Note:

1. In this E-book, attempts have been made to explain „how to understand Bill of Lading / Airway Bill’. It is expected that it will help departmental officers in their day to day work.

2. Though all efforts have been made to make this document error free, but it is possible that some errors might have crept into the document. If you notice any errors, the same may be brought to the notice to the NACEN, RTI, Kanpur on the Email addresses: [email protected]. This may not be a perfect E-book. If you have any suggestion to improve this book, you are requested to forward the same to us.

3. If any officer is interested in preparing E-book on any topic relating to Customs, Central Excise or Service Tax, he may forward the E-book prepared by him to the Email addresses mentioned above. After necessary vetting, we will include the same in our E-book library for benefit of all Departmental officers.

4. The matter in this e-Book is based on variety of sources including material freely available on Internet/Websites. The purpose of this e-Book is primarily education and training. It is not our intention to infringe any copyrights. However, if anybody has any issue with regard to any of the material used in this e-Book, the same may kindly be brought to my notice on the email address mentioned above.

5. This e-book has been prepared with active assistance and contribution of Shri V. Jagannadh, Superintendent of Customs, Air Cargo, Delhi. We, at NACEN, appreciate his participation and willingness to prepare e-books so as to help fellow departmental officers in capacity building and upgrading their knowledge.

6. If you feel that this e-book has really helped you in improving your knowledge or understanding of the subject matter, we request you to take few minutes out of your precious time and provide us your valuable feedback. Your feedback is important and will help us in improving our e-books.

Sd/-

(C. P. Goyal)

Additional Director General,

NACEN, RTI, Kanpur

1. Introduction

1.1. In today‟s environment, where the volume of the goods being imported or exported is continuously increasing, the number of Customs officers to deal with such goods has remained same or decreased. Now, a Customs officer,no longer, has liberty to hold the goods for long time or to subject every consignment of imported /exported goods for detailed physical examination.

1.2. In such a scenario, it becomes all the more important for the Customs officers to have adequate expertise and knowledge to identify the high risk consignments on the basis of documents or on the basis of declaration made by an importer/exporter.

1.3. A Custom officer should always be aware of the fact that any smuggler/offender, howsoever smart he may be, would leave umpteen number of risk signs/signals (or red flags) while smuggling contraband/restricted goods. It is for the customs officers to understand these risk signs /signals and thwart any such attempts of smuggling of contraband into or out of the country. While doing their work, they should be alert and be attentive to details or risk signals.

1.4. Any smuggling syndicate or smuggler has few concerns. His major concern is nondisclosure of identity in case of consignment attempted to be smuggled being caught by the Customs Authorities. This concern leads to creating a web of layers in any import/export transaction, non–disclosure of details of recipient of goods till last moment, avoiding financial trail, payment of goods and freight charges in cash, assume identity of reputed firms for importation/exportation, use of non-existent addresses or use of dummy person‟s name and address for transaction, etc.

1.5. Another major concern is relating to the method of concealment used whether it is enough to outsmart the controls adopted by the Customs authority. The objective of concealment is to ensure that under normal circumstances, the Customs authorities should not be able to detect the concealment of goods. This concern forces them to study in great details about the volume of import/exports, availability of equipment and manpower available at different port/ICDs/CFSs, and making selection of port for importation/exportation and choosing type and extent of packaging to be adopted.

1.6. Other concerns are the extent of examination adopted by the Customs Authority, effectiveness of controls adopted by the Customs authority at the port of import or export, and integrity and knowledge of the officers posted at the port. At times, we hear about Port-hopping where smuggling syndicate suddenly shift their imports/exports from one Port to another. Sometimes, it is noticed that import/export goods being cleared from smaller Ports/ICDs/CFSs located far away from the place where importer is located without any economic justification for the greater inconvenience, higher transportation cost etc. Any such abnormal route adopted by smuggling syndicate should ring alarm bells in the mind of the Customs officer.

1.7. As a Customs officer, one should learn talking to the documents. Any Customs officer while scrutinizing documents should ask questions such as who?, why?, what?, where?, when?and how? If the document is not able to provide any coherent and consistent answers, it should raise doubts in the mind of the Customs Officer. Customs Officer should always ask one question while examining the documents or consignment i.e. IS IT NORMAL?

For example,

- Who is Shipper or consignor?

- Is he a regular shipper or first time shipper?

- Is the consignor a manufacturer or trader?

- Is the consignee a manufacturer or trader?

- Does Consignor have presence in virtual world? If not, why not?

- Who is the buyer or consignee or importer?

- Is it a regular importer of the goods in question from the port/ICDs/CFSs in the past?

- Is the importer first time importer?

- Is the importer a manufacturer importer or a trading company?

