Insurance Regulatory and Development Authority of India

Ref: IRDAI/Life/Cir/Misc/254/10/2020

Date: 14/10/2020

To All Life Insurers,

Re: Guidelines on Standard Individual Term Life Insurance Product, “Saral Jeevan Bima”

A: Preamble:

It is observed that during the last few years, there has been an increased customer preference towards pure term life insurance products. In line with this growing demand, the Life Insurers have been introducing innovative protection products, with different features, options, riders, etc.

There are many term products in the market with varying terms and conditions. Customers who cannot devote adequate time and energy to make informed choices find it difficult to select the right product. Also, products may not be available for the intended sum assured. To take care of this situation and to make available a product by all Life Insurers that will broadly meet the needs of an average customer, it is felt necessary to introduce a standard, individual term life insurance product, with simple features and standard terms and conditions. Such a standard product will make it easier for the customers to make an informed choice, enhance the trust between the Insurers and the insured, and reduce mis-selling as well as potential disputes at the time of claim settlement.

Therefore, in exercise of powers under Section 34 (1) (a) of the Insurance Act, all Life Insurers are directed to offer the following product mandatorily.

B. The Standard Term Life Insurance Product:

1) The standard individual term life insurance product shall be called, “Saral Jeevan Bima”; the Insurer’s name shall be prefixed to the product name.

2) “Saral Jeevan Bima” is a non-linked non-participating individual pure risk premium life insurance plan, which provides for payment of Sum Assured in lump sum to the nominee in case of the Life Assured’s unfortunate death during the policy term.

3) Apart from the benefits and riders stated in the Annexure, no other riders / benefits / options / variants shall be offered. There shall be no exclusions under the product other than the suicide exclusion.

4) The product shall be offered to individuals without restrictions on gender, place of residence, travel, occupation or educational qualifications.

5) The Insurers shall have to file the product as per the above parameters and in compliance with the extant regulatory provisions through File and Use (F&U). The policy document and the terms and conditions of the Standard Product shall be in the format specified in Annexure -1 to this Circular.

C: Plan Features and Parameters:

| Sl. No. | Particulars | Norms |

| 1 | Minimum Age at Entry | 18 Years |

| 2 | Maximum Age at Entry | 65 Years |

| 3 | Policy Term | 5 to 40 years |

| 4 | Maximum Maturity Age | 70 years |

| 5 | Sum Assured | Minimum ₹5,00,000; Maximum ₹25,00,000*

(SA would be allowed only in the multiple of ₹50,000) *Insurers have the option of offering Sum Assured beyond ₹ 25,00,000 under Saral Jeevan Bima with all other terms and conditions remaining the same. |

| 6 | Large Sum Assured rebate | If any, it shall be clearly indicated in F&U |

| 7 | Premium Payment Options | i) Regular Premium;

ii) Limited Premium Payment Term for 5 years and 10 years; iii) Single Premium |

| 8 | Mode of Premium Payment | Regular and Limited Premium Payment Options:

– Yearly; Half Yearly; – Monthly (only under ECS / NACH) Single Premium: In Lump sum. |

| 9 | Death Benefit | For Regular & Limited Premium Payment policies: Highest of:

– 10 times of annualized premium; – 105% of all the premiums paid as on the date of death; – Absolute amount assured to be paid on death. For Single premium policies: Higher of: – 125% of single premium; – absolute amount assured to be paid on death. |

| 10 | Maturity Benefit | There shall be no maturity benefit under the policy. |

| 11 | Exclusions | Only suicide clause, as per extant regulations. |

| 12 | Waiting period | 45 days from the date of commencement of risk. In case of revival of Policy, the Waiting Period shall not be applicable.

