Central Board Of Indirect Taxes & Customs

Department of Revenue, Ministry of Finance, Government of India

Notice calling suggestions from stakeholders on “API-based Integration between ICEGATE and IEC/CBs/Third Party Software Developers – Onboarding Customs Suvidha Providers (CSPs) on ICEGATE” – reg.

Annexure

DRAFT NOTE ON API-BASED INTEGRATION BETWEEN ICEGATE AND IECs/CBs

It may kindly be recalled that as part of RFP, Infosys is mandated to develop API based interface for ICEGATE 2.0 with IEC/CB applications using which documents such as BE, SB, IGM, EGM etc. can be filed by IEC/CB to ICEGATE and receive Acknowledgement. This would result in resolution of grievances that arise due to non-receipt of timely acknowledgement of documents filed by these stakeholders.

2. Further as per the discussions held in various ICEGATE Governance Meetings, a need to bring the third party software vendors on a discussion/accreditation platform with ICEGATE has been felt so that any changes made in ICES/ICEGATE with respect to directions of the Board are immediately communicated to these third party application vendors thereby preventing any grievances about these software lagging behind the mandated requirements at ICES/ICEGATE. Therefore, these are being proposed to function as Customs Suvidha Providers (CSPs).

3. In this direction, since Infosys has already developed the said APIs as per the RFP requirements, a view was taken to test them with the existing software vendors and

accordingly testing has been conducted. It was also felt that once the testing is done and the third party applications are ready, they can be onboarded through a well defined accreditation process.

4. A meeting was held under the chairmanship of ADG, ICEGATE on April 05, 2024 at New Custom House, Mumbai with IEC/CB software developers to discuss API based integration with ICEGATE. The discussion began with a presentation on the scope and status of integration through APIs of the ICEGATE portal and the IEC/CBs; the current collaboration amongst ICEGATE and software developers was also discussed. The attendees also highlighted the operational challenges being faced by them with regard to the ICEGATE UAT environment, which were addressed by ICEGATE.

4.1. In the said meeting, the following issues were discussed at length namely:-

| Sr. No. | Issue discussed | Action Owner |

| 1. | (i)The status of testing of the APIs was discussed – all developers except eRoyal Tech have tested the APIs.

(ii) The attendees highlighted the challenges being faced in testing. (iii) It was decided that a separate meeting would be conducted by ICEGATE for the resolution of any testing issues. |

Developers/ ICEGATE |

| 2. | (i) It was further discussed that a Memorandum of Understanding would be prepared on the lines of the existing MoU between the GSTN Service Providers (GSPs)/software developers and GSTN to enhance interoperability between the ICEGATE portal and the document filing software which presently communicate through e-mail or web upload facility at ICEGATE for accepting files generated by these softwares.

(ii) The said MoU would inter alia include components of a Non-Disclosure Agreement which would ensure closer and more responsible interaction and safeguard financial and fiduciary data being handled presently by the software developed by these developers. (iii) Software Developers were also requested to provide a draft text of such MoU/NDA based on their experience with GSTN. (iv) The developers were requested to share the content/format of their existing contracts with major GST Suvidha Providers (GSPs) for reference in drafting the MoU. |

Software Developers |

| 3. | (i) The aspect of the requirement for software developers’ end users to sign a separate agreement with ICEGATE was also discussed.

(ii) It was decided that clarity for the same would be provided in the proposed MoU. |

ICEGATE |

| 4. | The attendees were also informed that a sandbox environment to test applications’ integration with ICEGATE was being planned and would be implemented in the future. | ICEGATE |

| 5. | The attendees were requested to create dummy data for the purposes of load testing of the integration of IEC/CBs with ICEGATE. | Software Developers |

5. In this regard, the empanelment/onboarding process of software developers being followed by GSTN has the following salient features, namely:-

(a) Third party applications connect via desktop, mobile, other interfaces to interact with the GST system via secure GST System APIs.

(b) The GST Service Provider (GSP) or application owners are empaneled on GSTN through an empaneled process and after empanelment, GSPs enter into an agreement with GST system.

(c) GST has set-out a policy for GSPs to adhere to during integration. This is set-out in the agreement. There is also guideline document for GSP/Infrastructure Service Provider and GST system integration.

(d) A well-defined eligibility criteria is being followed for selecting GSPs.

6. The difference between the process of empanelment/onboarding of software developers (called Customs Suvidha Providers (CSPs)) being proposed by ICEGATE visa- vis that followed by GSTN along with reasons for the same is as under, namely:-

| S. No. | Process Activity | GSTN | Proposed for DG System/ICEGATE | Remarks |

| 1. | Concept | (i) GSP providers are allowed to create GST application themselves or allow third-party application developers to access the GSTN through them.

(ii) Also, taxpayers are free to choose Application Providers or GSP of his/her choice, irrespective and independent to the other. Thus a taxpayer can choose a set of services from one GSP and the rest from other GSPs. For example, a taxpayer can obtain GST registration through one GSP or ASP, while filing GST return through another GSP or ASP. |

(i) CSPs may be allowed to create application to provide Customs related services themselves or allow third-party application developers to access the ICEGATE services through applications developed by them.

(ii) Also, trading community is free to choose CSP of their choice, irrespective and independent to the other. Thus, a trader/custom broker/service provider can choose a set of services from one CSP and the rest from other CSPs. For example, a trader/custom broker/service provider can file SB through one CSP, while EGM through another CSP or ASP. |

NO DIFFERENCE |

| 2. | Developer Portal | (i) GSTN has a developer portal where interested developers can learn about the specifications related to GST APIs. This portal also hosts sample code, public keys and sandbox information and will be a one stop shop for developer’, who wanted to build innovative application for Tax payers. (ii) Developers can also post their queries and issues related to APIs. | (i) There is no proposal for developing such a developer’s portal for the developer community in the CIS Phase-I contract where interested developers can learn about the specifications related to ICEGATE APIs.

(ii) ICEGATE would only assist CSPs in testing of their applications as per the testing slots available. |

NO SUCH FACILITY IS BEING PROVIDED AT ICEGATE. |

| 3. | Registration/ Application | (i) Software developers interested in empanelment, register or apply through an online portal provided by GSTN. (ii) This registration may require providing details about the company, its expertise, past projects, etc | (i) Software developers interested in empanelment can apply through e-mail to DG Systems. This registration may require providing details about the company, its expertise, past projects, etc. | NO SEPARATE REGISTRATION PORTAL IS BEING PROVIDED BY DG SYSTEMS FOR SOLICITING EXPRESSION OF INTEREST FOR REGISTERING AS CSP. |

| 4. | Documentation Submission | (i) Once registered, developers need to submit various documents for verification. These include company registration documents, certifications, client testimonials, etc. These documents are scrutinized to ensure compliance and capability. | (i) Once accepted, developers need to submit various documents for verification within a deadline set by DG SYSTEMS. These include company registration documents, certifications, client testimonials, etc.

(ii) A technical panel needs to be formed within DG Systems for verification of documents submitted by the d e v e l o p e rs. These documents are scrutinized to ensure compliance and capability as required for partnering with DG Systems as CSP. |

NO DIFFERENCE |

| 5. | Technical Evaluation | (i) GSTN conducts technical evaluation of the developer’s capabilities. This involves assessing his expertise in GST-related technologies, understanding of GSTN’s APIs (Application Programming Interfaces), previous experience in developing similar applications, etc. | (i) DG Systems needs to assess technical capability of the developer who has shown interest in becoming CSP.