- Does the importer have a history of compliance?

- Does the importer have presence in virtual world? If not, why not?

- Whether the address declared by Importer has sufficient details? Or it lack details?

The above list of questions is not exhaustive, but indicative only.

2. Scope of this E-book

Now, in this e-book, attempt has been made to decipher an important document, known as Bill of Lading (in case of sea transport) or Airway Bill in case of transport of goods by Air. The Bill of Lading/Airway Bill is basically a transportation document and not a Custom document, but it is available to the Custom officer. Indeed, it is a crucial document from Custom‟s point of view as it provides lot of additional and important information, whichotherwise, is not available on Bill of Entry and rather difficult to manipulate.

3. What is Bill of Lading?

3.1. The Bill of lading (also referred to as B/L) is a document issued by the Carrier or its agent to the shipper of goods as a contract of carriage of goods. It is also a receipt for cargo accepted for transportation. It must be presented for taking delivery of the goods at the destination. The B/L serves as a proof of ownership or title of the cargo.

3.2. It may be issued either in a negotiable or non-negotiable form. In case of negotiable form, it may be bought, sold or traded or used as security for borrowing money. To be negotiable the B/L must states “to order”. The ownership of the cargo belongs to the person who is holding the negotiable bill of lading.

3.3. The Non-Negotiable Bill of Lading declares that the cargo is consigned to a specific person and is Non Negotiable. A B/L is required for settlement of all claims of compensation in case of any damage, delay or loss of cargo and for the resolution of disputes regarding ownership of the cargo. On the back of B/L, the rights, responsibilities and liabilities of the carrier and shipper are mentioned. These are governed by Hague Rules or by Hague-Visby Rules.

3.4. Revised /amended Bill of Lading can be issued if required by the shipper or consignee prior to vessel arrival at destination. The revision/amendment is always subject to additional B/L amendment fee.

3.5. Two terms i.e. Master Bill of lading and House Bill of lading are also commonly used in transportation of goods by sea. The Master Bill of Lading is a document of title issued by the carrier who will transport the cargo from the shipper to named destination. Acquiring possession of the master bill of lading is entitling possession of the goods. The House Bill of Lading is issued by the freight forwarder, NVOCC who arrange goods transportation with the carrier. NVOCC stands for Non Vessel Owning Common Carrier. NVOCC operation comprises of sales, stuffing and transport of the containers to gateway ports.

4. What is Airway Bill?

4.1. An air waybill (AWB) or air consignment note is a receipt issued by an international airline for goods and an evidence of the contract of carriage, but it is not a document of title to the goods ( unlike Bill of lading which is a document of title of the goods). Hence, the air waybill is non-negotiable.

4.2. The main functions of an air waybill serves are as under:-

- Contract of Carriage: Behind every original of the Air Way bill, conditions of contract for carriage are mentioned.

- Evidence of Receipt of Goods: When the shipper delivers goods to be forwarded, he gets a receipt. The receipt is proof that the shipment has been handed over in good order and condition and also that the shipping instructions, as contained in the Shipper’s Letter of Instructions, are acceptable. After completion, an original copy of the air waybill is given to the shipper as evidence of the acceptance of goods and as proof of contract of carriage

- Freight Bill: The air waybill may be used as a bill or invoice together with supporting documents since it may indicate charges to be paid by the consignee, charges due to the agent or the carrier. An original copy of the air waybill is used for the carrier’s accounting

- Certificate of Insurance: The air waybill may also serve as an evidence if the carrier is in a position to insure the shipment and is requested to do so by the shipper.

- Customs Declaration: Although customs authorities require various documents like a commercial invoice, packing list, etc. the Airwaybill too is proof of the freight amount billed for the goods carried and may be needed to be presented for customs clearance

4.3. The format of the air waybill has been designed by IATA and these can be used for both domestic as well as international transportation.

4.4 Difference between Air Way bill and Bill of Lading at a glance

Table

| Bill of Lading (B/L) | Airway Bill (AWB) |

| Negotiable | Non Negotiable |

| It is issued after the complete consignment has been boarded onto vessel | It is issued after the complete consignment has been received by the airline. |

| The vessel company is responsible for issuing B/L | The carrier is responsible for issuing AWB |

| Goods delivered to the Bearer of the Original Bill of Lading. | Goods delivered to a Specified person as mentioned in the Airway Bill. |

5. What Information is available on Bill of Lading/Airway Bill

5.1. Considerable additional informationis available on Bill of Lading (in case of sea transport) and Airway Will (in case of transport by Air), which, otherwise, in not available on the Bill of Entry/Invoice/Packing list Thorough knowledge and understanding of this document and relevance of information available on this document can enable the Customs officers in identifying high risk consignment and their decision to go for more closer look at the documents, check on past history of importer/supplier/CHA, or detailed examination of the goods.

