Undisclosed Bank Accounts, deposits in Co-operatives and undisclosed income declaration scheme

Arjuna (Fictional Character): Krishna, the opportunity for disclosing black money will end on 30th September 2016. Also, the income tax department is carrying on survey, raid on the taxpayers evading tax. Also the department is conducting inquiry and collecting information from financial institutions, banks, co-operative banks, etc.. How a taxpayer should take benefit of this scheme and get free from the proceedings against him?

Krishna (Fictional Character): Arjuna, the one who is having undisclosed investment in the form of gold, land, cash, paintings, antics, fixed deposit, valuables, etc. or who has entered in unaccounted transactions, it is the last chance for such person to get relieved from all these by paying 45% tax.

Arjuna (Fictional Character): Krishna, what to do if there is unaccounted deposit in bank, financial institution, or bank account?

Krishna (Fictional Character): Arjuna, income tax department regularly collects information from nationalized banks, co-operative bank, credit co-operative society and financial institutions. That is why, if anybody has unaccounted deposit, saving or current account, etc., then its statement of accounts, account number, full name, address, KYC document, photo, aadhar card, the receipts of withdrawals and deposits in the bank or financial institutions, etc., and through computerized information, income tax department can bring such transactions in light. And later the account holder will not be able to hide it or deny that it was his account. Once the income tax department asks for the details, it is compulsory for banks and financial institutions to provide the necessary details and this information cannot be kept hidden. So, if someone has any unaccounted deposit, gold loan or some transactions, then he should take the benefit of this scheme.

Arjuna (Fictional Character): Krishna, what to do if fixed deposit, saving or current account are unaccounted?

Krishna (Fictional Character): Arjuna, the date of opening fixed deposit account, its amount, the source from where the principal amount was brought, the interest on such deposit, whether the interest was shown while calculating income tax, such questions gets arisen. Also, the banks deduct TDS on the interest amount. Because of this, the deposits and interest comes under the observation of the department. But credit institutions, credit co-operative societies are not required to deduct TDS on interest if the interest receiver is its member. Therefore, it is necessary for such taxpayers to show their deposits with such co-operative societies. Most of the times, such income on which TDS is not deducted was missed out or not shown in the income tax return. Because of this, if such deposit comes under the eye of the department, then interest and penalty will have to be paid on it. The chances of it are more in village areas. That is why, taxpayer should carefully verify his books of accounts and get relieved by participating in this scheme.

Arjuna (Fictional Character): Krishna, what is the connection between gold loan and income tax?

Krishna (Fictional Character): Arjuna, financial institutions, banks, gold loan companies give loan after mortgaging gold with them. The gold, jewellery mortgage for availing the loan has been accounted for in the books or not should be seen. If this is not done, then problems may arise when questions such as from where was the gold, jewellery purchased, what is its value, etc. are asked by the department. Thus, one can get relieved by declaring such investment under this scheme and paying 45% tax on fair market value of such investment as on 1st June 2016.

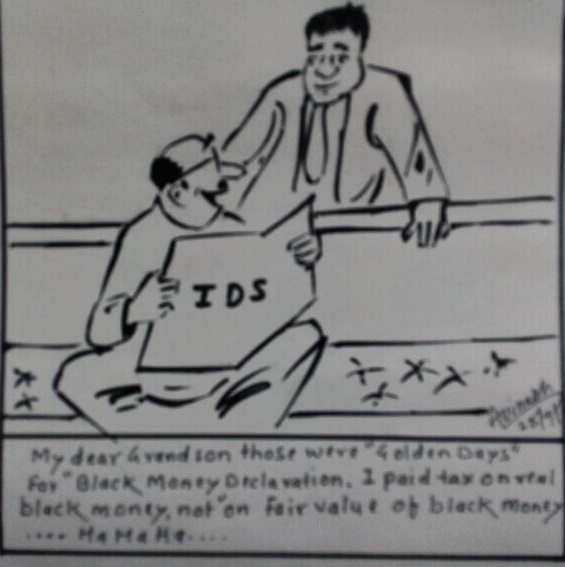

Arjuna (Fictional Character): Krishna, many taxpayers feel that 45% tax is quite high. Is it true?

Krishna (Fictional Character): Arjuna, the last date to participate in this scheme is 30th September 2016. After that, there is possibility that the 30% tax along with interest and penalty can even exceed 45% tax expense. From where, when and from whom did the undeclared and unaccounted income and expenditure on it come, etc. related inquiry can be conducted. Also anything else can also happen. Even expenditure and mental stress would increase. To get relived from this tension, even if 45% is required to be paid, it has to be paid in 3 installments in a time period of 1 year. If the tax rate according to it is calculated, then the tax rate so derived will be lower.

Arjuna (Fictional Character): Krishna, what should one learn from all this?

Krishna (Fictional Character): Arjuna, financial institutions, credit co-operative societies, co-operative banks, nationalized banks, etc. falls under the income tax provisions. So it should be verified by the account holder that whether the deposits, accounts opened in such banks are accounted for in the books or not. There are two parties to a transaction. For example, one party gives money and other receives it. If one party i.e. the receiver discloses it to income tax department and the other i.e. the giver does not disclose it, then it is the mistake of the later and he will only have to suffer. That is why, in such cases, the account holder will have to suffer. So, it is better to participate in this scheme before 30th September 2016 and get relieved.

Sir,

What to declare in IDS 2016 in case of undisclosed Bank a/c having only cash transactions relating to undisclosed business ? Whether theory of peak credit shall apply while arriving at the amount of declaration in IDS 2016?

nice one