The Union Budget 2023-24 is a well Balanced People’s Budget. It has put inclusive development at the heart of the country’s economic agenda by focusing on and facilitating ample opportunities for citizens to fulfil their aspirations, providing a strong impetus to growth and job creation and ensuring that the benefits reach the last mile.

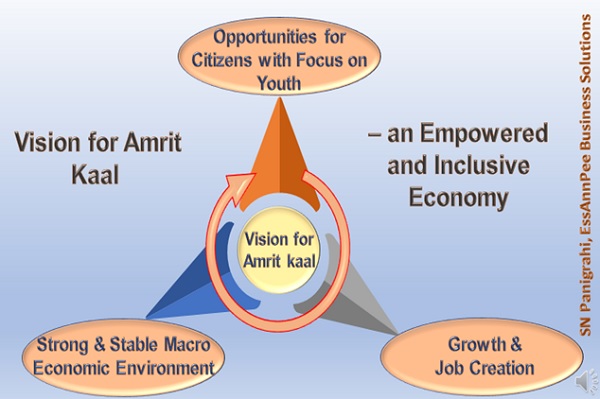

Union Budget 2023-24 presented by Smt. Nirmala Sitharaman, Union Minister of Finance and Corporate Affairs in the Parliament outlined the vision of Amrit Kaal which shall reflect an empowered and inclusive economy. “We envision a prosperous and inclusive India, in which the fruits of development reach all regions and citizens, especially our youth, women, farmers, OBCs, Scheduled Castes and Scheduled Tribes”, she said.

Vision for Amrit Kaal – an empowered and inclusive economy

Union Finance Minister highlighted that “Our vision for the Amrit Kaal includes technology-driven and knowledge-based economy with strong public finances, and a robust financial sector”. To achieve this, Jan Bhagidari through Sabka Saath Sabka Prayas is essential, she added.

The economic agenda for achieving this vision would focus on three priorities:

1. facilitating ample opportunities for citizens, especially the youth, to fulfil their aspirations;

2. providing strong impetus to growth and job creation; and

3. strengthening macro-economic stability

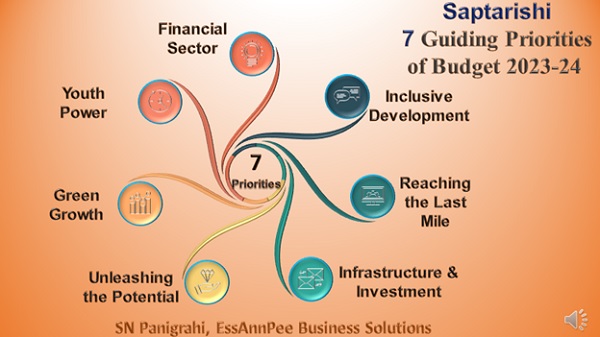

Saptarishi: Seven guiding priorities of Budget 2023-24

Union Finance Minister announced the first budget in Amrit Kaal will be guided by seven priorities that complement each other and act as the ‘Saptarishi’.

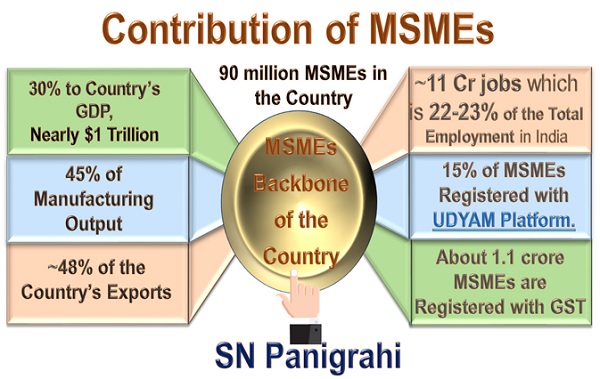

Contribution of MSMEs

MSMEs play a critical role in India’s Economic Growth and Development. MSMEs are the Backbone of the Country and are the Growth Engines of our Economy. There are around 90 million MSMEs in the Country. Let’s now discuss the Contribution of MSME Sector.

MSMEs Contribute :

> Around 30% to Country’s GDP, that is to the tune of Nearly $1 Trillion.

> Almost 45% of Manufacturing Output.

> Nearly 48% of the Country’s Exports.

