Q.1 What is Form 35?

If you are aggrieved by an order of an Assessing Officer (AO), you can file an appeal against the same before the Commissioner of Income Tax (Appeals) by submitting duly filled Form 35 online on the e-Filing portal.

Q.2 Who can use Form 35?

Any assessee / deductor who wants to prefer an appeal against the Order of an AO can use Form 35.

Q.3 Is there a fee for filing Form 35?

Every appeal is accompanied by payment of an appeal fee which is required to be paid before filing of Form 35. The quantum of appeal fees is dependent on the total income as computed or assessed by the AO.

Q.4 What is the time period within which Appeal can be filed before CIT (A)?

The assessee has to file Appeal within 30 days from the date of service of order or demand as the case may be.

Q.5 Can an Appeal be filed after 30 days?

Income Tax Law has provided a period of 30 days for filing Appeal before CIT (A). However, in exceptional cases where assessee has reasonable cause, due to which he is not able to file Appeal within prescribed time, then CIT (A) has power to condone the delay.

Q.6 What is the fee payable at the time of filing an Appeal with CIT(A)?

Fees to be paid before filing an Appeal to the CIT (A) depends upon total income determined by the Assessing Officer. Fees as under are to be paid and proof of payment of fee is to be attached with Form:

| Total Income Determined by the AO | Appeal Fee |

| Assessed total income ₹1 Lakh or less | ₹250 |

| Assessed total income more than ₹1 Lakh but not more than ₹2 Lakhs | ₹500 |

| Appeals involving total assessed income more than ₹2 Lakhs | ₹1000 |

| Appeals involving any other matter | ₹250 |

Q.7 Against which orders can appeals to CIT (A) be made?

Appeal can be filed before CIT(A), when an assessee is adversely affected by Orders passed by various Income tax authorities. Section 246A of the Income Tax Act lists the appealable orders. Some of the orders against which appeal can be preferred are listed below:

- Intimation issued u/s 143(1) making adjustments to the returned income

- Scrutiny Assessment Order u/s 143(3) or an ex-parte Assessment Order u/s 144, to object to income determined or loss assessed or tax determined or status under which assessed

- Re-assessment Order passed after reopening the assessment u/s 147/150

- Search Assessment Order u/s 153A or 158BC

- Rectification Order u/s 154 /155

- Order u/s 163 treating the taxpayer as agent of a Non-Resident etc.

1. Overview

Form 35 is available for use to any assessee / deductor aggrieved by an order of the Assessing Officer (AO). In such a case, the appeal can be filed against the order of the AO before the Commissioner of Income Tax (Appeals) using Form 35. e-filing of Form 35 has been made mandatory for persons for whom e-Filing of return of income is mandatory. For persons for whom e-Filing of Return of Income is not mandatory, Form 35 can be filed either in electronic form or paper form. An appeal is required to be filed along with Memorandum of Appeal, statement of facts and the grounds of appeal and should be accompanied by a copy of the order appealed against and the notice of demand

2. Prerequisites for availing this service

- Registered user on the e-Filing portal with valid user ID and password

- Valid Digital Signature Certificate (DSC) registered on the e-Filing portal, which is not expired if the Return of Income is required by verified using DSC. In any other case, EVC

3. About the Form

3.1 Purpose

If you are not satisfied with the order passed by your AO and aggrieved with respect to any additions, disallowances, reduction of benefits, exemptions, benefit of losses, you may file an appeal with the Commissioner of Income Tax (Appeals) using Form 35.

3.2 Who can use it?

Any assessee / deductor can use Form 35. Every appeal is accompanied by payment of an appeal fee which is required to be paid before filing of Form 35. The quantum of appeal fees is dependent on the total income as computed or assessed by the AO.

