In this article, I am going to explain about how to file LLP annual return i.e. Form-11 of LLP.

WHAT IS LLP FORM -11?

Form-11 is an annual return of LLP, it is mandatory annual compliance for all LLPs, irrespective of turnover or profit or business activity. Annual return or Form-11 includes the details of LLP and partners such as registered address, principal business, address of partner, appointment date, Nationality, contribution received from partners etc. Every LLP is required to file annual returns within 60days of closure of its financial year.

HOW TO FILE LLP Annual Return (Form-11)

Below is the step by step procedure to file annual return (Form-11): –

👉 STEP-1 – Download the form from MCA Portal.

👉 STEP-2 – Auto fill the details by click “Pre-Fill” button-

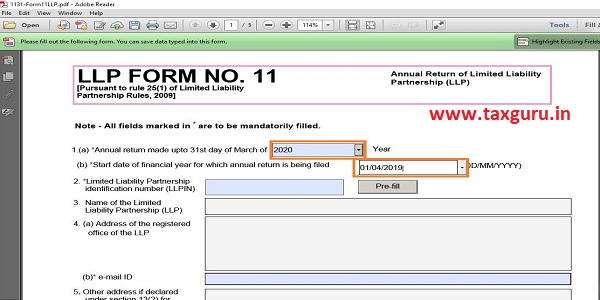

Before clicking the Pre fill button, first fill year for which this form relates and start date of financial year for which annual return is being filed (For e.g. for the year 2020, start date must be 01.04.2019). Now mention your LLPIN and then click on Pre fill button (Screenshot of the same is below).

Fig: 1.1

All details up to point 8 will be displayed automatically except Point 6- Business classification and Point 8(d) i.e. total contribution received by all partners of the LLP, these points are required to be filled manually (Screenshot of the same is below).

Fig: 1.2

Note: The Contribution received field to be entered in corresponding Form 8 (Statement of Account & Insolvency) should be same as the value entered in point 8(d) above.

👉 STEP-3 – Fill the details of Individual(s) as partners-

No need to fill point no. 9 (SRN of the partner’s details validated through the screen). Now come to point no. 10 – details of Individual’s as partners.

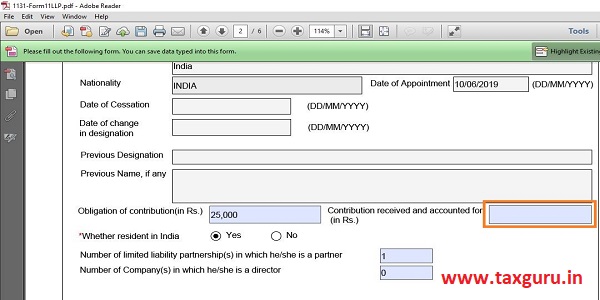

Just Click on Pre-fill Button all the detail of the partner will automatically filled except Contribution received and accounted, this is the amount which is required to be filled manually (Screenshot of the same is below).

Fig: 1.3

Same process shall be followed to fill all partners’ details.

Note: While mentioning the contribution received and accounted amount in partner details be sure that the total of all partner amount is equal to the total contribution received by all partners in point no. 8(d).

👉STEP- 4 – Fill the details of body corporate as partners-

If any partner in the firm is body corporate, then details of the same is required to be filled in Point No. 11. Just write the Body corporate Identification No. like CIN, FCRN, LLPIN, FLLPIN etc. and click on Pre fill button. Name and particulars of person signing on behalf of body corporate as nominee details is also required to be filled in this point.

👉 STEP-5 – Particulars of Penalty imposed on LLP and Partners and Compounding Offences-

In Point No. 12 (Summary of the designated partners as on 31st March of the period for which annual return is being filed) you have to do nothing, all the details will available automatically.

Now move to Point No. 13- If there is any penalty imposed on LLP and on any of the partner, then it is required to be mention in point 13 otherwise keep it as a blank.

In Point No. 14, details of Compounding offences, if any, to be mention.

👉 STEP-6- Whether LLP turnover exceeds Rs. 5 Crores-

In Point No. 15, you have to tick mark on the round box, whether turnover of the LLP exceeds Rs. 5 Crores, if yes, then click on Yes Button otherwise click on No Button.

👉 STEP-7 – Attachment-

Attached the details of LLP and/or company in which partner /designated partner is a director/partner in the format as below: –

| S. No. | CIN/LLPIN | Name of Company/LLP | Designation |

If you want to attach other informational documents, then select optional attachment and attach the documents.

👉 STEP-8 – VERIFICATION

After making necessary attachment, now comes to verification, click on the button- “To the best of my Knowledge and belief, the information given in this form and its attachment is correct and complete” and write the DPIN of the designated partner.