5.2. Normally, the Bill of Lading gives the following information:-

(i) Routing of the consignment

(ii) Name of the vessel

(iii) Name and address of the shipper/Consignor

(iv) Name and address of the consignee/ name of notify party

(v) Place of receipt of goods/Port of loading/Port of Discharge/place of Delivery of the goods

(vi) Description of the goods

(vii) Marks and Number

(viii) Number and kind of packages

(ix) Gross Weight of the goods and volume of the goods

(x) Handling information

(xi) Declared value for carriage

(xii) Freight paid or to be paid

(xiii) Whether freight paid in cash

5.3. Close scrutiny of the Bill of Lading may indicate several high risk signals justifying closer scrutiny of the documents, or closer inspection of the cargo, or detailed examination of the cargo.

6. Risk indicators

A. Attempt to conceal the identity of Importer

6.1 For any smuggling syndicate or smuggler, prime concern is non-disclosure of identity in case of consignment being caught by the Customs authority. To address this concern, any smuggler may resort to any of the following methods:-

(i) Assuming identity of any well-known firm. In such cases, the documents are filed in the name of well-known firm by fraudulently using their name and IEC number. If such consignment is caught, then inquiry would reach dead end when the declared firm deny having imported the consignment in question.

(ii) By creating firm on the basis of false document and with fake address. IEC is also obtained on the basis of such false/fake documents.

(iii) By creating firms in the name of dummy person without their knowledge and later use these firms for fraudulent import.

The above list is not exhaustive, but only illustrative.

6.2 To find out any attempt to conceal the identity of recipient of the goods, carefully see the following:-

(i) Whether name of consignor or consignee have P. O. Box number given as address or address with insufficient details.

(ii) Whether Bill of Lading have any of the following instructions

- Hold for pickup

- Shipper will contact

- Hold pending further instructions

- Last minute declaration of the name of importer.

B. Profile of Persons/Companies Involved

6.3 With regards to importer, find answers to the following questions:-

- Is the consignee profile (e.g. small shop owner) consistent with expected legitimate end-use (heavy industrial process in case of industrial chemicals/high technology goods)?

- Does the recipient exist (e.g. is it a registered company, is there something at the address)?

- Is the recipient negatively known from your service, other services, licensing authorities?

- Is it a first time consignee or consigner?

C. Check the routing of the Consignment

6.4 From the Bill of lading, try to find out the Place of receipt of goods/Port of loading/Port of Discharge/place of Delivery of the goods. Under normal circumstances, one will try to obtain the goods through shortest direct route as longer circuitous route will result in higher cost of transportation and longer period of consignment delivery. For example, if a consignment originating from Sri Lanka first go to Jebel Ali, UAE and then comes to Chennai would be abnormal route for shipment from Colombo to Chennai port.

6.5 On the basis of study of routing of cargo, try to find answers to the following question:-

- See whether it is unusual routing of consignment.

- Is the shipping route viable?

- Is the shipment going to a temporary destination (free trade zone, customs warehouse, import-export company)?

6.6 If the answer is yes, then it becomes higher risk consignment requiring greater scrutiny of documents and detailed examination of the cargo.

D. Unusual Weight/Volume ratio of the goods

6.7 Commonly, three types of containerssize i.e. 20‟, 40‟ and 45‟ containers are commonly used in case of sea transport. Normally height of the container is 8‟6”, but high cube container has height of 9‟6”.

6.8 The details of Tare weight, max Gross Weight, Volume of the containers commonly used for sea transport are as given below:-

|

Sr. No. |

Type of container |

Dimension (in Feet) |

Weight (Kg) |

Volume (Cubic Meter) |

||||

|

Ht. |

Width |

length |

Tare wt |

Max |

Max |

|||

| General purpose container [steel container with corrugated wall and wooden floor] |

8‟ 6” |

8‟ |

20‟ |

2250 |

28230 |

30480 |

33.2 |

|

|

2. |

General purpose container [steel container with corrugated wall and wooden floor] |

8‟6” |

8‟ |

40‟ |

3780 |

26700 |

30480 |

67.7 |

|

3. |

General Purpose High Cube container [Steel container with corrugated wall and wooden floor] . |

9‟6” |

8‟ |

40‟ |

4020 |

26460 |

30480 |

76.3 |

|

4. |

General Purpose High Cube container [ Steel container with corrugated wall and wooden floor] |

9‟6” |

8” |

45” |

4950 |

29050 |

34000 |

88.4 |

Note: There is wide variety of containers available such as general purpose container, high cube container, hard top container, open top container, ventilated container, refrigerated container, tank container etc. Further, there are variation in internal dimension, tare Weight, max Gross Load depending upon ISO size type code: 22G0, 22G1, 22U6, 42G0,42G1, 42U6, 45G0, 45G1, L5G0, L5G1 etc.