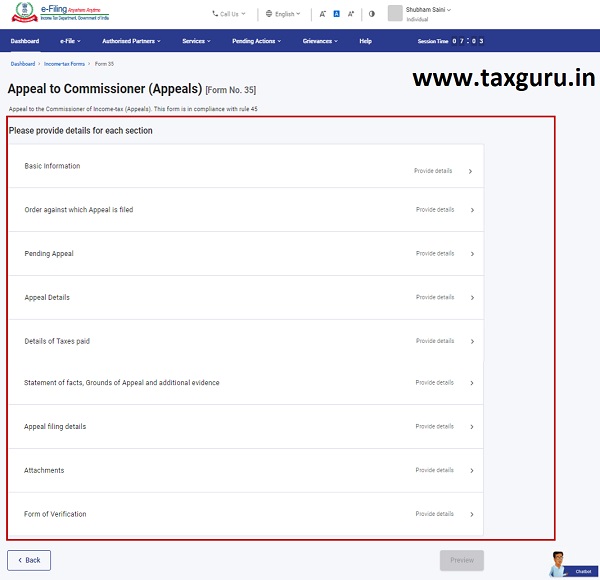

4. Form at a Glance

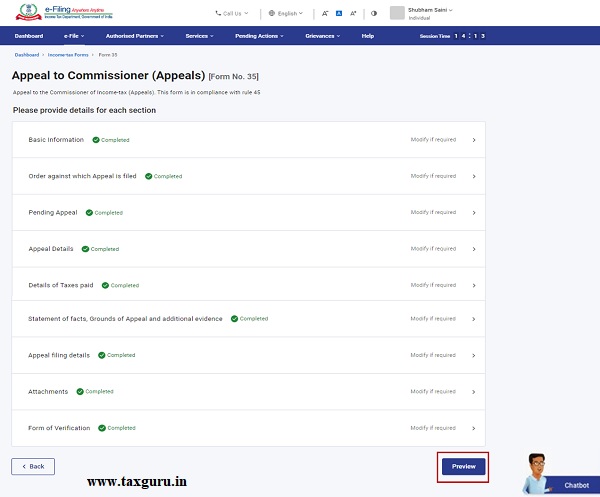

Form 35 has nine sections that you need to fill before submitting the form. These are:

- Basic Information

- Order against which Appeal is filed

- Pending Appeal

- Appeal details

- Details of taxes paid

- Statement of facts, Grounds of Appeal and additional evidence

- Appeal filing details

- Attachments

- Form of Verification

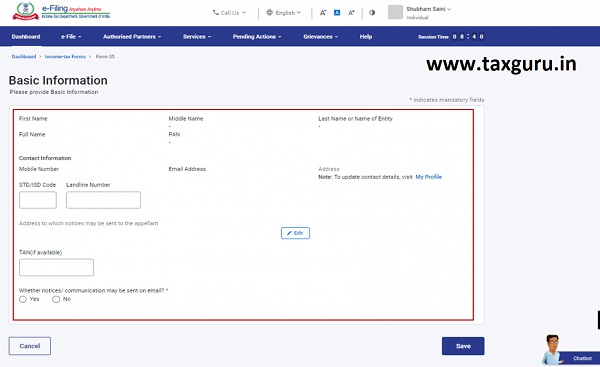

4.1 Basic Information

The Basic Information page is where you can review your personal information, including PAN and contact details. Contact details are prefilled in the Form.

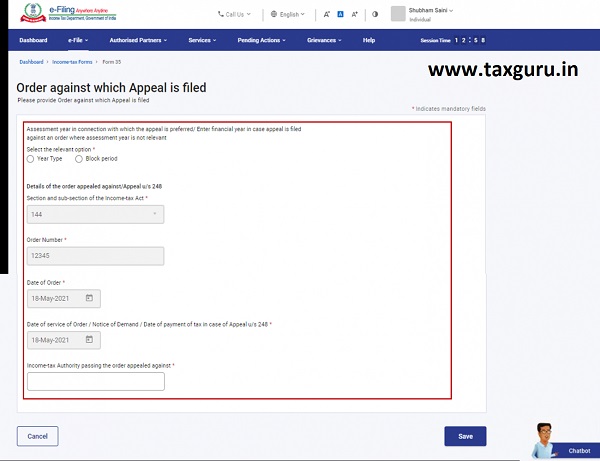

4.2 Order against which Appeal is filed

In the Order against which Appeal is filed page, you provide details of the Section and sub-section of the Income Tax Act and the order number.

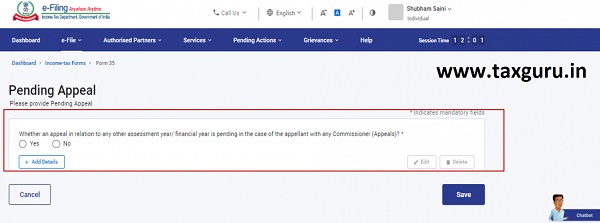

4.3 Pending Appeal

The Pending Appeal section provides details of your pending appeal, if any, from a previous Assessment Year (AY). You have the opportunity to review the information and edit as needed.