> Creates around 11 Cr jobswhich is 22-23% of the Total Employment in India.

> 15% of MSMEs Registered with UDYAM Platform.

> About1 crore MSMEs are Registered with GST

Union Budget 2023-24 : Boost to MSMEs

Budget 2023-24 may benefit the MSME Sector Significantly as the Government Intends to provide a Significant Boost to MSMEs, through Revamping of Collateral-free Guaranteed Credit Scheme for MSMEs; Measures to Ensuring Timely Payment by Buyers to MSMEs, Enhanced Limits of Presumptive Taxation and some other relief to the Sector while Encouraging Domestic Manufacturing, Investment Opportunities, Support to Artisans, and focusing on Exports which Directly and Indirectly Boost the Prospects of MSME Sector.

Access to Finance: Collateral-free Guaranteed Credit

In a big relief to Covid-hit 90 million Micro, Small and Medium Enterprises (MSMEs), Union Finance Minister Nirmala Sitharaman, announced in the Budget 2023-24 an infusion of Rs 9,000 crore into the corpus to revamp credit guarantee scheme for MSMEs. The scheme will be effective from April 1, 2023.

This will enable additional collateral-free guaranteed credit of Rs 2 lakh crore. Further, the cost of the credit will be reduced by about 1%.

This is expected to boost fund flow to the distressed and fund-starved MSME sector.

The scheme will give comfort to banks which are normally reluctant to lend to MSMEs in the absence of proper collateral.

It’s a big boost for young entrepreneurs, thereby realizing the vision of PM Sri Modi ji of Make in India & Atmanirbhar Bharat.

Return of 95 per cent of the Forfeited Amount Relating to Bid or Performance Security

Further, to provide relief to MSMEs, finance minister said that in cases of failure by MSMEs to execute contracts during the Covid period, 95 per cent of the forfeited amount relating to bid or performance security, will be returned to them by government and government undertakings.

The move is expected to benefit those whose capital was blocked as bid fee or performance guarantee to secure government and undertaking tenders due to Covid-related Challenges and Economic Disruptions.

Measures to Ensuring Timely Payment by Buyers to MSMEs

To support MSMEs in the timely receipt of payments, FM, Sitharaman also proposed the deduction for expenditure incurred on payments made to them by buyers only when payment is actually made to MSMEs.

“This means buyers cannot claim a deduction without first paying MSMEs. It will force them to pay in time.

The move is likely to force buyers to clear small businesses’ dues without much delay.

Presumptive Taxation : Limits Enhanced

Presumptive Taxation involves the use of indirect methods to compute tax liability, where the taxable income is calculated based on assumptions instead of actuals. Under the Scheme, the micro enterprises & professionals are required to declare a given percentage of gross receipts as its income, and pay a fixed percentage of it as tax. Under Presumptive Taxation, small businesses and professionals are not required to maintain their books of account and get their accounts audited, providing relief from tedious tax filing exercises.

Till now, micro enterprises with a turnover of up to Rs 2 crore and certain professionals with a turnover of up to Rs 50 lakh could avail the benefit of presumptive taxation.

In the Budget 2023-24, the limits are enhanced to Rs 3 crore and Rs 75 lakh, respectively, for the taxpayers whose cash receipts are no more than 5% of Total Receipts. .

PM Vishwakarma Kaushal Samman : To Support Artisans

The handicraft and handloom sector in India plays a vital role in the country’s economy and cultural heritage. For centuries, traditional artisans and craftspeople, who work with their hands using tools, have brought fame to India through their creations. The FM said the art and handicraft created by them represents the true spirit of Atmanirbhar Bharat.

For the first time, an assistance package called PM Vishwakarma Kaushal Samman has been conceptualised for traditional artisans and craftspeople to enable them to improve the quality, scale and reach of their products to integrate them with the MSME value chain, Sitharaman said in her budget speech.

The components of the scheme will include not only financial support but also access to advanced skill training, knowledge of modern digital techniques and efficient green technologies, brand promotion, linkage with local and global markets, digital payments, and social security.

This will greatly benefit the scheduled castes, scheduled tribes, OBCs, women and people belonging to the weaker sections.

