As the festive season is around the corner the E Commerce operators and people selling through them are gearing up for sales and discount days. It is expected that this Diwali season will attract over 2 Million e-shoppers, versus 13.5 million last year. As per Redseer consulting, e-commerce firms are set to generate sale of $ 3 Billion during the five day Diwali sale bonanza. Marketing teams of these E Commerce operators are burning the midnight oil to grab the major share of this $ 3 Billion pie. However, this time around it is not only the marketing team which is working overtime but also the accounting team, the reason being Tax collection at source (TCS) provisions of GST.

As the festive season is around the corner the E Commerce operators and people selling through them are gearing up for sales and discount days. It is expected that this Diwali season will attract over 2 Million e-shoppers, versus 13.5 million last year. As per Redseer consulting, e-commerce firms are set to generate sale of $ 3 Billion during the five day Diwali sale bonanza. Marketing teams of these E Commerce operators are burning the midnight oil to grab the major share of this $ 3 Billion pie. However, this time around it is not only the marketing team which is working overtime but also the accounting team, the reason being Tax collection at source (TCS) provisions of GST.India’s e-commerce industry is expected to grow from US$ 38.5 billion as of 2017 to US$ 200 billion by 2026.Online retail is expected to contribute 2.9% of retails market in 2018. While introducing GST, the authorities were well aware of the quantum of transactions that happens through E Commerce websites and its potential to increase from here on. Hence, TCS provisions were enshrined in the law. They are similar to TDS provisions in Income Tax. As per TCS provisions e-commerce operators will have to deduct TCS@ 1% of “net value of taxable supplies” and thereafter remit the balance funds (after deducting its own commission,etc)

Retailers selling through E-commerce websites like Amazon, Flipkart, etc have to operate on wafer thin margins in order to withstand the competition in price sensitive market. Further a good chunk is retained by e-commerce operator as their referral fees, fixed closing fee, shipping fee, etc. These fees may range from 15% to 30% depending on product category, weight, place of delivery, etc. Considering all these factors sellers target to achieve 3-4% of gross margin and try to do high volume business. When margins are so low TCS @ 1% will have huge impact on cash flow of sellers. Let us take an example of a seller who does business of 10 Cr per month through Amazon. On conservative basis let’s assume he pays 20% as commission etc to Amazon. Hence, net selling price for him will be Rs. 8 Cr. Amazon will do TCS@ 1% on 10 Cr. as TCS is required to be done “value of taxable supplies”. TCS Amount will be 0.10 Cr. Considering he sells at 4% gross margin his purchase cost would be Rs. 7.69 Cr.

Now, let us compute his GST liability –

GST on Sales – 1.80 Cr (18% of 10 Cr.)

Less: GST on Purchases – 1.38 Cr (18% of 7.69 Cr.)

Less: GST on Commission – 0.36 Cr (18% on 2 Cr)

Net Payable – 0.06 Cr.

TCS already deducted – 0.10 Cr

Excess deduction – 0.04 Cr.

TCS amount is transferred to Electronic Cash Ledger on the basis of filing of GSTR 8 by the E Comm operator. In the above example, there will be blockage of Rs. 0.04 Cr in electronic cash ledger of the seller.

The seller can claim a refund of the same. Application of Refund is to be done online.

However, it is subject to verification by GST Officer. Here is a step by step guide to claim refund of excess balance in Ever, it is subject to verification by GST Officer.lectronic Cash Ledger.

Step by step guide to claim refund of excess balance in Electronic Cash Ledger

Step 1 : Login to GST Portal at www.gst.gov.in with your login credentials.

