed by the Ld. Assessing Officer either in his order, however, the said aspect was raised before the Ld. CIT(A) in reply to the remand report (PB 874) the Ld. CIT(A), while upholding the addition, has recorded his findings qua the issue at Para 6.2 (xxii) Page 41 of the Appellate Order.

27. That in order to meet day-to-day expenditures for the business of the Company, certain withdrawals were made by the Company, directly from the bank accounts and after utilsing the amounts, the remaining/balance amounts were deposited back in the respective bank accounts.

28. It is therefore stated that the addition of these amounts, tantamounts to double addition as cash in hand withdrawn from the bank has been deposited in bank which cannot be added as the amount has already been added at the time of withdrawal being the balance available in bank.

PB 775 is the copy of Annexure 10 of Reply dated 12.07.2022 filed before the Ld. CIT(A) wherein the details of the cash deposits out of withdrawals after meeting expense of M/s Agrasen Polymers FZE was categorically provided. (See PB 755)

Pg. …………… Synopsis is the Reconciliation chart extracted from the bank statement is being provided here for the sake of convenience

29. In any manner, the deposits / withdrawals pertain and belong to the company, M/s Agrasen Polymers FZE and not to the Appellant. Therefore, in any view of the manner, taxing the said amount in the hands of the Appellant is wholly illegal and unjust.

GROUND NO. 6 – RS. 12,54,600/- PERTAINS TO REPAYMENT OF LOAN BY STAFF TO THE COMPANY ALONE AND IS NOT IN THE NATURE OF INCOME AND IN ANY MANNER, THE SAID AMOUNT HAS BEEN CONSIDERED AS ALL CREDITS HAVE BEEN CONSDIERED. THEREFORE, THE ADDITION OF THE SAID AMOUNT IS ILLEGAL AS THE SAME IS NOT IN THE NATURE OF INCOME AND ALSO AMOUNTS TO DOUBLE ADDITION, THEREFORE, ILLEGAL.

30. The said amount formed a part of the total credits, hence has not been expressly discussed by the Ld. Assessing Officer, however, the said issue was addressed by the Ld. Assessing Officer in his remand report (PB 875) and a reply thereto was offered in the reply to the remand report (PB 881). Thereafter, the Ld. CIT(A) has recorded his findings qua the issue at Para 6.2 (xxiii) Page 42 of the Appellate Order and confirmed the addition.

PB 776 is the copy of Annexure 11 of Reply dated 12.07.2022 filed before the Ld. CIT(A) wherein the details of the staff loan repaid to the non-resident company viz. M/s Agrasen Polymers FZE alone was categorically provided.

31. Without prejudice to the above, the said addition is made qua the repayment of loan given by the Company to its staff, the initial amount of loan given (being a part of the total credits) has already been considered. Therefore, addition of this amount amounts to double addition.

32. Without prejudice, the said amount pertains to repayment of loan by the staff to the non-resident company viz. M/s Agrasen Polymers FZE and therefore, is not in the nature of income. Let alone that of the Appellant, who is only a director in the non-resident company, M/s Agrasen Polymers FZE gave the loan and received the repayment thereof.

GROUND NO. 2 & 13 – CREDITS OF RS. 19,68,01,923/- APPEARING IN THE ACCOUNT BELONGS TO THE COMPANY, M/S AGRASEN POLYMERS FZE, AND NOT TO THE APPELLANT, AND THAT TOO IN THE NATURE OF A LIABILITY AND THEREFORE NOT LIABLE TO BE TAXED IN HIS HANDS OF THE APPELLANT

33. The said amount of Rs. 19,68,01,923/- formed a part of the total credits of Rs. 136,73,10,855/- hence has not been expressly discussed by the Ld. Assessing Officer, however, the Ld. CIT(A) has also not recorded his findings qua this issue in the Appellate Order, and after deleting the double additions so made, has merely sustained this amount (which remained a part of the credits).

34. It is stated that Rs. 19,68,01,923/- represents credits in bank accounts of the non-resident foreign company viz. M/s Agrasen Polymers FZE.