The following words shall be prominently displayed in BOLD, on the welcome letter of Policy Document as well as on the first page of Sales Literature. “This Policy will cover death due to accident only during the waiting period of 45 days from the date of commencement of risk. In case of death of the life assured other than due to accident during the waiting period, an amount equal to 100% of all premiums received excluding taxes, if any, shall be paid and the Sum Assured shall not be paid.” |

| 13 | Surrender Value | Surrender Value is not applicable under this Policy. |

| 14 | Policy Cancellation Value | Policy Cancellation Value shall be payable:

– upon the Policyholder applying for the same before the stipulated date of maturity in case of Single Premium Policy; – upon the Policyholder applying for the same before the stipulated date of maturity or at the end of revival period if the policy is not revived, in case of Limited Premium Payment Policies. The amount payable shall be as follows:

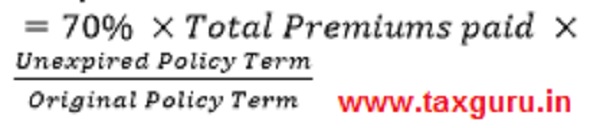

For Single Premium: The Policy Cancellation Value acquires immediately after receipt of Single Premium and is calculated as follows: Single Premium shall be inclusive of extra premium, if any. Limited Premium Payment Term (LPPT): 5 and 10 years: Policy Cancellation Value acquires if at least two (2) consecutive full years’ premiums are paid and is calculated as follows:

Total Premiums Paid shall be inclusive of extra premiums, if any. No policy cancellation value shall be payable in respect of regular premium policies. |

| 15 | Loan | No loan will be allowed against the policy |

| 16 | Optional Riders | Approved Accident Benefit and Permanent Disability Benefit Riders can be attached. |

| 17 | Pricing | As per the F&U |

| 18 | Underwriting and Medical Requirements | As per the Board Approved Underwriting Policy of the Insurer, subject to above criteria and any statutory requirements. |

| 19 | Interest on delayed payment of premiums | The rate of interest on delayed payment of premiums shall be as per the Insurer’s policy for similar products. |

The Insurer may suitably modify the definitions and other clauses of the policy contract prospectively based on the regulations or guidelines that may be issued by the Authority from time to time.

All Life Insurers permitted to transact new business shall mandatorily offer the standard product with effect from 1st January, 2021. The product may be filed by the Insurers latest by 1st December, 2020. However, Insurers may file the product earlier and offer the same on approval even before 1st January, 2021.

This is issued with the approval of the Competent Authority.

Signed/-

Chief General Manager (Life)

Encl: Annexure 1 – Policy Bond.

Annexure 1 to Circular IRDAI/Life/Cir/Misc/254/10/2020 dated 14/10/2020

<Life Insurance Company Name>

Registration Number:<Regn. No.>

<Insurer’s name> Saral Jeevan Bima (UIN:_____________________ )

A Non-Linked Non-participating Individual Pure Risk Premium Life Insurance Plan

PART A

<Welcome Letter, Preamble and Schedule>

Part – B: Definitions:

The definitions of terms/words used in the Policy Document are as under:

1. Age is the age of the Life Assured on the last birthday at the time of commencement of the policy.

2. Annualized Premium is the total amount of premium payable in a policy year excluding taxes, rider premiums, underwriting extra premiums and loadings for modal premiums, if any.

3. Appointee is the person to whom the proceeds/benefits secured under the Policy are payable if the benefit becomes payable to the nominee and nominee is minor as on the date of claim payment.

4. Assignee is the person to whom the rights and benefits are transferred by virtue of an Assignment.

5. Assignment is the process of transferring the rights and benefits to an “Assignee,” in accordance with the provisions of Section 38 of Insurance Act, 1938, as amended from time to time.

6. Assignor means the person who transfers the rights of the life insurance policy to the Assignee.

7. Base Policy is that part of the Policy referring to basic benefit (benefits referred to in this Policy Document excluding benefits covered under Rider(s), if opted for).

8. Basic Sum Assured means the amount specified in the Schedule as opted by the Policyholder at the time of taking the policy.

9. Beneficiary/Claimant means the person who is entitled to receive benefits under this Policy. The Beneficiary may be Life Assured or Policyholder or his Assignee or Nominees or proved Executors or Administrators or other Legal Representatives as the case may be.

10. Business Day or Working Day means the day on which the offices of the Company remain open for transactions with the public at the place where the concerned transaction is to be carried out.

11. Company or Corporation means <Insurer Name>.

12. Date of commencement of policy is the start date of this Policy.

13. Date of commencement of risk is the date on which the Company accepts the risk for insurance (cover) as evidenced in the schedule of the policy.