(ii) Assessment needs to be carried out by a Technical Committee to assess expertise in customs related technologies, understanding of ICEGATE APIs (Application Programming Interfaces), previous experience in developing similar applications, etc. |

DGS NEEDS TO APPOINT A TECHNICAL TEAM TO EVALUATE DEVELOPER’S CAPABILITIES. |

| 6. | Compliance Check | GSTN conduct compliance check to ensure that the developer adheres to all relevant laws and regulations. This includes tax compliance, data security standards, etc. | DG Systems needs to conduct a compliance check to ensure that the developer adheres to all relevant laws and regulations. This could include tax compliance, data security standards, compliance to ethical business practices etc | DGS NEEDS TO APPOINT A TECHNICAL TEAM TO ENSURE COMPLIANCE CHECK. |

| 7. | Empanelment/ Onboarding | If the developer passes all the checks and evaluations, they are officially empanelled or onboarded by GSTN. This typically involves signing agreements or contracts outlining the terms and conditions of engagement. | If the developer passes all the checks and evaluations, they would be officially empanelled or onboarded by DG Systems as CSPs. This typically involves signing agreements or contracts outlining the terms and conditions of engagement. Following important documents should be part of the onboarding:

1. Agreement of CSPs 2. Non Disclosure Agreement (NDA) 3. SOP for interaction between ICEGATE and CSPs Becoming a CSP would entitle the developers to develop software applications and offer other value added services to traders/brokers using ICEGATE APIs. |

BOARD NEEDS TO APPROVE DRAFT AGREEMENT |

| 8. | Ongoing | Empanelled developers are subjected to periodic evaluations to ensure continued compliance and quality of services. | Empanelled developers should be subjected to periodic evaluations/audit to ensure continued compliance and quality of services | DGS NEEDS TO APPOINT A TECHNICAL TEAM TO CONDUCT PERIODIC EVALUATIONS. |

7. In view of the above, a well defined process needs to be laid out for empaneling these IECs/CBs/Third Party Application/Software Developers so that the document exchange ecosystem between the trade users and ICEGATE can be formalised.

*****

STAMP PAPER

Customs Suvidha Provider Agreement

THIS CUSTOMS Suvidha Provider (CSP) Agreement (this “Agreement”) is signed and made at this date of <<month>>, 2024 (“Effective Date”), By & Between:

The President of India acting through the Directorate General of Systems and Data Management, Central Board of Indirect Taxes and Customs, Department of Revenue, Ministry of Finance, the Government of India (hereinafter referred to as “CUSTOMS”, which term shall, unless repugnant to the context or meaning thereof, mean and include its successors and permitted assign) of the FIRST PART.

AND

<<Company Name>> Pvt. Ltd., a company registered under_____________________ , having its registered office at <<full address of the registered office>>, India (hereinafter referred to as “<<Company Name>> or “CSP”, which term shall, unless repugnant to the context or meaning thereof, mean and include its successors and permitted assign) of the OTHER PART.

(Hereinafter CUSTOMS and the CSP referred to as the “Party” and_____ collectively as the “Parties”)

RECITALS:

(i) WHEREAS CUSTOMS is inter alia engaged in a Government of India project for setting up an information technology and communications infrastructure system (“ICEGATE System”) for providing e-filing services to the “Trade, Cargo Carriers and other Trading Partners” (hereinafter referred to as “TRADER COMMUNITY”) electronically.

(ii) WHEREAS <<COMPANY NAME>> is engaged in the business of .

(iii) CSP is a generic name given to such service providers, who have access to CUSTOMS APIs. Access to the aforesaid CUSTOMS APIs shall only be through a secured network. Provided the CSP may itself access CUSTOMS APIs and/or provide it to a Third-Party service provider also (as the case may be, as per the discretion of the CSP), to develop CSP Application.

(iv) WHEREAS, <<COMPANY NAME>> has approached CUSTOMS and showed its willingness to enter into an Agreement with CUSTOMS in relation to CSP arrangement and <<COMPANY NAME>> hereby also declares that it meets all standards, prerequisites and Initial Term Evaluation Criteria as set out in Annexure – 1, Annexure-3 and Annexure-4 respectively.

(v) WHEREAS, subject to the terms of this Agreement, CUSTOMS hereby agrees to grant recognition to and approval for the appointment of <<COMPANY NAME>> as CUSTOMS Suvidha Provider by allowing <<COMPANY NAME>> to provide CSP Services to the TRADER COMMUNITY electronically.

(vi) WHEREAS the CSP is aware of and understands that the CSP Services are authorized on an ‘as is’ basis, without any express or implied warranties in respect thereof on behalf of CUSTOMS.

NOW THEREFORE, in consideration of the mutual covenants and promises set forth herein and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Parties hereby covenant and agree and this Agreement witnesseth as follows:

Page Contents

- 1.1 DEFINITIONS

- 1.2 INTERPRETATION

- 1.3 APPOINTMENT OF CUSTOMS SUVIDHA PROVIDER (CSP)

- 2. TERM OF THIS AGREEMENT

- 3. REPRESENTATIONS AND WARRANTIES

- 4. OBLIGATIONS OF CSP

- 5. OBLIGATIONS OF CUSTOMS

- 6. CHARGES & PAYMENT

- 7. AUDIT, CERTIFICATION, DATA & IT SECURITY

- 8 CONFIDENTIALITY & DISCLOSURE

- 9. INTELLECTRUAL PROPERTY

- 10. INDEMNITY AND LIABILITY

- 11. LIMITATION OF LIABILITY

- 12. AMENDMENTS

- 13. SUBCONTRACT & ASSIGNMENT

- 16. SUSPENSION

- 17. TERMINATION

- 18. NOTICES

- 19. GENERAL

- 20. GOVERNING LAW AND JURISDICTION

- 21. SURVIVAL

1.1 DEFINITIONS

1.1.1. “Agreement” shall mean this agreement executed between the Parties, along with its schedules, annexures and exhibits, if any, and all instruments supplemental to or amending, modifying or confirming this agreement in accordance with the provisions of this agreement, if any, in each case as they may be supplemented or amended from time to time.

1.1.2. “Date of Commencement of the Services” means and includes the date from which CSP shall be required to provide/enable the Services in accordance with the terms of this Agreement, provided such date shall fall, after CUSTOMS shall notify in writing to CSP to start the Services from a certain date.

1.1.3. “CUSTOMS Act” means the CUSTOMS ACT, 1962 and all its subsequent amendments which has been or may be passed by the Government of India and thereafter it shall become effective from the date of its notification or as may be mentioned thereunder.

1.1.4. “CSP Application” means and includes an application/system developed by the CSP and/or a Third-Party service provider, to enable the TRADER COMMUNITY to electronically access the ICEGATE System for CUSTOMS related activities.

1.1.5. “CSP Integration Methodology” means and includes, the detailed process defined under Annexure-1 in relation to managing the Services by the CSP, for the purpose of this Agreement. Such Methodology may be subject to modification from time to time by CUSTOMS on the basis of changes in applicable laws, judgments, quasi-judicial orders and Government’s directives etc.

1.1.6. “Initial Term” means and includes the initial one-year period after signing of this Agreement, during which the CSP shall be subject to Initial Term Evaluation Criteria.

1.1.7. “Initial Term Evaluation Criteria” mean and include the evaluation criteria as defined under Annexure-4 attached herewith, of which the CSP shall be under obligation to meet during the Initial Term.

1.1.8. “Services” or “CSP Services” means and includes the CUSTOMS Suvidha Provider Services, as specified under Annexure-1 of this Agreement. Such Services shall be provided by the CSP to the trader directly by CSP itself or indirectly through its appointed Third Parties, by using ICEGATE System System in accordance with the CSP Integration Methodology, to enable trader to pay their custom duties and/or do any activities as may be required by him under the applicable CUSTOMS Act / laws.\

1.1.9. “SLAs” or “Service Level Agreement” means and includes service level agreements as may be defined under Annexure-5 (“Annexure-5”) by CUSTOMS.

1.1.10. “trader” means the person and/or any entity who is/are governed by CUSTOMS Act and is/are required to comply the provisions of CUSTOMS Act, whereby such person and/or entity may be required Act

1.1.11. uploaded/shared/accessed by the Trader/s onto ICEGATE System, such as documents, challan and requisite information etc., as may be specified under the CUSTOMS Act, from time to time.

1.1.12. “Third-Party” shall mean a party which is not a Party to this Agreement.

1.1.13. “Disclosing Party” shall mean and include CUSTOMS or CSP as the case may be, which is providing its data.

1.1.14. “Receiving Party” shall mean and include CUSTOMS or CSP as the case may be, which receives data from the Disclosing Party.

1.2 INTERPRETATION

1.2.1 In this Agreement, unless the context requires otherwise:

(i) reference to singular includes a reference to the plural and vice versa.

(ii) reference to any gender includes a reference to all other genders.

(iii) reference to an individual shall include his legal representative, successor, legal heir, executor and administrator; reference to statutory provisions shall be construed as meaning and including references also to any amendment or re-enactment (whether before or after the date of this Agreement) for the time being in force and to all statutory instruments or orders made pursuant to statutory provisions.

