Finally Great News for all GST Taxpayers.

As per GST Law 20th October was the last date to add/modify/correct/delete any details of outward supplies or inward supplies pertaining to previous financial year. So that means any rectification in already filed return of July 2017 to March 2018 is possible on or before 31.10.2018 (being due date for filing GSTR 1 as per relaxation given by Govt).

But being first year of GST many taxpayer filed return with many mistake & many a times instead of having GSTN of parties, invoice was filed in B2C or with wrong GSTN. But the same mistake was noticed by purchaser after 31.10.2018 & I heard that purchaser got an opportunity to delay payment or stop payment for invoice with a reason that bills was not reflected in B2B so payment will be not released unless the same will be modified or corrected.

This was genuine problem faced by all dealers until Govt come up with great news

In terms of Order No.02/2018-Central Tax dated 31st December 2018, rectification of error / omission in respect of Form GSTR-1 for the FY 2017-18 would be allowed till the due date of furnishing of Form GSTR-1 for the month of March 2019 i.e. April 11, 2019.

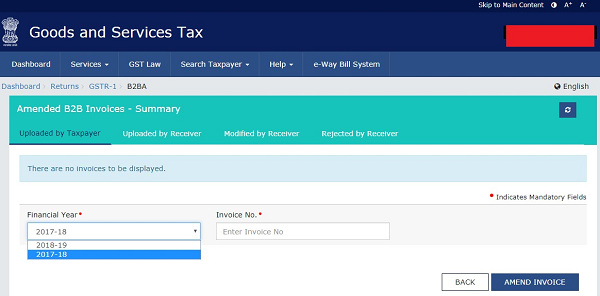

Government has already started the new functionality on GST Portal. So now January 2019 GSTR 1 allows amendment in invoice pertaining to financial year 2017-18.

But please note that last date to amend bills is 11.04.2019 so take this opportunity & rectify all your GSTR1 related mistakes.

Sir,

Is it any option to amendment of B2B invoice for the FY 2018-19, due to interchange of GSTN.

In GSRT 1, January 2019 i was put one invoice date 13-01-2018 instated of 13-01-2019. For that reason party not taken input.That error noticed in this month (February 2020). And now portal not allowed to amend that invoice.

Please suggest the solution and rectification procedure.

Sir , I uploaded one bill two time by mistake i changed bill number so 1 bill uploaded two time in gstr 1 , how can i amend this bill ?

BEFORE SUBMITTING IN DEC-19 GSTR9 FOR THE YEAR 2017-18 IT COME MY NOTICE THAT DURING THE MONTH OF DEC-17 WE BILLED TO DIFF ABCD BRANCH BY MISTAKE GSTIN NO FILLED SAME IN ALL BRANCHES PLEASE MAY BE GUIDE ME HOW THIS MISTAKE NOW CAN BE RECTIFIED.THANKS

please advice to me, how to amend FY-2017-2018 GSTR1 return on now.

Dear Sir,

We amended B2C to B2B once. We can amend once again?

Thanks & Regards

Sir i have to ask that if I have filled 17-18 and 18-19 all GSTR 1 but now I have to add missing bill of 17-18 and i have filled 17-18, 18-19 both GSTr 1 what is the solution?????

there is any possible to change/AMENDED B 2 B INVOICES FOR THE MONTH OF AUG 2017

there is any possible to change/AMENDED B 2 B INVOICES FOR THE MONTH OF AUG 2017

gstr 1 17-18 mistake b2c amment in september-18 but wrongly entered we had b2b figure is entered in ammentment

Dear sir

please suggest me how to revise Customer gst No in GSTR1 for the FY 1718

Sir, I wanna ask that if a B2B invoice of March 2018 has been added in B2C because at that time GSTN no. in that invoice was not provided, but now GSTN no. has been provided. So can I amend that invoice & revise the GSTR-1 of March 2018 now? Please tell me what should I do now?

LAST DATE OF AMENDMENT GSTR1 FY 2017-18

how we AMEND, rectify/modify the B2B INVOICE OF DECEMBER,2018 ON THE MONTH OF MARCH GSTR1 RETURN PLZ ADVICE ME

Sir,

We are service provider of Technical Services. I have added by mistake, the IGST amount of my service receiver, who is a registered UIN holder along with Non-registered UIN holder under B2C (for March 2018) and filed the return. Pls suggest me how to rectify this error.

Thanks in Advance sir

What about mistakes done in exempt supply .Amount of sales filed wrong?

sir , I am not getting amendment column. can you please explain step by step? how can we reach such screen?

there is no such functionality as on date. I have checked

please provide full detail. how to get such screen shot ?