Sponsored

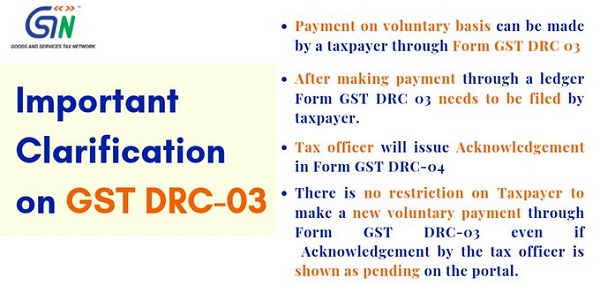

GSTN Clarification on Form GST DRC-03 for Payment of tax on voluntary basis

Form GST DRC-03 DRC-03 is a payment form in which a taxpayer can pay the GST by raising its liability voluntarily or in response to the show cause notice (SCN) raised by the GST Department.

- Payment on Voluntary Basis can be made by a taxpayer through GST Form DRC 3.

- After making payment through a ledger GST Form DRC 3 needs to be filed by taxpayer.

- Tax Officer will issue Acknowledgement in form GST DRC-04.

- There is no restriction on the taxpayer to make a new voluntary payment through Form GST DRC-03, even if acknowledgement by the tax official is shown pending on the portal.

Sponsored

Kindly Refer to

Privacy Policy &

Complete Terms of Use and Disclaimer.