6.9 The Bill of Lading has information about weight of the consignment as well as volume of the consignment. Some goods have very high weight/volume ratio such as metals. On the other hand, some goods have very low weight/volume ratio such as cotton, textile etc. Check whether weight /volume ratio is commensurate with the goods declared. If you find that the goods have light density, but having high weight /volume ration, then it is likely that the contents are mis-declared.

6.10 Check whether weight of container far exceeds the class of merchandise; or merchandise heavier or lighter than normal. This may help us in detecting any misdeclaration of the goods.

6.11 Except at major port, where wide varieties of goods are imported, at most of ICDs/CFS, only certain types of goods are imported. Officer may make a note of commodity-wise weight/volume ratio. If they observe any significant deviation from the average weight/volume ratio, then, they may decide to go for 100% physical examination of the cargo.

E. Method of Shipping

6.12 You might have noticed that nature of goods imported/exported by sea/air/post/courier is different. While high value and low volume goods are imported /exported through air, the high volume and low value goods are imported /exported through sea. Documents/samples/gifts/emergency medicines are commonly sent through post/courier.

6.13 Ask yourself a question as to whether method of shipping is common for the goods in question? For example, whether Shipping Scrap copper by Air is common? If you find something not normal, you may go for further scrutiny of documents or inspection of cargo to look for more risk sign/signals are present.

F. Description of the goods on the Bill of Lading/Airway Bill

6.14 With regard to description of the goods mentioned on the Bill of Lading/Air way bill, check the following:-

- Check whether description of the goods on the Bill of Lading/Airway bill, invoice, packing list etc. is the same as declared in the Bill of Entry.

- Check whether description of the goods on the Bill of lading/Airway Bill is too vague or too precise.Either vague description or very precise declaration is an indicator of high risk. For example, declaration of goods as mixed metal scrap is a vague description compared to the description of goods as copper scrap, brass scraps etc.

- In case of transport of hazardous/dangerous goods such as explosives, hazardous chemicals, other coding systems such as UN code and CAS code are used and mentioned on the shipping documents. The knowledge about UN coding system and CAS coding system, which are required to be mentioned on the shipping documents for the purpose of communication of various hazards (such as physical hazards, health hazards and environmental hazards) posed by such dangerous goods/chemicals can enable officer to detect any mis-declaration of goods at the time of custom clearance. [ Learn about UN Coding /CAS Coding system by reading e-book on UN Code/CAS Code/HS Code]

- In case of international trade in dangerous goods, check UN code/CAS code mentioned on the transportation document, invoice, packing list, individual package, and see the goods declared to customs in Bill of Entry ( which normally have description of goods, but no declaration of UN Code/CAS No.) have the same UN Code/CAS No. Also look at the Material Safety Data Sheet attached with the cargo (of dangerous good) to check any mis-declaration of goods in the Bill of Entry.

- In case of transportation of dangerous/hazardous goods by sea/air, the shipping lines/airlines are required to follow UN regulations for transport of dangerous goods. These regulations cast responsibility on the shipper as well as transport agencies with regard to communication of hazards to all the stake holders. This is necessary to ensure safety of public, property and environment. Declarations made on the shipping document including various pictograms in compliance with UN regulation may also enable officer to detect any attempt of smuggling of goods.

G. Origin of goods

6.15 Find answers to the following questions:-

- Known source countries for the commodity in question

- Goods not normally produced in the stated country of origin

Note: It has been observed that in case of imposition of anti-dumping duty, after imposition of antidumping duty, same goods starts coming from nearby countries with it’s Certificate of origin to avoid payment of anti-dumping duty.

H. Unusual Term of payment

6.16 Terms of payment can be an important indicator of high risk or suspect consignment. Following may enable customs officer to identify high risk consignment.

- Freight prepaid in cash [it may be indicator of an attempt to disguise/ avoid disclosure of the financial chain].

- Unusual payment condition for imported goods such as cash payment or paid in advance in cash or collected by seller in cash [ it may be indicator of an attempt to hide/conceal the financial chain with an aim to conceal the identity of real importer] .

- Very high payment of freight for low value goods.

- Low value and high volume goods imported through air or very high value and low volume goods being imported through sea.

I. Sign of undue haste

6.17 Behavior Analysis (or observation of any abnormal behavior) of the person dealing with custom clearance of the Cargo could be a good indicator of any suspected smuggling attempt. Smuggler does not want the contraband to remain in Custom area for long time and his concern is to clear the goods at the earliest or clear the goods at the odd time when either workload is too much or when there is lean presence of Customs officer.

