1. For login to the GST Common Portal, can I use the username and password which I use to login as State Registrant?

No, you cannot use the username or password that you use to login to the State VAT Portal.

For the first time login to the GST Common Portal, you need to provide the username and password that you received from the State VAT or Center Tax Department. For subsequent login, you need to create a username and password during enrollment at the GST Common Portal. You can then use the username and password that you created to login at the GST Common Portal.

2. Which username can I choose after first login?

You can choose any username of your choice following the rules of the username creation as displayed during username creation.

3. I have not received my Provisional ID and password to apply for enrollment with GST. What can I do now?

4. I have received my Provisional ID and password to apply for enrollment with GST. My Provisional ID and password are not working. What can I do now?

5. I have forgotten my password. What can I do now?

Click the Forgot Password link to generate an OTP. OTP will be sent to your registered e-mail address and mobile phone number. Use the OTP to reset the password.

Please note that the Security Questions and Answers page is temporarily removed and you are advised to keep note of your security questions and answers after changing it on the GST Common Portal.

6. Can I give e-mail address and mobile number of my Tax Professional during enrollment with GST?

No, you cannot mention the e-mail address and mobile number of your Tax Professional during enrollment. You MUST provide the e-mail address and mobile number of the primary Authorized Signatory appointed by you. This e-mail address and mobile number will be registered with GST. All future correspondence from the GST Common Portal will be sent on this registered mobile number and e-mail address only.

Tax professionals will be given separate username and password by the GST System for the purpose of login to the GST Common Portal.

7. Who can be the primary Authorized Signatory?

A primary Authorized Signatory is the person who is primarily responsible to perform action at the GST Common Portal on behalf of the taxpayer. All communication from the GST Common Portal relating to taxpayer will be sent to the primary Authorized Signatory.

| Type of Business | Who can be the Authorized Signatory? |

| Proprietor | The proprietor or any person authorized by the proprietor |

| Partnership | Any authorized partner or any person authorized by the partners |

| Company, LLP, Society or Trust | The person authorized by Board or Governing Body. can act as Primary Authorized Signatory |

In case there is a single Authorized Signatory for a business entity, the single Authorized Signatory will be assumed to be the primary Authorized Signatory.

In case there are multiple Authorized Signatories for a single business entity, one Authorized Signatory need to be designated as primary Authorized Signatory. The e-mail address and mobile number of the Authorized Signatory needs to be provided during enrollment.

Note: The Authorized Signatory or Primary Authorized cannot be Minor in age.

8. How long is the OTP valid?

The OTP sent to your e-mail address and mobile number is valid for 10 minutes. It expires after 10 minutes.

9. I have not received the OTP on my mobile? What do I do now?

Your OTP is sent on your registered mobile number and e-mail address. In case you have not received the e-mail OTP in your Inbox, you can check your spam folder for same.

If you have not received the OTP within 10 minutes, click the RESEND OTP button. The OTP will be sent again on your registered e-mail address and mobile number.

If you do not receive the OTP via SMS on your mobile number even after clicking the RESEND OTP button, please verify if the mobile number provided by you is correct.

If you do not receive the OTP on your e-mail address even after clicking the RESEND OTP button, please verify if your e-mail address entered is correct and the Internet and mobile network are available. You can also check your spam folder in case you have not received the e-mail OTP in your Inbox.

10. Why have I received two different One Time Passwords (OTPs)? Or I have received OTP in my mobile number. I have entered the same OTP in the OTP verification page for E-mail OTP and Mobile OTP fields. Are these OTPs different?

All future correspondence from the GST Common Portal will be sent on the registered e-mail address and mobile number only. Both the e-mail address and mobile number need to be verified using the OTPs.

During verification, two separate OTPs are sent. One OTP is sent on e-mail address and another OPT is sent on mobile number

Enter the OTP that you received on your e-mail address in the Email OTP field.

Enter the OTP received on your mobile number in the Mobile OTP field.

11. Which details are pre filled in the Enrollment Application? Can I make changes in my Legal Name, State Name and PAN in the Enrollment Application?

Following details are auto-populated from the VAT database in the Enrollment Application:

- PAN of the Business

- Legal Name of Business

- Name of the State

- Reason of liability to obtain registration

You cannot make changes to any of these fields as appearing in the Enrollment Application.

12. What does the red asterisk (*) appearing besides the fields in the Enrollment Application indicate?

Red asterisk (*) indicates mandatory field. You need to fill all mandatory fields to submit the Enrollment Application successfully.

13. In the Enrollment Application, I need to fill the State Jurisdiction, Ward, Circle, Sector No. and Center Jurisdiction? How can I find these details?

Refer your VAT Registration Certificate to find your State Jurisdiction and Ward, Circle and Sector No.

If you are registered with Central Excise, refer the Registration Certificate to find your Center Jurisdiction.

