1. Meaning of Intangible Assets: As per the provision of Ind As-38, Intangible assets can be recognized in Balance sheet only if the following 5 condition are satisfied.

Condition 1: It should not have any physical substance.

+

Condition 2: It should be under the control of the enterprise.

+

Condition 3: It should be an identifiable asset which is separate from others.

+

Condition 4: It should be a non-monetary asset.

+

Condition 5: The company should have reliable estimate for the cost of these assets.

2. Assets not covered Ind-As 38:

1. Intangible assets held for sale in the ordinary course of business (Ind As 2).

2. Deferred Tax (Ind As 12)

3. Leases of Intangible assets (Ind As 116)

4. Assets arising from employee benefits (Ind As 19)

5. Financial Assets (Ind As 32)

6. Goodwill arising in a business combination (Ind As 103)

7. Deferred acquisition costs and intangible assets arising from insurance contract (Ind As 104).

8. Non current Assets classified as held for sale (Ind As 105).

9. Assets arising from contract with customer (Ind As 115).

10. Mineral oils and ores (Ind As 106).

3. Measurement of Intangible Assets:

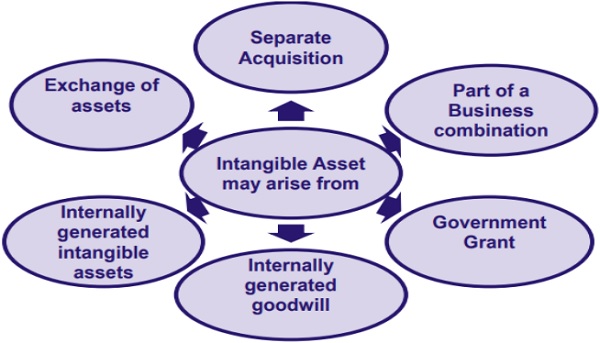

Intangible assets should be measured initially at cost. Intangible assets may be acquired and can be self generated. The below diagram reflects the method and mode by which intangible assets may arise.

1. Measurement of cost for intangible assets acquired separately:

The cost of separately acquired intangible asset comprises:

a. Its purchase price, including import duties and non-refundable purchase taxes, after deducting trade discounts and rebates; and

b. Any directly attributable Cost of preparing the assets for its intended use.

Examples of directly attributable costs are:

Employee benefits cost (as defined in Ind As 19) arising directly from bringing the asset to its working condition.

Professional Fees arising directly from the assets to its working condition.

Costs of testing- whether it’s working properly.

Expenses not to be included in cost:

a. Staff training Cost.

b. Expenditure on advertisement.

c. Administrative and other general overhead costs.

d. Startup cost

e. Operating losses

f. Costs incurred in using or redeploying an intangible assets.

B. Deferred Consideration:

If payment for an intangible asset is deferred beyond normal credit terms, then cost Of such intangible assets is the cash equivalent. The difference between this amount and the total payments is recognized as interest expenses over the period of credit unless it is capitalized in accordance with Ind As 23, Borrowing Costs.

2. Acquisition by way of a government grant:

In some cases, an intangible asset may be acquired free of charge, or for nominal consideration, by way of a government grant. This may happen when a government transfers or allocates to an entity intangible asset such as airport landing rights, licences to operate radio or television stations, import licences or quotas or rights to access other restricted resources. In accordance with Ind AS 20 Accounting for Government Grants and Disclosure of Government Assistance, an entity recognises both the intangible asset and the grant initially at fair value.

If entity chooses not to recognize the assets at fair value, the entity recognizes the asset initially at a nominal amount (the other treatment permitted by Ind As 20) plus any expenditure that is directly attributable to preparing the asset for its intended use.

3. Internally generated goodwill:

Internally generated goodwill shall not be recognised as an asset.

In some cases, expenditure is incurred to generate future economic benefits, but it does not result in the creat:ion of an intangible asset that meets the recognition criteria in this Standard. Such expenditure is often described as contributing to internally generated goodwill. Internally generated goodwill is not recognised as an asset because it is not an identifiable resource (ie it is not separable nor does it arise from contractual or other legal rights) controlled by the entity that can be measured reliably at cost.

4. Acquisition as part of a business combination:

As per provisions of Ind As-38, Intangible Assets of vendor company can be incorporated in the books of purchasing company only if fair value is available for these Intangible assets.

It can also be said that intangible asset of vendor co. can not be taken at book value by purchasing company.

5. Exchanges of assets:

Situation 1: if fair value of taken up & given up assets is known.

