Reserve Bank of India (RBI) on 22nd January 2021 released Discussion Paper on Revised Regulatory Framework for NBFCs – A Scale-Based Approach for public comments, which covered a wide range of revisions in the applicable NBFC Framework including but not limited to a structure based on scale, net owned fund requirements, board structure, corporate governance, capital requirements, prudential regulation, and other compliances.

Upon finalization of the aforesaid discussion paper, RBI issued the integrated regulatory framework on 22.10.2021 under the SBR Framework for NBFCs along with respective timelines. Further, detailed guidelines shall be issued by RBI subsequently. The said guidelines shall come into effect on 01st October 2022.

I. HISTORY AND EXISTING APPROACH OF RBI

RBI acquired the powers to regulate and supervise NBFCs in 1964, since then with various amendments and recommendations of Shah Working Group, RBIs powers have been enhanced over NBFCs. In 1997, RBI Act, 1934 was further amended and regulation over NBFCs was made more comprehensive, since then the NBFCs regulatory framework has taken a huge turnaround—

1998: Framework introduced

1. Categorised NBFCs into[1]—

| Public Deposit Accepting |

| Non-Deposit Accepting Core Investment Companies |

| Non-Public Deposit Accepting |

2. Clarified term ‘deposits’

3. Credit Rating and net owned funds (NOF)

4. Prohibition from grant of loan against the security of its own shares

5. Exemption to NBFCs-ND from the application of prudential norms

6. Widening scope of auditors’ certificate

2006: Classification Based on Asset Size

1. Recognised NBFCs with asset size INR 100 Crore & above as Systematically Important NBFC-ND.

2. Prudential regulations such as capital adequacy requirements and exposure norms were made applicable to them.

2014: Revised Regulatory Framework[2]

1. NOF requirement of minimum INR 2 Crore

2. Harmonised deposit acceptance

3. NBFC-ND-SI asset size increased from INR 100 Crore to INR 500 Crore

4. Differentiated regulatory approach based on customer interface and source of funds[3].

5. Harmonisation of asset classification norms for NBFC-D and NBFC-ND-SI

6. Review of corporate governance and disclosure norms[4]

The regulatory regime governing the NBFC sector is built on the principle of proportionality such that adequate operational flexibility is available to the sector through calibrated regulatory measures. However, there are rapid developments in the last few years, which have led to a significant increase in size and interconnectedness of the NBFC sector. There is, therefore, a need to review the regulatory framework in line with the changing risk profile of NBFCs.

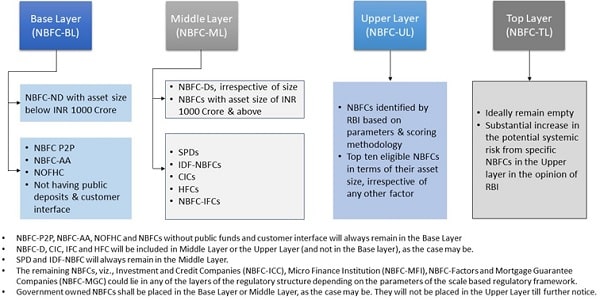

The present approach of RBI is based on the size of the NBFCs and failure of any large and deeply interconnected NBFC is capable of transmitting shocks into the entire financial sector and causing a disruption even to the operations of the small and mid-sized NBFCs. Considering the said reason, RBI decided to introduce a legal framework on Scale-Based Regulatory (SBR) structure for NBFCs comprising of four layers based on their size, activity, and perceived riskiness.

II. INTRODUCTION TO SBR

SBR framework encompasses different facets of regulation of NBFCs covering capital requirements, governance standards, prudential regulation, etc., so on 22nd October 2021, an Scale Based Regulation (SBR): A Revised Regulatory Framework for NBFCs is introduced providing a holistic view of the SBR structure, set of fresh regulations being introduced and respective timelines. Detailed guidelines as delineated in the Annex, are proposed to be issued subsequently.