(iv) references to any statute or regulation made using a commonly used abbreviation, shall be construed as a reference to the title of the statute or regulation.

(v) references to any Article, Clause, Section, Schedule, or Annexure, if any, shall be deemed to be a reference to an Article, Clause, Section, Schedule or Annexure of or to this Agreement.

1.2.2 Clause headings in this Agreement are inserted for convenience only and shall not be used in its interpretation.

1.2.3 When any number of days is prescribed in this Agreement, the same shall be reckoned exclusively of the first and inclusively of the last day unless the last day does not fall on a Business Day, in which case the last day shall be the next succeeding

1.2.4 If any provision in this Agreement is a substantive provision conferring rights or imposing obligations on anyone, effect shall be given to it as if it were a substantive provision in the body of this Agreement.

1.2.5 Any word or phrase defined in the body of this Agreement shall have the meaning assigned to it in such definition throughout this Agreement unless the contrary is expressly stated or the contrary clearly appears from the context.

1.2.6 The rule of construction, if any, that a contract shall be interpreted against the party responsible for the drafting and preparation thereof shall not apply.

1.2.7 Reference to days, months or years in this Agreement shall be a reference to calendar days, months, or years unless the contrary is expressly stated or clearly appears from the context.

1.2.8 Reference to any agreement, deed, document, instrument, rule, regulation, notification, statute or the like shall mean a reference to the same, as may have been duly amended, modified or replaced. For the avoidance of doubt, a document shall be construed as amended, modified, or replaced only if such amendment, modification, or replacement is executed in compliance with the provisions of such document(s).

1.2.9 In the event of any ambiguity on/amongst any word/s or phrase/s or term/s or provision/s of this Agreement or in case any word/s or phrase/s or term/s or provision/s is not defined or fails to bring clarity in accordance with the terms of this Agreement, then CUSTOMS’s decision in that case shall be final.

1.2.10 This Agreement, together with its Annexures appended thereto and any amendment or variation from time to time in accordance with the terms hereof, constitute the entire agreement between the Parties, and as to all other representations, understandings or agreements which are not fully expressed or mentioned herein are explicitly excluded by the Parties.

1.3 APPOINTMENT OF CUSTOMS SUVIDHA PROVIDER (CSP)

1.3.1 CUSTOMS hereby appoints Party of the OTHER PART, as CUSTOMS Suvidha Provider (i.e. CSP), to enable Traders pay his custom duties and/or do any activities as may be required by him under the applicable CUSTOMS Act / laws by accessing the ICEGATE System, directly by CSP itself or indirectly through any Third-Party appointed by CSP.

1.3.2 The CSP hereby unequivocally accepts its appointment as a CUSTOMS Suvidha Provider, for providing CSP Services to the Trader/s, directly or indirectly, by CSP in accordance with the process as set out under Annexure-1 attached with the Agreement (“Annexure-1”).

1.3.3 The CSP understand that, during the Initial Term it shall be subject to Initial Term Evaluation Criteria as specified under Annexure-4 (“Annexure-4”), and if the CSP fails to meet the aforesaid Initial Term Evaluation Criteria to the satisfaction of CUSTOMS, then CUSTOMS shall be entitled to terminate this Agreement, without any liability to CUSTOMS, in accordance with the Termination provisions hereof.

1.3.4 Subject to the terms of this Agreement, CUSTOMS hereby grants the CSP a non- exclusive, non-transferable and revocable right to provide the CSP Services, in the manner set out in this Agreement. The CSP hereby understands and agrees that it shall be responsible to CUSTOMS for all CSP Services/CSP Integration Methodology related aspects, covered by this Agreement.

1.3.5 It is hereby mutually agreed between the Parties that the rights and obligations of the CSP, under this Agreement, are non-transferable and non-assignable whether by sale, merger, or by operation of law, except with the express prior written consent of CUSTOMS.

1.3.6 The CSP hereby unequivocally agrees that where it provides CSP Services to the Trader/s indirectly by appointing one or more Third-Party service provider/s, the CSP shall enter into a separate agreement with such Third-Party (“Third-Party Agreement”) to govern their mutual rights and obligations under the said Third-Party Agreement. It is hereby clearly understood that CUSTOMS shall have no role and responsibility and/or liability in relation to the said Third-Party Agreement. However, the CSP shall ensure that the terms of the said Third-Party Agreement shall not be in contravention of this Agreement and/or business interest of CUSTOMS.

1.3.7 The CSP hereby unequivocally agrees that it shall be prepared for the services in accordance with the terms of this Agreement, upon the Date of Commencement of the Services.

1.3.8 CUSTOMS shall have the sole right and discretion, without any liability of any nature, through all means (whether manual or automated) to accept/reject or deny any Trader/s Data from being transmitted to the ICEGATE System from the CSP Application.

1.3.9. The CSP shall adhere with the CSP Integration Methodology as set out in Annexure-1 attached with this Agreement.

1.3.10 The CSP shall follow and adhere with the guidelines relating to CSPs, prepared, proposed and updated by CUSTOMS, from time to time.

2. TERM OF THIS AGREEMENT

2.1 Subject to clauses 1.3.3 and 17, this Agreement shall come into effect from the Effective Date and thereafter shall continue for a period of five years form the Date of Commencement of the Services (“Term”). However, subject to the discretion of CUSTOMS, this Agreement may further be extendable for another term as may be mutually agreed between the Parties.

2.2 Notwithstanding anything contained in Clause 1.1.2, the CSP at all times shall be prepared for commencing the Services for the purposes of this Agreement from the Date of Commencement of the Services.

3. REPRESENTATIONS AND WARRANTIES

A. The CSP represents and warrants that:

(i) it is duly organized and validly existing under the laws of India, and has full power and authority to execute and perform its obligations under this Agreement and other agreements which it may be required to execute with CUSTOMS for the purpose of this Agreement.

(ii) it has taken all necessary actions under applicable laws to authorize the execution and delivery of this Agreement and to validly exercise its rights and perform its obligations under/for the purpose of this Agreement.

(iii) it has the financial standing and capacity to undertake the Services and obligations in accordance with the terms of this Agreement.

(iv) in providing the Services, it shall use reasonable endeavors not to cause any unnecessary disruption to CUSTOMS’s normal business operations.

(v) this Agreement has been duly executed by it and constitutes a legal, valid and binding

obligation, enforceable against it in accordance with the terms hereof, and its obligations under this Agreement shall be legally valid, binding and enforceable against it in accordance with the terms hereof.

(vi) the execution, delivery and performance of this Agreement shall not be in conflict with, which may result in the breach of or constitute a default of, any of the terms of its Memorandum and Articles of Association or any Applicable Laws or any covenant, contract, agreement, arrangement, understanding, decree or order to which it is a party or by which it or any of its properties or assets is bound or effected;

(vii) there are no material actions, suits, proceedings, or investigations pending , to its knowledge, before any court, tribunals, or any other judicial, quasi- judicial, administrative authority, the outcome of which may result in the breach of this Agreement or which individually or in the aggregate may result in any material impairment of its ability to perform any of its material obligations under this Agreement;

(viii) it has no knowledge of any violation or default with respect to any order, writ, injunction or decree of any court or any legally binding order of any Government Instrumentality which may result in any adverse effect on its ability to perform its obligations under this Agreement and no fact or circumstance exists which may give rise to such proceedings that would adversely affect the performance of its obligations under this Agreement.

(ix) it has complied with applicable Laws in all material respects and has not been subject to any fines, penalties, injunctive relief or any other civil or criminal liabilities which in the aggregate have or may have an adverse effect on its ability to perform its obligations under this Agreement.

(x) no representation or warranty by it contained herein or in any other document furnished by it to CUSTOMS or its nominated agencies in relation consents contains or shall contain any untrue or misleading statement of material fact or omits or shall omit to state a material fact necessary to make such representation or warranty not misleading; and

(xi) no sums, in cash or kind, have been paid or shall be paid, by it or on its behalf, to any person by way of fees, commission or otherwise for entering into this Agreement or for influencing or attempting to influence any officer or employee of CUSTOMS or its nominated agencies in connection therewith.

(xii) The CSP Application is secure, and it shall ensure that there is no Data breach. It has put all compliance, certifications, and security systems in place in order to ensure secure Data transmission by its network to ICEGATE System, without any exposure of breach, theft or loss of Data.