If you are only a VAT registered dealer, you need to find your Central Jurisdiction based on the address of your Principal place of Business. You may visit CBEC website www.cbec.gov.in for details.

(Refer URL- http://www.cbec.gov.in/resources//htdocs-cbec/deptt_offcr/cadre-restruct/cadre-restructg-notifications.pdf).

14. I own a property and I pay Service Tax on the rent received. Do I need to register under GST? If yes, what should I select as Constitution of Business? Which document do I need to attach as Proof of Constitution of Business?

If you pay service tax on the rent received on your own property and your turnover is above threshold under GST, you need to register/enroll (applicable in case of existing taxpayer) with GST. Please select the Others option in the Constitution of Business drop-down field.

In the Proof of Constitution of Business drop-down field, select the Registration Certificate option and attach the Service Tax Registration Certificate as a supporting document.

15. I am a self-employed professional and I pay Service Tax? Do I need to register under GST? If yes, what should I select as Constitution of Business? Which document do I need to attach as Proof of Constitution of Business?

If you are self-employed professional and pay Service Tax, you need to register/enroll (applicable for existing taxpayer) under GST. Please select the Others option in the Constitution of Business drop-down field.

In the Proof of Constitution of Business drop-down field, select the Registration Certificate option and attach the Service Tax Registration Certificate as a supporting document.

16. I filled all the details in the Business Details page while filling the form. But now all the fields are appearing blank. Why?

You need to save every tab page of the Enrollment Application after filling the details. Click the SAVE & CONTINUE button at the bottom of each page to save the entered details and then proceed further to the next page.

17. What is DIN?

DIN stands for Director Identification Number given to Directors of a Company by Ministry of Corporate Affairs. To know your DIN, refer your DIN allotment letter issued by Ministry of Corporate Affairs or visit the MCA Portal – www.mca.gov.in .

18. What is Principal Place of Business and Additional Place of Business?

Principal Place of Business is the primary location within the State where a taxpayer’s business is performed. The principal place of business is generally the address where the business’s books of accounts and records are kept and is often where the head of the firm or at least top management is located.

Additional Place of business is the place of business where taxpayer carries out business related activities within the State, in addition to the Principal Place of Business.

19. What is HSN and SAC code?

HSN stands for Harmonized System of Nomenclature which is internationally accepted product coding system used to maintain uniformity in classification of goods.

SAC stands for Service Accounting Codes which are adopted by the Central Board of Excise and Customs (CBEC) for identification of the services.

20. Which bank account should I provide in the Enrollment Application? I have more than one bank account. Can I add all of them while enrolling with GST Common Portal?

Enter the details of the bank accounts used for the purpose of carrying out business transactions in the Enrollment Application while enrolling with the GST Common Portal.

You can add up to 10 bank accounts while enrolling with GST Common Portal in the Enrollment Application.

21. Can I submit my Enrollment Application at GST Common Portal without electronically signing the application with DSC or E-sign or EVC?

No, you cannot submit the Enrollment Application at the GST Common Portal without electronically signing the application. You need to sign and submit the application with DSC/ E-Signature/ EVC.

22. Is electronically signing the Enrollment Application using the DSC mandatory for enrollment?

Electronically signing the Enrollment Application using DSC is mandatory for enrollment by Companies, Foreign Companies, Limited Liability Partnership (LLPs) and Foreign Limited Liability Partnership (FLLPs).

For other taxpayers, electronically signing using DSC is optional.

23. My DSC is not registered with the GST Common Portal? Will I be able to submit my Enrollment Application with my DSC? How can I register my DSC with the GST Common Portal?

You cannot submit the Enrollment Application if your DSC is not registered with the GST Common Portal. Therefore, you need to register your DSC at the GST Common Portal by clicking the Register DSC menu.

During registration of DSC with the GST Common Portal, the PAN of the DSC holder will be matched with the PAN database of the CBDT. After validation you need to select the certificate that you need to register.

Note: Only Class -2 or Class 3 DSC can be registered at the GST Common Portal.

24. Is there any charge applicable on submission of the Enrollment Application at the GST Common Portal?

No, there is no charge applicable on submission of the Enrollment Application at the GST Common Portal.