Step 1: Cash Settlement = F.V. of taken up assets – F.V. of given up assets.

Step 2: Profit on Exchange = F.V of given up assets – WDV of given up assets.

Situation 2: If fair value for taken up asset is known but fair value for given up asset is not known.

In the given case, there will be no settlement in cash but difference between F.V. of taken up assets and WDV of given up assets shall be considered as profit and loss on exchange.

Situation 3: FV of taken up assets is not given but FV of given up assets is available.

In the given case, there will be no cash settlement but fair value of given up assets will be assumed cost of new asset.

Situation 4: None of fair value is available

In the given case, there will be no cash settlement as well as there will be no profit/loss on exchange of Assets. But carrying amount/WDV/Book Value of given up asset will be considered as cost of asset.

6. Internally generated intangible assets:

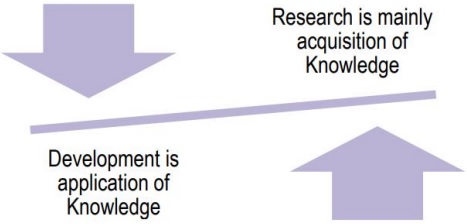

To assess whether an internally generated intangible asset meets the criteria for recognition, an entity classifies the generation of the asset into:

(a) a research phase; and

(b) a development phase.

a. Research phase:

No intangible asset arising from research (or from the research phase of an internal project) shall be recognised. Expenditure on research (or on the research phase of an internal project) shall be recognised as an expense when it is incurred.

In the research phase of an internal project, an entity cannot demonstrate that an intangible asset exists that will generate probable future economic benefits. Therefore, this expenditure is recognised as an expense when it is incurred.

Examples of research activities are:

(a) activities aimed at obtaining new knowledge;

(b) the search for, evaluation and final selection of, applications of research findings or another knowledge;

(c) the search for alternatives for materials, devices, products, processes, systems or services; and

(d) the formulation, design, evaluation and final selection of possible alternatives for new or improved materials, devices, products, processes, systems or services.

b. Development phase:

An intangible asset arising from development (or from the development phase of an internal project) shall be recognised if, and only if, an entity can demonstrate all of the following:

(a) the technical feasibility of completing the intangible asset so that it will be available for use or sale.

(b) its intention to complete the intangible asset and use or sell it.

(c) its ability to use or sell the intangible asset.

(d) how the intangible asset will generate probable future economic benefits. Among other things, the entity can demonstrate the existence of a market for the output of the intangible asset or the intangible asset itself or, if it is to be used internally, the usefulness of the intangible asset.

(e) the availability of adequate technical, financial and other resources to complete the development and to use or sell the intangible asset.

(f) its ability to measure reliably the expenditure attributable to the intangible asset during its development.

In the development phase of an internal project, an entity can, in some instances, identify an intangible asset and demonstrate that the asset will generate probable future economic benefits. This is because the development phase of a project is further advanced than the research phase.

Examples of development activities are:

(a) the design, construction and testing of pre-production or pre-use prototypes and models;

(b) the design of tools, jigs, moulds and dies involving new technology;

(c) the design, construction and operation of a pilot plant that is not of a scale economically feasible for commercial production; and

(d) the design, construction and testing of a chosen alternative for new or improved materials, devices, products, processes, systems or services.

Internally generated brands, mastheads, publishing titles, customer lists and items similar in substance shall not be recognised as intangible assets.

4. Measurement after recognition:

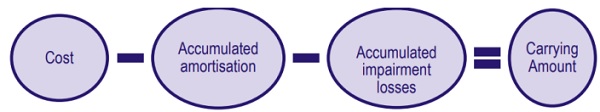

a. Cost model:

After initial recognition, an intangible asset shall be carried at its cost less any accumulated amortisation and any accumulated impairment losses.

b. Revaluation model:

After initial recognition, an intangible asset shall be carried at a revalued amount, being its fair value at the date of the revaluation less any subsequent accumulated amortisation and any subsequent accumulated impairment losses. For the purpose of revaluations under this Standard, fair value shall be determined by reference to an active market. Revaluations shall be made with such regularity that at the end of the reporting period the carrying amount of the asset does not differ materially from its fair value.

The revaluation model does not allow:

(a) the revaluation of intangible assets that have not previously been recognised as assets; or

(b) the initial recognition of intangible assets at amounts other than cost

If an intangible asset is revalued, any accumulated amortisation at the date of the revaluation is either:

Method 1: Direct Method (Carrying amount Method)

Under this method original cost & accumulated depreciation are not revised, but we change the carrying amount only.

