Summary: The practical rollout of the 3-day GST registration under Rule 14A has revealed a serious compliance breakdown, with the GST portal now blocking GSTR-1 filing once monthly B2B tax liability exceeds Rs. 2.5 lakh. Taxpayers registered under the optional category face a system-enforced error that prevents generation of the GSTR-1 summary, effectively halting return filing despite tax liability having arisen and invoices being issued. While the portal advises opting out of the optional category, GSTN advisories mandate a minimum return-filing period before withdrawal, creating a lock-in even after the threshold is breached. This results in a compliance deadlock where taxpayers can neither continue under Rule 14A nor exit immediately to regularise filings. The situation is system-created rather than a taxpayer default. In practice, obtaining a fresh GST registration outside Rule 14A has emerged as the only workable compliance solution, with careful documentation essential to demonstrate bona fide conduct and avoid future disputes.

Practical Fallout of 3-Day GST Registration: Rule 14A – ₹2.5 Lakh System Error Now Blocking GSTR-1

(Continuation of the article: “3-Day GST Registration under Rule 14A – Auto Approval Doesn’t Ensure Relief” – https://taxguru.in/goods-and-service-tax/3-day-gst-registration-rule-14a-auto-approval-doesnt-ensure-relief.html)

In the earlier article, it was highlighted that auto-approval of GST registration under Rule 14A does not necessarily translate into seamless compliance relief for taxpayers. Recent developments on the GST portal have now validated this concern, with multiple taxpayers encountering system-level blocks once B2B tax liability exceeds ₹2.5 lakh per month.

The issue has moved beyond theory and has now materialised into a hard compliance stop, as evidenced by the error message presently displayed on the GST portal.

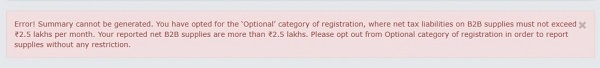

The Error Message – A System-Enforced Restriction

Taxpayers registered under the Optional category of registration under Rule 14A are now encountering the following message while attempting to file GSTR-1 (attached screenshot):

“Error! Summary cannot be generated. You have opted for the ‘Optional’ category of registration, where net tax liabilities on B2B supplies must not exceed ₹2.5 lakhs per month. Your reported net B2B supplies are more than ₹2.5 lakhs. Please opt out from Optional category of registration in order to report supplies without any restriction.”

This error effectively prevents generation of GSTR-1 summary, thereby blocking return filing altogether.

Why This Is a Serious Compliance Breakdown

At first glance, the message suggests a simple solution — “opt out from Optional category.”

However, in reality:

- Opt-out is not permitted immediately;

- The GSTN Advisory clearly mandates completion of a minimum period of return filing;

- The taxpayer is locked in for a prescribed duration, even after breaching the ₹2.5 lakh condition.

This leads to a paradoxical situation where:

- Tax liability exists,

- Supplies have been made,

- Invoices have been issued,

- But returns cannot be filed due to system restriction.

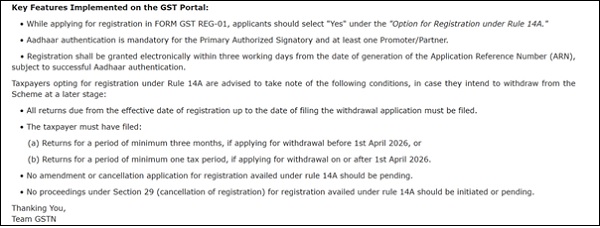

GSTN Advisory – The Root of the Lock-In

As per the GSTN Advisory dated 1 November 2025, issued in pursuance of Rule 14A:

- Registration under Rule 14A is meant only for taxpayers who self-assess that monthly output tax liability will not exceed ₹2.5 lakh;

- Withdrawal from the scheme is permitted only after:

- Filing returns for a minimum of three months (if withdrawal applied before 1 April 2026), or

- Filing returns for one tax period (if applied on or after 1 April 2026);

- No amendment, cancellation, or withdrawal application can be filed if:

- Returns are pending, or

- Proceedings under section 29 are initiated.

Thus, even where the taxpayer genuinely outgrows the threshold, the system does not allow an immediate exit.

Practical Consequence: Compliance Deadlock

This combination of:

- ₹2.5 lakh hard system cap,

- Mandatory minimum filing period,

- And portal-level blocking of GSTR-1,

creates a compliance deadlock, where:

- Taxpayer cannot continue under Rule 14A,

- Cannot opt out immediately,

- And cannot file returns to complete the lock-in condition.

This is a system-created impossibility, not a taxpayer default.

Advisable Course of Action – Practical Advisory (Updated)

In light of the above, the following approach is emerging in practice:

a. Recognise That the Registration Has Become Systemically Unworkable

Once the ₹2.5 lakh B2B tax liability is breached and the error appears:

- The registration effectively becomes non-operational;

- Continuing business without return filing exposes the taxpayer to:

- Late fees,

- Interest,

- Future cancellation proceedings.

At this stage, waiting indefinitely is not a viable option.

b. Fresh GST Registration as a Practical Compliance Solution

Where:

- GSTR-1 cannot be filed due to the Rule 14A system error, and

- Opt-out is blocked due to minimum-period conditions,

obtaining a fresh GST registration (not under Rule 14A) is emerging as the only workable compliance route.

This ensures that:

- Supplies continue under a valid GSTIN,

- Returns can be filed without restriction,

- Tax payment and reporting remain uninterrupted.

The earlier Rule 14A registration can later be regularised or cancelled, once procedural access is restored or guidance is issued.

c. Documentation Is Critical

Taxpayers should preserve:

- Screenshot of the portal error,

- Copy of GSTN advisory,

- Month-wise tax liability workings,

- Internal note explaining why continuation was impossible.

This establishes bona fide conduct and absence of tax evasion intent.

d. Avoid Artificial Suppression or Splitting of B2B Supplies

Attempting to stay below ₹2.5 lakh by:

- Splitting invoices,

- Delaying billing,

- Or shifting supplies informally,

may create larger exposure than the system issue itself and should be avoided.

Key Takeaway

The current implementation of Rule 14A has converted what was intended as a facilitative provision into a hard compliance trap once business grows faster than anticipated. The ₹2.5 lakh error message is no longer a warning — it is a functional blockade.

Until the GST framework provides:

- An immediate opt-out mechanism, or

- Automatic migration upon threshold breach,

fresh registration remains the only practical compliance exit in blocked cases.

Closing Remarks

The Rule 14A experience reinforces an important lesson: Speed of registration cannot substitute procedural flexibility.

Unless the GST portal evolves to recognise real-world business growth, professionals will continue to guide taxpayers toward defensive, compliance-first solutions, even if that means duplicative registrations.

******

Author’s Note: This article is based on practical experience during GST compliance and is intended to highlight a practical system issue faced by professionals. The views expressed are personal and aimed at improving clarity and compliance efficiency. For any query related to above article, or if you face any issue in Income Tax, GST, SEZ, STPI, MCA compliances etc., especially in cases involving legal proceedings, notices, litigation, or demand matters. Please feel free to contact us at the details mentioned below:

Contact: +91-7893796315; Email: cakrupanand@gmail.com