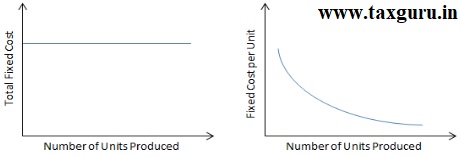

The fixed Overhead amount is constant per period; the cost per unit of production varies with the volume, this variation is inverse since with increase in production, Cost per unit decreases as the same amount of fixed overheads is spread over larger units of production. As Graphical representation given below-

Example:-

|

Case |

Output Units |

Fixed Overheads |

Variable Overheads |

Total |

Overhead Per Unit | ||

| Fixed | Variable | Total | |||||

| I | 5,000 | 20,000 | 25,000 | 45,000 | 4.00 | 5.00 | 9.00 |

| II | 7,000 | 20,000 | 35,000 | 55,000 | 2.86 | 5.00 | 7.86 |

| III | 9,000 | 20,000 | 45,000 | 65,000 | 2.22 | 5.00 | 7.22 |

| IV | 10,000 | 20,000 | 50,000 | 70,000 | 2.00 | 5.00 | 7.00 |

Generally it considered incurred fixed cost is respective of normal production/normal capacity not respective of installed capacity because installed capacity practically not possible to achieve due to certain normal reasons like-

(i) Holidays, normal shut down days and normal idle time,

(ii) No. of shifts.

(iii) Time lost due to preventive maintenance,

(iv) Normal time lost in set up time or batch change over

(v) Off Season (like-Ice Cream, Fridge, Cooler demand high only in Summer Season) and

Normal Capacity is production achieved or achievable on an average over a period or season under normal circumstances taking into account the loss of capacity resulting from planned maintenance.

Therefore incurred fixed cost should be absorbed to normal production. But in case of plant capacity is underutilized due to mismanagement, underutilization of available resources, lower of demand or any other reason so does not mean 100 percentage burden of actual fixed cost to be passed on to consumer, means if actual fixed cost is absorbed to actual production it will make product costlier in competitive market. Therefore fixed cost is absorbed according to weightage of actual production on Normal production and incase of overutilization of plant capacity actual fixed cost loaded.

Difference in above example can be noticed Case I to IV as the production is on increase fixed cost per unit is getting down, which is indicating higher the production cheaper the per unit fixed cost, therefore management aim should be higher production for recovery of fixed cost.

And normal capacity/production can be worked out by two method

(1) Normal Capacity as per First Method

| Installed Capacity | ********** |

| Less Loss of capacity due to normal reasons | ********** |

| ————— | |

| Normal Capacity | ********** |

| ————— |

(2) Normal Capacity as per Second Method

(i) Take actual production of preceding four year & current financial year and

(ii) Select highest 3 out of them and take out “average” and this average production is normal production/capacity

Example:-

There is company of pipe manufacturing where cost records for the f/y 2018-19, to be prepared details given below-

| S.NO. | Year | Production (In MT.) |

| 1 | 2014-15 | 150,000 |

| 2 | 2015-16 | 170,000 |

| 3 | 2016-17 | 155,000 |

| 4 | 2017-18 | 160,000 |

| 5 | 2018-19 | 145,000 |

–

| S.NO. | Particulars | Amount (In Rs.) |

| 1 | Depreciation | 950,000 |

| 2 | Rent | 300,000 |

| 3 | Permanent Staff Salary | 700,000 |

| 4 | Preventive Maintenance Expenses | 455,000 |

| 5 | Insurance | 100,000 |

| Total | 2,505,000 |

Calculate the Fixed Cost to be absorbed and unabsorbed-

Working:-

(1) First calculate the normal capacity/production, Select highest three year production out of preceding four f/y year & current f/y

| S.NO. | Highest 3 Year | Production (In MT.) |

| 1 | 2015-16 | 170,000 |

| 2 | 2016-17 | 155,000 |

| 3 | 2017-18 | 160,000 |

| Average Production for F/Y 2018-19 | 161,667 |

Normal Capacity/Production is 161,667 MT for the f/y 2018-19 Actual Production is 1,45,000 MT for the f/y 2018-19

(2) Now work out absorption percentage of Fixed Cost on Product, dividing actual production on normal production

Absorption Percentage of Fixed Cost = Production for F/Y 2018-19 / Normal Production for F/Y 2018-19 = 1,45,000/1,61,667*100 = 90%

FC to be absorbed to Product = Total Fixed Cost for f/y 2018-19 * Absorption Percentage of FC = 25,05,000 * 90% = Rs. 22,54,500

Unutilized Fixed Cost = Total Fixed Cost for f/y 2018-19 * Unabsorption Percentage of FC = 25,05,000 * 10% = Rs. 2,50,500

Unutilised/Unabsorbed Fixed Cost to be taken to Reconciliation of Costing Profit to Profit As Per Financial

Nice presentation.. Sir ji..