14. Date of issuance of policy means the date as specified in the policy schedule.

15. Date of Maturity means the date specified in the Schedule on which the Policy Term is completed.

16. Death Benefit means the benefit, agreed at the commencement of the contract, and means the amount as specified in the policy bond and is payable on death of Life Assured as per the terms and conditions of the policy.

17. Discharge form is the form to be filled by policyholder/claimant to claim the death benefit/refund under the policy.

18. Due Date (applicable in case of Regular Premium / Limited Premium payment) means a fixed date on which the policy premium is due and payable by the policyholder.

19. Endorsement means conditions attached/ affixed to this Policy incorporating any amendments or modifications agreed to or issued by the Company.

20. Free Look Period is the period of 15 days (30 days if the Policy is an electronic policy or is purchased through Distance Marketing where distance marketing means through any means of communication other than in person) from the date of receipt of the Policy Document by the Policyholder to review the terms and conditions of this policy and where the Policyholder disagrees to any of those terms and conditions, he/ she has the option to return this policy as detailed in Condition 2 of Part D of this Policy Document.

21. Grace period is the time granted by the insurer from the due date for the payment of premium, without any penalty/ late fee, during which time the policy is considered to be inforce with the insurance cover without any interruption as per the terms of the policy.

22. Inforce policy means a policy in which all the due premiums have been paid and the premiums are not outstanding.

23. IRDAI / Authority means Insurance Regulatory and Development Authority of India.

24. Lapse is the status of the Policy when due premium is not paid within the grace period and the benefits under the Policy will cease from the date of such unpaid premium.

25. Life Assured is the person on whose life the insurance cover has been accepted.

26. Material information is the information already known to the Life Assured at the time of applying for Life Insurance, which has a bearing on underwriting of the proposal /Policy submitted.

27. Nomination is the process of nominating a person(s) in accordance with provisions of Section 39 of the Insurance Act, 1938 as amended from time to time.

28. Nominee(s) means the person(s) nominated by the Policyholder (who is also the Life Assured) under this Policy who is(are) authorised to receive the claim benefit payable under this Policy.

29. Non-Participating means the Policy is not eligible for share of profit depending upon the Company’s experience.

30. Policy Anniversary means one year from the date of commencement of the Policy and the same date falling each year thereafter, till the date of maturity.

31. Policy Cancellation means complete withdrawal or termination of the entire policy before the stipulated date of maturity.

32. Policy Cancellation Value means an amount, if any, that becomes payable in case of cancellation in accordance with the terms and conditions of this policy.

33. Policy/ Policy Document means this document along with endorsements, if any, issued by the Company which evidences the contract of Insurance between the policyholder and the Company.

34. Policyholder is the legal owner of this policy.

35. Policy term is the period, in years, as chosen by the policyholder and mentioned in the Schedule, commencing from the Date of commencement of policy to the date of Maturity.

36. Policy year is the period between two consecutive policy anniversaries. This period includes the first day and excludes the next policy anniversary day.

37. Premium is the contractual amount payable by the Policyholder at specified times periodically as mentioned in the schedule of this Policy Document to secure the benefits under the policy. The premium payable will be “Total Single / Instalment Premium” which includes single / instalment Premium for Base Policy and instalment Premium for Rider(s), if rider(s) has/have been opted for. The term ‘Premium’ used anywhere in this Policy Document does not include any taxes which are payable separately.

38. Premium paying term means the period, in years, during which premium is payable.

39. Proof of continued insurability is the information that may be sought from the policyholder to decide revival of the policy. This includes Form of declaration of Good Health, Medical Reports, Special Reports and any such document as may be called for by the Company, in accordance with the Board Approved Underwriting Policy of the Company.

40. Proposer is a person who proposes the life insurance proposal.

41. Revival of a policy means restoration of a lapsed policy which was discontinued due to the non-payment of premium, by the insurer with all the benefits mentioned in the policy document, with or without rider benefits if any, upon the receipt of all the premiums due and other charges/late fee, if any, as per the terms and conditions of the policy, upon being satisfied as to the continued insurability of the insured/ policyholder on the basis of the information, documents and reports furnished by the policyholder, in accordance with the then existing Board Approved Underwriting Policy of the Company.