6.18 See whether any symptom of undue haste / undue aggressiveness or undue submissive behavior on part of importer or his agent? If it is there, it is an indicator of some problem with the consignment. See whether any attempt by importer or agent pressing for release of goods. If so, be extra alert.

J. Packaging of Shipment

6.19 Carefully see the packaging of the consignment and try to answer the following questions.

- What do the labels indicate?

- Are safety makings (in case of dangerous goods) consistent with the product?

- Does the customs code match the description on the invoice and other commercial paper work?

- Is the packaging consistent with the practice for this product (e.g. bottles for what is usually transported in drums or scrap copper in Barrels etc.)?

K. Unavailability of certain documents normally available with consignment.

6.20 Check if documents normally accompanying invoice are missing such as detailed packing list in heterogeneous consignment, authencity certificate or user certificate?

L. Falsification of documents

6.21 Carefully look at the documents accompanying the goods for any sign of falsifying the documents. Any documentissued by any reputed company will have its logo and complete address on the document. Further, any Government issued documents will have specific pattern. Carefully look at the Certificate of Origin where duty benefitsunder Free Trade Agreement are being claimed. Make sure that it is in the notified format and is signed by notified officials of the Originating countries of the goods. The import /export documents, which are most likely to be falsified, are,-

- Invoice (Proforma and original)

- Bill of Lading

- Transit documents

- Origin certificate

- Certificate of Authencity

- Airway bills

- Letter of credit

- Manifest

- Import and Export Permits

7. Formats of Bill of Lading/Airway Bill

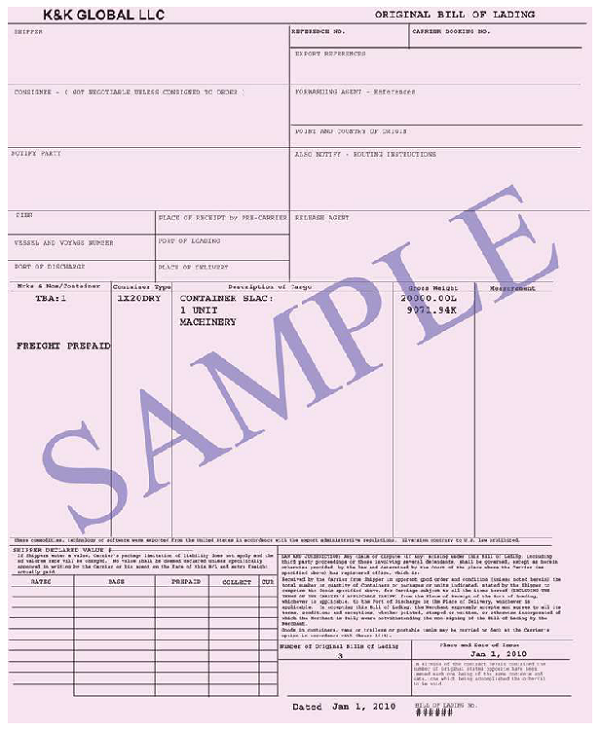

7. 1 Format of Bill of Lading

Explanation of the information contained in the Bill of Lading

1. Consignee: The person who is to receive the goods. Name, address, zip code, telephone, fax, email (person/company).

2. Loader/Exporter: Full name, address, post code, telephone, fax, email (person/company).

3. Lading No: Boarding Reference.

4. Party to notify: upon the ship’s arrival. Name, address, post code, telephone, fax, E-mail (person/company). It may be the same address as recorded in consignee column.

5. Reference for the transported goods: This may be a reference to the shipper or forwarder.

6. Vessel/Voyage: Name of vessel and voyage number.

7. Embarkation Port – Port of Discharge.

8. Issue Date: Date of issuance of the Bill of lading

9. Description of goods: Description of the goods, container type, temperature (if chilled goods).

10. Place of receipt of the goods

11. Place of delivery of the goods

12. Measures volume of goods: Unit of measure specified.

13. Goods Gross weight: Unit of measure specified.

7.2 Format of Air waybill

Form To be Inserted

1. Airport of Departure: In this field, the IATA three letter code of the Airport of Departure is mentioned. For example, HKG for Hongkong, DEL for Delhi, LHR for London Heathrow, SHA for Shanghai etc.

2. Shipper’s Name and address: In this field, the name, address, city and country of the shipper is inserted. Further, one or more method of contact (telephone, telefax) and the number is mentioned.

