“Unlock tax benefits with a corporate car lease policy! Explore how opting for a salary-linked car leasing model provided by your employer can significantly reduce taxable income. Discover the advantages, tax savings up to 30%, and a comprehensive impact on your financial well-being.”

In the realm of employment compensation, it’s crucial to recognize that your salary goes beyond the basic pay. The totality of your remuneration often encompasses a variety of benefits and incentives, such as house rent allowance, telephone reimbursements, car allowances, and bonuses. One frequently overlooked but impactful benefit is the potential income tax advantage of opting for a corporate car lease policy provided by your employer. In this detailed exploration, we will delve into the intricacies of a salary-linked corporate car leasing policy and elucidate how it can significantly reduce your taxable income.

Understanding Corporate Car Lease Policies

A salary-linked corporate car leasing policy is a unique model wherein employees have the option to select a car, and the monthly lease rental is deducted directly from their pre-tax salary by the employer. The implementation of such a policy involves the employer collaborating with a car leasing company, undergoing a credit check, and establishing a comprehensive company car lease policy for its workforce.

Benefits for Employees:

- No Down Payment Required: As a lessee, you are not required to make any down payment when obtaining a leased car. This unique feature places the leasing company as the primary owner, covering all associated expenses, including accessories, on-road price, and insurance.

- Maintenance Benefits: Leasing companies typically offer two types of arrangements: wet leasing, where maintenance expenses are covered, and dry leasing, where the lessee is responsible for maintenance. Opting for wet leasing relieves employees from unexpected and often high maintenance costs associated with vehicle ownership.

- Hassle-Free Car Replacement: One of the notable advantages of car lease policies is the ease of vehicle replacement or upgrade during lease renewal. This flexibility provides employees with the opportunity to enhance their vehicles, offering improved comfort and safety. This becomes particularly relevant when considering vehicle scrappage policies and green taxes.

- Tax Savings: Perhaps one of the most significant advantages of opting for a corporate car lease policy is the potential for substantial tax savings. Employees can benefit from tax advantages on lease amounts, fuel cost reimbursements, and even the driver’s salary by demonstrating regular use for company-related purposes. These tax benefits can result in significant reductions of up to 30% in vehicle-related expenses.

- Simpler Approval Process: Unlike the often lengthy approval process associated with traditional car loans, car leases can be approved within 24 hours, requiring minimal paperwork. This streamlined process adds to the convenience and efficiency of opting for a corporate car lease.

- Insurance Coverage: Lease instalments cover insurance charges, providing a comprehensive insurance package that includes repair and maintenance costs, theft, and accidents. The lessee is relieved of the burden of managing insurance renewals, simplifying the entire process.

Illustrative Example:

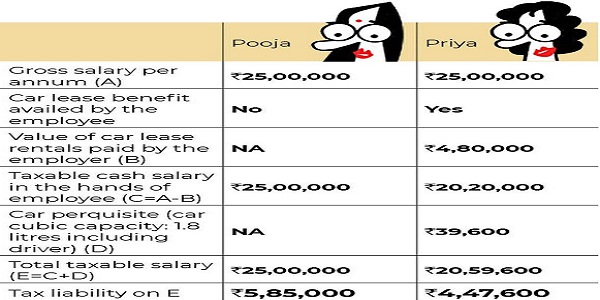

Consider a hypothetical scenario where your salary package is Rs. 25,00,000. Out of this, Rs. 4,80,000 is allocated for the car lease, and an additional Rs. 39,600 is designated for car maintenance, insurance, fuel, and driver allowance. This results in a deduction of Rs. 5,19,600 from your taxable income, leaving you liable to pay tax on Rs. 20,59,600 only. This strategic approach can lead to tax savings exceeding Rs. 1.6 lakh on an income of over Rs. 5.2 lakh.

The Comprehensive Impact

In contemplating the comprehensive impact of opting for a corporate car lease policy, it becomes evident that the benefits extend far beyond mere financial savings. The advantages of no down payment, maintenance coverage, hassle-free replacements, and simplified approval processes contribute to an enhanced overall experience for employees.

Furthermore, the flexibility to replace or upgrade vehicles aligns seamlessly with evolving needs and preferences. This is particularly pertinent in light of contemporary concerns such as the vehicle scrappage policy and green taxes. The mandatory fitness checks for vehicles older than 15 years, coupled with potential green taxes for vehicles over eight years old, can present significant challenges for companies. However, corporate car leasing emerges as a strategic solution that mitigates these challenges and ensures a hassle-free vehicle ownership experience.

Tax Savings: A Closer Look

Delving deeper into the realm of tax savings, it’s crucial to understand the intricacies of the income tax benefits associated with corporate car lease policies. By allocating certain components of your salary package, such as car lease amounts, towards pre-tax benefits, employees can substantially reduce their taxable income.

The tax benefits extend beyond the lease amount and encompass other related expenses, including maintenance, driver expenses, and fuel allowances. This comprehensive approach to pre-tax components creates a domino effect, resulting in significant tax savings for employees.

The example provided earlier illustrates the tangible impact on tax liability. By strategically utilizing the corporate car lease policy, an individual can save more than Rs. 1.6 lakh on an income exceeding Rs. 5.2 lakh. This not only highlights the financial prudence of such a strategy but also underscores the importance of leveraging available benefits to optimize overall compensation.

Conclusion

In conclusion, the decision to opt for a corporate car lease policy transcends traditional considerations of vehicle ownership. It becomes a strategic financial move that not only offers tangible benefits such as no down payment, maintenance coverage, and hassle-free replacements but also presents an opportunity for substantial income tax savings.

For employees seeking a tax-efficient and convenient vehicle ownership experience, a corporate car lease policy stands out as a compelling option. However, it’s essential to note that individual circumstances may vary, and consulting with a financial advisor is recommended to ensure personalized advice based on specific situations.

Disclaimer: The author, identified as an Income Tax, Accounting, and GST Practitioner, can be contacted at 9024915488. However, readers are advised to seek professional advice and consult with financial experts for personalized guidance based on their unique circumstances.

Can i opt of lease of my choice of leasing company and not thru my organisation and still claim the tax rebate?

1. Whether car Lease policy is applicable for old car purchased in the name of employee

2. Tax status if car lease rental is paid to employee in case of old car

Hi sir, My company is providing car lease policy to me should I otp for it?

Can you please explian me in detail impact on my income and tax after opting it

Yes, to discuss in detail you can contact us at 9024915488.