👉 STEP-9- CERTIFICATION

Now click on button- “I Certify that Annual return contains true and correct information”.

In case total obligation of contribution of partners of the LLP exceeds Rs. 50 lakhs or turnover of

LLP exceeds Rs. 5 crores, then the form needs to be certified by a Company Secretary in whole time practice. Enter the certificate of practice number and select whether he/ she is associate or fellow.

In case total obligation of contribution of partners of the LLP does not exceed Rs. 50 lakhs and turnover of LLP does not exceed Rs. 5 crores, then the form needs to be certified by the designated partner of the LLP. Enter the DPIN of the DP.

Note: Verification and Certification cannot be done by same partner.

👉 STEP-10- CHECK FORM

When all the details of the form are complete, then click on check form button for form level validation and when the validation is complete the message, “Form level pre scrutiny is successful “is displayed (Screenshot of the same is below). The form level validation is done without being connected to the internet.

Fig: 1.4

The “Modify” button gets enabled after the check form is done. By clicking this button, you can make changes in the filled form and once you have changed the filled form, click the Check form button again.

👉 STEP- 11 – PRE-SCRUTINY

The ‘Pre-Scrutiny” button gets enabled once the check form is done. You are required to connect to the internet for pre-scrutiny. On pre-scrutiny, the system level check is performed and if there are any errors, the same are displayed to the user.

After correcting the pre scrutiny errors, attach the Digital signature on the form in the signature filed.

Now all the steps for form completion is done and now we are ready to upload the form on MCA portal. You need to have MCA Login ID or password to upload the form.

👉 STEP-12- UPLOAD FORM ON MCA PORTAL

Before uploading the form, please verify designated partners or professional whose digital signature are affixed on form are registered on MCA portal.

Now below are the steps for uploading Form -11 on MCA Portal: –

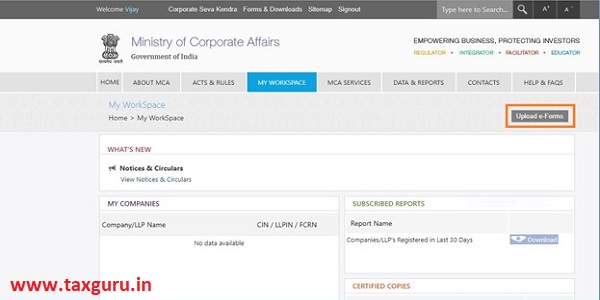

- Login to MCA portal with your credentials.

- Now go to my workspace, click on Upload Form (Screenshot of the same is below)

Fig: 1.5

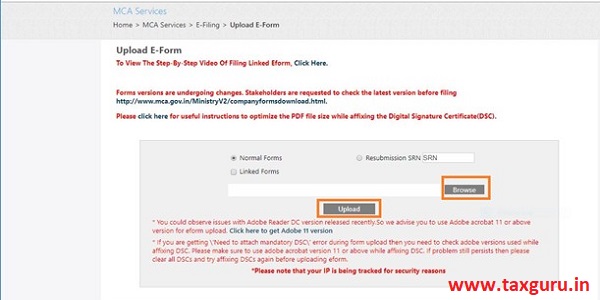

On the next page, you will be asked to upload form, browse your PDF file and click on upload (Screenshot of the same is below).

Fig: 1.6

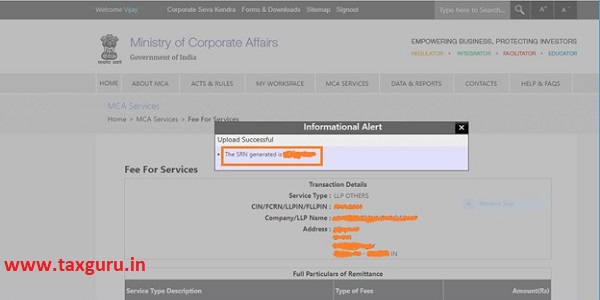

After successful uploading, SRN is generated (Screenshot of the same is below)

Fig 1.7

Now it’s your choice, you want to pay fee now or later, MCA provides the Pay later facility to the user, in this facility, user can upload the form without payment and generate SRN/challan and make payment at a later point in time using online payment mode. User are required to make payment within the validity date as per challan.

Conclusion- In this article, I have explained the step by step procedure to file Annual Return of LLP i.e. Form -11. Hope this article is beneficial for all!

very nice articles,helpful

Thank you for this very detailed and informative article.

I think that the extension of due date due to this COVID-19 situation also can be included in the article.