HRA is covered under Section 10(13A) of Income Tax Act 1961. Salaried Employees who live in a Rented house can claim HRA to lower their taxes – partially or wholly. The decision of how much HRA needs to be paid is made by employer. Part of Salary is apportioned to HRA.

1. CONDITIONS FOR CLAIMING HRA EXEMPTION?

– Salaried Individual only can claim HRA.

(Self employed cannot claim HRA. However Self Employed can also claim deduction of Rent paid under Section 80GG of Income Tax Act 1961.)

– Stay in Rented Accommodation

(Not living in a self owned).

– Rent paid exceeds 10% of Salary.

– HRA is a part of Salary.

(Can be seen in Form 16(B) Sr.no. 2 (e).)

– Not paying rent to spouse.

2. HOW MUCH DEDUCTION CAN BE TAKEN?

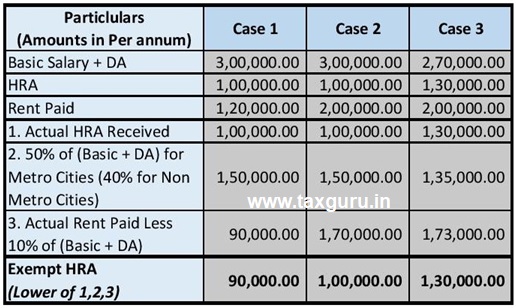

Deduction available is least of the following:

i. Actual HRA Received.

ii. 50% of (Basic salary + DA) for living in Metro Cities (40% for Non Metro Cities).

iii. Actual Rent paid less 10% of Basic Salary + DA

Let us understand with the help of some Examples below:

3. DOCUMENTATION IN CASE OF SUBMITTING PROOF TO EMPLOYER?

1st: Rent Receipt provided by the Landlord.

Note: If Total Annual Rent paid is more than Rs. 1,00,000/- than PAN

Number of Landlord is Mandatorily to be mentioned.

(If PAN Number is not provided by the Landlord then take a Declaration from the landlord of not holding the PAN Number).

2nd: Rent agreement should be furnished if demanded by the employer.

3rd: It is always advisable to pay rent by Cheque or by electronic payment mode.

4. Can Mr. XYZ claim HRA by paying rent to family members?

YES! HRA can be claimed by paying Rent to Parents.

Following steps needs to be taken:

- Mr. XYZ needs to be make rent agreement with the Parents.

- He can pay rent to the parents and claim benefit.

- He needs to transfer money to their bank account.

- Parents have to show that Income as Rental Income in Tax return filing.

Please Note: That HRA cannot be claimed by paying rent to spouse.

5. FREQUENTLY ASKED QUESTIONS?

- HRA Exemption and Home Loan Deduction, Can both be claimed? – Yes.

- Two Rented houses in Two different Locations. Can HRA be claimed for Both? – No, Only for ONE House.

- Rent Receipt Required? – Yes, if rent is above Rs. 5000/- per month.

- HRA includes Electricity/Maintenance Charges? – No it only includes Rent paid.

- Does a tenant have to pay TDS on the rent paid to landlord? – Yes TDS @5%, under section 194IB if Rent exceeds Rs. 50,000/- per month.

sir an Govt employee can show his rent paid receipt from working place or other place

Sir, I required an information regarding and Employee earning HRA and reimbursement of Rent paid by Company for eg. HRA 50000*12 = 6 lakh and reimbursement house rent is 22000*12=264000 ?

Hi, If my parents are staying in a different city in a rented house and I am paying the rentals on behalf of my parents (who are dependant on me). Can I claim HRA on such rental paid for my dependant parents?

IF I AM STAYING IN BENGALURU IN MY OWN HOUSE AND IF MY FAMILY MEMBERS ARE STAYING AT HYDERABAD CAN I CLAIM HRA EXEMPTION

Can I claim HRA Exemption under section 80GG if my company has provided accomodation and I am paying rent for accomodation provided to my parents back in home town.

उपयोगी जानकारी

Is there any limit of amount to be paid as rent to parents

Is there any limit on the amount of rent can be paid against a property to parent?