These guidelines shall be effective from October 01, 2022. The instructions relating to the ceiling on IPO funding given vide Scale Based Regulation (SBR): A Revised Regulatory Framework for NBFCs shall come into effect from April 01, 2022.

III. LAYERS OF NBFCS UNDER SBR

Over some time, different types of NBFCs based on the activity have been adopted by RBI and recognized by different names, whereas post introduction of SBR these NBFCs shall be divided into four categories only.

Relevant Abbreviations

| CIC | Core Investment Companies |

| NBFC | Non-Banking Financial Company |

| NBFC-AA | Non-Banking Financial Company – Account Aggregator |

| NBFC-D | Deposit-taking Non-Banking Financial Company |

| NBFC-HFC | Non-Banking Financial Company – Housing Finance Company |

| NBFC-ICC | Non-Banking Financial Company – Investment and Credit Company |

| IDF- NBFC | Infrastructure Debt Fund – Non-Banking Finance Company |

| NBFC-IFC | Non-Banking Financial Company – Infrastructure Finance Company |

| NBFC-MGC | Non-Banking Financial Company – Mortgage Guarantee Company |

| NBFC-MFI | Non-Banking Financial Company – Micro Finance Institution |

| NBFC-ND | Non-Banking Financial Company – Non-Systemically Important Non-Deposit taking Company |

| NBFC-P2P | Non-Banking Financial Company – Peer to Peer Lending Platform |

| NBFC-ND-SI | Non-Banking Financial Company – Systematically Important Non-Deposit taking Company |

| NOFHC | Non-Operative Financial Holding Company |

| SPD | Standalone Primary Dealer |

IV. IMPACT OF NEW LAYERS

1. Change in references

a. NBFC-ND, NBFC-ND-SI & NBFC-D shall mean NBFC-BL.[5]

b. All references to NBFC-D and NBFC-NDSI shall mean NBFC-ML or NBFC-UL, as the case may be.[6]

Note: Existing NBFC-NDSI having asset size more than INR 500 Crore but below INR 1000 Crore shall be categorized as NBFC-BL, if not falling under NBFC-ML

2. Regulatory Revisions

a. Revisions applicable to lower layers of NBFCs shall apply to NBFCs residing in higher layers

b. (unless specifically excluded).

c. Existing guidelines for NBFC-BL shall be the same as applicable to NBFC-ND (except as discussed below).

d. New guidelines for NBFC-P2P, NBFC-AA, and NOFHC shall be subject to extant regulations governing them.

e. Guidelines for NBFC-ML shall continue to follow regulations as currently applicable for NBFC-ND-SIs, NBFC-Ds, CICs, SPDs, and HFCs, as the case may be (except as discussed below).

f. Guidelines for NBFC-UL shall be subject to regulations applicable to NBFC-ML in addition to the changes discussed herein below.

V. NEW CLASSIFICATION OF THE LAYERS

It is noteworthy that there shall be no cancellation of NBFCs, merely the classification of the current type of NBFCs shall be done in layers based on asset size and activity, which is simplified hereinbelow for ease of reference—

| Type of NBFC | New Layer |

| NBFC-ND (Asset size below INR 500 Cr.) | NBFC-BL |

| NBFC-ND (Asset size INR 500 Cr. & above but below INR 1000 Cr.) | NBFC-BL |

| NBFC-ND (Asset size INR 1000 Cr. & above) | NBFC-ML |

| NBFC-Ds | NBFC-ML |

| NBFC-P2P | NBFC-BL |

| NBFC-AA | NBFC-BL |

| NOFHC | NBFC-BL |

| NBFC not having public deposits and customer interface (irrespective of asset size) | NBFC-BL |

| SPDs | NBFC-ML |

| IDF-NBFCs | NBFC-ML |

| CICs | NBFC-ML |

| HFCs | NBFC-ML |

| NBFC-IFCs | NBFC-ML |

| NBFC-ICC (Asset Finance Companies (AFC), Loan Companies (LCs) and Investment Companies (ICs))[7] | Based on Parameters |

| NBFC-MFI | Based on Parameters |

| NBFC-Factors | Based on Parameters |

| NBFC-MGC | Based on Parameters |

- Shall always remain fixed

- May be classified as NBFC-ML or NBFC-UL based on scoring parameter

VI. SCORING METHOD FOR UPPER LAYER

NBFC-UL shall be decided based on the scoring methodology, which shall comprise of following parameters—