42. Revival Period means the period of five consecutive years from the due date of first unpaid premium or as is allowed under applicable Product Regulations, during which period the policyholder is entitled to revive the policy which was discontinued due to the non-payment of premium.

43. Rider is an add-on benefit which the Proposer has purchased separately in addition to basic benefits as specified under this Policy Document.

44. Rider Premium is the premium payable by the policyholder which is in addition to the premium paid under Base Policy towards the additional cover/benefit opted under the rider, if opted.

45. Rider Sum Assured is the assured amount payable on happening of a specified event covered under the rider, if opted.

46. Schedule is the part of policy document that gives the specific details of your policy.

47. Sum Assured on Death is the life insurance cover opted by the Proposer and is the absolute amount of benefit which is guaranteed to become payable on death of the life assured in accordance with the terms and conditions of the policy, as mentioned in Condition 1 (a) of Part C of this Policy Document.

48. Surrender means complete withdrawal / termination of the entire policy before maturity.

49. Surrender value means an amount, if any, that becomes payable in case of surrender in accordance with the terms and conditions of this policy.

50. Underwriting is the term used to describe the process of assessing risk and ensuring that the cost of the cover is proportionate to the risks faced by the individual concerned. Based on underwriting, a decision on acceptance or rejection of cover as well as applicability of suitable premium or modified terms, if any, is taken.

51. UIN means the Unique Identification Number allotted to this plan by the IRDAI.

52. Waiting Period means a period of 45 (forty five) days from the Date of Commencement of Risk. In case of revival of Policy, the Waiting period shall not be applicable.

PART– C: BENEFITS

1) The following are the benefits under the policy:

a) Death Benefit:

i) On death of the Life Assured during the Waiting Period and provided the Policy

is in force, the Death Benefit amount payable as a lump sum is:

(1) In case of Accidental Death, for regular premium or limited premium payment policy, equal to Sum Assured on Death which is the highest of:

(a) 10 times the Annualized Premium, or

(b) 105% of all premiums paid as on the date of death, or

(c) Absolute amount assured to be paid on death.

(2) In case of Accidental Death, for single premium policy, equal to Sum Assured on Death which is the higher of:

(a) 125% of Single premium or

(b) Absolute amount assured to be paid on death.

(3) In case of death due to other than accident, the Death Benefit is equal to 100% of all Premiums paid excluding taxes, if any.

ii) On death of the Life Assured after the expiry of Waiting Period but before the stipulated date of maturity and provided the Policy is in force, the Death Benefit amount payable as a lump sum is:

(1) For Regular premium or Limited premium payment policy, “Sum Assured on Death” which is the highest of:

(a) 10 times of annualized premium; or

(b) 105% of all the premiums paid as on the date of death; or

(c) Absolute amount assured to be paid on death.

(2) For Single premium policy, “Sum Assured on Death” which is the higher of:

(a) 125% of Single Premium or

(b) Absolute amount assured to be paid on death.

Premiums referred above shall not include any extra amount chargeable under the policy due to underwriting decision and rider premium(s), if any.

Absolute amount assured to be paid on death shall be an amount equal to Basic Sum Assured.

b) Maturity Benefit:

No Maturity Benefit shall be payable on the Life Assured surviving the stipulated

Date of Maturity.

c) Rider Benefits:

<Mention the rider name, UIN and details of the approved riders>

Conditions of the above rider, if opted, are enclosed as endorsement to this policy.

2) Payment of Premiums (Applicable in case of Limited and Regular Premium payment policies only):

a) The policyholder has to pay the Premium on or before the due dates as specified in the Schedule of this Policy Document along with applicable taxes, if any.

b) In case of death of Life Assured under an inforce policy wherein all the premiums due till the date of death have been paid and where the mode of payment of premium is other than yearly, balance premium(s), if any, falling due from the date of death and before the next policy anniversary shall be deducted from the claim amount.

The Company does not have any obligation to issue a notice that premium is due or for the amount that is due.

3) Grace Period (Applicable in case of Limited and Regular Premium payment policies only):

A grace period of 30 days where the mode of payment of Premium is yearly or half yearly and 15 days in case of monthly, is allowed for the payment of each renewal Premium. If the premium is not paid before the expiry of the days of grace, the Policy lapses.