3. Shipper’s Account Number: This field is reserved for the issuing carrier.

4. Consignee’s Name and address: In this field, the name, address and country of the consignee are inserted. Further, the consignee‟s telephone number if known is also mentioned. Sometimes, when shipments for any reason, is required to be addressed to a bank or to an agent, a notify party is required to be mentioned in the field (of Handling Information). The notify party is considered as the actual consignee of the shipment(s). If the shipper insists that a person or the firm other than the consignee, should also be notified, then the address of the person or the firm is also required to be mentioned in the column (of Handling Information) and should be preceded by the words “also notify”.

5. Consignee’s Account Number: It is a code assigned by the airlines to identify the customer. This entry is reserved for the delivering carrier at its option.

6. Issuing Carrier’s Agent, Name and City: In this field, the name and city of the carrier‟s agent entitled to the commission is inserted. When the commission is payable to an IATA cargo agent in the country of destination, the name and location of such IATA Cargo agent is inserted and is preceded by the words by “commissionable agent”.

7. Agents’ IATA Code: In this field, the IATA code of the agent in field 6 is mentioned.

8. Issuing Carrier’s Agent, Account Number: This field is reserved for the issuing carrier.

9. Airport of Departure ( address of First Carrier), Requested Routing: In this field, the airport of departure ( in terms of three letter City Code) and any requested routing is inserted.

10. Accounting Information: In this field, any special accounting information for example, method of payment e.g. by cash or cheque, freight prepaid or collect, service type level such as ExW ( Ex works) or Airport to Airport Standard service.

Important Note: If Service Type level is mentioned as Ex-works, then charges for movement of goods from the Ex-works to the Airport are required to be added to the Ex-works value to arrive at FOB value.

11. Routing and Destination: In this field, except for the indication of the name of the first carrier, the use of these boxes is optional. If filled in, then three letter-airport code under the “to” heading and two letter code of airlines[ such as AI for Air India, MH for Malaysia Airline ], under the “by” heading to be mentioned.

12. Currency: In this field, the ISO three letter currency code of the currency applicable in the country of departure is mentioned. All amount mentioned in the airway bill except which are mentioned to be “Collect charges in destination country” are to be in this currency only. For example, USD for US dollars, INR for Indian Rupees, HKD for Hong Kong Dollars, SGD for Singapore dollars etc.

13. Charges code: It is used by the Carrier‟s accounting office only.

14. Weight/Valuation Charge: Prepaid/Collect: Weight Charge is the amount resulting from multiplication of a rate by the chargeable weight, or a flat amount applicable to a shipment (minimum charge or charge for a shipment carried in unit load devices). Valuation charge is the amount resulting from the application of a percentage based on a declared value for carriage of goods (valuation charge). In this field, the shipper/agent, who does not show details of charges in the appropriate fields of the Airway Bill are required to insert “X” in the appropriate field – whether weight and valuation charges are wholly prepaid or wholly collect. Both of these charges are required to be either wholly prepaid or wholly collect, unless otherwise specifically indicated.

15. Other charges at origin- Prepaid/Collect : The shipper/agent, who does not show these charges either in the ‘Total Other Prepaid Charges’ box or the ‘Total Other Collect Charges’ box described later in this documents, are required to indicate by insertion of an ‘x’ in this box, whether all other charges at origin are wholly prepaid or wholly collect. If the information contained in the boxes described in paragraph 15 above is in conflict with the information in the boxes ‘Total Prepaid’ described in Heading 27 and/or ‘Total Collect’ described in Heading 28, the later take precedence.

16. Declared Value for Carriage: In this field, declared value as specified by the Shipper is inserted. The declared value limits the liability of carrier in case of loss, damage to cargo and the valuation charges are assessed on the amount of declared value. If the shipper wants to insert “No Value Declared”, then this field is filled with abbreviation “NVD”.

17. Declared value for Customs: If the shipper declares a value for customs purpose, then such value is inserted in this field. If the shipper does not want to declare the value for customs, then NVD (No value declared) is inserted in this field or it is left blank. At times, NCV (no custom value) is declared.

18. Airport of Destination: In this field, the name of the town or airport of destination of the last carrier is mentioned.

19. Requested Flight/date: In this field, flight No and date is mentioned.

20. Amount of Insurance: In case, the shipper wants insurance of the goods, then insured amount is mentioned here. The amount for which the goods are to be insured, may not be the same as the declared value for carriage. This insurance also covers the loss or damage in case the value for carriage is declared as NVD on the AWB. Insurance premium due is inserted in the field “total other charges due carrier” either in prepaid or in collect. In case the currency of insured amount is different from the currency of the

commercial invoice, the original currency amount to be insured is required to be mentioned in the field meant for “Handling information”.

