E- Assessment is a roadway towards a paperless, faceless assessment stripping away at bureaucratic layers. E-Assessment didn’t just magically appear from nowhere, it was tried and tested by the Income tax Department before going forth with the E-ASSESSMENT SCHEME, 2019. To understand any scheme, one needs to understand how it came to be formulated.

So, the history trails as follows,

- E-Assessment was initially introduced for the very first time on a pilot basis in five cities, inter-alia, Ahmedabad, Bangalore, Chennai, Delhi and Mumbai in 2015, which was extended to two more metros Kolkata and Pune in the year 2016. In the year 2017, the Income-tax Dept. had developed an integrated platform, i.e., Income Tax Business Application (ITBA) to carry out various electronic functions/proceedings including assessments. Central Board of Direct Taxes (CBDT) has made it mandatory for the tax officers to take recourse of electronic communications for all limited and detailed scrutiny cases.

- Then, came a Board vide Letter No. 225/157/2017, dated 23-6-2017 to help facilitate the conduct of assessment proceedings electronically which also prescribed revised format of notice to be issued by the assessing officers to make scrutiny assessment.

- Instruction No. 8/2017 dated 29.09.2017 dated extended the scope of E-Assessment it covered various aspects of conducting scrutiny assessments electronically in cases which were getting barred by limitation during the financial year 2017-18. However, there still was an option with the assesses to voluntarily opt-out from ‘e-Proceeding’.

- A new Instruction No. 1/2018 dated 12-02-2018, provided that except for search-related assessments, proceedings in other pending scrutiny assessment cases was to be conducted only through the ‘E-Proceeding’. There still remains an option to object the conduct of e-assessment, and those cases were on hold.

- Now CBDT through instruction No. 03/2018, dated 20-8-2018, that in all cases where assessment is required to be framed under Section 143(3) during the year 2018-19, assessment proceedings shall be through E-Assessment. In the e-assessment proceedings, a taxpayer is not required to appear in person before the Assessing Officer as assessment proceedings in all cases selected under scrutiny is conducted through e-mail-based communications.

- And finally, via the Finance Act, 2018, two new Sub-sections (3A) and (3B) to Section 143 of the Income-tax Act, 1961 were introduced enabling Central Government to introduce a scheme for the electronic assessments. These sub-sections help in launching a new scheme for scrutiny assessments to eliminate the interface between the AO and the taxpayers.

- After all these actions, the CBDT notified an ‘E-Assessment Scheme, 2019‘ vide Notification no. 61/2019 & 62/2019, dated 12-09-2019 to conduct e-assessments with effect from September 12, 2019.

The scrutiny assessments to be carried out on or after 12-09-2019 are governed by this ‘E-assessment Scheme, 2019. It is a well thought out plan, with structured procedures and a step towards aiming to reduce red tape and a more transparent assessment system. Whether it will work as smoothly as it has been designed, only time will tell, but let’s now understand its structure and the process.

Structural Guide for E-Assessment.

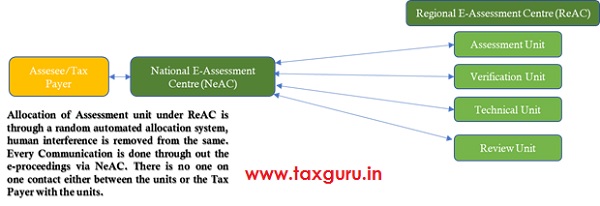

The complete idea behind e-assessment was to reduce human interference between Assessing Officer and Assessees. E-Assessment scheme could be a labyrinth where one could easily get confused and lost. It is formed on the bases of establishing ‘centres’ and ‘units’ and specifying their respective jurisdiction in order to reduce corruption and harassment of taxpayers. In order to understand the mechanism of the scheme it is necessary to know the role and structure of each center or unit. The following hierarchy of centres and units play a vital role in the scheme of the E Assessment:

- A ‘National e-Assessment Centre’ to facilitate and centrally control the complete e-assessment. Communications between all the units, to make an assessment would be through the National e-Assessment Centre.

- ‘Regional e-Assessment Centres’ under the jurisdiction of the regional Principal Chief Commissioner for making an assessment. It is assigned and selected by the NeAC (National e-Assessment Centre’) randomly and automatically.

- ‘Assessment units’ for identifying points or issues, material for the determination of any liability (including refund), analyzing information, and such other functions.

- ‘Verification units’ for enquiry, cross verification, examination of books of accounts, witness and recording of statements (through VC), and such other functions.

- ‘Technical units’ for technical assistance including any assistance or advice on legal, accounting, forensics, information technology, valuation, transfer pricing, data analytics, management or any other technical matter.

- ‘Review units’ for reviewing the draft assessment order to check whether the facts, relevant evidence, sustainability of particular addition or exemption or deduction, applicability of judicial pronouncements, among others have been considered in the draft order.

All these centres have been assigned their role-play and they are restricted to the same.

Service of Notice for E-Assessment

In accordance with the scheme, certain modifications are made pertaining to the service of notice. Notice shall be delivered to the addressee, being the assessee, by way of—

(a) placing an authenticated copy in the assessee’s registered account; i.e. the e-login ID at the income tax portal

(b) sending an authenticated copy to the registered email address of the assessee or his authorised representative;

(c) uploading an authenticated copy on the assessee’s Mobile App;

It is significant to note that all these will be followed by a real-time alert.

In fact, any notice, order or any electronic communication be delivered to the addressee by sending an authenticated copy to the registered email address of such person, followed by a real-time alert.

Communication only via electronic mode

All communications including internal communication, i.e the NeAC and the assessee or his AR, as well as communications between the NeAC, ReAC and various units, shall be exchanged exclusively by electronic mode.