35. It is stated that at the time of opening the bank account of the non-resident foreign company viz. M/s Agrasen Polymers FZE, Rs. 18,56,28,608/- (AED 10487493 at PB 236 – 237) were credited in account no. ending with 2010 and Rs. 1,11,73,315/- (AED 4,99,460 + 77,123 PB 496) were transferred in the account no. ending with 2026 in the year 2017. The company had taken some loan from their own sources which was credited in the bank account of the company. The same was also informed to the CIT(A) during the proceedings, which is evident from the reply of the remand report (PB 882). However, the same was of no avail as the same was not taken into consideration which is evident as there has been no discussion whatsoever about the said additions in the Appellate Order passed by the CIT(A).

36. It is further stated that said payables of the company are the liability in the nature of loans taken by the foreign company viz. M/s Agrasen Polymers FZE which is not an income or an asset, rather a liability and, therefore, they are out of the purview of Black Money Act. An asset is a resource with economic value that an individual, corporation, or country owns or controls with the expectation that it will provide a future benefit. Assets are reported on a company’s balance sheet and are bought or created to increase a firm’s value or benefit the firm’s operations. An asset can be thought of as something that, in the future, can generate cash flow, reduce expenses, or improve sales, regardless of whether it’s manufacturing equipment or a patent. We, therefore, state that loan cannot, under any circumstances, be classified ~ as an asset and that the Ld. Assessing Officer has wrongly made the additions.

37. Furthermore, it can be seen from the audited Balance Sheets of the nonresident foreign company viz. M/s Agrasen Polymers FZE, that the liability in the nature of loan is duly reflected in the payables side of the Balance Sheet and, therefore, cannot be added as an asset of the assessee.

PB 236-237 & 496 are the copies of the respective Bank Statement reflecting the amount of funds being received in the bank account of the company.

PB 290, 297 are the copy of the balance sheet which clearly reflects the amount of loan taken by the non-resident foreign company.

PB 771 – 755 is the copy of Annexure 6 submitted to the Ld. CIT(A) along with the reply dated 12.07.2022, which clearly demonstrates the amount of loan received by the non-resident Foreign Company.

38. Further, it can be seen from the balance sheet that major portion of loan has already been returned and only Rs 6.70 Cr (Approx.) is outstanding as trade and other payables under the head liabilities, as per the balance Sheet of 2018.

PB 724 is the copy of the Notes to Accounts forming part of the Audited Financials of M/s Agrasen Polymers FZE, whereby Trade and other Payables have reduced to 3,358,200 Dirhams (equivalent to Approx. 6.5 Cr)

PB 801 & 802 are the Copies of Bank Statement of account no. ending with 2026, whereby amount of loan was returned (AED 8,25,000/- PB 801, AED 6,50,000/-, AED 600,000/-, AED 500,000/-, AED 750,000/-, AED 1,550,000/- & AED 1,150,000/- (PB 802)) by the non-resident Foreign Company viz. M/s Agrasen Polymers FZE.

For the sake of convenience to the bench a tabulated chart has been produced below of the repayment made:

| Sr. No. | Date | Cheque No. | Amount | Currency | Reference of PB |

| 1. | 12.09.2018 | 175294 | 8,25,000 | AED | 801 |

| 2. | 07.08.2018 | 175288 | 6,50,000 | 802 | |

| 3. | 07.08.2018 | 175287 | 6,00,000 | 802 | |

| 4. | 07.08.2018 | 175289 | 5,00,000 | 802 | |

| 5. | 08.08.2018 | 175290 | 750,000 | 802 | |

| 6. | 29.08.2018 | 175291 | 1,550,000 | 802 | |

| 7. | 05.09.2018 | 175292 | 1,150,000 | 802 | |

| TOTAL | 6,025,000 | ||||

39. Thus, this amount, firstly and undisputedly was a loan (liability), which was taken by the non-resident foreign company and has been repaid back by the company alone. This unequivocally proves that the same did not belong or even pertain to the Appellant. It clearly belonged to the company and that too as a liability, therefore, by no stretch of imagination can be taxed in the hands of the Appellant. Secondly, even if is presumed to be belonging to the Appellant, even then, it is a loan, viz. falling in the nature of a ‘liability’ and not ‘income’, in any which manner. Therefore, the addition of Rs. 19,68,01,923/- is wholly illegal and liable to be quashed.