(xiii) ICEGATE System shall be free from viruses, trojan horses, worms, time bombs or any other computer programming devices which are intended to damage a user system or data or prevent the user from using same or any external threat etc. when CSP Application shall be used by CSP for the purpose of providing the Services.

(xiv) It has clearly understood the purpose and requirement of this Agreement and has no doubt about his role as a CSP and the CSP Integration Methodology required for the purpose of enabling the Service to Trader/s interfacing the ICEGATE System.

B. CUSTOMS represents and warrants that:

(i) It has full power and authority to execute, deliver and perform its obligations under this Agreement and to carry out the transactions contemplated herein and that it has taken all actions necessary to execute this Agreement, exercise its rights and perform its obligations, under this Agreement and carry out the transactions contemplated hereby;

(ii) It has taken all necessary actions under applicable laws to authorize the execution, delivery and performance of this Agreement and to validly exercise its rights and perform its obligations under this Agreement.

(iii) It has the financial standing and capacity to perform its obligations under the Agreement.

(iv) This Agreement has been duly executed by it and constitutes a legal, valid and binding obligation enforceable against it in accordance with the terms hereof and its obligations under this Agreement shall be legally valid, binding and enforceable

(v) It has no knowledge of any violation or default with respect to any order, writ, injunction or any decree of any court or any legally binding order of any Government Instrumentality which may result in any adverse effect on CUSTOMS or its nominated agencies ability to perform its obligations under this Agreement and no fact or circumstance exists which may give rise to such proceedings that would adversely affect the performance of its obligations under this Agreement;

(vi) It is in compliance with applicable laws in relation to this Agreement.

4. OBLIGATIONS OF CSP

Without prejudice to any other undertakings or obligations or warranty of CSP under this Agreement, CSP shall perform the following:

(i) Always provide continuous and flawless Services unless it is prevented by reason of any Force Majeure Event, or any other exceptions as may be set out under the SLA as may be defined under Annexure-5.

(ii) The CSP shall add and reflect on its CSP Application, such disclaimers as CUSTOMS may require from time to time.

(iii) The CSP Application should be free from any Third-Party IPR breach.

(iv) The CSP shall ensure that CSP Application is at all-time connected with ICEGATE System.

(v) The CSP shall bear all costs in relation to provision of all the Services and obligations it may have under this Agreement, including but limited to establishment/deployment/development of hardware, infrastructure, applications etc.

(vi) During the Term of this Agreement and thereafter abstain itself from any such activity/es which is/are intended to or be expected to or lead to unwanted, unfavorable or adverse publicity against CUSTOMS, through any medium/publication whatsoever, which (directly or indirectly) to CUSTOMS or its reputation.

(vii) The CSP shall always honour the SLAs and service credits, as may be set out under Annexure 3 hereof.

(viii) All the APIs provided by CUSTOMS to the CSP shall be further released by the CSP with its Third-Party service providers in the same form and quantum as may be provided to it by CUSTOMS. The CSP shall not show, directly or indirectly, any kind of biasness or preferential treatment in sharing of APIs provided by CUSTOMS as aforesaid.

(ix) The CSP shall not at any time indulge in any kind of anti-competitive/ monopolistic activities which may prevent access of APIs’ to any interested Third-Party service provider.

5. OBLIGATIONS OF CUSTOMS

Without prejudice to any other undertakings or obligations of CUSTOMS under this Agreement, CUSTOMS shall allow access of ICEGATE System to CSP as specified under Annexure-1.

6. CHARGES & PAYMENT

6.1 In consideration of authorizing CSP to access the ICEGATE System, the CSP shall pay such charges/tariff (“Charges”) to CUSTOMS as may be decided by CUSTOMS, from time to time, in its sole discretion, in such manner as may be set out by CUSTOMS under Annexure 2 of this Agreement (“Annexure-2”). The payment and Charges, as may be applicable on the CSP under this Agreement and Annexures, shall be made in accordance with the terms of this clause.

Provided that CUSTOMS reserves its right to notify the Charges to be paid by CSP at a later date by way of Annexure-2, however such notification shall not be treated as an amendment to this Agreement. Notwithstanding the above, the aforesaid Annexure-2 (including any changes made thereunder, from time to time, at the sole and exclusive discretion of CUSTOMS) shall form as an integral part of this Agreement.

6.2. The Charges decided by the CUSTOMS shall be binding upon the CSP and CSP shall be liable to make the payment of such Charges to CUSTOMS within Due Date of Payment thereof.

6.3. CUSTOMS shall start levying and collecting the Charges from the CSP, from such date as it may deem appropriate during the term of the Agreement, however, CUSTOMS shall notify the CSP in relation to the aforesaid date.

6.4. After the date of notification of the Charges under aforesaid sub-clause 6.3, the CSP shall be liable to make the payment of such Charges to CUSTOMS, without any failure, within 7 days at the commencement of every month (“Due Date of Payment”).

6.5. In case of default in payment of the payable Charges by the CSP, within the Due Date of Payment, the CSP shall be liable to pay an interest @ 18% per annum which shall paid by the CSP till the complete payment of outstanding amount of the Charges to CUSTOMS.

6.6 Notwithstanding anything contained under this Agreement, in case of default in payment of the Charges by the CSP to CUSTOMS, within the Due Date of Payment, CUSTOMS shall be entitled to:

(i) suspend this Agreement, without any liability of CUSTOMS of any nature, till the payment of complete outstanding amount, by the CSP; and/or

(ii) terminate this Agreement, in accordance with Clause 17 hereof.

All rights of CUSTOMS under this clause, in case of non-payment or delay in payment by the CSP, shall be without prejudice to any other rights of CUSTOMS as may be available to it under this Agreement and/or the applicable laws.

6.7 CUSTOMS shall not be responsible for any payment and/or any tax/es (including but not limited to any applicable withholding taxes) which may accrue in relation to CSP Application or use of CSP Application and/or Services by Third-Party/Traders.

7. AUDIT, CERTIFICATION, DATA & IT SECURITY

7.1 (a) The CSP shall before the Date of Commencement of the Services and annually thereafter shall conduct a security audit in accordance with ISO 27001/2013 (as updated from time to time), of its CSP Application that directly integrates with ICEGATE System, by an accredited external auditor as may be suggested by CUSTOMS.

(b) In case, the external auditor as mentioned under sub-clause 7.1(a) recommends any y observation to CSP, then CSP shall be liable__ to take necessary actions thereon, failing which the CSP shall not be entitled to commence/ continue (as the case may be) the Services under this Agreement and the Agreement shall be terminated in accordance with the terms hereof.

(c) Notwithstanding the above, after taking necessary action under sub-clause 7.1(b), the CSP shall be entitled to commence the Services only after getting clearance from the same agency, which had conducted the audit under sub-clause 7.1(a).

(d) The CUSTOMS shall not be liable for any cost as may be incurred by the CSP under this clause

7.2 The CSP shall maintain logs of all the transactions as specified in Annexure-I processed by it, capturing the complete details of the CSP Application transactions, such as the transaction id, application id/license/sub-license key, date and timestamp, API type, response status (success/failure) etc. as prescribed by CUSTOMS from time to time. The CSP understands and agrees that the logs maintained by it shall be shared with any individual or entity only on a need-basis, and that the storage of the logs maintained by it shall comply with all the relevant laws, rules, and regulations.

Provided that CUSTOMS shall be entitled to conduct audit without any notice in case of apprehension of fraud or breach.

7.3 The CSP shall, without any cost implication to CUSTOMS, take necessary actions as may be suggested/required by the audit, to the satisfaction of CUSTOMS.

7.4 The CSP shall maintain logs of all the transactions as specified in Annexure-I processed by it, capturing the complete details of the CSP Application transactions, such as the transaction code, authentication type, requesting CSP, requesting authentication device, date and timestamp, etc. as prescribed by CUSTOMS from time to time. The CSP understands and agrees that the logs maintained by it shall be shared with any individual or entity only on a need-basis, and that the storage of the logs maintained by it shall comply with all the relevant laws, rules, and regulations.

On the request of CUSTOMS, CSP shall furnish to CUSTOMS within reasonable time, as may be required, from time to time, the copy/ies or record/s of proof of transactions or logs or any activity done by CSP through its CSP Application.

7.5 The CSP shall disclose its privacy policy on its CSP Application and ensure that it conducts services in accordance with the same. The CSP shall make necessary changes to the aforesaid policy, if suggested by CUSTOMS, during the term of this Agreement.