If the death of the Life Assured occurs within the grace period but before the payment of the premium then due, the policy will still be valid and the benefits shall be paid after deductions of the said unpaid premium as also the balance premium(s), if any, falling due from the date of death and before the next policy anniversary.

The above grace period will also apply to rider premiums which are payable along with premium for base policy.

PART – D: CONDITIONS RELATED TO SERVICING ASPECTS

1) Proof of Age:

The premiums under the Policy are calculated based on the age of the Life Assured as declared in the Proposal.

If the Age of the life assured has been misstated and if the correct Age of the Life Assured makes the Life Assured ineligible for this Policy, the Company may offer a suitable plan as per the then existing underwriting norms. If the life assured does not wish to opt for the alternative plan or if it is not possible for the Company to grant any other plan, then the Policy shall be cancelled and the premiums paid shall be refunded without interest, subject to deduction of stamp duty paid and the cost of medicals, if any. The Policy will terminate on the said payment.

If the correct Age of the Life Assured makes the Life Assured eligible for this Policy, revised Premium depending upon the Correct Age will be payable. Difference of premium from inception will be collected with interest, if age declared is higher and excess premium collected will be refunded without interest, if age is found to be lower.

The provisions of Section 45 of the Insurance Act, 1938 as amended from time to time shall be applicable.

2) Free Look Period:

a) This is an option to review the Policy following receipt of Policy Document. The Policyholder has a free look period of 15 days (30 days in case of electronic policies and policies obtained through distance mode) from the date of receipt of the policy document, to review the terms and conditions of the policy and where the policyholder disagrees to any of those terms and conditions, the policy holder has the option to return the policy to the Company for cancellation, stating the reasons for his objection, then the policyholder shall be entitled to a refund of the premium paid subject only to the deduction of a proportionate risk premium for the period of cover and expenses incurred by the Company on medical examination of the proposer and stamp duty charges.

b) A request received by the Company for free look cancellation of the policy shall be processed and premium refunded within 15 days of receipt of the request, as stated vide (a) above.

c) The Policy shall terminate on payment of this amount and all rights, benefits and interests under this Policy will stand extinguished.

3) Forfeiture provisions:

a) In case of Regular Premium and Limited Premium payment policies, if the premium has not been paid in respect of this policy and any subsequent premium be not duly paid, all the benefits shall cease after the expiry of grace period from the date of first unpaid premium and nothing shall be payable, and the premiums paid till then are also not refundable.

b) Forfeiture in Certain Other Events: In case any condition herein contained or endorsed hereon be contravened or in case it is found that any untrue or incorrect statement is contained in the proposal, personal statement, declaration and connected documents or any material information is withheld, then and in every such case this policy shall be void and all claims to any benefit by virtue hereof shall be subject to the provisions of Section 45 of the Insurance Act , 1938, as amended from time to time.

4) Revival of lapsed Policies (Applicable for Regular and Limited Premium policies):

a) If the Policy has lapsed due to nonpayment of due premium within the days of grace, it may be revived during the life time of the Life Assured, but within the Revival Period and before the Date of Maturity, as the case may be, on payment of all the arrears of premium(s) together with interest at a rate which shall be determined as follows: <mention the method of determination of the interest rate and also the current applicable rate>. Any change in the basis of determination of interest rate shall be done only after prior approval of the Authority.

b) In addition to the arrears of premium with interest, proof of continued insurability may be required for revival of the discontinued policy. The Company, however, reserves the right to accept at original terms, accept with modified terms or decline the revival of a discontinued policy. The revival of the discontinued policy shall take effect only after the same is approved by the Company and is specifically communicated to the Policyholder.

c) If a lapsed policy is not revived within the revival period but before the Date of Maturity, the policy will automatically terminate. In case of Regular Premium policies, nothing shall be payable. However, in case of Limited Premium Payment policies, the amount as payable in case of surrender shall be refunded and the policy will terminate.

d) Revival of Rider, if opted for, will only be considered along with the revival of the Base Policy and not in isolation.

5) Surrender: Surrender value is not applicable under this Policy.