1. Quantitative— 70% weightage

a. Size & Leverage

b. Interconnectedness

c. Complexity

2. Qualitative— 30% weightage

a. Nature and type of liabilities

b. Group Structure

c. Segment penetration

Criteria

a. Top 50 NBFCs (excluding top ten NBFCs based on asset size, which automatically fall in the Upper Layer) based on their total exposure including credit equivalent of off-balance sheet exposure.

b. NBFCs designated as NBFC-UL in the previous year.

c. NBFCs added to the set by supervisors using supervisory judgment.

The computation of scores of all NBFCs in the above set shall be performed annually based on their position as on March 31 each year.

VII. REGULATORY CHANGES UNDER SBR FOR ALL THE LAYERS

1. Net Owned Funds Requirement

It is stated that the regulatory minimum Net Owned Fund (NOF) for NBFC-ICC, NBFC-MFI, and NBFC-Factors shall be increased to INR 10 crore. The present situation accordingly stands revised as follows—

| Type of NBFC | NOF Requirement (INR in Crore) |

| NBFC-ND (Asset size below INR 500 Cr.) | 2 |

| NBFC-ND (Asset size INR 500 Cr. & above but below INR 1000 Cr.) | 2 |

| NBFC-ND (Asset size INR 1000 Cr. & above) | 2 |

| NBFC-Ds | 2 |

| NBFC-P2P | 2 |

| NBFC-AA | 2 |

| NOFHC | 500 |

| NBFC not having public deposits and customer interface (irrespective of asset size) | 2 |

| SPDs | 150/ 250, as the case may be[8] |

| IDF-NBFCs | 300 |

| CICs | 2 |

| HFCs | 20 |

| NBFC-IFCs | 300 |

| NBFC-ICC (Asset Finance Companies (AFC), Loan Companies (LCs) and Investment Companies (ICs))[9] | 2

5- 31.03.2025 10-31.03.2027 |

| NBFC-MFI | 5 (2 in NE Region)

7- 31.03.2025 (5 in NE Region) 10-31.03.2027 (All Regions) |

| NBFC-Factors | 5

7- 31.03.2025 10-31.03.2027 |

| NBFC-MGC | 100 |

2. NPA Classification

As NBFC-clients often demand relaxed norms as their cash flows are uniquely different and often longer in frequency, NPA overdue period is to be revised from 180 days to 90 days for all NBFCs, except which presently follow 90 days. A glide path is provided to NBFCs in Base Layer to adhere to the 90 days NPA norm as under –

| NPA Norms | Timeline |

| > 150 days overdue | By March 31, 2024 |

| > 120 days overdue | By March 31, 2025 |

| > 90 days | By March 31, 2026 |

3. Experience of the Board

Considering the need for professional experience in managing the affairs of NBFCs, at least one of the directors shall have relevant experience of having worked in a bank/ NBFC.

4. Ceiling on IPO Funding

In the case of banks, Initial Public Offer (IPO) financing limit to an individual borrower stands at INR 10 lakhs but at present, there is no such limit for NBFCs and now such ceiling shall be fixed at INR 1 Crore. Although, the NBFC can fix more conservative limits at its discretion.

