Overview

Year 2020 trending New Norm – ‘Social Distancing’, a new way in which we are now required to equip our lifestyle on account of an infectious disease COVID-19 with which the entire world is fighting and till now its vaccine is to maintain good respiratory hygiene, social distance and to wash hands frequently. Looks like the same pandemic was prevailing under our Indian tax system for a long time as high level of personal interaction between the taxpayer and the tax department leads to certain undesirable practices on the part of tax officials which are getting transferred from one person to another and in order to eliminate these practices our Hon’ble Finance Minister have applied the same vaccine under our Indian tax system, i.e. launch of an E-assessment scheme, 2019 by CBDT vide notification no. 61/2019 on 12 September 2019, to impart greater efficiency, transparency, accountability in assessment procedures and to eliminate the interface between the assessee and the assessing officer.

In my last Article on Income Tax E-Proceedings – An Aurora of New Era, we discussed about the chronology of events in respect of e-proceedings and its features; meaning of ITBA; procedure for e-communication; time and place of dispatch and receipt of e-communication; various challenges in e-proceedings etc. In this Article we would be discussing on the Applicability and Structure of Income Tax E-assessment; Key features of scheme and some key points to think upon.

Applicability of E-assessment Scheme, 2019

Scheme is applicable for assessment u/s 143(3) of the Income-tax Act, 1961 (the Act) i.e. on scrutiny assessments. The scheme has been notified under section 143(3A) of the Act and its provisions prevails over various provisions of the Act as notified under Notification No. 62/ 2019 dated 12 September 2019 by reason of powers conferred under section 143(3B) of the Act.

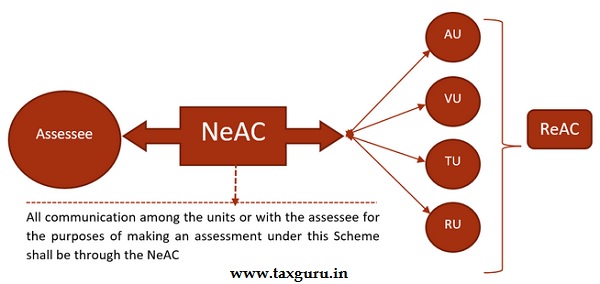

Structure of E-assessment: Centres and Units

In E-assessment Scheme, the CBDT has set up two ‘Centres’ and four ‘Units’ i.e. National E-assessment Centre (NeAC), Regional E-assessment Centre (ReAC), Assessment Units (AU), Verification Units (VU), Technical Units (TU) and Review Units (RU). The assessment will be undertaken in a centralised manner and for that NeAC is setup to facilitate and centrally control the E-assessment and to act as a link through which all the units will communicate for making an assessment.

Role of Units:

AU: to facilitate the conduct of E-assessment, to perform the function of making assessment;

VU: to perform the function of verification, which includes enquiry, cross verification, examination of books of accounts, examination of witnesses and recording of statements and such other functions;

TU: to perform the function of providing technical assistance which includes any assistance or advice on legal, accounting, forensic, information technology, valuation and such other functions.;

RU: for reviewing the draft assessment order to check whether the facts, relevant evidence and law and judicial decisions have been considered in the draft order.

Key features of the scheme:

| Particulars | Features |

| Assignment of case through an automated allocation system | The NeAC shall assign the case selected for the purposes of E-assessment under this Scheme to a specific AU in any one ReAC through an automated allocation system |

| All Communications by e-mode | All communications between the NeAC and the assessee, or his authorised representative, shall be exchanged exclusively by e-mode. Even all internal communications between the Centres and various units shall be exchanged exclusively by e-mode |

| No Personal Appearance | The scheme does not require personal appearance of parties from the stage of notice till passing of the assessment order |

| Video Conferencing | In case an opportunity of personal hearing is provided to the assessee at the stage of review of draft order, the same would be done exclusively through video conferencing |

| Delivery of e-record | Every notice or order or any other e-communication under this Scheme shall be served either on:

followed by a real time alert |

| Mobile App | The Income-tax Department shall develop an application software for mobile devices which is required to be downloaded and installed on the registered mobile number of the assessee |

| Draft Assessment order | The draft assessment order will be communicated to the taxpayer before passing the final assessment order. This step in the scheme will help in reducing litigations |

| Transfer of e-records to Jurisdictional AO | The NeAC shall, after completion of assessment, transfer all the e-records of the case to the Assessing Officer having jurisdiction over such case;

Also the NeAC may at any stage of the assessment, if considered necessary, transfer the case to the Assessing Officer having jurisdiction over such case |

Key Points to think upon:

a. Assessment through documentation/submission vis-à-vis personal hearing:

Technological advancement such as Artificial Intelligence (AI), blockchain, computational technologies, and virtual and augmented reality are transforming the digital world and businesses like never before and are creating more & more complex business structure. Because of such complexities mostly the Assessing officer fail to understand the business model and during personal hearings such issues get sorted out as the authorized representative is able to explain the officer the complete business working. Now we need to think upon that how this issue will get resolved during faceless assessment. Will this adversely affect taxpayers as officers may not be able to understand such complexities of business through just documentation.

b. Technological issues:

The success of the scheme depends upon how well the infrastructure and technology is implemented and how well the department is trained to use such technology. The IT facilities should be able to handle bulky submissions and heavy traffic during peak season, else the whole purpose of E-assessment will become infructuous.

c. Comprehensive Submissions:

The professionals are required to write clear, concise and well drafted submissions in order to effectively communicate and remove any sort of ambiguity, making intentions known.

Conclusion

In this era of technical development, where the use of technology is at its rising pace, the launch of E-Assessment Scheme is a must needed framework in which assessments need to be conducted. Tax authorities are increasingly becoming digital and getting closer to the source data to understand taxpayer trends better and ensure better compliance. To optimise the use of resources and to reduce the scope of discretion the scheme is framed to utilise automated allocation technology tools including artificial intelligence and machine learning. Digitalization and emerging technologies have opened the doors to new opportunities not just for businesses, but for tax administrators as well to transform their day-to-day operations. For the scheme to be successful there has to be a change in approach of the taxpayer, tax department and the tax consultant. As the taxpayer need to ensure that mobile number and the e-mail id are correctly updated on the income-tax portal for avoiding any issue on receipt of notices. The tax department apart from updating themselves on technology front, need to develop industry specific knowledge or industry specific cells can be created in the ReAC for a qualitative assessment. The tax consultant needs to ensure that all relevant facts/ documents are placed on record during the assessment and detailed submissions are made in respect of various tax issues to remove any sort of ambiguity.

DISCLAIMER: The views expressed in this article are strictly of the author. The contents of this article are solely for information purpose. It does not constitute professional advice or recommendation by the author. The author does not accept any liabilities for any loss or damage of any kind arising out of any information in this article nor for any actions taken in reliance thereon

A good idea indeed. But I expect some hitches. All oldies cannot be Tech savvy and forcing them to go through a Technological Maze will give many oldies, who self do ITRs online, will face a lot of problems.