7.6 CUSTOMS shall be entitled to prohibit display of any material on CSP Application, if the act or manner of such display is found contrary to any applicable laws, regulations, government policies, orders or guidelines or which is detrimental its interest.

Provided that decision of CUSTOMS that display of any material on CSP Application is detrimental to its interest shall be final.

7.7 CUSTOMS shall be entitled to publish notices, disclaimers and indemnities in its ICEGATE System (in relation to CSP Services or CSP Integration Methodology or otherwise for any other purposes whatsoever), without any objection of the CSP, in the manner and to the extent deemed necessary by CUSTOMS in accordance with CUSTOMS’s internal business, operational and/or policy guidelines.

7.8 (a) The CSP shall not retain/store Trader/s’ Data and/or Confidential Information, of any nature (either wholly or partially), in CSP’s server or cloud or otherwise in any other medium, as may be transmitted/processed/passed through by CSP if CSP is only providing access to CUSTOMS API to any Third-Party service provider. If CSP is providing “CSP Application” then it can retain aforesaid data with explicit Trader/s consent.

(b) Notwithstanding the above, the CSP Application may retain/store Trader/s’ Data and/or information only for such period as may be required for the purpose of processing / passing through the Data and/or information from CSP Application to ICEGATE System,

(c) Subject to above sub-clause (b), the CSP shall permanently destroy/remove/erase all data, as may be retained/stored by it, in relation to any transaction, once the transaction is completed after acceptance or reject of Data by ICEGATE System.

7.9 CUSTOMS may prescribe other standards and specifications that it may deem necessary, from time to time, in its sole judgment, in relation to ICEGATE System and CSP Services which shall be binding on the CSP without any objection.

8 CONFIDENTIALITY & DISCLOSURE

8.1 The Receiving Party shall not, at any time during or after the term of this Agreement for a further five (5) years thereafter, without the consent in writing of Disclosing Party disclose (whether wholly or partially), reveal or make public any information or data of whatever nature (whether wholly or partially), reveal or make public any information or data of whatever nature (whether disclosed in writing or oral or otherwise) in connection with this Agreement or as may be processed/accessed by the Receiving Party in relation to the Trader/s (“Confidential Information”), to any Third-Party or any other person not authorized in writing by the Disclosing Party in terms of this Agreement.

8.2 The Confidential Information shared by Disclosing Party, directly or indirectly, to the Receiving Party, shall be proprietary of the Disclosing Party only who had originally shared the Confidential Information. The Parties agrees not to disclose Confidential Information to any Third-Party without the express written permission of the Disclosing Party. The Receiving Party shall take all necessary precautions to maintain the secrecy and confidentiality of such Confidential Information. However a Receiving Party may reveal Confidential Information to those of its employees, representatives, affiliates and Third-Party (collectively “Representatives”) to the extent of need-to-know basis strictly only for the purpose of meeting the objective of this Agreement, provided the Receiving Party puts similar obligations of confidentiality on such representatives.

8.3 It is hereby mutually agreed between the Parties that CUSTOMS assumes no responsibility or liability for any action or inaction, use or misuse of the Confidential Information and other Data in the control of the CSP, or any other Third-Party.

8.4 The above obligation of non-disclosure will not be deemed to restrict a Receiving Party from using and/or disclosing any of the Confidential Information which:

a) is or becomes publicly known or comes within the public domain without the breach of this Agreement,

b) was known to it (subject to substantially proved by the Disclosing Party) prior to its receipt thereof from the Disclosing Party,

c) is separately developed (subject to substantially proved by the Disclosing Party), whether before or after the date of this Agreement, by persons not privy to the Confidential Information,

d) has been or is subsequently disclosed to it by a Third-Party who is not under an obligation of confidentiality to the Disclosing Party, or

e) is required by law or by any Court or governmental agency or authority to be disclosed, in which case the Receiving Party will provide prompt notice of such request or requirement to the Disclosing Party.

8.5 The Both Parties acknowledge that

a. any disclosure or use of the Confidential Information, not in accordance with the terms of this Agreement by the Receiving Party, would be a breach of this Agreement and may cause immediate and irreparable harm to the Disclosing Party;

b. the damages from such disclosure or use by it may be impossible to measure accurately; and

c. injury sustained by the Disclosing Party may be impossible to calculate and remedy fully.

Therefore, notwithstanding anything contained under this Agreement, in the event of such breach, the Disclosing Party shall be entitled to specific performance by the Receiving Party of obligations contained in this clause and/or take any legal action against the Receiving Party as may be available under the applicable laws, including not limited to, temporary restraining orders, preliminary injunctions, and permanent injunctions. In addition, the Receiving Party shall indemnify the Disclosing Party of the actual damages which may be demanded by the Disclosing Party. Moreover, the Disclosing Party shall be entitled to recover all costs (including reasonable attorneys’ fees) which it or they may incur in connection with defending its interests and enforcement of legal rights arising due to a breach of confidentiality by the Receiving Party under this agreement.

9. INTELLECTRUAL PROPERTY

9.1 The ICEGATE System is an intellectual property of CUSTOMS and all intellectual property rights (of any nature) including without limitation, the title, interests, name and/or logo in relation to ICEGATE Portal shall, at all times, either during the operation of this Agreement or otherwise, exclusively vest with CUSTOMS only. The CSP shall have a non-exclusive, non-transferable/ non-assignable and/or revocable rights to use the ICEGATE System.

9.2 The CSP acknowledges and warrants that CSP Application is free from all Third-Party intellectual property rights (of any nature) and the CSP shall be liable to ensure that:

a. all the Intellectual Property Rights in the CSP Application exclusively belong to it; or

b. in case the CSP owns CSP Application of a Third-Party service provider then such Third-Party’s application should be freer from all Third-Party Intellectual Property rights’ claims/liability/suits/breach, of any nature.

9.3. CSP shall be liable to ensure that, during the term of this Agreement and thereafter, no Third-Party intellectual property rights claims/disputes/liabilities, of any nature, shall arise against CUSTOMS, in relation to its CSP Application whether owned by the CSP directly or indirectly.

9.4. In case of any Third-Party intellectual property rights claims/disputes/liabilities, of any nature, arises against CUSTOMS in relation to CSP Application (including but not limited to the CSP Application which is owned by the CSP from a Third-Party service provider), then it shall, without limitation, be liable to indemnify to CUSTOMS.

9.5 No intellectual property rights (of any nature) is being transferred by CUSTOMS to the CSP by way of this Agreement.

9.3 Subject to clause 6:

(i) any design, production marketing/promotional materials or advertisement which bears the name, logo and/or trademark of CUSTOMS, shall not be used /distributed / issued by the CSP without prior written permission of CUSTOMS.

(ii) any design, production, marketing/commercial/promotional activities/materials and/or advertisement as may be carried by the CSP, which include the CUSTOMS’s trademark/name/logo etc., shall be strictly in reference to the Services provided by the CSP in terms of this Agreement and shall at all-time be in compliance with the guidelines issued by CUSTOMS from time to time in relation thereto.

9.4 The CSP hereby unequivocally agrees that it shall represent itself with the name as “CUSTOMS Suvidha Provider” and/or “CSP” only without any modification, in its promotional, educational, marketing, and informational literature, for the duration of this Agreement.

10. INDEMNITY AND LIABILITY

10.1 CUSTOMS shall not be liable against the CSP for any Third Party or Traders claim/liability/suit which may arise in relation to the CSP Services and/or CSP Application and/or breach of any terms and conditions of this Agreement which may be attributable to the CSP and/or Third-Party Agreement. The CSP acknowledges without limitation to hold CUSTOMS indemnified against such claims as aforesaid mentioned.

10.2 Notwithstanding anything contained in this Agreement, it is hereby clearly understood by the Parties that CUSTOMS shall have no responsibility or liability in relation to failure of any activity, if such activity may have initiated by a Trader and/or Third-Party through CSP or by CSP itself, and that has failed or delayed on account of the process of authentication and acceptance of Trader/s Data by ICEGATE System or otherwise, including but not limited as a result of, network or connectivity failure, device or application failure, CUSTOMS’s System’s failure, possible down time at ICEGATE System’s end or any other technical or non-technical error of any nature, whether foreseen or unforeseen at the time of entering into this Agreement.