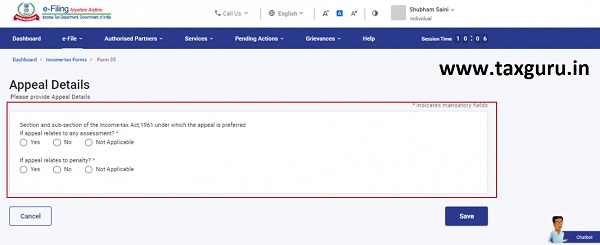

4.4 Appeal Details

In the Appeal Details page, you can state if the appeal is relevant to assessment or penalty levied by the Income Tax Department.

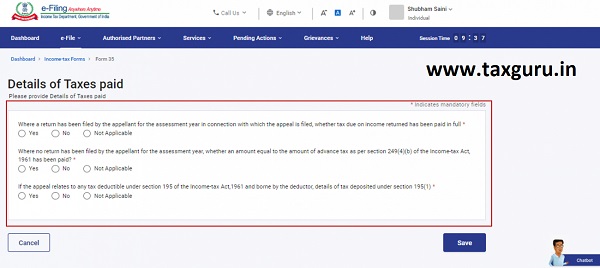

4.5 Details of Taxes

The Details of Taxes paid page is where you provide details of tax you have paid for the AY.

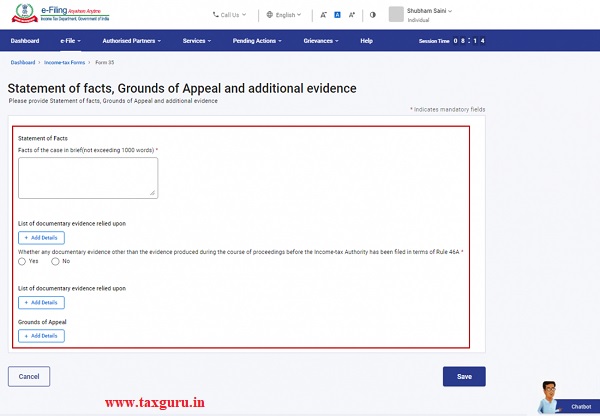

4.6 Statement of facts, Grounds of Appeal and additional evidence

On the Statement of facts, Grounds of Appeal and additional evidence page you can provide the facts of your case in a short paragraph and on what grounds you are filing an appeal.

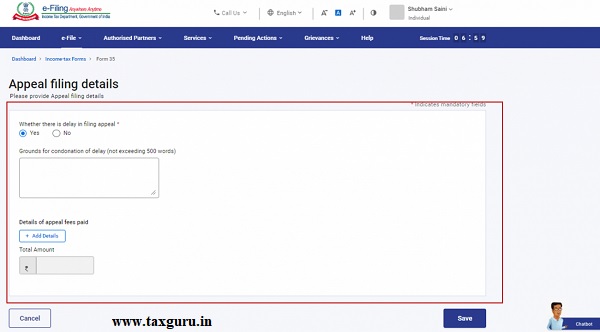

4.7 Appeal filing details

The details of petition condonation (if there was a delay in filing the petition) and appeal fees is provided on the Appeal filing details page.

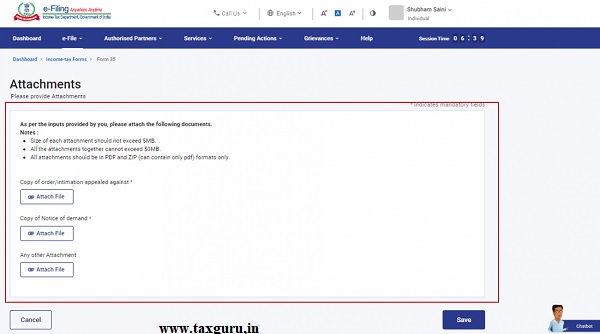

4.8 Attachments

In this section, attach a copy of the order appealed against and the notice of demand.

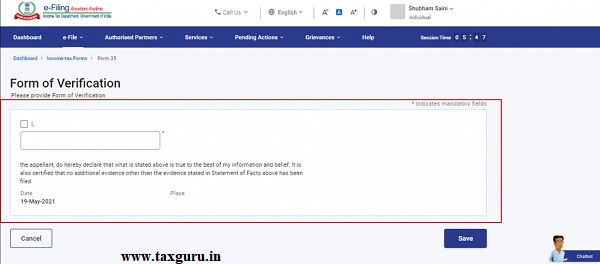

4.9 Form of Verification

Form of Verification page is a declaration from the assessee filing Form 35.

