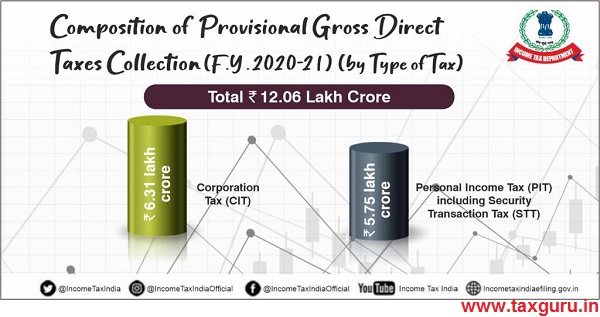

Gross Direct Taxes collected during FY 2020-21 (before adjustment of refunds) are approximately Rs. 12.06 lakh crore (provisional). The major contributors : Corporation Tax (CIT) Rs. 6.31 lakh crore & Personal Income Tax (PIT) Including Security Transaction Tax (SIT) Rs. 5.75 lakh crore approximately.

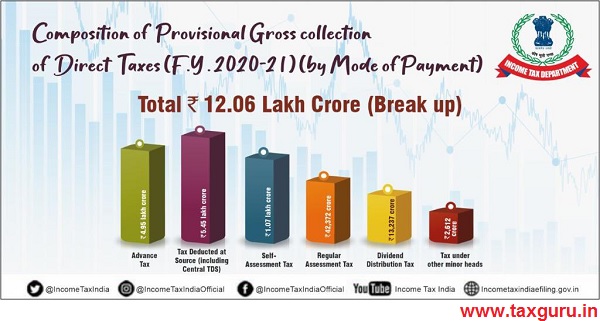

Here is the composition of the Gross collections of Direct Taxes (provisional) for FY 2020-21.

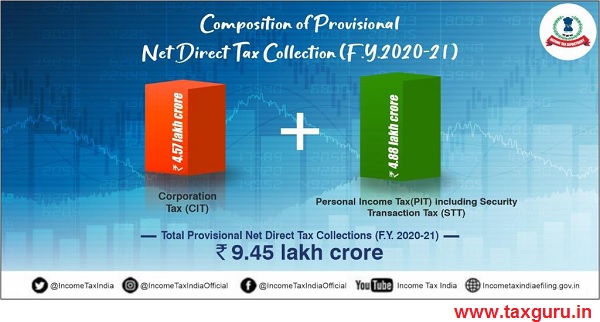

Net Direct Taxes collected during FY 2020-21 are approx. Rs. 9.45 lakh crore (provisional). Net collections are 104.46% of the Revised Estimates of Rs. 9.05 lakh crore. The major contributors : Corporation Tax (CIT) Rs. 4.57 lakh crore & Personal Income Tax (PIT) Including Security Transaction Tax (SIT) Rs. 4.88 lakh crore approx.

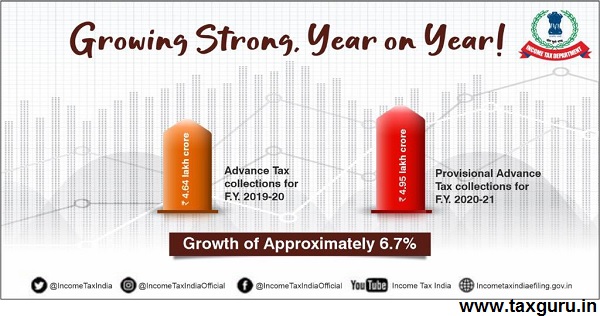

Despite a challenging year due to the COVID-19 pandemic, Advance Tax collections show a growth of almost 6.7% y-o-y.

Keeping in mind the difficult times faced by our taxpayers, pending refunds were issued expeditiously. Refunds of approximately Rs. 2.61 lakh crore were issued in FY 2020-21 marking an increase of almost 42% over the preceding year.