10.3 Without prejudice to the above, the CSP shall indemnify and protect the interests of CUSTOMS and indemnify it against all claims, liabilities, losses and incurred costs, fines, penalties, expenses, taxes, assessment, punitive damages, fees (including advocate’s/ attorney’s fee), liabilities (including any investigative, legal and other expenses incurred in connection with, and any amounts paid in settlement of, any pending or threatened legal action or proceeding), judgments, awards, assessments, obligations, damages, etc., which CUSTOMS may suffer or incur arising out of, or in connection with:

i. any act, neglect, default or omission on the part of the CSP, its affiliates and subsidiaries or its authorized sub-agency or any other Third-Party, including but not limited to liabilities arising from non-compliance of standards and regulations prescribed by CUSTOMS, from time to time, unauthorized use or disclosure of Confidential Information and failure to comply with data protection and storage requirements, as prescribed by CUSTOMS, from time to time and/or as may be required under the term of this Agreement;

ii. any breach by the CSP of the terms and conditions under this Agreement.

iii. any breach by the CSP and/or its authorized sub-agency or any other Third-Party engaged by the CSP, of its obligations under any applicable law(s), statutory instructions, notifications, guidelines as may be issued by the Government due to which CUSTOMS may be held responsible for any liability.

iv. any Third-Party claim, which may arise in relation to the CSP Services and/or IPR breach of CSP Application.

v. any Third-Party claim which may arise in relation to Third-Party Agreement.

vi. any Traders’ claim/liability which may be attributable to the CSP and/or the CSP Services

11. LIMITATION OF LIABILITY

a) Where the charges have been notified by CUSTOMS, the liability of Parties (whether in contract, tort, negligence, strict liability in tort, by statute or otherwise) for any claim in any manner related to this Agreement, including the work, deliverables or Services covered by this Agreement, shall be the payment of direct damages only which shall in no event in the aggregate exceed the immediate preceding twelve months’ charges paid and/or payable by the CSP to CUSTOMS under the Agreement. However, the aforesaid limitation shall not be applicable in case of any Third-Party intellectual property rights’ infringement and/or breach of confidentiality obligations and/or Trader’s Data security breach and/or any

b) Except as otherwise provided herein, in no event shall either party be liable for any consequential, incidental, indirect, special or punitive damage, loss or expenses (including but not limited to business interruption, lost business, lost profits, or lost savings) even if it has been advised of their possible existence.

12. AMENDMENTS

12.1 This Agreement shall not be varied, amended or modified by any of the Parties in any manner whatsoever unless such variation, amendment or modification is mutually discussed & agreed to in writing and duly executed by both the Parties.

Provided that no amendment shall be required for the purpose of Annexures of this Agreement, however, all the aforesaid Annexures shall form integral part of this Agreement and be binding upon the Parties with full effect, including any changes made therein by CUSTOMS, from time to time, if any.

12.2 Notwithstanding, anything provided in clause 12.1 nothing shall limit CUSTOMS’s right to add, revise and modify (whether in whole or in part), without any liability of CUSTOMS, any of the Annexures and/or CSP Services as set out under this Agreement, without any objection of the CSP, at any time, in its sole discretion, for any reasons whatsoever.

12.3 Any addition, revision and modification (whether in whole or in part) under Clause 12.2 and/or proviso to Clause 19.7 shall be made by CUSTOMS, by providing a written notice of fifteen (15) days to the CSP to carry out such addition, revision, modification.

Notwithstanding anything contained in this Agreement where any addition, revision or modification (whether in whole or in part) is required to be carried out by virtue of any Statutory and/or Government Order and/or Guidelines and/or Regulations and/or Notifications and/or any other applicable law, CUSTOMS shall be entitled to provide a written notice of any period which may be lesser than the aforesaid period of 15 days to carry out such addition, revision, modification.

12.4 CUSTOMS reserves the right to amend, modify or make new rules, regulations and policies about CSP Services, CSP Integration Methodology, Third-Party service provider appointed by the CSP and/or any other stakeholder in relation to CUSTOMS Suvidha Provider arrangement. Such rules, regulations and policies shall be binding upon CSP and all Third Parties.

13. SUBCONTRACT & ASSIGNMENT

13.1 The CSP shall not assign the benefit or delegate the burden of this Agreement and/or otherwise sub-contract and/or transfer any or all of its rights and obligations (whether wholly or partially) under this Agreement to any Third-Party (including but not limited to the CSP’s affiliates subsidiaries and group companies etc.) without the prior written express consent of CUSTOMS.

13.2 Subject to sub-clause 13.1, in case of sub-contract, the CSP shall be the solely liable against CUSTOMS for the breach of any terms and conditions of this Agreement.

15. FORCE MAJEURE

15.1 Definition of Force Majeure

CUSTOMS or the CSP as the case may be, shall be entitled to suspend or excuse performance of its respective obligations (except payment obligations) under this Agreement to the extent that such performance is impeded by an event of force majeure (‘Force Majeure’)

15.2 Force Majeure Event

A Force Majeure event means any event or circumstance, or a combination of events and circumstances referred to in this clause, which:

i. is beyond the reasonable control of the affected

ii. such Party could not have prevented or overcome with the exercise of reasonable skill and care.

iii. does not result from the negligence of such Party or the failure of such Party to perform its obligations under this Agreement.

iv. is of an incapacitating nature and prevents or causes a delay or impediment in performance.

and

v. may be classified as all or any of the following events: Such events include:

a. act of God, including earthquake, flood, inundation, landslide, exceptionally adverse weather conditions, storm, tempest, hurricane, cyclone, lightning, thunder, volcanic eruption, fire or other extreme atmospheric conditions.

b. radioactive contamination or ionizing radiation or biological contamination except as may be attributable to the MSP’s use of radiation or radioactivity or biologically contaminating material.

c. industry wide strikes, lockouts, boycotts, labour disruptions or any other industrial disturbances as the case may be not arising on account of the acts or omissions of the CSP, and which affects the performance of the CSP under this Agreement; or

d. an act of war (whether declared or undeclared), hostilities, invasion, armed conflict or act of foreign enemy, blockade, embargo, prolonged riot, insurrection, terrorist or military action, civil commotion, or politically motivated sabotage, for a continuous period exceeding seven (7) days.

15.3 For the avoidance of doubt, it is further clarified that any negligence in performance of the Services which directly causes any breach of security like hacking aren’t the forces of nature and hence wouldn’t qualify under the definition of “Force Majeure”. In so far as applicable to the performance of Services, the CSP will be solely responsible to complete the risk assessment and ensure implementation of adequate security hygiene, best practices, processes and technology to prevent any breach of security and any resulting liability therefrom (wherever applicable).

15.4 Notification procedure for Force Majeure

i. The affected Party shall notify the other Party of a Force Majeure Event within seven (7) days of occurrence of such event. If the other Party disputes the claim for relief under Force Majeure it shall give the claiming Party written notice of such dispute within thirty (7) days of such notice. Such dispute shall be dealt with in accordance with the dispute resolution mechanism clause.

ii. Upon cessation of the situation which led the Party claiming Force Majeure, the claiming Party shall within seven (7) days thereof notify the other Party in writing of the cessation and the Parties shall as soon as practicable thereafter continue performance of all obligations under this Agreement.

15.5 Save and except as expressly provided in this Clause, neither Party shall be liable in any manner whatsoever to the other Party in respect of any loss, damage, costs, expense, claims, demands and proceedings relating to or arising out of occurrence or existence of any Force Majeure Event or exercise of any right pursuant hereof, provided the affected Party shall, at its own cost, take all steps reasonably required to remedy and mitigate the effects of the Force Majeure event and restore its ability to perform its obligations under this Agreement as soon as reasonably practicable. The Parties shall consult with each other to determine the reasonable measures to be implemented to minimize the losses of each Party resulting from the Force Majeure event. The affected Party shall keep the other Party informed of its efforts to remedy the effect of the Force Majeure event and shall make reasonable efforts to mitigate such event on a continuous basis and shall provide written notice of the resumption of performance hereunder.