5. How to Access and Submit

You can fill and submit Form 35 through the following methods:

- Online Mode – through the e-Filing portal

- Offline Mode – through the Offline Utility

Note: Refer to the Offline Utility (Statutory Forms) user manual to learn more.

Follow the below steps to fill and submit Form 35 through online mode.

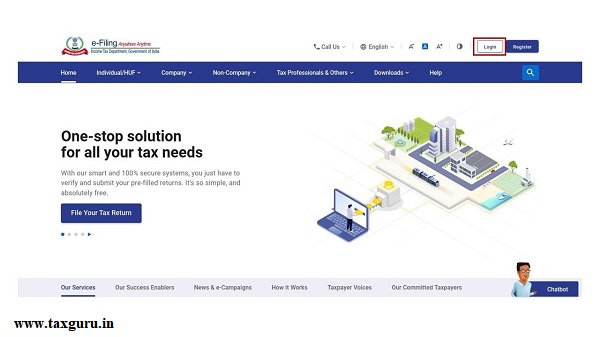

Step 1: Log in to the e-Filing portal using your user ID and password.

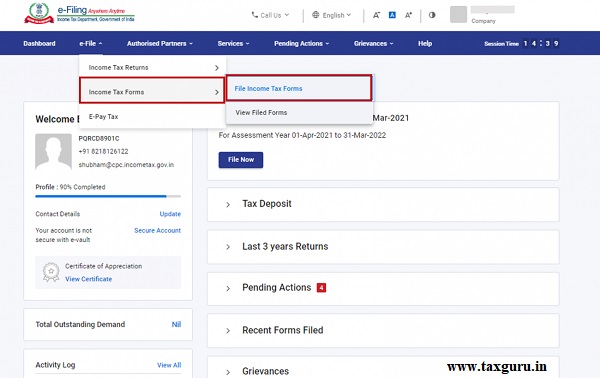

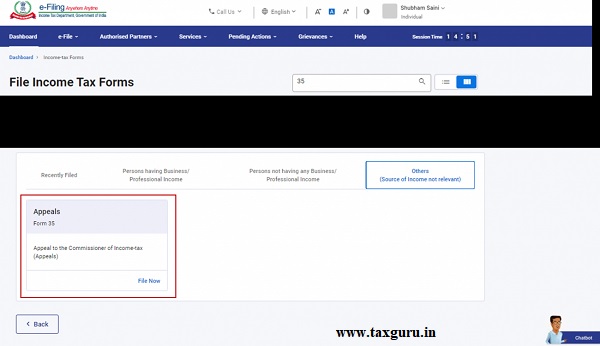

Step 2: On your Dashboard page, click e-file > Income tax forms > File Income Tax Forms.

Step 3: On the File Income Tax Forms page, select the Form 35. Alternatively, enter Form 35 in the search box to file the form

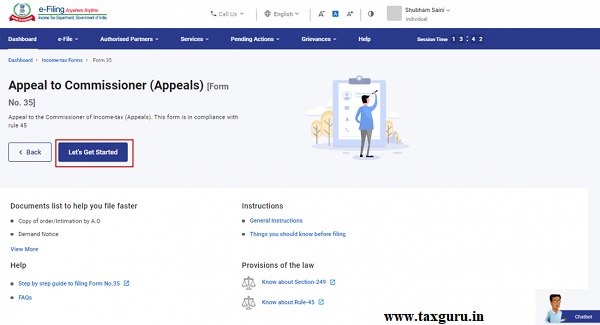

Step 4: On the Instructions page, click Let’s Get Started.

Step 5: On click of Let’s Get Started, Form 35 is displayed. Fill all the required details and click Preview.

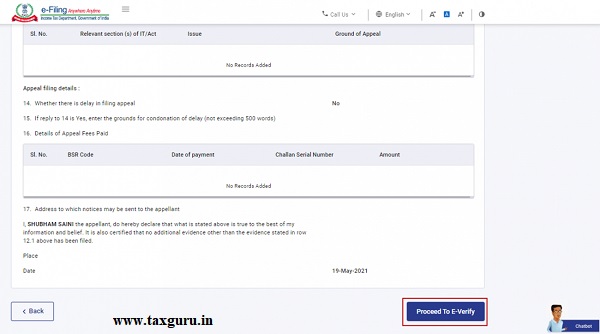

Step 6: On the Preview page, verify the details and click Proceed to e-Verify.

