“Learn the steps for efficient Form FC-TRS filing using the FIRMS portal. Understand the process, required details, and documents. Author, Mrs. Kajal Goyal, a practicing Company Secretary, provides insights and guidance.”

The Reserve Bank in 2018 has introduced an online application i.e., FIRMS (Foreign Investment Reporting and Management System), which provides for reporting of 9 forms for foreign investment including FC-GPR, FC-TRS, LLP-I, LLP-II, CN, DRR, ESOP, DI and InVi in single form i.e., SMF (Single Master Form). The same can be accessed on FIRMS website i.e. on https://firms.rbi.org.in.

However, in this article, we shall study specifically about filing of Form FC-TRS.

Form FC-TRS is basically filed where there is a transfer of shares of an Indian Company from Resident in India to Non-Resident/Non-Resident of India or vice versa within 60 days of date of remittance or date of transfer, whichever is earlier.

STEPS FOR FILING FORM FC-TRS?

Step 1: Login into the FIRMS portal

Once Entity User and Business User ID is created, then we have to login into the FIRMS portal using the Business User ID credentials.

Step 2: Select your Return Type

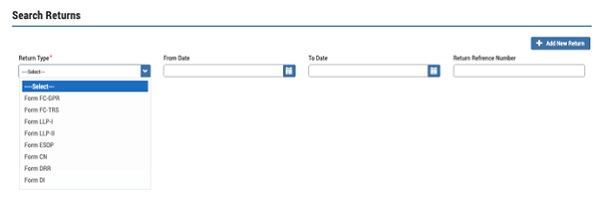

After logging, the main dashboard will open and we have to click on “Single Master Form” on “File Return” tab on left. There, we have to select “Form FC-TRS” in drop down of “Return Type” and then select “Add New Return” on top right.

Step 3: Once the Form FC-TRS is opened, we have to enter the details of received FDI-Entry Route and Applicable Sect oral Cap.

After this, there are basically three tabs under which we have to fill data i.e. mentioned as following:

- Common Details

- Particulars of Transfer

- Remittance Details

- Shareholding Pattern (Auto filled)

Step 4: Enter the common details mainly such as:

- Whether the transfer is by way of gift or sale?

- Details of Transferor and Transferee

- Date of Transfer

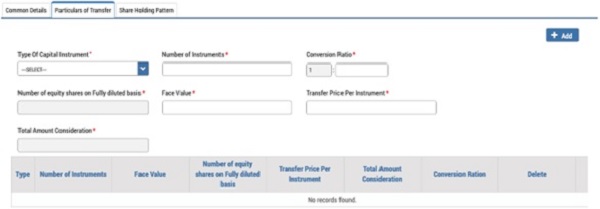

Step 5: Next tab is of particulars of transfer wherein the following details needs to be filled:

- Type of Capital Instruments

- Number of Instruments

- Conversion Ratio

- Number of equity shares on Fully diluted basis

- Face Value

- Transfer Price Per Instrument

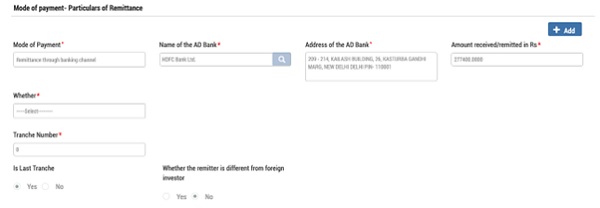

Step 6: The last tab is of “Remittance Details” tab under which the following details needs to be entered:

- Mode of Payment

- Name of AD Bank along with the IFSC Code

- Amount Received

- Date of Receiving Amount

Step 7: Make sure that all the pre filled details are correct in “Shareholding Pattern” tab.

Step 8: Once all the tab are filled, click on “Save and Submit” at extreme top right.

DOCUMENTS TO BE ATTACHED:

1. Buyers and Sellers Consent

2. Valuation Report

3. Shareholder Agreement entered, if any

4. Certified true copy of Board Resolution approving share transfer

5. Copy of FCGPR approvals for all the shares being transferred

6. Copy of 15CA and CB

7. FIRC and KYC

8. Declaration by Non Resident Transferor/Transferee

Post submission of the form, we will receive an email from autoreply-firms@rbi.org.in that the Form FC_TRS is auto acknowledged.

After 3-4 days, through the same email ID, the approval or rejection of filed FC-TRS comes. On rejection, you can again follow the aforementioned process and file the FC-TRS keeping in mind the remarks of rejection.

WHAT HAPPENS WHEN YOU ARE FILING FORM FC-TRS WITH DELAY?

In case FC-TRS is being filed with delay, the mail for approval comes with the Late Submission Fee (“LSF”) that needs to be deposited to RBI by way of demand draft. However, the LSF in accordance with A.P. (DIR Series) Circular No. 16 dated September 30, 2022 is calculated as below:

Late Submission Fee = 7500 + (0.025% x A x n)

Wherein “A” is the amount involved in the delayed reporting;

And, “n” is the number of years of delay in submission rounded-upwards to the nearest month and expressed up to 2 decimal points.

*****

{The author i.e., Mrs. Kajal Goyal is a Company Secretary in Practice and can be reached at (M) +91-9999952595 and (E) cskajalgoyal@gmail.com}

In the case of the new company, what kind of valuation report is needed? Can we simply upload a letter stating that the company is recently incorporated and not commenced a business yet so FMV is equal to Face value or NAV.