The Overview

In the realm of taxation, fairness, efficiency, and revenue generation are critical facets. India, like many countries, has been grappling with these issues within its taxation system. Unfair taxes, low tax collection, high debt, and a cumbersome manual taxation process have long plagued the nation’s economic landscape. This article explores how Digital Transaction Tax (DTT) serves as a transformative solution to these enduring challenges.

Also Read: Benefits of Digital Transaction Tax (DTT) for a tax payer

The Problem

India’s taxation system has, for years, been perceived as inequitable, affecting only a small percentage of the population – approximately 3 to 4% – who pay direct taxes. This stark disparity in the tax base calls for a re-evaluation of how India generates revenue. The primary stakeholders in this predicament are Indian taxpayers and the government itself. The current system relies heavily on direct taxes, which disproportionately burden salaried individuals and small businesses.

For many, filing tax returns has become an arduous task, particularly for those with multiple sources of income. India’s mounting debt crisis is another alarming concern. As of FY21-22, the nation’s debt reached a staggering 152 trillion INR, a looming shadow over its fiscal health. To exacerbate matters further, India’s net tax collection for FY21-22 stood at a mere 17.65 trillion INR, reflecting a severe shortfall in revenue. The dire need for enhanced tax collection has driven the Indian government towards accumulating more debt, a cycle that appears unsustainable in the long run.

The Solution: Digital Transaction Tax (DTT)

In the face of these challenges, DTT emerges as a practical and progressive solution. India’s burgeoning digital economy and the remarkable growth of digital transactions since 2017-2018 provide a fertile ground for DTT’s implementation.

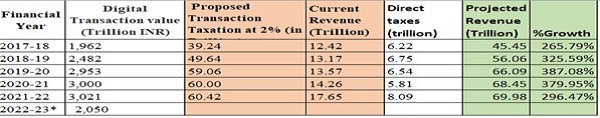

Digital transactions have witnessed an astonishing surge, growing by a staggering 380% over the past five years. Leveraging this robust foundation, DTT proposes a modest 2% tax on digital transactions for the fiscal year FY21-22, leading to a significant tax collection of 60.42 trillion INR. This figure marks a monumental achievement, outperforming the conventional tax structure by a whopping 42.77 trillion INR.

DTT is characterized by its comprehensive approach, which incorporates a 2% digital transaction tax and an additional 4% to 8% tax on cash withdrawals within a given financial year. This dual-pronged strategy aims to incentivize digital transactions while promoting financial inclusion.

The Data Pattern

With Digital transactions having a strong footprint in history, we can reverse the Direct tax and instead levy Digital Transaction tax starting from 2017-18 for every Digital transaction. This can prove to be a game changer in the tax collection. Please find details in the below chart, notice the last column %Growth which signifies the growth of DTT (Projected Revenue) in comparison to current revenue. Here in the below chart Projected Revenue = Proposed Transaction Tax + Current Revenue – Direct Taxes. Kindly note 1 Trillion = 1 Lakh Crore

Promoting Progressive Taxation with DTT

Digital Transaction Tax (DTT) marks a significant departure from the uniform taxation approach seen with the Bank Transaction Tax (BTT). Unlike its predecessor, DTT introduced a 2% tax on digital transactions, a notably lower percentage when compared to income tax slabs. This strategic approach not only eases the tax burden on taxpayers but also encourages broader compliance, ultimately benefiting the nation’s financial health.

By harnessing India’s robust digital transaction ecosystem, DTT not only tackles current tax challenges but also sets the stage for a more equitable and efficient taxation system. It strives to expand the tax base, encompassing a larger segment of the population and lessening the burden on a select few.

In summation, DTT serves as a promising catalyst for advancing progressive taxation in India. Its innovative approach, exemplified by the mere 2% tax rate, underscores its commitment to fairness and inclusivity. The transformation DTT brings has the potential to reshape India’s perception of taxation, fostering a more equitable and prosperous economic landscape for all.

Submission to the Government

The presented case study has already been submitted to the esteemed Government of India and has been officially acknowledged as a suggestion. However, if you wish for the government to give it even greater consideration, we recommend filing a grievance through the ‘Interact with PM’ portal, addressing it to the Finance and Revenue department. You should get an acknowledgement as shown below after raising a grievance:

******

Disclaimer: The case study showcased in the article is a demonstration with conservative percentage values applied to the financial data submitted by the government. These calculations can serve as a foundational reference for the government’s forthcoming tax revision process.

References:

Kindly refer to the webinar hosted by TaxGuru for more insights on Digital Transaction Tax:

https://www.youtube.com/watch?v=7ifIqaNIf4c

For deeper insights, don’t miss my YouTube video on this topic! 📺🔍

Watch here: https://www.youtube.com/watch?v=xKKomevGw1k to uncover the full story and explore the world of Digital Transaction Tax. Let’s dive in together!

Although the proposed taxation seems a very good proposal , this would also trigger people to avoid digital transaction as much as possible.

This proposal also in line with Chanakya’s way of collecting taxes like a bee collects nectar from flowers

In the spirit of fostering a fair taxation system, I truly appreciate your engagement with this proposal. I’d like to highlight that the proposed Digital Transaction Tax (DTT) includes a 4 to 8% tax on cash withdrawals, strategically designed to discourage cash transactions. This dual-pronged approach aims to strike a balance between incentivizing digital transactions and curbing the use of cash, ultimately contributing to a more equitable and efficient tax collection system. Appreciate your valuable input!