Assesse or the AR not required to appear before the AO

There has to be no appearance either personally or through authorized representative in connection with any proceedings under this Scheme before the income-tax authority at the NeAC or ReAC or any unit set-up under this Scheme.

New Technology used to bring anonymity in proceedings

In order to ensure that vested interests do not obstruct the due course of law, the Income-tax Department proposes to align its operations with contemporary technology techniques being-

(a)”Automated allocation system” for randomized allocation of cases using inter alia artificial intelligence and machine learning;

(b)”Automated examination tool” for a standardized examination of orders using inter alia artificial intelligence and machine learning;

(c)”Mobile app” providing a host of utilities to the Assessee or the Tax Payer

(d)”Video Conference” for audio and video communication interface between Revenue authorities and taxpayer

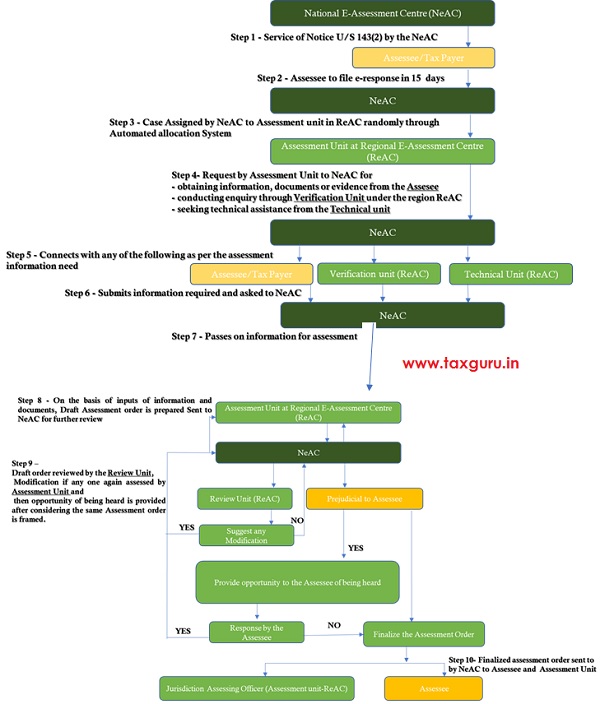

Procedure in E-assessment

The procedure for e-assessment is explained via Diagrammatic presentation as given in next page:

The National e-assessment Centre shall, after completion of the assessment, transfer all the electronic records of the case to the Assessing Officer having jurisdiction over such case., for —

(a) imposition of penalty;

(b) collection and recovery of demand;

(c) rectification of mistake;

(d) giving effect to appellate orders;

(e) submission of remand report, or any other report to be furnished before CIT(A) or courts

(f) proposal seeking sanction for launch of prosecution and filing of complaint before the Court;

Exceptions are carved out for certain types of proceedings such as search and seizure cases, re-assessments, best judgement assessments, etc., where the assessment would be done through personal hearing process.

Transfer of case to AO in Jurisdiction

The National e-assessment Centre may at any stage of the assessment, if considered necessary, transfer the case to the Assessing Officer having jurisdiction over such case.

Other Aspects of E-Assessment

Penalty proceedings can be initiated by the assessment unit through National E-assessment center in case of non-compliance of any notice, direction or order.

- E-assessment is not a special type of assessment. All the current assessments can be carried out in an electronic manner following the procedure mentioned above. Interestingly, re-assessment u/s 147 has not been covered and that has to happen through offline mode.

- Appeals u/s 246A shall remain lie with the jurisdictional Commissioner (Appeals).

Portal of E-filing used for E-proceeding

‘E-proceedings’ platform all the letters, income tax notices, questionnaires, intimations, orders and other communications from the assessing authority are directly sent to the taxpayers’ registered ‘e-filing’ account in the ‘e-filing’ portal of the Income-tax department website. The taxpayers are able to submit the responses electronically by uploading the same along with attachments on the ‘e-Filing’ portal. The submissions made by the assessee are viewed by the assessing authority electronically in Income-Tax Business Application (lTBA) module. This revolutionary and path-breaking initiative, besides saving precious time of the assessee, also provides a 24X7 anytime/anywhere convenience to the taxpayers to submit their responses to the departmental queries in the course of assessment proceedings.

By completing the entire assessment proceedings online and electronically, the taxpayer has access to the ‘e-proceedings’ at all times and has access to all documents and information submitted in the process. This initiative is taxpayer-friendly and environment-friendly as assessment proceedings have become ‘faceless’ ‘paperless’ and ‘jurisdiction-less’.

Bottlenecks and Hurdles in E-Assessment

Generally, an assessment would involve a submission comprising 300+ printed pages. Huge workload would be expected as the same would have to be converted into digital format. Since it is a new beginning, we may expect technical glitches like unexpected rush and crashing of servers . The assesses will find the compliance cumbersome while uploading their documents . Automated systems are not free from errors therefore technical glitches and bugs would have to be fixed as soon as possible in real-time too.

Precautions are to be taken like ensuring that fields used in the return are consistent as it is totally automated. Clerical errors without having a bearing on the tax payable may trigger penalty proceeding.

Ensure that mobile number and the e-mail id are updated as the assesses would be notified through an SMS/e-mail.

A step towards the right direction

E-Assessment is the first step towards making assessment procedure transparent, and cleansing the bureaucratic unnecessary layers and reducing litigation cost for both revenue and taxpayer.

Disclaimer: ‐ This document is intended for private circulation & knowledge sharing purpose only. All efforts have been made to ensure the accuracy of information in this document, however we will not be responsible for any errors that may have crept in inadvertently and do not accept any liability whatsoever, for any direct or consequential loss howsoever arising from any use of this document. The document shall not be construed as professional advice or an opinion.

hi give help me

Good work done by Nidhi for the current scenario of Goverment policy.