16. SUSPENSION

16.1. Without prejudice to any other provision for suspension of Services in this Agreement, CUSTOMS shall be entitled to forthwith suspend CSP Services, without any liability to CUSTOMS, by providing seven (7) days’ notice in writing to the CSP of its intention to suspend the Services, upon the occurrence of any of the following events:

a. If CSP defaults in making payment in accordance with the term of this Agreement.

b. Subject to Clause 17.1 (A) (a), if CSP fails to remedy any breach capable of being remedied.

c. The complaints registered with CUSTOMS, against the CSP, are of such nature that the functioning of the CSP defeats the purpose of this Agreement.

16.2 Notwithstanding, anything mentioned in clause 16.1 suspend the Services of the CSP, without any notice, upon the occurrence of the following events:

a. If CSP fails to adhere to security standards as may be prescribed under this Agreement or may be prescribed by CUSTOMS from time to time.

b. If CSP is found in breach of any confidential/data security obligation as prescribed under this Agreement or may be prescribed by CUSTOMS from time to time.

c. If CSP Portal is found to be inactive beyond a period of one week or any other period as may be specified by CUSTOMS from time to time.

16.3 Subject to Clause 16.1 and 16.2 CUSTOMS shall conduct an inquiry, before or after Suspension of Services, as the case may, by providing reasonable opportunity to the CSP to present its case by issuing a show cause notice to CSP.

Provided that the decision of CUSTOMS in this regard shall be final and binding upon the CSP.

16.4 If upon conducting inquiry, CUSTOMS comes to the conclusion that the CSP has reasonable justification for its default and/or the default was not attributable to the CSP and/or the CSP has rectified its default, in terms of clause 16.1 and 16.2, the Services of the CSP shall be resumed or shall not be suspended, as the case may be.

Provided that where CUSTOMS comes to the conclusion after inquiry conducted by it in accordance with clause 16.3, that there was reasonable justification for default by CSP and/or the default of CSP was not attributable to the CSP, the Suspension shall not be treated as a ground of Termination of Agreement in terms of Clause 17.1 A (b).

17. TERMINATION

17.1 (A)

Without prejudice to any other provision for termination in this Agreement, CUSTOMS shall be entitled to forthwith terminate this Agreement, without any liability to CUSTOMS, by providing notice in writing to the CSP of this Agreement upon the occurrence of any of the following events:

a) If the CSP fails to fulfill Initial Term Evaluation Criteria as set out in Annexure-4 to the satisfaction of CUSTOMS. Provided that due opportune it has fulfilled the aforesaid Criteria.

b) If the CSP commits any breach, of any of the terms and conditions of this Agreement or the SLA as set out under Annxuer-3 hereof, and in case such breach is capable of being remedied, the CSP fails to remedy the same within thirty (30) days after receipt of a notice in writing from CUSTOMS giving full particulars of the breach and requiring it to be remedied; or

c) Subject to clause 16.4, if the Services of CSP have been suspended for two or more times in one quarter, in the manner as prescribed under clause 16.

d) If the CSP commits breach of any of the terms and conditions of this Agreement and if such breach is not capable of being remedied; or

e) If CSP is found involved in fraud or other illegal or unethical activities in relation to any subject matter associated with this Agreement; or

f) if the CSP enters into liquidation whether compulsory or voluntary (save for the purpose of amalgamation or reconstruction) or makes an assignment for the benefit of or compounds with its creditors or has a manger or receiver appointed in respect of all or any part of its business or a petition for winding-up.

g) If CSP is found in breach of Intellectual Property Rights/ Confidentiality/ Data security obligations it shall be treated as wilful default of CSP.

h) If CSP defaults in making the payment in accordance with the terms of this Agreement.

17.2 Termination of this Agreement, for any reasons, shall result in automatic cancellation of the empanelment of the CSP as CUSTOMS Suvidha Provider, granted by CUSTOMS, without any notification, in this regard, to the CSP.

17.3 Party to this agreement shall be entitled, without any liability against the other, to terminate this Agreement without cause at any time by service of a ninety (90) days’ notice in writing to the other Party. Upon receiving the notice under this clause, the CSP shall take all steps to terminate all Third-Party Agreements which it may have entered into with all Third Parties, without any liability to CUSTOMS, and shall inform, in writing, to CUSTOMS about the same.

17.4 Upon termination of this Agreement, the CSP shall, forthwith, cease to use the CSP name and logo for any purposes, and in any form, whatsoever.

17.5 Notwithstanding anything contained in this clause, the CSP shall not be absolved form its liability of making the outstanding payment in accordance with the terms of this Agreement, if such payment still remains due even after the termination, for any reasons whatsoever.

18. NOTICES

18.1 Notices, writings and other communications under this Agreement may be delivered by hand, by registered mail, by overnight courier services or facsimile.

18.2 In relation to a notice given under this Agreement, any such notice or other document shall be addressed to the other Party’s principal or registered office address as set out below:

To CUSTOMS

Directorate General of Systems & Data Management (ICEGATE)

1st Floor, CR Building, IP Estate

New Delhi – 110095

To CSP:

Tel: ______________

Fax: ___________________

Email: __________________

Contact: _________________

18.3 Notice will be deemed given:

a. in the case of hand delivery or registered mail or overnight courier upon written acknowledgement of receipt by an officer or other duly authorized employee or representative of the receiving party.

b. In the case of facsimiles upon completion of transmission as soon as the sender’s facsimiles machine creates and the sender retains a transmission report showing successful transmission. Provided that in case of the date of receipt not being a business day, notice shall be deemed to have been received on the next business day. Provided ‘further that in case of a notice being forwarded by facsimile, a copy of the notice shall also be forwarded by hand delivery, registered mail or overnight courier services.

18.4 The address for notice may be changed by either party by giving notice to the other party as provided herein.

18.5 Nothing in the aforesaid clause shall affect any communication given by way of the internet

19. GENERAL

19.1 Binding effect:

This Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective legal successors.

19.2 Counterparts:

This Agreement may be executed simultaneously in two counterparts, each of which shall be deemed to be original and all of which together shall constitute the same Agreement.

19.3 Non-partnership:

19.3.1 This Agreement shall be on a principal-to-principal basis and shall not create any Principal-Agent relationship between the parties.

19.3.2 Nothing in this Agreement shall be deemed to constitute a partnership between the parties nor otherwise entitle the Party to have an authority to bind the other Party for any purpose. The CSP shall take necessary steps and/or precautions to ensure that the Services offered by CSP through its CSP Application, are not misrepresented as being offered by CUSTOMS.

19.4 severability:

if any provision of this Agreement is agreed by the parties to be illegal, void or unenforceable under any law that is applicable hereto or if any court of competent jurisdiction in a final decision so determines, this Agreement shall continue in force save that such provision shall be deemed to be deleted here from with effect from the date of such agreement or decision or such earlier date as the Parties may agree.

19.5 waiver:

A failure by any Party to exercise or enforce any nights conferred upon it by this Agreement shall not be deemed to be a waiver of any such rights or operate so as to bar the exercise or enforcement thereof at any subsequent time or times.

19.6 CUSTOMS shall have right to use, make changes or customize the ICEGATE System and application or make available any information/data or carry out any other activity/ business on ICEGATE System/ICEGATE Portal/application, as it may require, from time to time, for the purpose of CUSTOMS’s present/future business objectives and/or this Agreement. For the aforesaid purpose CUSTOMS shall be under no obligation to take any approval / consent, of any nature, from CSP.

Provided that wherever such change or customization referred to above require substantial changes or customization in the CSP application/ website, the procedure prescribed for providing notice under clause 12.3 shall be followed.

20. GOVERNING LAW AND JURISDICTION

20.1 The construction, validity and performance of this Agreement shall be governed in all respects by the laws of India. The parties hereby submit to the non-exclusive jurisdiction of the Indian Courts at Delhi only.

20.2 All disputes arising out of or in connection with this Agreement shall be attempted to be settled within (30) thirty days following the day of written notification of the dispute by either Party, through good faith negotiations between the senior management of both the Parties.

20.2 If the dispute is not so resolved amicably within thirty (30) days of written notification of the dispute, the Parties shall immediately sign a document marked “without prejudice”, containing information on what has been agreed and what remains in dispute between them on the date at which the negotiations failed. Hereafter either Party may initiate arbitration proceedings.