21. Handling Information: This field is used to indicate any information related to the handling of the consignment for which a special area does not appear elsewhere on the Air Waybill. Where there is not a sufficient space, an extension list may be used. Some types of information which may be put here when required for special handling by governments, shippers, or carriers are the following;

- Identifying marks and numbers which appear on the consignment and method of packing.

- The name and address of any person to be notified of arrival of the consignment in addition to the consignee.

- Documents to accompany the Air Waybill [using cargo IMP (Interchange message Procedure) codes where appropriate].

- The original currency amount of the insured value in case it is different from the amount of insurance box.

- Net weight of shipment where required.

- Indication of where delivery service is requested.

- Any other special handling information or instructions relating to the shipment-using cargo-IMP [Interchange Message Procedures] codes where appropriate except that the following instructions are not accepted on the Air Waybill or otherwise:

- To execute a document intended to effect transfer of title to the shipment.

- To obtain proof of payment, acceptance of a draft, etc. before delivery.

- When a consignment is returned because of non-delivery, the new Air Waybill for the returning carriage is required to have the original Air Waybill number inserted in this field.

22A: Number of Packages: In this field, the number of packages is mentioned. In case where there is more than one entry, the total number of packages should also be mentioned below “the total line”.

22B: Gross Weight: The actual gross weight of the packages is inserted in the horizontal lines as the respective number of packages. In case where there is more than one entry, the total gross weight is also mentioned below “the total line”.

22C: Kg/Lb: In this field, the unit of measurement /weight used for kilograms or pounds (K or L) is inserted.

22D: Rate Class: In this field, one or more of the following codes is inserted as appropriate:

| Rate class Code |

Explanation of rate class |

|

M |

Minimum Charge |

|

N |

Normal under 45kg (100 lb) rate or under 100kg rate where no under 45 kg rate exists. |

|

Q |

Quantity over 45kg ( or 100 lb) rate |

|

C |

Specific Commodity Rate |

|

R |

Class Rate (Reduction) |

|

S |

Class Rate (Surcharge) |

|

U |

Pivot Weight And Applicable Pivot Weight Charge |

|

E |

Weight in excess of pivot weight and applicable rate |

|

X |

Unit Load Device |

|

Y |

Unit Load Device Discount |

22E: Commodity Item Number:

- If the Code ‘C’ has been inserted in field 22D, the IATA specific commodity item number is required to be inserted. List of SCR given at the End of the e-book.

- Where a surcharge or a discount applies in connection with a Class rate, the applicable percentage of the normal under 45 kgs/100 lbs rate is shown here; i.e. 150% of N-rate is shown as 150%, 66% of N-rate is shown as 66%. (A Class rate requiring the normal rate without any quantity reduction is shown as S-1 00%.)

- When a ULD is used, the applicable IATA rate classification code is required to be inserted on the same line as the code ‘X’ in field 22D.

The abbreviation ULD means Unit Load device (ULD). It is a pallet or container used to load luggage, freight, and mail on wide-body aircraft and specific narrow-body aircraft. It allows a large quantity of cargo to be bundled into a single unit. Since this leads to fewer units to load, it saves ground crews time and effort and helps prevent delayed flights. Each ULD has its own packing list (or manifest) so that its contents can be tracked.

22F: Chargeable Weight: In this field, the gross weight per rate class or the volume weight is mentioned.

22G. Rate/Charge: The applicable rate per kg or per lb is mentioned.

22H. Total (If available): In this field, the total charge for each separate line entry is mentioned. In case, where there is more than one entry, the total amount is required to be inserted below the total line.

22I: Nature and quantity of goods [including dimensions or volume):

(a) Nature and Quantity describe goods in as much details as possible. They should immediately be identifiable, particularly for customs and rating purpose. Description such as „Sample of no value’, ‘Textiles’, ‘Machinery Parts’, etc. are too general description and should be avoided. Instead ‘Samples of Aluminium Foil’, ‘Cotton piece goods’, ‘Parts of agricultural machinery’, etc. should be used. Special attention should be drawn to the shipments containing DANGEROUS goods and the rules given in the dangerous Goods Regulations should strictly be followed. If a consignment is acceptable only on cargo aircraft, the words ‘CARGO AIRCRAFT ONLY’ are inserted.

(b) Dimensions and Volume: For each package in the shipment or for the entire shipment, insert three dimensions in the following sequence: greatest length, greatest width, greatest height (or volume)

(c) IATA Registered Unit Load Devices: If one or more IATA registered unit load devices are used in the shipment, the appropriate IATA registration code is shown on the same horizontal line as the ‘X’ in the ‘rate class’ field (22D).

