Before understanding what is compound financial instruments we have to understand what is the Financial Instruments. Under the earlier GAAP there were no guidance on Financial Instruments except for Accounting Standard 13 ‘Accounting for Investments’ and Accounting Standard 11 ‘The Effects of Changes in Foreign Exchange Rates’. In order to comply with the Ind As requirements MCA notifies following Ind As to deal with accounting of Financial Instruments :

Ind As 109 – Financial Instruments

Ind As 32 – Financial Instruments: Presentation

Ind As 107 – Financial Instruments: Disclosures

The above Ind As covers all the aspects. Compound Financial Instruments are also part of these topics.

What are Financial Instruments ? Financial Instruments is any contract that gives rise to a Financial Asset of one entity and a Financial liability or equity instrument of another entity.

What are Compound Financial Instruments ? Instruments which have features of both Financial Liability and Equity Instruments are called as “Compound Financial Instruments”. An example would be a bond that can be converted into shares. It doesn’t matter whether the bondholders will ultimately opt for conversion.

Accounting of Compound Financial Instruments :

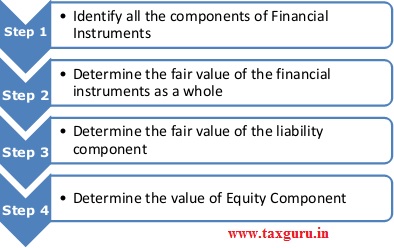

Ind As 109 deals with the measurement of financial assets and financial liabilities. Equity instruments are instruments that evidence a residual interest in the assets of an entity after deducting all of its liability. Therefore, when the initial carrying amount of compound financial instruments is allocated to its equity and liability components:

The equity component is assigned the residual amount i.e.

> Fair value of the instrument as a whole less;

> The amount separately determined for the liability component.

The sum of the carrying amounts assigned to the liability and equity components on initial recognition is always equal to the fair value that would be ascribed to the instrument as a whole.

No gain or loss arises from initially recognizing the components of the instruments separately

Examples of Compound Financial Instruments :

1. 6% Optionally Convertible Debenture

X ltd (issuer) has issued 6% p.a. debentures to Y Ltd. (holder) for a consideration of Rs. 30 lakhs. The holder has an option to convert these debentures to a fixed number of equity instrument of the issuer anytime up to a period of 3 years. If the option is not exercised by the holder, the debentures are redeemed at the end of 3 years. The prevailing market rate for similar debentures without the conversion feature is 9% p.a.

The instrument has two components – (1) Contractual obligation that is conditional on holder exercising his right to redeem, and (2) conversion option with the holder.

The first component is a financial liability because the entity does not have an unconditional right to avoid delivering cash. The other component, conversion option with the holder, is an equity feature.

The values of liability and equity component are calculated as follows:

Present value of principal payable at the end of 3 years (Rs. 30 Lakhs discounted at 9% for 3 years)= Rs. 23,16,550.

Present value of interest payable in arrears for 3 years (Rs. 1,80,000 discounted at 9% for each of 3 years) = Rs. 4,55,632

Total financial liability= Rs. 27,72,182.

Therefore, equity component= fair value of CFI, say Rs. 30 Lakhs less financial liability component i.e. Rs. 27, 72,182=Rs. 2, 27,818.

In subsequent years the profit is charged with interest of 9% on the debt instrument.

2. 9% Preference shares with partial conversion and partial redemption

Company M has issued 10,000 9% Preference shares having face value Rs. 100 each with mandatory dividends and mandatory conversion of 50% preference shares into equity and balance 50% redemption at the end of 3 years from the date of issue. Market rate for Preference shares with similar credit status and other features except the conversion feature is 12%p.a.

The preference share has two components – (1) Contractual obligation for payment of mandatory dividend and mandatory redemption of 50% Preference shares. (2) Mandatory conversion of 50% Preference shares into equity.

The first component is a financial liability because the same consist of contractual obligation to pay cash and the entity does not have an unconditional right to avoid delivering cash.

The second component is equity since there is mandatory conversion into equity shares, which, in substance, signifies that the amount for the equity is already prepended even before receiving the shares in reality.

The values of equity and liability components are calculated as follows:

Present value of Principal payable at the end of the 3 years (Rs. 5,00,000 discounted at 12% for 3 years)= Rs.3,55,890.

Present value of contractual obligation to pay dividends in arrears for 3 years (Rs. 90,000 discounted at 12% for 3 years) = Rs. 2,16,165

Total financial liability= Rs.5, 72, 055.

Therefore, equity component= fair value of CFI, say Rs. 10,00,000

less financial liability component i.e. Rs. 5,72,055=Rs. 4,27,945.

Subsequent year‟s profit and loss account is charged with interest amortisation at 12% on the financial liability component and dividend expense of Rs. 90,000 each.

The move towards substance over form and fair value accounting is fairly reflected with the introduction of the concept of compound financial instrument

IF Interest rate (13%)is higher than discounting rate (9%) , then also Split accounting will be done?

As per my understanding there will be no split accounting as there is no benefit

informative article.. Nice

Thanks

very beautifully explained….