Vinita Nair, Debolina Banerjee

Preamble –

A favourable turnaround in the Foreign Direct Investment (FDI) was expected after Reserve Bank of India (RBI) published its First Bi- monthly Monetary Policy Statement, 2014-15 dated 1st April, 2014. Point 24 of Part B of the Monetary Policy Statement 2014-15 distinctly stated that the regulatory authority has decided to withdraw all existing guidelines relating to valuation in case of any acquisition/sale of shares. Accordingly such transactions shall henceforth be based on “acceptable market prices” and that operating guidelines will be notified separately. Keeping in line with what was assured in the monetary policy statement, RBI vide RBI/2014-15/129 A. P. (DIR Series) Circular No. 4 dated 15th July, 2014 (Present Circular) issued the revised pricing guidelines for Issue or Transfer of Shares or Convertible Debentures for FDI in India.

RBI vide Notification No. FEMA. 306/2014-RB dated 23rd May, 2014, which was published in official gazette on 8th July, 2014 vide G.S.R. No. 435(E), amended the Foreign Exchange Management (Transfer or Issue of Security by a Person Resident outside India) Regulations, 2000 (Principal Regulations) to effect the change in existing regime governing the pricing guidelines for issue or transfer of shares or convertible debentures and for exit from investment in equity shares with or without optionality clauses , of listed/unlisted Indian companies to extend more freedom and flexibility to the FDI framework.

Pricing as per erstwhile provisions

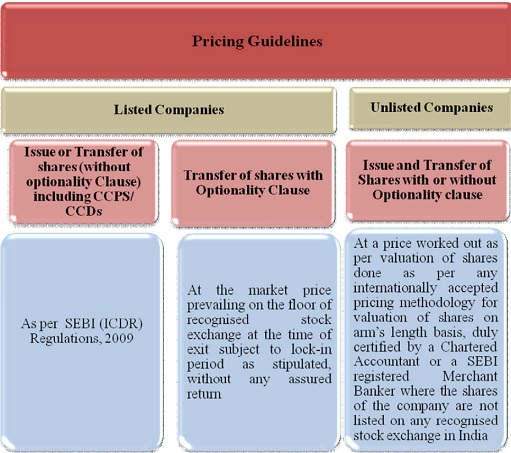

RBI amended the Schedule I of Principal regulations relating to Issue price for shares issued to person resident outside India. In case of Listed companies, the same was always governed by SEBI guidelines.

However, in case of unlisted companies earlier the Issue Price was regulated by valuation guidelines issued by Controller of Capital Issues and thereafter with effect from 21st April, 2010 price was arrived based on fair valuation done as per Discounted Free Cash Flow method by a SEBI registered Category I- Merchant Banker or a Chartered Accountant. The same has now been done away with.

Further, in case of transfer of shares with Optionality clause, the same was permitted subject to minimum lock-in period of one year or minimum lock-in period as prescribed under Annex-B of Schedule I of Principal Regulations, whichever was higher and without any assured return at below mentioned price:

• Listed Company – at Market Price

• Equity Shares of unlisted company- At a price not exceeding that arrived on the basis of Return on Equity (i.e. Profit after Tax/ Net Worth; Net worth = paid up capital + free reserves) as per last audited balance sheet.

• Preference shares or debentures of unlisted company- At a price not exceeding that arrived at as per any internationally accepted pricing methodology for valuation of shares on arm’s length basis, duly certified by a Chartered Accountant or a SEBI registered Merchant Banker.

Pricing as per Present Circular

Further, An Indian company taking on record in its books any transfer of its shares or convertible debenture by way of sale from a resident to a non-resident and a non-resident to a resident shall disclose in its balance sheet for the financial year, in which the transaction took place, the details of valuation of share or convertible debentures, the pricing methodology adopted for the same as well as the agency that has given/certified the valuation.

Thus, RBI has done away with the recommendation to compute price by a particular method and has thereby enabled the Chartered Accountant and the SEBI registered Merchant Bankers to choose any internationally accepted methodology for pricing. This is surely in line with what was assured in the policy statement.

[The above post is contributed by CS Vinita Nair and Debolina Banerjee at Vinod Kothari & Co. They can be contacted at vinita@vinodkothari.com and mt@vinodkothari.com respectively]

[1] http://www.rbi.org.in/scripts/BS_PressReleaseDisplay.aspx?prid=30911

[1] http://rbi.org.in/Scripts/NotificationUser.aspx?Id=9106&Mode=0

[1] http://rbi.org.in/Scripts/NotificationUser.aspx?Id=9105&Mode=0

[1]As permitted vide RBI/ 2013-2014/ 436 A.P. (DIR Series) Circular No. 86 dated 9th January, 2014 http://rbi.org.in/Scripts/NotificationUser.aspx?Id=8682&Mode=0

Here the issues are about Internationally Accepted Pricing Methodology, which is open, now everything is open and anyone can use their own methods and apply it according to their situations. again it will be an open area. Very difficult to justify with all govt. authorities like Income Tax, Companies Act & FEMA

What are the internationally accepted pricing methold. Companies face challenges in pricing of shared issued from variosu authorities e.g. ITO, RBI etc. So far based on a stipulated methold their concerns were addressed to some extent. In the absence of a stipulated method of determining the pricing, the substantiating the price before various regulatory authorities remain a chellange.