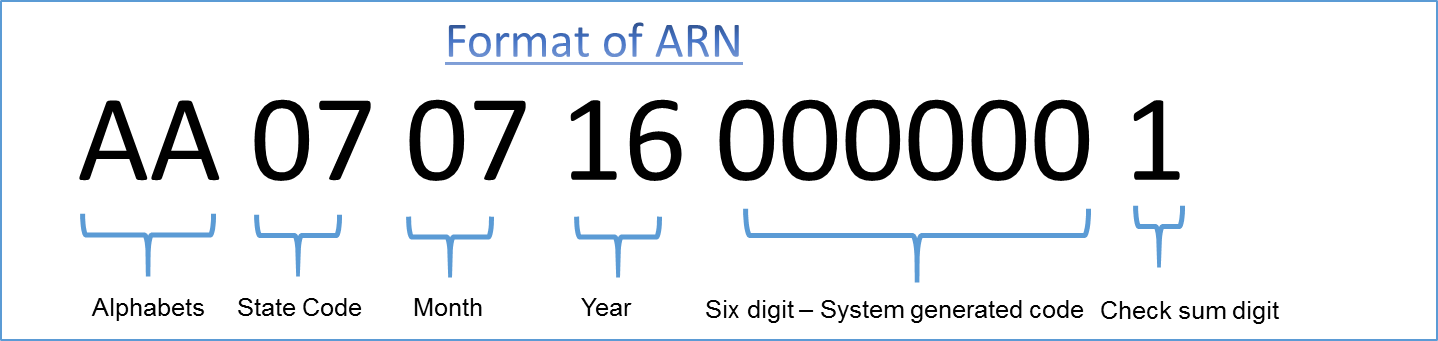

25. What is ARN? What is the format of ARN?

ARN refers to Application Reference Number. It is a unique number assigned to each transaction completed at the GST Common Portal. It will also be generated on submission of the Enrollment Application that is electronically signed using DSC. ARN can be used for future correspondence with GSTN.

26. I have not yet received the Application Reference Number (ARN). What should I do now?

If you don’t receive ARN within 15 minutes of submission of the Enrollment Application, an e-mail will be sent to you with detailed instructions for further course of action.

27. While entering the details, the Internet connection was lost. How can I retrieve the saved Enrollment Application?

To retrieve the saved Enrollment Application, login to the GST Common Portal with valid credentials. Go to Dashboard > My Saved Application menu. Click the Edit button to retrieve the saved Enrollment Application.

28. I got an e-mail indicating that there is a mismatch during PAN validation. What should I do now?

You need to resubmit the Enrollment Application with valid details as per your PAN details.

29. My DSC has expired or revoked? What do I do now?

You need to re-register your valid DSC with GST. Login to the GST Common Portal with valid credentials. Go to Dashboard > Register/ Update DSC menu.

In case of revocation, register another valid DSC with the GST Common Portal.

30. What is E-Sign? How does it work?

E-Sign stands for Electronic Signature. E-Sign is an online electronic signature service to facilitate an Aadhaar holder to digitally sign a document. If the Applicant opts to electronically sign the Enrollment Application using the E-Sign service, the Applicant needs to perform the following steps:

1. The applicant clicks the SUBMIT WITH E-SIGNATURE button on the Verification page.

2. After validating the Aadhar Number of the Authorized Signatory, an OTP will be sent to the e-mail address and mobile phone number registered in the Aadhaar database. (E-Sign service can only be used if the Aadhar number of the Authorized Signatory is mentioned in the Partners/Promoters or Authorized Signatory tab page.)

3. The GST Common Portal prompts the applicant to enter the OTP.

4. The applicant enters the OTP and submit the Enrollment Application. The e-Signing process is complete.

31. What are the various modes for user authentication on the GST Common Portal?

There are three methods for user authentication on the GST Common Portal.

- Digital Signature Certificate (DSC) is the digital equivalent (that is electronic format) of physical or paper certificates. A digital certificate can be presented electronically to prove one’s identity, to access information or services on the Internet or to sign certain documents digitally. In India, DSC are issues by authorized Certifying Authorities.

The GST Common Portal accepts only PAN based Class II and III DSC.

To obtain a DSC, please contact any one of the authorised DSC-issuing Certifying Authorities: http://www.cca.gov.in/cca/?q=licensed_ca.html

- eSign is an online electronic signature service in India to facilitate an Aadhar holder to digitally sign a document. A One Time Password (OTP) will be sent to mobile phone number that is registered with Aadhar at the time of digitally signing documents at the GST Common Portal.

To avail this service, the user must have a valid Aadhaar Card and valid mobile phone number that is registered in the Aadhar database.

- The Electronic Verification Code (EVC) authenticates the identity of the user at the GST Common Portal by generating a 10-digit alphanumeric code. The EVC will be sent to the user via SMS on the mobile number that is registered in the Aadhar database and e-mail address for verification.

To avail this service, the user must have a valid Aadhaar Card and valid mobile phone number that is registered in the Aadhar database.

32. Is Aadhaar Number mandatory to fill in the Enrollment Application?

It is optional to mention your Aadhaar Number when you fill the Enrollment Application. However, in case you want to electronically sign the Enrollment Application using E-Sign, you need to enter the Aadhar Number.

During submission of your Enrollment Application at GST Common Portal, you can electronically sign the application using DSC or Aadhaar based E-Signing.

33. Is there a Help desk available?

Yes, Help desk is available and the call number is displayed on the bottom of the GST Common Portal.