Sponsored

Highlights of Budget 2018-19

- Finance Minister Shri Arun Jaitley presents general Budget 2018-19 in Parliament.

- Budget guided by mission to strengthen agriculture, rural development, health, education, employment, MSME and infrastructure sectors

- Government says, a series of structural reforms will propel India among the fastest growing economies of the world. Country firmly on course to achieve over 8 % growth as manufacturing, services and exports back on good growth path.

- MSP for all unannounced kharif crops will be one and half times of their production cost like majority of rabi crops: Institutional Farm Credit raised to 11 lakh crore in 2018-19 from 8.5 lakh crore in 2014-15.

- 22,000 rural haats to be developed and upgraded into Gramin Agricultural Markets to protect the interests of 86% small and marginal farmers.

- “Operation Greens” launched to address price fluctuations in potato, tomato and onion for benefit of farmers and consumers.

- Two New Funds of Rs10,000 crore announced for Fisheries and Animal Husbandary sectors; Re-structured National Bamboo Mission gets Rs.1290 crore.

- Loans to Women Self Help Groups will increase to Rs.75,000 crore in 2019 from 42,500 crore last year.

- Higher targets for Ujjwala, Saubhagya and Swachh Mission to cater to lower and middle class in providing free LPG connections, electricity and toilets.

- Outlay on health, education and social protection will be 1.38 lakh crore. Tribal students to get Ekalavya Residential School in each tribal block by 2022. Welfare fund for SCs gets a boost.

- World’s largest Health Protection Scheme covering over 10 crore poor and vulnerable families launched with a family limit upto 5 lakh rupees for secondary and tertiary treatment.

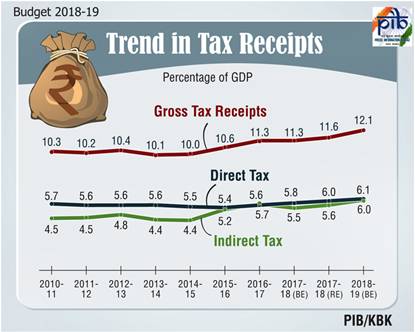

- Fiscal Deficit pegged at 3.5 %, projected at 3.3 % for 2018-19.

- Rs. 5.97 lakh crore allocation for infrastructure

- Ten prominent sites to be developed as Iconic tourist destinations

- NITI Aayog to initiate a national programme on Artificial Intelligence(AI)

- Centres of excellence to be set up on robotics, AI, Internet of things etc

- Disinvestment crossed target of Rs 72,500 crore to reach Rs 1,00,000 crore

- Comprehensive Gold Policy on the anvil to develop yellow metal as an asset class

- 100 percent deduction proposed to companies registered as Farmer Producer Companies with an annual turnover upto Rs. 100 crore on profit derived from such activities, for five years from 2018-19.

- Deduction of 30 percent on emoluments paid to new employees Under Section 80-JJAA to be relaxed to 150 days for footwear and leather industry, to create more employment.

- No adjustment in respect of transactions in immovable property where Circle Rate value does not exceed 5 percent of consideration.

- Proposal to extend reduced rate of 25 percent currently available for companies with turnover of less than 50 crore (in Financial Year 2015-16), to companies reporting turnover up to Rs. 250 crore in Financial Year 2016-17, to benefit micro, small and medium enterprises.

- Standard Deduction of Rs. 40,000 in place of present exemption for transport allowance and reimbursement of miscellaneous medical expenses. 2.5 crore salaried employees and pensioners to benefit.

- Relief to Senior Citizens proposed:-

- Exemption of interest income on deposits with banks and post offices to be increased from Rs. 10,000 to Rs. 50,000.

- TDS not required to be deducted under section 194A. Benefit also available for interest from all fixed deposit schemes and recurring deposit schemes.

- Hike in deduction limit for health insurance premium and/ or medical expenditure from Rs. 30,000 to Rs. 50,000 under section 80D.

- Increase in deduction limit for medical expenditure for certain critical illness from Rs. 60,000 (in case of senior citizens) and from Rs. 80,000 (in case of very senior citizens) to Rs. 1 lakh for all senior citizens, under section 80DDB.

- Proposed to extend Pradhan Mantri Vaya Vandana Yojana up to March, 2020. Current investment limit proposed to be increased to Rs. 15 lakh from the existing limit of Rs. 7.5 lakh per senior citizen.

- More concessions for International Financial Services Centre (IFSC), to promote trade in stock exchanges located in IFSC.

- To control cash economy, payments exceeding Rs. 10,000 in cash made by trusts and institutions to be disallowed and would be subject to tax.

- Tax on Long Term Capital Gains exceeding Rs. 1 lakh at the rate of 10 percent, without allowing any indexation benefit. However, all gains up to 31st January, 2018 will be grandfathered.

- Proposal to introduce tax on distributed income by equity oriented mutual funds at the rate of 10 percent.

- Proposal to increase cess on personal income tax and corporation tax to 4 percent from present 3 percent.

- Proposal to roll out E-assessment across the country to almost eliminate person to person contact leading to greater efficiency and transparency in direct tax collection.

- Proposed changes in customs duty to promote creation of more jobs in the country and also to incentivise domestic value addition and Make in India in sectors such as food processing, electronics, auto components, footwear and furniture.

Sponsored

Kindly Refer to

Privacy Policy &

Complete Terms of Use and Disclaimer.

What about LTCG by salecof residential land in urban Chennai bought prior to 1981 ? How LTCG determined ? Is TDS as. Adv tax need to be paid ? Example pl?

Upto 31.1.2018 will be under pre-budget status and from 1.2.2018 onwards new LTCG will apply @ announced in the Union Budget.

IT MEANS THAT LONG TERM CAPITAL GAIN WILL BE CALCULATED ON SELLING PRICE WHICH EXCEED MARKET VALUE OF SHARES AS ON 31/1/2018. APPRECIATION IN VALUE UPTO 31/1/2018 WILL BE EXEMPTED FROM LT GAINS

In the instant case, gain on sale of equity shares holding more than 12 months is termed as long term capital gain. Till FY 31-01-2018, there is no tax on long term capital gain of shares. Now it has been introduced by the present Finance Bill 2018.

can u please elaborate this” Proposal to introduce tax on distributed income by equity oriented mutual funds at the rate of 10 percent.”

Excellent

Tax on Long Term Capital Gains exceeding Rs. 1 lakh at the rate of 10 percent, without allowing any indexation benefit. However, all gains up to 31st January, 2018 will be grandfathered.

COULD YOU PLEASE EXPLAIN THIS ?

THANKS FOR YOUR RETURN REPLY