Introduction

Under Income Tax laws there are two options to file Income Tax Return (ITR), generally known and called as Old Regime and New Regime, however the same can be called as With Deductions, as first and Without Deduction as Second. The person can choose whether they want to opt for With Deductions OR Without Deductions. Upto FY 2022-2023, Income Tax slab (With Deductions) was applicable as default and the person has to specifically opt if he wish to go for slab of Without Deduction. But for FY 2023-2024 and onwards tax slabs Without Deduction shall be applicable as DEFAULT and if the person wants to go for With Deduction than he has file Form 10IE. (Refer Section 115 BAC (1A) and Rule 21AG)

What is With Deductions?

There are various exemption and deduction available under old regime like deductions u/s 80c and 80D, HRA and LTA etc. these can help person to reduce their tax liabilities on their income. Below given are the tax slabs under With Deductions.

Tax rate slabs

|

Slabs |

Below age 60 Years | Between 60 to 80 years | Above 80 Years |

| Up to ₹2,50,000 | NIL | NIL | NIL |

| ₹2,50,000 to ₹3,00,000 | 5% (subject to section 87A) | NIL | NIL |

| ₹3,00,000 to ₹,5,00,000 | 5% (subject to section 87A) | 5% (subject to section 87A) | NIL |

| ₹5,00,000 to ₹10,00,000 | 20% | 20% | 20% |

| Above ₹10,00,000 | 30% | 30% | 30% |

Rebate of Income tax under section 87A.

Section 87A states that if the total income (after deduction) of an individual does not exceed ₹5,00,000 than the individual can claim tax rebate upto ₹12,500. And if the total income (after deduction) is ₹5,00,001 or more than tax calculation will be from ₹2,50,000 as shown in above table and there will be no rebate of Section 87A.

Section 87A is only applicable for individual.

Major deductions available in Income Tax

1. Deduction from income from house property.

i. Standard deduction of 30% on total rent received. [Section 24(a)]

ii. Actual interest paid on housing loan. [Section 24(b)]

2. Deduction from income from salary.

i. Basic standard deduction of ₹50,000. [Section 16(ia)]

ii. House Rent Allowance (HRA) deduction in respect of house rent the person can claim 40% if he is living in non-metro cities and if a person is living in a metro city than the he can claim 50% of deduction. [Section 10(13A)]

iii. Leave Travel Allowance (LTA) can be claim twice in a block of four years and LTA covers only domestic travel and mode of travel must be either railway, air travel or public transport. The exemption doesn’t include costs incurred for the entire trip such as shopping, food expenses and entertainment. (Section 10(5) and Rule 2B).

iv. Mobile reimbursement can be claim if mobiles and telephones are being used by taxpayer at their residence and taxpayer can claim a tax free reimbursement. [Section 10(14)].

v. Books and Periodicals exemptions can be claimed when taxpayer is incurring expenses on newspaper, books etc. than taxpayer can claim a tax free reimbursement. [Section 10(14)].

vi. Children Allowance employee can claim maximum exemption of ₹100/ month as an exemption of ₹1200 per annum. The exemption is allowed for a maximum of 2 children. [Section 10(14)].

vii. Hostel Expenditure of Children employee can claim maximum exemption of ₹300/ month as an exemption of ₹2600 per annum. The exemption is allowed for a maximum of 2 children. [Section 10(14)].

viii. Transport allowance employee working in transport business to meet his personal expenditure than he can claim 70% of such allowance up to maximum of ₹10000. [Section 10(14)].

3. Chapter VI-A deduction.

i. 80C taxpayer can claim deduction of maximum of ₹1,50,000 which generally includes Life insurance premium, EPF, PPF, ULIP, Tuition Fees, Mutual funds, FDR, House repayment.

ii. 80CCD deduction in respect of contribution made in National Pension Scheme (NPS) of central government and you can claim maximum deduction of ₹50,000 apart from the maximum deduction u/s 80C of ₹1,50,000.

iii. 80D deduction in respect of health insurance premium where you can claim maximum deduction of ₹25,000 but in the case of senior citizen you can claim maximum deduction of ₹50,000.