VIII. REGULATORY CHANGES UNDER SBR BASED ON LAYERS- CAPITAL GUIDELINES

| NBFC-BL | NBFC-ML and NBFC-UL | NBFC-UL* |

| Existing Guidelines shall be followed | Internal Capital Adequacy Assessment Process (ICAAP)[10] shall be on similar lines as ICAAP prescribed for commercial banks under Pillar 2 (Master Circular – Basel III Capital Regulations dated July 01, 2015). While Pillar 2 capital will not be insisted upon, NBFCs are required to make a realistic assessment of risks. |

|

*Detailed Circular shall be issued by the RBI

IX. REGULATORY CHANGES UNDER SBR BASED ON LAYERS- PRUDENTIAL GUIDELINES

| NBFC-BL | NBFC-ML and NBFC-UL | NBFC-UL |

| Not Applicable |

Board is free to determine various sub-limits within the overall SSE internal limits, but a sub-limit within the commercial real estate exposure ceiling shall be fixed internally for financing land acquisition and ceiling on IPO Funding as hereinabove.[11]

a. Granting loans and advances to directors, their relatives, and entities where they have a major shareholding. b. Granting loans and advances to Senior Officers of the NBFC. c. In the case of real estate, NBFCs shall ensure that the borrowers have obtained prior permission from government / local governments /other statutory authorities for the project. |

The board shall also determine internal exposure limits on other important sectors to which credit is extended. Further, NBFC-UL shall put in place an internal Board-approved limit for exposure to the NBFC sector. |

*Detailed Circular shall be issued by the RBI

X. REGULATORY CHANGES UNDER SBR BASED ON LAYERS- GOVERNANCE GUIDELINES

| NBFC-BL | NBFC-ML and NBFC-UL | NBFC-UL |

|

a. Corporate Governance report containing composition and category of directors, the shareholding of non-executive directors, etc. b. Disclosure on modified opinion, if any, expressed by auditors, its impact on various financial items and views of management on qualifications c. Items of income and expenditure of exceptional nature d. Breaches in terms of covenants in respect of loans availed by the NBFC or debt securities issued by the NBFC including incidence/s of default e. Divergence in asset classification and provisioning above a certain threshold to be decided by the Reserve Bank

|

|

*Detailed Circular shall be issued by the RBI

XI. REGULATORY GUIDELINES FOR NBFCS UNDER TOP LAYER

NBFCs falling in the Top Layer of the regulatory structure shall, inter alia, be subject to higher capital charges. Such higher requirements shall be specifically communicated to the NBFC at the time of its classification in the Top Layer. There will be enhanced and intensive supervisory engagement with these NBFCs.

XII. TRANSITION PATH

1. Transition Plan

When identified as NBFC-UL, RBI shall advise the classification. For this purpose, the following timelines shall be adhered to:

a. Within 3 months of being advised, the NBFC shall put in place a Board approved policy for the adoption of the enhanced regulatory framework and chart out an implementation plan.

b. The Board shall ensure that the stipulations prescribed for the NBFC-UL are adhered to within a maximum period of 24 months (including above 3 months) from the date of advice.

c. The roadmap as approved by the Board towards implementation of the enhanced regulatory requirement shall be submitted to the Reserve Bank and shall be subject to supervisory review.

2. Transition of NBFCs to the Upper Layer

a. Once an NBFC is categorized as NBFC-UL, enhanced regulatory requirement, at least for five years from its classification, even in case it does not meet the parametric criteria in the subsequent year/s.

b. NBFC-UL may however move out of the enhanced regulatory framework before the period of five years if the movement is on account of a voluntary strategic move to readjust operations as per a Board-approved policy.[15]

c. NBFCs which are close to meeting the parameters and benchmarks that would render them eligible for classification as NBFC-UL shall be intimated about the same to enable them to readjust their operations (In case they intend to continue to function as NBFC-ML on a long-term basis and do not want to graduate to NBFC-UL).

3. Review of Assessment Methodology

The methodology for assessing the NBFC-UL shall be reviewed periodically.

4. Classification of Government-owned NBFCs

As per the Reserve Bank’s circular on ‘Withdrawal of Exemptions Granted to Government-Owned NBFCs’ dated May 31, 2018, the Government-owned NBFCs are still in the transition period to attain the minimum CRAR. It has, therefore, been decided not to subject these NBFCs to the Upper Layer regulatory framework at this juncture. A decision on including eligible Government NBFCs meeting the specified criteria into the Upper Layer will be taken at a later stage and till that time the guidelines as applicable for the NBFC-ML shall apply.