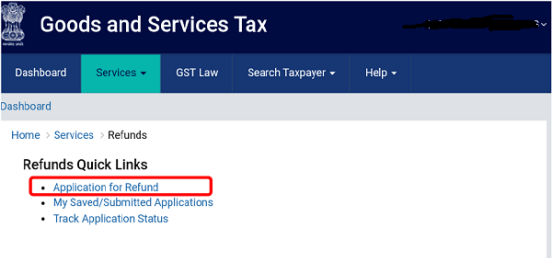

Step 2: Click on Services tab > Refunds > Application for Refund

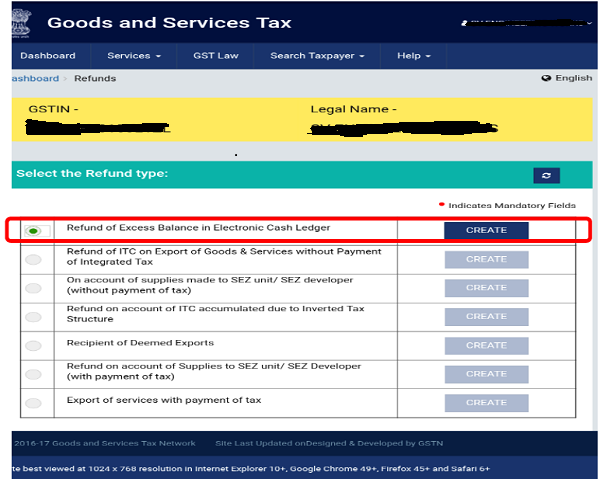

Step 3: Select the top most option naming Refund of Excess Balance in Electronic Cash Ledger and click on ‘CREATE’

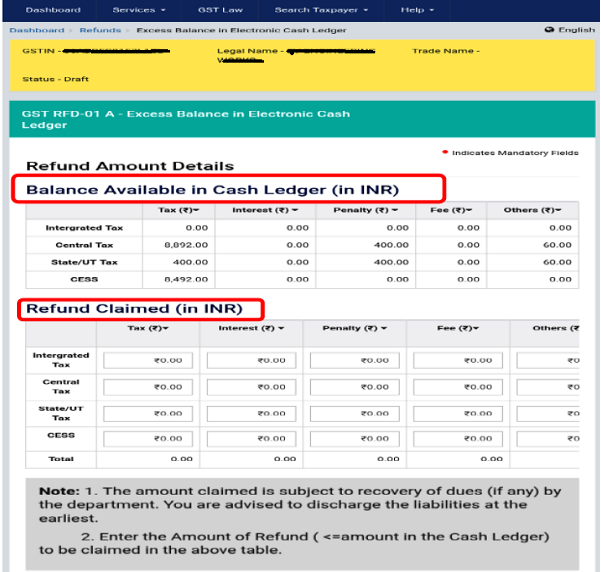

Step 4: Once you click on ‘CREATE’, a screen will appear reflecting all balances in the Electronic Cash Ledger

Enter values of the refund to be claimed in the ‘Refund Claimed’ table subject to maximum available balance in Cash ledger showing above the Refund Claimed table

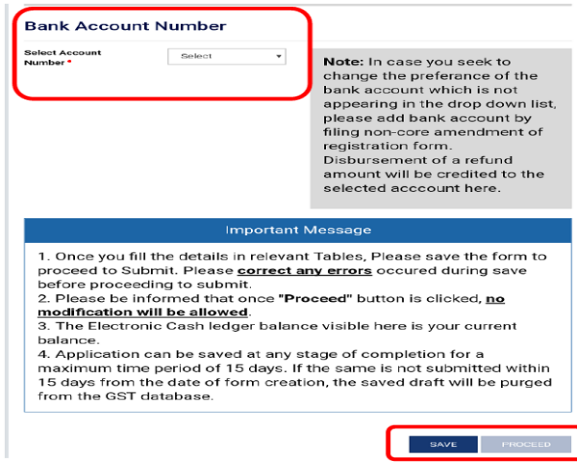

Step 5: Select the Bank Account from the drop-down list, if you wish to get refund in bank account other than appearing in drop-down list, file non-core amendment registration and add new bank details and click on ‘SAVE’ and then PROCEED

Step 6: Click on the checkbox and Select the name fo the ‘Authorized Signatory’ from the drop-down list and click on ‘SUBMIT WITH DSC’ or ‘SUBMIT WITH EVC’ as per your availability.

Enter the EVC sent on your registered mobile number and email to submit the form RFD-01

Once RFD-01 is submitted Refund ARN Receipt is generated in PDF format as shown below

> Submit Refund ARN receipt along with copy of your GST registration certificate to your Jurisdictional GST Office,after inspection by a GST officer refund will be credited to the bank account.

> You can also track your status of submitted RFD-01 application by going to Services tab > Refunds > Track application status > enter ARN number and click on search.

As of now GSTN not specified any time limit for processing of Refund application RFD-01 but generally application will be processed and amount will be credited into bank account within Thirty (30) days but soon CBEC will cut-short this time limit for processing refund application and hope going forward GSTN will process refund applications instantly like how E-commerce sites were doing.

Sir what about GST ITC on account of commission bills, can we apply for gst refund ?