GROUND NO. 12 – UNDER THE FACTS AND THE CIRCUMSTANCES OF THE CASE AND IN LAW, THE LD. CIT(A) HAS GROSSLY ERRED IN ALLEGING THAT THE APPELLANT ADMITTED HAVING RECEIVED COMMISSION INCOME FROM COMPANIES/ PERSONS OF UAE AND TURKEY DIRECTLY IN HIS UAE-BASED BANK ACCOUNTS WITHOUT APPRECIATING THE CORRECT FACTS ON RECORD.

40. It is most respectfully submitted that the facts of case have been incorrectly interpreted and wrongly portrayed. It has been alleged that the Appellant admitted that certain commission received by him was taken aboard directly to UAE in M/s Agrasen Polymers FZE, which is wholly incorrect and unjust.

PB 200 – 201 is the copy of the statement of the Appellant recorded u/s 132(4) of the Income Tax Act, 1961 whereby the Appellant mentioned that commission / incentive was paid by the Turkish companies to maintain continuity.

41. The statement has been misinterpreted as the transactions were between foreign companies and the companies in which the Appellant was acting in Fiduciary Capacity. No such amount was received by the Appellant on his personal account. Neither was the same the income of the Appellant.

42. Furthermore, there is no whisper as to any amount / transaction which could’ve been this alleged commission amount, if any. Therefore, taxing any/all transactions, that too of a non-resident foreign company in the hands of the Appellant is wholly illegal, unjust, and liable to be quashed.

43. It is further to be noted that this was a case of search, where documents from the laptop etc. were recovered. However, no such document has admittedly been found showing any such commission amount to be received by the nonresident Foreign Company, let alone the Appellant in his personal capacity. Therefore, no reliance, let alone any adverse observation can be based on that statement to make any addition in the hands of the Appellant. In this regard, reliance is placed on the following judgments:

CIT v. Harjeev Aggarwal: [2016] 229 DLT 33

Statement recorded during the course of search, on a standalone basis, without any reference to material found/discovered during the search would not empower the AO to make block assessment merely because of any admission made by Assessee during the search operation.

CIT vs. Naresh Kumar Agarwal, I.T.T.A No.112 OF 2003 dated 09.09.2014 (Andhra Pradesh High Court)

……………….. The circumstances under which a statement is recorded from an assessee, in the course of search and seizure, are not difficult to imagine. He is virtually put under pressure and is denied of access to external advice or opportunity to think independently. A battalion o f officers, who hardly feel any limits on their power, pounce upon the assessee, as though he is a hardcore criminal. The nature of steps, taken during the course of search are sometimes frightening. Locks are broken, seats of sofas are mercilessly cut and opened. Every possible item is forcibly dissected. Even the pillows are not spared and their acts are backed by the powers of an investigating officer under Section 94 of Cr.P.C by operation of sub-section (13) of Section 132 of the Act. The objective may be genuine, and the exercise may be legal. However, the freedom of a citizen that transcends, even the Constitution cannot be treated as non- existent…………..

……………….. This, in turn, is referable to a time-tested right of an individual which is recognised under Article 20(3)of the Constitution o f India which mandates no person, accused of any offence, shall be compelled to be a witness against himself. The citing of a statement o f an individual as the only evidence, in the penal proceedings initiated against him, is never treated as part of a developed and mature lega l system. Section 31 of the Evidence Act, 1872 also assumes significance in this regard. It reads: Admissions not conclusive proof, but, may estop: Admissions are not conclusive proof of the matters admitted, but they may operate as estoppels under the provisions hereinafter contained

B.R. Associates Pvt. Ltd. Vs ACIT (ITAT Delhi)

In absence of adverse material found during search, no addition could be made merely on the basis of statement recorded under section 132(4) o f Income Tax Act, 1961 which did not constitute conclusive evidence and having been given under pressure was immediately retracted. Additions made u/s 153A of the Act, in the absence of incriminating material found as a result of search is outside the scope of section 153A of the Act.