6) Policy Cancellation Value:

Policy Cancellation Value shall be payable:

a) upon the Policyholder applying for the same before the stipulated date of maturity in case of Single premium Policy; or

b) upon the Policyholder applying for the same before the stipulated date of maturity or at the end of revival period if the policy is not revived, in case of Limited Premium Payment Policies.

c) The amount payable shall be as follows:

i) Single Premium Policies:

The Policy Cancellation Value acquires immediately after receipt of Single

Premium and is calculated as follows:

Single Premium shall be inclusive of extra premium, if any.

ii) Limited Premium Payment Term: 5 years or 10 years:

The Policy Cancellation Value acquires if at least two (2) consecutive full years’ premiums are paid and is calculated as follows:

Total Premiums Paid shall be inclusive of extra premiums, if any.

d) No policy cancellation value shall be payable in respect of regular premium policies.

7) Policy Loan: No loan will be available under this policy

8) Termination of Policy:

The policy shall immediately and automatically terminate on the earliest occurrence of any of the following events:

a) The date on which death benefit becomes payable; or

b) The date on which refund, if applicable, is settled, in case of cancellation of policy ; or

c) The date of maturity; or

d) On expiry of revival period, if the policy has not been revived; or

e) On payment of free look cancellation amount.

PART E

Not Applicable.

PART – F: OTHER TERMS AND CONDITIONS

1) Assignment: Assignment is allowed under this plan as per section 38 of the Insurance Act, 1938, as amended from time to time. The current provisions of Section 38 are contained in Annexure-1 of this Policy Document. The notice of assignment should be submitted for registration to the office of the Company, where the policy is serviced.

2) Nomination: Nomination by the holder of a policy of life assurance on his/her own life is allowed as per Section 39 of the Insurance Act, 1938, as amended from time to time.The current provisions of Section 39 are contained in Annexure-2 of this Policy Document. The notice of nomination or change of nomination should be submitted for registration to the office of the Company, where the policy is serviced. In registering nomination the Company does not accept any responsibility or express any opinion as to its validity or legal effect.

3) Section 45 of the Insurance Act 1938:

The provisions of Section 45 of the Insurance Act 1938, as amended from time to time, shall be applicable. The current provisions are contained in Annexure-3 of this policy document.

4) Suicide Exclusion:

a) Under Regular/Limited Premium Policy:

This policy shall be void if the Life Assured commits suicide at any time within 12 months from the date of commencement of risk, provided the policy is inforce or within 12 months from the date of revival and the Company will not entertain any claim except for 80% of the premiums paid (excluding any extra amount if charged under the policy due to underwriting decisions, taxes and rider premiums, if any) till the date of death.

This clause shall not be applicable for a lapsed policy as nothing is payable under such policies.

b) Under single Premium Policy:

This policy shall be void if the Life assured commits suicide at any time within 12 months from the date of commencement of risk and the Company will not entertain any claim except 90 % of the Single Premium paid excluding any extra amount if charged under the policy due to underwriting decisions and rider premiums, if any.

5) Tax:

Statutory Taxes, if any, imposed on such insurance plans by the Government of India or any other constitutional tax Authority of India shall be as per the Tax laws and the rate of tax as applicable from time to time.

The amount of applicable taxes as per the prevailing rates, shall be payable by the policyholder on premiums (for base policy and rider, if any) including extra amount if charged under the policy due to underwriting decisions, which shall be collected separately over and above in addition to the premiums payable by the policyholder.

The amount of tax paid shall not be considered for the calculation of benefits payable under the plan.

The tax benefits, if any, would be as per the prevailing provisions of the tax laws in India. The Policyholder or the nominee shall be liable for compliance of applicable tax provisions.

6) Normal requirements for a claim:

a) Death Claim: The normal documents which the claimant shall submit while lodging the claim in case of death of the Life Assured shall be claim forms, as prescribed by the Company, accompanied with original policy document, NEFT mandate from the claimant for direct credit of the claim amount to the bank account, proof of title, proof of death, medical treatment prior to the death (if any), school/ college/ employer’s certificate, whichever is applicable, to the satisfaction of the Company. If the age is not admitted under the policy, the proof of age of the Life assured shall also be submitted.