If there is any preventive health checkup than the person can claim rebate of ₹5,000 in the above limits.

iv. 80DD deduction in respect of maintenance or medical treatment of a disable dependent. The person can claim deduction of ₹75,000, irrespective of expenses incurred. If the person has severe disability (more than 80%) than the person can claim deduction of ₹1,25,000.

v. 80DDB deduction in respect of medical treatment for specified disease, wherein for self person can claim deduction of ₹40,000 and in the case of senior citizen person can claim deduction of ₹1,00,000.

vi. 80E deduction is in respect of interest paid on the loan (EMI) on the education loan taken by the person himself. This deduction is available for a maximum 8 years or till the interest is paid whichever is earlier. Person can claim deduction apart from basic deduction of u/s 80C ₹1,50,000.

vii. 80G provides deduction in respect of donation made to specified organizations where you can claim 100% deduction. But donation made to other than specified organizations person can claim only 50% of deduction. Person can claim deduction apart from basic deduction of u/s 80C ₹1,50,000.

viii. 80GG provides deduction in respect of rent paid by the person, wherein he can claim deduction under this section. The maximum deduction person can claim is ₹60000. But then deduction of HRA not cannot be claim for the same period u/s [Section 10(13A)].

ix. 80TTA deduction in respect of interest received on saving bank account. The person can claim maximum deduction of ₹10,000.

x. 80TTB Interest received on saving bank account and deposits by senior citizen. The person can claim maximum deduction of ₹50,000.

What is Without Deductions?

It was introduced in Finance Act 2020, wherein new tax slabs were introduced. The person who are opting for new slab (Without Deduction) are not eligible to claim following deduction:-

- House rent allowance (HRA)

- Leave Travel Allowance (LTA)

- Chapter VI-A (like 80C, 80D, 80TTA and 80TTB )

Upto FY 2022-2023 only individuals and HUF were eligible to opt for slab of Without Deductions. But for FY 2023-2024 slab of Without Deduction is default and it is eligible for individuals, HUF, AOP and BOI.

Tax rate slabs

|

Slabs |

Tax Rates |

| Up to ₹3,00,000 | NIL |

| ₹3,00,000 to ₹6,00,000 | 5% (subject to section 87A) |

| ₹6,00,001 to ₹9,00,000 | 10% (subject to section 87A upto ₹7,00,000) |

| ₹9,00,001 to ₹12,00,000 | 15% |

| ₹12,00,001 to ₹15,00,001 | 20% |

| Above ₹15,00,000 | 30% |

Rebate of Income tax under section 87A.

Section 87A states that if the total income (after deduction) of an individual does not exceed ₹7,00,000 than the individual can claim tax rebate upto ₹25,000. And if the total income (after deduction) is ₹7,00,001 or more than tax calculation will be from ₹3,00,000 as shown in above table and there will be no rebate of Section 87A.

Deductions allowed under section 115BAC.

1. Deduction from income from house property.

i. Standard deduction of 30% on total rent received.

ii. Actual interest paid on housing loan.

2. Deduction from income from salary.

i. Basic standard deduction of ₹50,000.

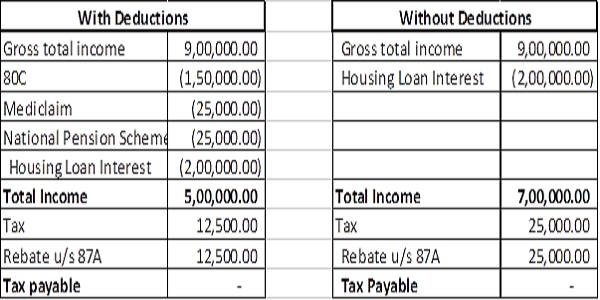

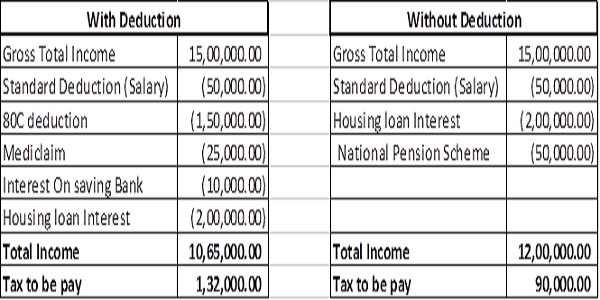

To illustrate the above given tax rates and deductions there are some hypothetical examples given below:- (excluding calculation of Cess and Surcharge)

Illustration 1

Illustration 2

Illustration 3

Conclusion: Understanding income tax calculations with and without deductions is crucial for taxpayers to make informed decisions. While deductions reduce tax burdens, the new regime offers simplified tax slabs with limited deductions. Taxpayers must evaluate their financial situations to choose the regime that best suits their needs.

Author: Sneha Jain | Intern Assistant | HKG & Co. | Chartered Accountants.

Perfect Calculations

Appreciate

Thanks