(d) Extension List: If details cannot fully be shown in this box, an extension list is used and is prepared with the same number of copies as the AWB to which they are attached. In this field of the AWB, the word ‘SEE EXTENSION LIST‘ are inserted and at least the total number of pieces, the total weight of the consignment and the total volume of the items are shown on the AWB itself. The AWB number is shown on each copy of the extension list.

23. Other Charges

(a) Descriptions and amount of individual charges and fees other than weight and valuation charge is required to be inserted. When the AWB is electronically transmitted, the following codes as given in Table below are used:-

Table

| AC | Animal Container | HR | Human Remains | RF | Remit following |

| AS | Assembly service fee | IN | Insurance premium | SD | collectiocharge- Surface destination |

| AT | Attendant | LA | Live Animals | SI | Stop in transit |

| AW | Air Waybill Fee | MA | Miscellaneous-Due agent ( Note 1.) | SP | Separate early release |

| BL | Blacklist Certificate | MB | Miscellaneous-unassigned ( Note 2.) | SR | Storage-destination |

| BR | Bank release | MC | Miscellaneous-Due carrier ( Note 3.) | SS | Signature service |

| CD | Clearance and handling-destination |

MD to MN | Miscellaneous-Due last carrier |

ST | State sales tax |

| CH | Clearance and handling-origin |

MO to MZ | Miscellaneous-Due issuing carrier | SO | Storage-origin |

| DB | Disbursement Fee | PK | Packing | SU | Surface charges |

| DF | Disbursement | PU | Pick UP | TR | Transit |

| FC | Service Fee Chargs collect fee | RA | Dangerous goods fee | TX | Taxes |

| GT | Government Tax | RC | Referral of charge | UH | ULD handling |

- MA code is used if the miscellaneous charge is due agent but cannot be further identified.

- MB code is used if the miscellaneous charge cannot be determined as being due agent or due carrier

- MC code is used if the miscellaneous charge is due carrier but cannot be further identified

(b) To indicate whether such other charges accrue to carrier or agent, one of the following entitlement codes : A (due Agent) or C (due Carrier) is used following the above codes and preceding the amounts

(c) The sum of the various other charges shown in field 23 is mentioned in heading No.27 and 28.

(d) When a consignment is returned because of non-delivery, the new AWB for the returning carriageis required to have all charges, which should have been but were not collected from the original consignee, inserted in this field.

24. Weight Charge (Prepaid/Collect): In this field, the weight/volume charge for air carriage is inserted. Both the weight/volume charge and the valuation charge are to be inserted on the Air Waybill as either wholly prepaid or wholly collect.

25. Valuation Charge (Prepaid/Collect): In this field, the valuation charge is inserted; both the weight/volume charge and the valuation chare is mentioned in the Air Way Bill as either wholly prepaid or wholly collect.

26A. Total Other Charges Due Agent (Prepaid/Collect): In this field, when the charge for preparation of Air Waybill is due agent, it is mentioned here. Collect charges “due agent”, which are explained in heading 23 above are shown here.

26 B. The Total Other Charges Due Carrier ( Prepaid and Collect) : In this field, the total of charges and fees due to carrier ( other than weight charge and valuation charges as specified in field 25 above are required to be mentioned.

27. Total Prepaid: In this field, the total of all prepaid charges, i.e. weight /volume charge, valuation charge and other prepaid charge due carrier and due agent must be inserted.

28. Total Collect: In this field, the total of all collect charges i.e. weight/volume charge, valuation charge and the collect charges due carrier and due agent are mentioned.

29. Shipper’s Certificate Box: In this field, the signature of the shipper or his agent (Printed, signed or stamped) is inserted.

30. Carrier’s Execution Box: In this field, the date and place of execution of the Air Way Bill is inserted. The month is shown in full or abbreviated, not by number. The signature of the carrier or its agent can be printed, signed or stamped.

International Convention Governing International Carriage by Air

The following international Conventions govern International Carriage by Air.

- The Convention for the Unification of Certain Rules Relating to International Carriage by Air, signed at Warsaw on 12.10.1929 (also known as the “Warsaw Convention”);

- The Protocol to amend Warsaw Convention signed at Hague on 28.09.1955 (also known as the “Hague Protocol”);

- The Convention for the Unification of Certain Rules for International Carriage by Air; done at Montreal on 28.05.1999 (Also known as the “Montreal Convention”).

International Convention Governing International Carriage by Sea

The following international Conventions govern International carriage by Sea:-

- The Hague-Visby Rules – The Hague Rules as Amended by the Brussels Protocol, 1968.

- United Nations Convention on the Carriage of Goods by Sea, 1978 (also known as Hamburg Rules )

Wonderful compilation of details. Very informative., A boon for all people who handle the import export jobs in their organisation. Keep it up. R Vijayan.Consultant.