“Today, I woke up relaxed, had steaming-hot home made breakfast, read the newspaper and went through my day’s schedule. No rushing up, no boarding crowded trains, not running after auto rickshaws to drop me to office. My day was planned full of things I love doing. So as I headed up for my shower and I noticed my hair had turned grey..” And then MY ALARM RANG..

Was this A dream? Yes, A Dream to Retire, A Dream to work on things I love, A Dream to Not work for Money..

This Dream can be true. If we Plan for it. Yes, you can live your dream life, follow your passion, work at your start up, do social work, anything you dream of..

One of the most Important and Ignored Financial Goals is RETIREMENT. Retirement doesn’t only mean sitting at home doing nothing. It means, having enough money to do things you love and live your life comfortably. Some may want to Retire Early, while Some may want to Never Retire. But everyone wants Financial Freedom.

It is worry some that people do not give the deserving Importance to Retirement Planning.

Retirement Planning

Wondering about Planning your Retirement. Follow these Five simple steps below :

1. WHEN YOU INVEST, YOU ARE BUYING YOURSELF A DAY THAT YOU DON’T HAVE TO WORK

Youth in their late twenties believe that its too early to think about Retirement. But friends, its better to Start Early. Lets see in the example below, the Benefits of Starting Early. Assuming that the Target is Rs 1 crore and Rate of Return is 10%, the following are sums are required to be saved by individuals ageing 25, 30, 35, 40 and 45 years.

Don’t you think even an auto driver or office boy can afford to invest Rs 2,610 per month? But they Fail to Plan due to lack of Financial Literacy.

START INVESTING FOR YOUR RETIREMENT THE DAY YOU START EARNING

2. NEVER BREAK YOUR RETIREMENT CORPUS FOR ANY REASON

Generally, people don’t earmark investments for RETIREMENT Corpus. As a result they end up spending their RETIREMENT corpus whenever the need arises say, to pump in money for purchase of house, child’s higher education, etc. But please REMEMBER – you can get education loan, home loan, other personal loan but you will not get A SINGLE PENNY for RETIREMENT..!

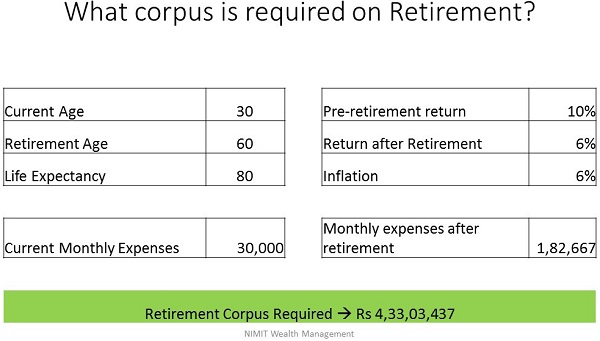

3. DETERMINE YOUR RETIREMENT CORPUS DILIGENTLY

Determination of Retirement Corpus is one of the most important steps which requires utmost care and attention.

(Taxation, Lifestyle Inflation, increase in Healthcare costs post retirement and other factors are ignored for sake of simplicity)

(Taxation, Lifestyle Inflation, increase in Healthcare costs post retirement and other factors are ignored for sake of simplicity)

4. STAY INVESTED

Some people are highly enthusiastic at the beginning but stop investing half way or withdraw the amount too soon. The Investment Journey is a roller coaster ride. Enjoy the ups and downs, do not panic in downfall and do not get excited in at a high point. Stay invested till you reach your Destination / Goal.

In the above example, invest consistently Rs 19,335 per month from Age 30 to Age 60 or invest lumpsum Rs 22,36,962 and stay invested.

(Assumed Pre Retirement return 10%, Post Retirement Return 6%, inflation 6%. Taxation, Lifestyle Inflation, increase in Healthcare costs post retirement and other factors are ignored for sake of simplicity)

5. ITS PERSONAL FINANCE, PERSONALISE IT..!

Some people get duped by the Pension Plans provided by a few market players.

Don’t go for ready made plans, it will hardly beat inflation.

Customise your own Retirement Plan by planning the systematic withdrawals required each month and make sufficient investments in your earning years.

CA Nitesh Buddhadev, CA Mitsu Buddhadev, NIMIT Wealth Management

You may reach out to us at info@nimitwealthmanagement.com for any queries, suggestions or feedback.