Journal:

PPE A/c- Dr. XXXX

To Revaluation Reserve A/c XXXX

Method 2: Original Cost Method

Under this method we increase original cost and accumulated depreciation proportionately as per the increase in carrying amount of assets.

Journal:

PPE A/c- Dr. XXXX

To Revaluation Reserve A/c XXXX

To Accumulated Dep. A/c XXXX

5. Useful life:

An entity shall assess whether the useful life of an intangible asset is finite or indefinite and, if finite, the length of, or number of production or similar units constituting, that useful life. An intangible asset shall be regarded by the entity as having an indefinite useful life when, based on an analysis of all of the relevant factors, there is no foreseeable limit to the period over which the asset is expected to generate net cash inflows for the entity.

Many factors are considered in determining the useful life of an intangible asset, including:

(a) the expected usage of the asset by the entity and whether the asset could be managed efficiently by another management team;

(b) typical product life cycles for the asset and public information on estimates of useful lives of similar assets that are used in a similar way;

(c) technical, technological, commercial or other types of obsolescence;

(d) the stability of the industry in which the asset operates and changes in the market demand for the products or services output from the asset;

(e) expected actions by competitors or potential competitors;

(f) the level of maintenance expenditure required to obtain the expected future economic benefits from the asset and the entity’s ability and intention to reach such a level;

(g) the period of control over the asset and legal or similar limits on the use of the asset, such as the expiry dates of related leases; and

(h) whether the useful life of the asset is dependent on the useful life of other assets of the entity.

a. Intangible assets with finite useful lives:

i. Amortisation period and amortisation method

The depreciable amount of an intangible asset with a finite useful life shall be allocated on a systematic basis over its useful life. Amortisation shall begin when the asset is available for use, ie when it is in the location and condition necessary for it to be capable of operating in the manner intended by management. Amortisation shall cease at the earlier of the date that the asset is classified as held for sale (or included in a disposal group that is classified as held for sale) in accordance with Ind AS 105 and the date that the asset is derecognised. The amortisation method used shall reflect the pattern in which the asset’s future economic benefits are expected to be consumed by the entity. If that pattern cannot be determined reliably, the straight-line method shall be used. The amortisation charge for each period shall be recognised in profit or loss unless this or another Standard permits or requires it to be included in the carrying amount of another asset.

ii. Residual value:

The residual value of an intangible asset with a finite useful life shall be assumed to be zero unless:

(a) there is a commitment by a third party to purchase the asset at the end of its useful life; or (b) there is an active market for the asset and

(i) residual value can be determined by reference to that market; and (ii) it is probable that such a market will exist at the end of the asset’s useful life.

iii. Review of amortisation period and amortisation method:

The amortisation period and the amortisation method for an intangible asset with a finite useful life shall be reviewed at least at each financial year-end. If the expected useful life of the asset is different from previous estimates, the amortisation period shall be changed accordingly. If there has been a change in the expected pattern of consumption of the future economic benefits embodied in the asset, the amortisation method shall be changed to reflect the changed pattern. Such changes shall be accounted for as changes in accounting estimates in accordance with Ind AS 8.

b. Intangible assets with indefinite useful lives:

An intangible asset with an indefinite useful life shall not be amortised.

In accordance with Ind AS 36, an entity is required to test an intangible asset with an indefinite useful life for impairment by comparing its recoverable amount with it carrying amount

(a) annually, and

(b) whenever there is an indication that the intangible asset may be impaired.

Review of useful life assessment

The useful life of an intangible asset that is not being amortised shall be reviewed each period to determine whether events and circumstances continue to support an indefinite useful life assessment for that asset. If they do not, the change in the useful life assessment from indefinite to finite shall be accounted for as a change in an accounting estimate in accordance with Ind AS 8.

6. Disclosure

For each class of intangible asset, an entity is required to disclose following:

1. Useful life or rate of amortization;

2. Method of amortization;

3. Gross carrying value and amount of accumulated amortization;

4. Line items of statement of profit & loss in which amortization is included;

5. Reconciliation statement of the carrying value at the beginning and the end of the period;

6. Basis for ascertaining that an intangible has an indefinite life;

7. Description and carrying amount of individual material intangible asset;

8. Specific disclosures about intangible assets that are acquired by way of government grants;

9. Information about those intangible assets whose title is restricted;

10. Contractual commitments to acquire intangible assets;

11. Intangible assets carried at revalued amounts; and

12. The amount of research and development expenditure recognized as an expense in the current period.

Excellent job done. Article is quite informatory for both students as well as professionals.