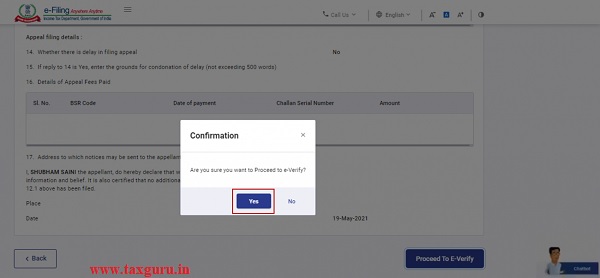

Step 7: Click Yes to submit.

Step 8: On clicking Yes, you will be taken to the e-Verify page.

Note: Refer to the How to e-Verify to learn more.

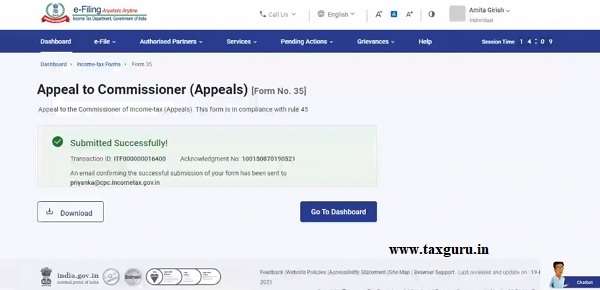

After successful e-Verification, a success message is displayed along with a Transaction ID and Acknowledgement Receipt Number. Please keep note of the Transaction ID and Acknowledgement Receipt Number for future reference. An email confirming successful submission of your form is sent to the email ID and mobile number registered with the e-Filing portal.

There is no notice of demand in order U/s 143)1) as there is no demand but refund. How can we attach notice of demand and how to file appeal in this case?

I have filed form 35 appeal for for my refund US 89. yet not not reply received from IT Authroity.

Although the order appealed against and demand notice are in pdf format of less than 5MB, they are not getting attached and show error when attempted

Good response.

I am facing problem while fling Form 35 on 13.4.22, Attachments are filed in PDF form not more than 5 MB. But while submitting pds less than 5 MB “error” is shsown. What is meaning of such error and how it can not be rectified.

Whether original intimation u/s 143(1) and Rectified order u/s 154 can not be filed at a time.

warning

Error : Please enter DIN as Section selected by you at Field 2(a) is other than ‘195’ and Date of Order is on or after 01st October, 2019

How to fix this error??

when i am filling details in Order against which Appeal is filed, DIN required to fill and in your screens order number showing, when i am putting DIN from assessment order, they are showing error that :

warning

Error : Please enter DIN as Section selected by you at Field 2(a) is other than ‘195’ and Date of Order is on or after 01st October, 2019

there is also no full space to fill entire DIN, AND BSR CODE NOT captured 0 please help.

I am also facing the same issue… and also some other issues

1. BSR code – starting with Zero eg. 0035625 – zero not accepted then error showing – 7 digits required

2. Copy and paste grounds from word to website not saved… so many times i tried and finally saved.

3. I want to know how to give documentary evidences details in website – that page not explained in your articles – please help to solve this issue – you can can send mail personally…

Thank you in advance

When i am filling details in Order against which Appeal is filed, DIN required to fill and in your screens order number showing, when i am putting DIN from assessment order, they are showing error that :

warning

Error : Please enter DIN as Section selected by you at Field 2(a) is other than ‘195’ and Date of Order is on or after 01st October, 2019

there is also no full space to fill entire DIN, please help.

I am also unable to enter DIN number. Any solution?

when i am filling details in Order against which Appeal is filed, DIN required to fill and in your screens order number showing, when i am putting DIN from assessment order, they are showing error that :

warning

Error : Please enter DIN as Section selected by you at Field 2(a) is other than ‘195’ and Date of Order is on or after 01st October, 2019

there is also no full space to fill entire DIN, AND BSR CODE NOT captured 0 please help.

Hi,

While filing form 35 I’m facing the same DIN as raised in other request. Kindly provide an alternative or guide through the resolution for same.

Thank You

The portal is not accepting the DIN of the assessment order against which appeal is being filed.

the portal is not taking all the characters of DIN, so I am unable to file an appeal, is there any solution for that

attachment of order, demand notice is not possible

when i am filling details in Order against which Appeal is filed, DIN required to fill and in your screens order number showing, when i am putting DIN from assessment order, they are showing error that :

warning

Error : Please enter DIN as Section selected by you at Field 2(a) is other than ‘195’ and Date of Order is on or after 01st October, 2019

there is also no full space to fill entire DIN, please help.