Gursimaran Singh

Section 56(2)(viib) was inserted via Finance Act, 2012. The objective of introducing the section was to deter the generation and use of unaccounted money done through subscription of shares of a closely held company, at a value which is higher than the Fair Market Value (FMV) of shares of such company.

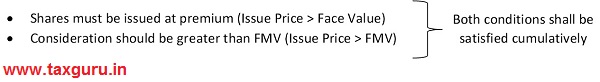

By virtue of section 56(2)(viib) of the Act, it states that, where a company, not being a company in which the public are substantially interested, receives, in any previous year, from any person being a resident, any consideration for issue of shares that exceeds the face value of such shares, the aggregate consideration received for such shares as exceeds the fair market value of the shares shall be deemed to be the income of the concerned company chargeable to tax under the head Income from other Sources for the relevant financial year.

Applicability

Going by the above definition, the key points identified therein can be laid as follows –

- A Private limited Company – It means a closely held company and not being a public limited company.

- Receives, in any previous year – It means that the sum of money shall be received by the company as stated in point (1) above and in the relevant financial year.

- Person being a resident – The term resident shall be read in accordance with the Income Tax Act, 1961.

- Any consideration for issue of shares for a value which exceeds the FMV of such shares – The consideration shall mean the money received by the company in pursuance to the issuance of shares.

Hence the applicability can be summarised as below-

Non – Applicability

- Company receiving consideration is a company in which public is substantially interested I; e, a public company.

- Consideration is received by a Venture Capital company or Venture Capital Fund or other Notified company.

Determination of FMV

The FMV of the shares shall be higher of the following:

- As per the methods prescribed under Rule 11UA(2) which are

- Book value Method (NAV) and

- Discounted Cash flow method (Allowed to a Merchant Banker Only), or

- Any other value as may be substantiated by the company to the satisfaction of the Assessing Officer.

Treatment by the Assessing Officer

There have been many cases where Assessing Officer disregarded the value ascertained using Discounted Cash flow method in Valuation report and later in Appeals, this was allowed to Assessee. Since Assessee has option to choose any of the two methods given in Rule 11UA, Assessing officer may use a method different from method used by the assessee which may become reason of disagreement.

The same can be seen in the case of; Cinestaan Entertainment (P.) Ltd. New Delhi in the ITAT Delhi Bench and Vodafone M-Pesa Ltd. v. Deputy Commissioner of Income-tax Circle 8(3)(2), Mumbai in the ITAT Mumbai.

Special Case Scenario – A new company particularly in the service sector does not have sufficient capital base at the inception and hence NAV method sometimes becomes impractical to apply. Due to this reason, lot of companies adopt DCF (Discounted Cash flow) method which requires lot of subjective analysis in terms of revenue projections, adoption of discounting factor, risk free rate of interest, inflation rate, etc.

Efforts have been made to help start-ups with the provisions of the said section. Thus, an entity will continue to be recognised as a Start-up, if its turnover for any of the financial years since incorporation and registration has not exceeded Rs. 100 crore in place of earlier benchmark of Rs. 25 crore.

A Start-up will be eligible for exemption under Section 56(2)(viib) of Income Tax Act, if it is a private limited company recognized by DPIIT (Department for Promotion of Industry and Internal Trade) and is not investing in any of the following assets (inter-alia) –

- Building or land appurtenant thereto, being a residential house, other than that used by the Start-ups for the purposes of renting or held by it as stock-in-trade, in the ordinary course of business

- A motor vehicle, aircraft, yacht or any other mode of transport, the actual cost of which exceeds ten lakh rupees, other than that held by the Start-ups for the purpose of plying, hiring, leasing or as stock-in-trade, in the ordinary course of business

- Jewellery other than that held by the Start-ups as stock-in-trade in the ordinary course of business

Moreover, consideration received by eligible Start-ups for shares issued or proposed to be issued shall be exempt up to an aggregate limit of Rs. 25 crore.

In addition, consideration received by eligible Start-up for shares issued or proposed to be issued to a listed company having a net worth of Rs.100 crore or turnover of at least Rs. 250 crore will also be exempted.

The aggregate limit of Rs. 25 crore will exclude consideration received by eligible Start-up for the following classes of persons:

i. Non-Residents

ii. Alternative Investment Funds- Category-I registered with SEBI

iii. Listed company having a net worth of Rs.100 Crores or turnover of at least Rs. 250 crore provided that its shares are frequently traded on registered stock exchange

(Author is associated with ‘International Business Advisors, Delhi’ as Senior Analyst-Direct Tax.)

We are DPIIT registered startup and have already taken tax benefits since last 2 years and now this is our final year. I would like to know that we are non-funded and never issued premium shares to anyone. So am I eligible to buy a motor vehicle above Rs.10 lakh? I think this rule of below Rs. 10 lakh assets apply to only startups who have taken funding or issued premium shares. Please provide clarification. Thanks.

It is proposed to include the consideration received from a non- resident also under the ambit of clause (viib) by removing the phrase ‘being a resident’ from the said clause. This will make the provision applicable for receipt of consideration for issue of shares from any person irrespective of his residency status.

(This amendment will take effect from 1st April, 2024)

Where it was given that startup if it had no investments in renting or held as stock in trade in residential units, motor vehicles etc that they will be exempt from 56(2)(VIIB)?