44. It is therefore submitted that no reliance can be placed on such a statement without there being any corroborative material found the course of search or otherwise, to justify the allegation.

ADDITIONAL SUBMISSION ON GROUND NO.1 & 13: – THE LD. ASSESSING OFFICER AS WELL AS THE LD. CIT(A) ERRED IN TAXING THE APPELLANT WITHOUT CONSIDERING THAT THERE IS NO SCOPE OF UNDISCLOSED FOREIGN INCOME & ASSET IN THE HANDS OF THE APPELLANT AS PER SECTION 4 OF THE BLACK MONEY (UFIA) & IMPOSITION OF TAX ACT, 2015.

45. It is to be noted that there is no income earned by the Appellant which has been omitted to be disclosed in the return of the Appellant, nor is there any ‘undisclosed asset located outside India’ which can be taxed in the hands of the Appellant-assessee, therefore, the liability ascribed on the Appellant is wholly without jurisdiction as there exists no ‘Scope of total undisclosed foreign income and asset’ in the hands of the Appellant as per section 4 of the Act.

46. For ready reference, the provision of section 4 is reproduced as under: 4. Scope of total undisclosed foreign income and asset.—

(1) Subject to the provisions of this Act, the total undisclosed foreign income and asset of any previous year of an assessee shall be,—

(a) the income from a source located outside India, which has not been disclosed in the return of income furnished within the time specified in Explanation 2 to sub-section (1) or under subsection (4) or sub-section (5) of section 139 of the Income-tax Act;

(b) the income, from a source located outside India, in respect of which a return is required to be furnished under section 139 of the Income-tax Act but no return of income has been furnished within the time specified in Explanation 2 to sub-section (1) or under sub-section (4) or sub-section (5) of section 139 of the said Act; and

(c) the value of an undisclosed asset located outside India.

(2) Notwithstanding anything contained in sub-section (1), any variation made in the income from a source outside India in the assessment or reassessment of the total income of any previous year, of the assessee under the Income-tax Act in accordance with the provisions of section 29 to section 43C or section 57 to section 59 or section 92C of the said Act, shall not be included in the tota l undisclosed foreign income.

(3) The income included in the total undisclosed foreign income and asset under this Act shall not form part of the total income under the Income-tax Act.

That from a bare perusal of the provision above, there can be any scope of undisclosed foreign income and asset, if and only if, a) there is any income from a source outside India which has not been disclosed in the return of income and b) where there is income as mentioned in point a) above but no return has been furnished and c) Value of undisclosed asset located outside India.

47. That the first condition, viz. income from a source located outside India not disclosed in return, is not met in the case as there is no income of the Appellant which has not been disclosed to tax in India and nor is there any allegation to that effect.

Without prejudice, there must be cogent, tangible material showing the income earned abroad and not disclosed to tax in India. Unless, shown to exist, there can be no liability which can be imposed on the Appellant.

48. Coming to the second condition, it stipulates where no return is furnished, which is not the case, the Appellant is a regular tax filer and has also disclosed the bank account held by him in fiduciary capacity and other details of the foreign asset of the company, in his return. Thus, making the second condition also inapplicable.

49. The third condition is the value of ‘undisclosed asset located outside India’. In order to examine this issue, it is crucial to ascertain whether the conditions of section 2(11) of the Act – undisclosed asset located outside India’, which is reproduced as under:

(11) “undisclosed asset located outside India” means an asset (including financial interest in any entity) located outside India, held by the assessee in his name or in respect of which he is a beneficial owner, and he has no explanation about the source of investment in such asset or the explanation given by him is in the opinion of the Assessing Officer unsatisfactory;