5. Regulation of NBFCs not availing public funds and not having customer interface

NBFCs not availing public funds and not having a customer interface bear a different risk profile and hence deserve a differential regulatory treatment. It has been decided that Reserve Bank will come out with separate regulations for such NBFCs in due course. Till such time, the extant regulations will continue to apply.

XIII. CONCLUSION

Reserve Bank to mitigate the risks involved with NBFCs has come up with many revisions in the current regulatory system. At present these revisions seem to be complex but upon introduction of further guidelines better understanding can be made. All the existing NBFCs shall be categorized in the manner as explained hereinabove into 4 layers, NBFC-BL, NBFC-ML, NBFC-UL, and NBFC-TL. The majority of NBFCs would fall under NBFC-BL and NBFC-ML. Further, the NBFCs shall prudently adopt the regulatory changes as the penalties are likely to be high on non-compliances.

REFERENCES

1. Scale Based Regulation (SBR): A Revised Regulatory Framework for NBFCs

2. Discussion paper titled ‘Revised Regulatory Framework for NBFCs A Scale-based Approach

3. Master Directions, Guidelines, Circulars, Notifications applicable to NBFCs

———-

[1] Non-Public deposit accepting but engaged in loan, investment, hire-purchase, and equipment leasing) and non-deposit accepting core investment companies, not trading (investment not less than 90% in group companies)

[2] Presently applicable framework on NBFCs

[3] At one end of the spectrum, entities with asset size less than ₹500 crore and not accessing public funds with no customer interface were exempted from prudential and business conduct regulations.

[4] Leading to constitution of Board Committees (Audit Committee, Nomination Committee, and Risk Management Committee) and rotation of audit partners every three years applicable for NBFC-D and NBFC-ND-SI.

[5] With effect from 1st October 2022

[6] With effect from 1st October 2022

[7] NBFCs not taking public deposit but having customer interface would fall under this category concerning the risks involved

[8] SPDs which undertake only the core activities – ₹150 crore, SPDs which also undertake non-core activities -₹250 crore

[9] NBFCs not taking public deposit but having customer interface would fall under this category concerning the risks involved

[10] Internal capital assessment shall factor in credit risk, market risk, operational risk and all other residual risks as per methodology to be determined internally. The methodology for internal assessment of capital shall be proportionate to the scale and complexity of operations as per their Board approved policy.

[11] Housing Finance Companies shall continue to follow specific regulation on sensitive sector exposure, as are currently applicable in terms of paragraph 227 & 238 of Master Direction – Non-Banking Financial Company – Housing Finance Company (Reserve Bank) Directions, 2021

[12] Simplified and separate guidelines will be issued incorporating the definition of large exposure, regulatory reporting and large exposure limits.

[13] The policy shall include, a) constitution of a Remuneration Committee, b) principles for fixed/ variable pay structures, and c) malus/ claw back provisions.

[14] Disclosure requirements shall be put in place on the same lines as applicable to a listed company even before the actual listing, as per Board approved policy of the NBFC.

[15] This stipulation shall not apply if the scaling down of operations is on account of adverse situations specific to the NBFC and its deteriorating financial conditions.

****

Author Details: Email info@kyslawassociates.com | Contact +91 8826629077 | Address 3rd Floor, 437, Sector-27, Gurugram, Haryana- 122009

Disclaimer- This paper is for information purposes only, and the views stated herein are personal to the author, and shall not be rendered as any legal advice or opinion to any person, and accordingly, no legal opinion shall be rendered by implication. The Note does not intend to induce any person to omit, commit or act in any particular manner, and that you should seek legal advise before you act on any information or view expressed herein. We expressly disclaim any financial or other responsibility arising due to any action taken by any person on the basis of this Note.