The ministry of Finance on 15/10/2020 notified 6 notifications incorporating various changes to the CGST Act and CGST Rule. In this Article we will discuss the notifications with reference to the original act or rules.

1.Notification No 74/2020-Central Tax

This notification revised the due date for filing of GSTR-1 for small tax payer who files GSTR 1 Quarterly . Registered person whose aggregate turnover in preceding financial year or current year up to 1.5 Crore , will file GSTR 1 Quarterly within 13th of succeeding month for the tax period October 2020 to March 2021.

2. Notification No 75/20200-Central Tax

Registered person whose aggregate turnover in preceding financial year or current year exceeds 1.5 Crore , will file GSTR 1 monthly within 11th of month succeeding the quarter for the tax period from October 2020 to March 2021.

3. Notification No 76/202-Central Tax

GSTR 3B to be filed : within 20th of succeeding Month

However a registered person whose aggregate turnover is up to 5 Core in the preceding financial year and have principal place of business in Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra,Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, the Union territories of Daman and Diu and Dadra and Nagar Haveli, Puducherry, Andaman and Nicobar Islands or Lakshadweep, the return in FORM GSTR-3B for the months of October, 2020 to March, 2021 shall be furnished on or before the twenty-second day of the month succeeding such month

However for taxpayers having an aggregate turnover of up to five crore rupees in the previous financial year, whose principal place of business is in the States of Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya,Assam, West Bengal, Jharkhand or Odisha, the Union territories of Jammu and Kashmir, Ladakh, Chandigarh or Delhi, the return in FORM GSTR-3B of the said rules for the months of October, 2020 to March, 2021 shall be furnished eon or before the twenty-fourth day of the month succeeding such month.

4. Notification No 77/2020-Central Tax:

A small tax payer whose aggregate turnover in a financial year does not exceed 2 Crore is not required ( option given may or may not) to file Annual return for the Financial year 2019-20 if they have not filled the Annual return before the due date.

5. Notification No 78/2020-Central Tax: ( Amendment to Notification No – 12/2017)

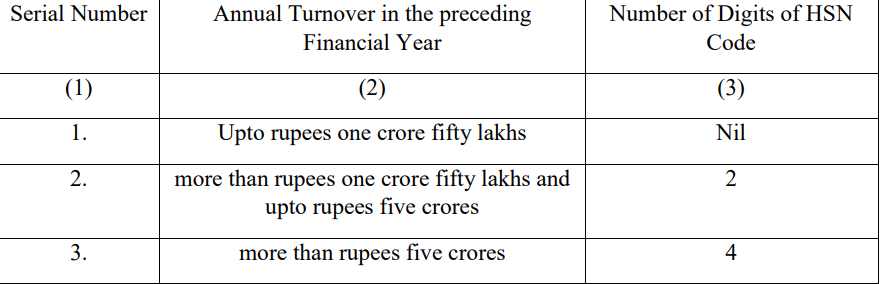

Rule 46 of CGST Rule states what should be the content of tax invoice . One of the content is HSN code. Government had notified the number of HSN code to be mentioned in the tax invoice vide notification no 12/2017 as below:

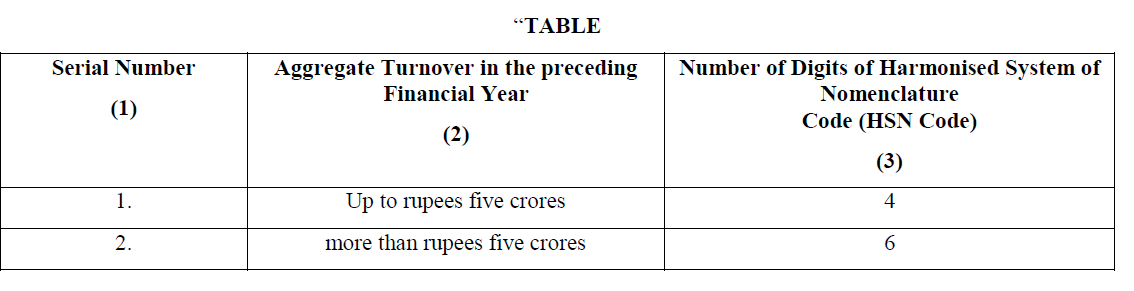

Amendment : The government vide Notification No 78/2020, has substituted the above table as below:

Provided that a registered person having aggregate turnover up to five crores rupees in the previous financial year may not mention the number of digits of HSN Code, as specified in the corresponding entry in column (3) of the said Table in a tax invoice issued by him under the said rules in respect of supplies made to unregistered persons.

6. Notification 79/2020-Central Tax

This notification has amended the CGST Rule 2017.These amendment are discussed below.

a) Rule 46: HSN Code

The amendment gave power to government to notify certain supply and the number of digits of HSN code that need to be mentioned in the invoice.

b) Rule 67A: Filing of Return Through SMS

Now GSTR 1, GSTR-3B and CMP-08 can be filed through Short messaging service (SMS) facility.

c) Rule 80: Annual Audit and Filing of form GSTR – 9C

For financial year 2018-19 and 2019-20 , account need to be audited under section 35(5) and GSTR 9C need to be filed only if the T/O exceeds 5 Crore during a financial year.

Note: Normally the threshold limit for audit and filing of GSTR 9C is Rs 2 Crores.

d) Rule 138 E: Generating Part A of E Way Bill

As per the rule if any person failed to file CMP-08 ( Quarterly filed by Composite Tax payer within 18 th of Succeeding month of the quarter) for a consecutive 2 tax period or failed to file GSTR -1 and GSTR-3B for a consecutive 2 months, such person can not fill the PART A of E WAY bill.

Provided also that the said restriction shall not apply during the period from the 20th day of March, 2020 till the 15th day of October, 2020 in case where the return in FORM GSTR-3B or the statement of outward supplies in FORM GSTR-1 or the statement in FORM GST CMP-08, as the case may be, has not been furnished for the period February, 2020 to August, 2020

Crux : The above restriction to be applied after the period 15th October 2020.

For further query related to Income Tax, GST you can reach to me at the following details: Mob: 7205215075/7846822085 – Gmail. bijaykumarnath222@gmail.com

Nice summary, however, the mistakes should be avoided.

For readers, don’t follow blindly.

All income tax and gst tax paid refunds returns to my accounts.

I have not filled my gst 3 b return from Nov.2018 to till date business crisis is a reason to not filling my gst 3b return because some tax liability are occurred during nov 2018 to Jan 2019.meantime that whenever govt.gave relaxation on penalty and interest free time till sep2020, I could not filled my previously 3b now what can I do if now I able to pay balance tax,it can be a chance to waive of?