Pradhan Mantri Kaushal Vikas Yojana (PMKVY) 4.0 : Digital Ecosystem for Skilling

In order to further expand the digital ecosystem for skilling, FM, Sitharaman said a unified Skill India Digital platform will be launched enabling demand-based formal skilling, linking with employers including MSMEs, and facilitating access to entrepreneurship schemes.

The Government will introduce on-the-job training across all short-term courses while launching new age courses that will be industry-specific as part of the revamped Pradhan Mantri Kaushal Vikas Yojana (PMKVY) 4.0, to substantially improve the employability of Indian youth.

Finance minister Nirmala Sitharaman announced a host of skilling initiatives over the next three years that could make India the global hub for skilling, including stipends to 47 lakh youth, setting up of setting up of Skill India Digital Platform and building 30 Skill India International Centres across different states to open up job opportunities for Indian youths overseas.

PMKVY 4.0 will be industry centric and impart training on new age courses like coding, AI, robotics, mechatronics, IOT, 3D printing, drones and soft skills.

Under the National Apprenticeship Promotion Scheme, the government will provide stipend support to 47 lakh youth in three years through direct benefit transfer for which a pan-India National Apprenticeship Promotion Scheme will be rolled out.

As part of its Vision 2047, the government wants India to be the largest skill bank in the world, transforming itself into a hub of economic activities using sustainable technologies while also reaping the benefits of demographic dividend in the country.

Supply-side Policies in Budget to Boost Manufacturing

The government has proposed a number of supply-side policies in Budget to boost manufacturing. As a result of which, India may emerge as one of the favorite destinations for investments from both within and outside.

To mention a few, in the Budget the government has proposed to reduce the custom duties on several Electronic Components, while increasing it on the finished products. The Budget has also extended the concessional custom duty on several input parts to boost local manufacturing & investment to Encourage “Make in India” in the electronics sector.

Customs Duty Reduction to Make Indian Manufacturing Competitive

The custom duty on certain components like certain parts used for manufacturing of open cell television panels, reduced from 5% to 2.5%, and brought it down to nil on several mobile phone components – camera lens and parts used in the manufacturing of camera module (earlier 2.5% duty), palladium tetra amine sulphate for manufacturing of parts of connectors and specified items for manufacture of pre-calcined ferrite powder(earlier both were at 7.5% duty).

The basic custom duty exemption on certain components and accessories for manufacturing of CCTV Camera and IP camera, lithium-ion battery and battery pack, open cell and parts for LCD and LED TV panels, e-readers and video games is extended by one year till March 2024 to boost local manufacturing.

Similar exemption has also been extended on components used in the manufacturing of brushless direct current (BLDC) motors used in fans and appliances, ethylene – propylene – non-conjugated diene rubber (EPDM) for insulated wires and cables, moulds, tools and dies for parts of electronic components and equipment, parts used in the manufacturing of LED lights or fixtures including LED lamps and LED drivers, components of digital still image video camera and parts used in reception equipment of televisions.

Discouraging Imports to Encourage Local Production

With the intension to Discourage Imports and to Encourage Local Production, the Budget has proposed to double the basic custom duty on kitchen chimneys from 7.5% to 15%, while on heat coils for use in manufacture of electric kitchen chimney is being reduced from 20% to 15%.

Customs Duty on bicycles increased from 30% to 35%, and toys and parts of toys (except electronic toy parts) from 60% to 70%; compounded rubber is being increased from 10% to ‘25% or Rs. 30/kg whichever is lower.

These measures, in turn, will increase the prices of the imported products and make locally manufactured products cost competitive.

Digi-sharing of Documents

An “Entity DigiLocker” will be set up for use by MSMEs, large business and charitable trusts, according to the budget. This will help these companies store documents online securely so that these can be, whenever needed, shared with various authorities, regulators, banks and other business entities easily.

Conclusion

Finance Minister Nirmala Sitharaman, in the budget, had a slew of announcements that would impact the MSME sector.

The government has proposed to spend a record Rs 22,138 crore on allocations aimed at micro, small, and medium enterprises (MSMEs) ministry in the Budget 2023-24, giving a boost to employment in the country.

These measures propel the growth, specially of manufacturing sector backed by MSMEs. India already overtook the UK as the world’s fifth-largest economy in 2022, and is on track to achieving PM Narendra Modi’s vision of a $5 trillion economy by 2026-27.

(Author can be reached at Snpanigrahi1963@gmail.com)