In case of unnatural death or death on account of or arising from an accident, the Company may call for the copies of First Information Report (FIR), Panchnama and Post Mortem report. The Company may also call for additional documents as may be required by them.

Within 90 days from the date of death, intimation of death along with death certificate must be notified in writing to the office of the Company where the policy is serviced. However, delay in intimation of the genuine claim by the claimant, may be condoned by the Company, on merit, and where delay is proved to be for the reasons beyond his/her control.

b) Policy Cancellation: In case of cancellation of the policy, the Policyholder shall submit the discharge form along with the original policy document, NEFT mandate from the claimant for direct credit of the claim amount to the bank account.

In addition to above, any requirement mandated under any statutory provision or as may be required as per law shall also be required to be submitted.

7) Issuance of duplicate Policy:

a) The Policyholder can make an application for duplicate Policy on payment of <₹ > upon loss of policy document along with other requirements as may be prescribed by the Company.

8) Jurisdiction:

The Policy shall be governed by the laws of India and the Indian Courts shall have jurisdiction to settle any disputes arising under the Policy.

9) Legislative Changes:

The Terms and Conditions including the premiums and benefits payable under this policy are subject to variation in accordance with the applicable laws and regulations.

PART – G: Grievance Redressal Mechanism

1) Grievance Redressal Mechanism:

<Grievance Redressal Mechanism of the Company>

Grievance Redressal Mechanism of IRDAI:

In case the policyholder is not satisfied with the response or does not receive a response from the Company within 15 days, then the customer may approach the Grievance Cell of the IRDAI through any of the following modes:

- Calling Toll Free Number 155255 / 18004254732 (i.e. IRDAI Grievance Call Centre)

- Sending an email to complaints@irda.gov.in

- Register the complaint online at http://www.igms.irda.gov.in

- Address for sending the complaint through courier / letter:

Consumer Affairs Department, Insurance Regulatory and Development Authority of India, Survey No.115/1, Financial District,

Nanakramguda, Gachibowli, Hyderabad-500032, Telangana.

Ombudsman:

For redressal of Claims related grievances, claimants can also approach Insurance Ombudsman who provides for low cost, speedy arbitration to customers.

The Ombudsman, as per Insurance Ombudsman Rules, 2017, can receive and consider complaints or disputes relating to the matters such as:

(a) Delay in settlement of claims, beyond the time specified in the regulations, framed under the Insurance Regulatory and Development Authority of India Act,1999

(b) Any partial or total repudiation of claims by the life insurer, General insurer or the health insurer;

(c) Disputes over premium paid or payable in terms of insurance policy;

(d) Misrepresentation of policy terms and conditions at any time in the policy document or policy contract;

(e) Legal construction of insurance policies insofar as the dispute relates to claim;

(f) Policy servicing related grievances against insurers and their agents and intermediaries;

(g) Issuance of life insurance policy, general insurance policy including health insurance policy which is not in conformity with the proposal form submitted by the proposer;

(h) Non-issuance of insurance policy after receipt of premium in life insurance and general insurance including health insurance; and

(i) Any other matter resulting from the violation of provisions of the Insurance Act, 1938, as amended from time to time, or the regulations, circulars , guidelines or instructions issued by IRDAI from time to time or the terms and conditions of the policy contract, in so far as they relate to issues mentioned at clauses (a) to (f).

<Details of existing offices of the Insurance Ombudsman>

Note: In case of dispute in respect of interpretation of these terms and conditions and special provisions/conditions the English version shall stand valid.

YOU ARE REQUESTED TO EXAMINE THIS POLICY DOCUMENT, AND IF ANY MISTAKE BE FOUND THEREIN, RETURN IT IMMEDIATELY FOR CORRECTION.

_______________

_______________

Annexure 1 to Policy Bond

<Provisions pertaining to: Assignment – As per Section 38 of the Insurance Act 1938>

Annexure 2 to the Policy Bond

<Provisions pertaining to: Nomination – As per Section 39 of the Insurance Act 1938>

Annexure 3 to the Policy Bond.

<Provisions pertaining to Section 45 as per the Insurance Act 1938 >

Endorsement(s)

<Approved Riders as opted for>