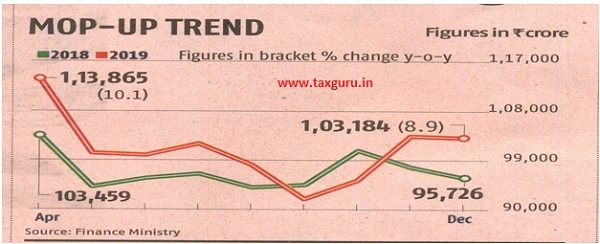

The gross GST revenue collected in the month of December. 2039 is Rs. 1,03,184 crore of which CGST is Rs. 19,962 crore, SGST is Rs. 26,792 crore, IGST is Rs. 48,099 crore (including Rs. 21,295 erore collected on imports) and Cess is Rs. 8,331 crore (including Rs. 847 crore collected on imports). The total number of GSTR 3B Returns filed lor the month of November up to 31st December, 2019 is 81.21 lakh.

CBIC has for the first time provided state wise GST Collections in public domain. This shown a 16% growth in year on year collection in December, 2019.

YoY growth in GST revenue in December, 2019 is @ 9% (6% is November, 2019). Besides stiff targets to field formations, Government’s measures to improve collection have yielded results. The YoY growth in domestic GST collections is still much higher @ 16%. It we consider IGST also, it would be 9% wherein there is a negative growth of 10 percent.

Total GST Collections upto December, 2019 (Rs. in crores)

| Month | 2017-18 | 2018-19 | 2019-20 |

| April | – | 1,03,459 | 1,13,865 |

| May | – | 94,016 | 1,00,289 |

| June | – | 95,610 | 99,939 |

| July | 21,572 | 96,483 | 102083 |

| August | 95,633 | 93,960 | 98202 |

| September | 94,064 | 94,442 | 91916 |

| October | 93,333 | 1,00,710 | 95380 |

| November | 83,780 | 97,637 | 103492 |

| December | 84,314 | 94,726 | 103184 |

| January | 89,825 | 1,02,503 | – |

| February | 85,962 | 97,247 | – |

| March | 92,167 | 1,06,577 | – |

| Total | 7,40,650 | 11,77,369 | 908350 |

| Average | 89,885 | 98,114 | 100927 |

Fearing actions such as search & seizure, arrests, cancellation of registration and blocking of input tax credit can also be attributed as contributing factors. With e-invoicing and new returns, one can expect revenue leakage to be curbed, leading to increase in revenue. Tax evasion will also be curbed by more use of artificial intelligence, data analytics and other measures. The increased domestic tax collection also indicate that an efficient tax administration can bring in the desired difference. The focus now seem to be on plugging GST leakages and streamlining the GST system. Also, it would be too early to jump to a conclusion that the increase in revenue is indicative of any economic recovery.