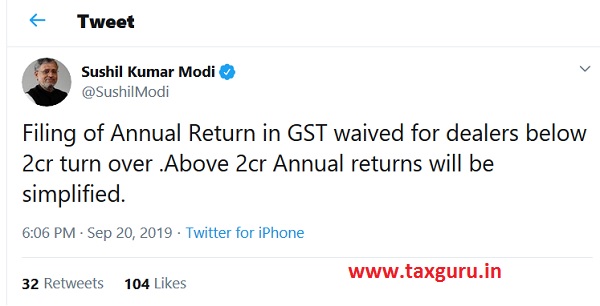

As per twitter handle of Deputy CM of Bihar , Shri Sushil Kumar Modi – Filing of Annual Return in GST waived for dealers below 2 crore turn over. Above 2 crore Annual GST returns will be simplified.

Further Update from Press Releases by Ministry of Finance on decisions taken in 37th GST Council Meeting

GST Council, in its meeting recommended –

1. Relaxation in filing of annual returns for MSMEs for FY 2017-18 and FY 2018-19 as under:

a. waiver of the requirement of filing FORM GSTR-9A for Composition Taxpayers for the said tax periods; and

b. filing of FORM GSTR-9 for those taxpayers who (are required to file the said return but) have aggregate turnover up to Rs. 2 crores made optional for the said tax periods.

2. A Committee of Officers to be constituted to examine the simplification of Forms for Annual Return and reconciliation statement.

Also Read Press Releases by Ministry of Finance on decisions taken in 37th GST Council Meeting

Changes in GST Rate on Goods | 37th GST Council Meeting

Changes in GST Rate on Services | 37th GST Council Meeting

Changes in GST Law and Return Filing including Annual Returns

the language used is optional not waived.it seems like gstin holders who doesnt file annual return will have to be ready for assessment.better to file annual return.

Honorable Finance Minister first to appreciate that you have taken excellent decision to smooth the trading operation. In continuation of that please extend the due date for filing tax audit for the Financial year 2018-2019 to 30th November 2019 so that Everyone will get some relief and exercise to file the return without any error.

Why does everyone talkabout extension? We get good 6 months time. It’s time we become more efficient and updated. The government can’t support our lazy attitudes every time. And at the same time, the Government should also follow strict shedule to complete the assessments.

EXTEND THE DATE OF 44AB FILING WHATEVER MAY BE 31ST OCTOBER 30TH NOVEMBER OR 15TH NOVEMBER KINDLY DECLARED AT AN EARLY BECAUSE PPROFESSIONAL ARE SUFFERING FROM HEALTH ISSUES LIKE BP SUGAR ETC

To,

Respected Finance Minister

Please we request your Extend the Tax Audit Return Filing date up to 31/10/2019 due to heavy rain and extended the return due date of non audited income tax return

It is not Waived .. It is made optional ..!! Please check the facts before posting !!

Respected finance minister

Please extend tax audit return filing due date up to 30th Nov 2019

GST Annual Return and reconciliation statement should be made optional till the period GSTR 3B is abolished. It is because of self declaration of GST liability and ITC, the problem of annual return mounts. Once we upload sales details and adjust ITC what is available on GST portal, things will be easier our accounting professionals. The business peoples also can follow-up with non-filers and withhold their payment at least GST part .

Therefore, it is requested that annual return and reconciliation may be waived till GSTR 3B is taken out.

To

Respected finance minister

Please extend tax audit return date up to 30th Nov 2019

To

Respected finance minister

Please extend tax audit return filing due date up to 30th Nov 2019