20.3 Subject to the right of a Party to seek injunctive relief, the dispute shall be resolved through binding arbitration in accordance with the provisions of the Arbitration and Conciliation Act, 1996. The language of the arbitration shall be English. The place of arbitration will be New Delhi and shall be presided over by a single arbitrator chosen by mutual consent of both the parties under the Arbitration and Conciliation Act, 1996 (including any statutory modifications and substitutions made thereto). Where the single arbitrator is not agreed upon between the Parties within fifteen days from the date at which the negotiations failed, the arbitration shall be conducted by three arbitrators with both Parties hereto shall be entitled to appoint one arbitrator each and the appointed arbitrators to appoint an additional arbitrator. If the Parties cannot (within fifteen (15) days from the initial request by one Party to the other) agree on the selection of a third arbitrator, such arbitrator shall be appointed in accordance with the Arbitration and Conciliation Act, 1996.Any award rendered by the arbitrator(s) shall be final and judgment may be entered upon it in any court of competent jurisdiction. The arbitrator(s) shall not have authority to award attorneys’ fees or costs to either Party, or each Party shall accordingly bear its own attorneys’ fees, costs and expenses incurred in the resolution of any dispute under this Agreement.

21. SURVIVAL

Notwithstanding anything herein contained in this Agreement, the provisions of clause 7, 8,10,11 shall survive the completion of the Term of this Agreement or the Termination of this Agreement, as the case may be.

IN WITNESS HEREOF, and intending to be legally bound, the parties have executed this Agreement to make it effective from the date and year first written above.

For CUSTOMS For___________

________________

(Authorized Signatory) (Authorized Signatory)

Name: Name:

Title: ___________________ Title:______________

WITNESSES: WITNESSES:

1. 1.

Annexure-1

CSP INTEGRATION METHODOLOGY

INTRODUCTION

The CUSTOMS Suvidha Providers (CSPs) are envisaged to provide innovative and convenient methods to trader/s and other stakeholders in interacting with the ICEGATE Systems for activities e.g electronic filing of the Bill of Entry (import goods declaration), Shipping Bills (export goods declaration), e-Payment of Customs Duty, and so on and so forth, as permitted by the CUSTOMS Act and Rules.

The CSPs shall be free to adopt any business model with the Third-Party /Traders as may be suitable to it.

Below are few of examples of use cases for CSPs (indicative and not exhaustive):

a) CSP providing services from a portal similar to the ICEGATE System Portal, with additional and innovative user interface as compared to ICEGATE Portal – this will be the value add that the CSP will offer to his end user.

b) CSP providing Mobile Apps to users that shall offer functionality similar to the ICEGATE portal.

c) CSP providing Accounting software/ERP having complete accounting features as well as functionalities like upload statutory/mandatory documents and pay duties, submitting enquiries etc ICEGATE System.

d) CSP providing only access to APIs provided by CUSTOMS.

e) CSP providing enriched API like Bulk uploading of IGM/EGM, conversion of data formats (CSV to JSON, XML to JSON), latest HSN code custom duty rate, prepare IGM/EGM, and enquiries etc.

The potential stakeholders and prospective CSPs that fit the Use Cases described above for providing services are as follows:

1. Accounting Software providing companies like Tally, Swift, Fact etc.

2. ERP Solution providers like SAP, Oracle, Microsoft, Ramco, Cloud ERP service provider.

3. Startup and Small companies providing Import/Export solution for trader community, logistic service provider, supply chain companies etc

CSP Ecosystem Approach:

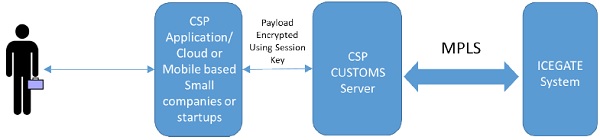

1. CUSTOMS will provide the API only through MPLS to the CSPs. This is to ensure that the ICEGATE System is only open to trusted/secure and registered CSP systems thus reducing threat of attacks. It will also ensure that there is no single point of failure in case of DOS type of attacks as there will be many CSPs through which our services will still be accessible.

2. To Authenticate/Authorize CSP, every CSP will be provided a unique license key and ability to generate more sub license keys. Through sub license keys CSP could provide controlled access of APIs to Application providers who shall have agreements /relationships with the CSPs as their partners.

3. Providing Trader/s complete control, security and privacy, while interacting with ICEGATE System through any channel (portal or API).

(i) In case of Portal, Trader will authenticate himself on the Portal by providing userid /password and his data will travel encrypted using https channel.

(ii) In case of API access, Trader will also authenticate by providing userid, OTP. The communication will again be encrypted, with a symmetric session key that will be shared between CSP Application and ICEGATE System electronically during session initiation.

(iii) Trader shall have the flexibility and option to anytime choose not to use API access of CSPs by simply logging in to ICEGATE portal and uncheck option. This shall afford the trader the independence of choice.

4. Trader can also choose a long time session in case CSP application wants to interact regularly with ICEGATE System without providing OTP for each session.

Process of Self Registration: CSP

- CUSTOMS will provide a Registration Form on the ICEGATE Portal to apply for CSP license.

- After initial verification, CSP will be intimated to submit Agreement copy with relevant document.

Process of Issue of License Key: CSP

- Upon execution of the Agreement, userid and password will be shared with CSP.

- CSP will then login in to the ICEGATE Portal and generate a unique license key.

- CSP can also generate sub license key for third party or for its own different application.

- CSP will also be able to get all API Documentation, API usage details etc. through this portal.

Flow of Authentication/Authorization:

- Before using any CUSTOMS API, CSP Application has to first Authenticate with ICEGATE System and obtain a token and session key for communication. Below figure explain the process:

Figure 1 Authentication of CSP App User

- After this step CSP Application user will have token, which will provide CSP Application user access to any CUSTOMS API for a typical session time (of say 20 -30 minutes) and a symmetric session key for encrypting API payload.

- In case Trader want long session without authenticating through OTP, CUSTOMS is also providing an API to automatically renew token and session key without OTP. Details of it is as below:

Using above mechanism, CSP User can get fresh token and session key without OTP/Trader intervention, and this can only be done until the time specified by Trader on the ICEGATE portal.

Illustrative realization of above-mentioned Use Cases:

Use Case 1 and 2:

- CSP providing portal like ICEGATE with some innovative and different user interface.

- CSP providing Mobile Apps having functionality similar to portal.

Use Case 3:

- CSP providing Accounting software/ERP having complete accounting features as well as functionalities like upload statutory/mandatory documents and pay duties, submitting enquiries etc ICEGATE System.

Use Case 4:

CSP providing only access to APIs provided by CUSTOMS.

Use Case 5:

CSP providing enriched API like Bulk uploading of IGM/EGM, conversion of data formats (CSV to JSON, XML to JSON), latest HSN code custom duty rate, prepare IGM/EGM, and enquiries etc.

Using above solution approach where CSP is only interacting with ICEGATE system using a nimble application (CSP-ICEGATE Server), which only expose API to outside world and send/receive encrypted information to ICEGATE system.

Roles and Responsibilities, Do’s, and Don’ts: CSP

Roles and Responsibilities, Do’s, and Don’ts: CSP

a) CSP shall connect to ICEGATE System through MPLS. API consumption to be measured at CSP and CUSTOMS end to assess usage for billing purpose.

b) All third-party partners of CSP shall connect to and aggregate to CSP

c) Third-Party partners of CSP or CSP’s applications (Portal, App, Accounting Application) shall not integrate with ICEGATE System directly.

d) CSP could offer CSP Services (value added services) through additional APIs in form of additional enrichment features to end Traders. (Refer Use Case 5).

e) CSP or their third party may bill the traders for the value-added services.

f) CSP is responsible to inform end user, either itself or through its third-party partners, about

data privacy, encryption, authorization features provided by CUSTOMS and its compliance to those features.

g) CSP will ensure security, privacy and integrity of data travelling from end user application to its system.

Annexure 2: (Charges & Payment)

(Note: Deliberately left blank, Charges & payment to be decided by CUSTOMS later, refer to agreed clause 6 of the Agreement.)

Annexure 3: (GSP’s Pre-requisites)

CSP hereby acknowledges and confirms that it meets all the following pre-requisites, for the purpose of entering into this Agreement with CUSTOMS:

In case any contents of this Annexure is found to be alse/misleading/misrepresented/fabricated etc. then, notwithstanding anything contained in the Agreement, CUSTOMS shall be entitled to forthwith terminate the Agreement without any notice to the CSP. The aforesaid termination shall be without any prejudice to any other rights and/or remedies which CUSTOMS may have under the applicable laws and this Agreement.