Page Contents

Meaning of Joint Development Agreement

In a Joint Development Agreement, land owner contributes his land and enters into an arrangement with the developer to develop and construct a real estate project at the developer’s cost.The key feature of JDA is that the land owner contributes land and developer undertakes the responsibility of obtaining approvals, property development, launching and marketing the project with his financial resource.

The land owner may get consideration in the form of either

- lump sum consideration or

- percentage of sales revenue or

- certain percentage of constructed area in the project,

depending upon the terms and conditions agreed upon between them. In this manner, the resources and efforts of land owner and developer are pooled together.

Taxability of Joint Development Agreement from the point of view of Land Owner

According to section 2(47) of the Income Tax Act, 1961 the term Transfer includes and shall be deemed to have always included disposing off or parting with an asset or any interest therein, or creating any interest in any asset in any manner whatsoever, directly or indirectly, absolutely or unconditionally, voluntarily or involuntarily, by way of an agreement (whether entered into in India or outside India).

Also, as per section 45 of the Income Tax Act,1961 capital gains is chargeable to tax in the year in which transfer takes place except in certain cases.

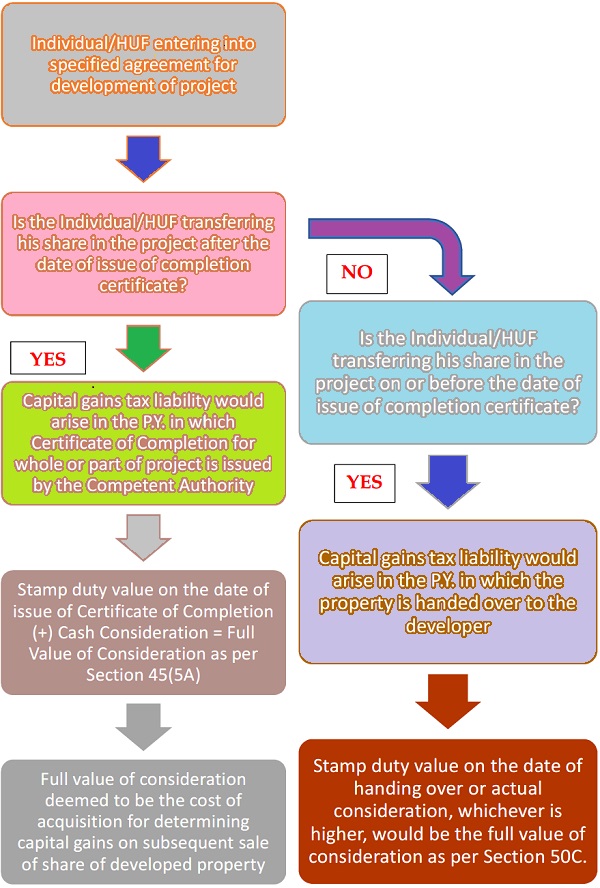

In such a scenario, execution of joint development agreement between the owner of the immovable property and the developer gives rise to capital gains tax liability in the year in which the possession of immovable property is handed over to the developer for development of project .The receipt of consideration (share of constructed area or share in revenue) in future, does not affect the timing of the taxable event.

With a view to minimize the genuine hardship which the owner of land may face in paying capital gains tax in the year of transfer, a new sub-section (5A) in section 45 of the Act has been inserted through Finance Act,2017 so as to provide that in case of an assessee being individual or Hindu undivided family, who enters into a specified agreement for development of a project, the capital gains shall be chargeable to income-tax as income of the previous year in which the certificate of completion for the whole or the part of the project is issued by the competent authority. However, the provisions of this sub section shall not apply where the assesse transfers his share in project on or before the date of issue of the said certificate.

Also, Finance Act 2017 has provided that the stamp duty value of land or building or both, in the project on the date of issuing of said certificate of completion given to the land owner as increased by any monetary consideration received, if any, shall be deemed to be the full value of the consideration received or accruing as a result of the transfer of the capital asset.

Taxability of Joint Development Agreement from the point of view of Developer

In case of developer, the nature of income would be business income. The property would constitute stock in trade for him. Overall, his income comprises of sale proceeds he gets from the buyers of the developed land and the cost would involve the expenditure incurred on development of the property.

Liability to deduct TDS

Consequently, a new section 194-IC was also inserted wide Finance Act,to 2017 to deduct TDS on monetary consideration. This section overrides the provisions contained in section 194-IAof the Act,which provides for deduction of TDS @ 1 % on transfer of immovable property where consideration exceeds Rs 50 Lakhs. According to section 194-IC, if under a joint development t agreement, any developer pays any amount to the land owner in addition to the share in the project, then such builder shall deduct TDS @ 10 % on such payment.

The scope of Capital Gains in Joint Development Agreement is a vast one.

The last decade has witnessed a major slowdown over the past decade. It also witnessed the growth in legal disputes regarding tax matters. Hence, the steps taken by the government in this behalf have been welcomed by the real estate sector.

I am a NRI and entered into a JDA with a builder. As per agreement he is to pay 65 lakhs and four flats . When the amount is given in instalments when TDS would arise? Can TDS be deducted during last instalment?

I am a NRI and entered o a JDA with a builder. As per agreement he is to pay 65 lakhs and four flats . When the amount is given in instalments when TDS would arise?

A has Notarised 400syds Plot in the year 1998 for Rs.42000/-

Cost of leveling and construction of shed and compound wall is rs. 300000/- in the year 2004.

It is given for development 40:60 ration in the year 2018 April to get 4 flats to owner and 6 flats for builder. JDA is not registered. Still under construction.

Does this attract tax and even if any flat is sold, it will under Notarised Sale Agreement only as there is no Registration for this one.

pl clarify reg Capital gains on sale and Tax liability on JDA.

What will be the Taxability if the Owner of the Property have entered into a Joint Venture with a Construction Firm and The Owner won’t be incurring any construction cost under sction 80-IBA

If ‘A’ given amount Rs 1 Cr to ‘B’ for JV land development but ‘B’ has sold the full land without development to ‘C’. Now B has returned amount Rs 1.50 CR (Rs 1 CR Principal + Income Rs 50 Lac) to ‘A’ then Rs 50 lac is taxable under Capital gain or business income?

Please give me suggetion.

For agreements entered prior to 2017, will this finance act 2017 on capital gains be applicable?

A repeat (:

This is seen to deal with / touche upon certain, but not all, tax iand other implications to parties to a JDA. In particular, the observations in the write-up , in reference to the newly introduced sub-section (5A) in sec 45 do not seem to cover the tax (including ST/VAT, now GST under migration to) implications from all angles.

May have more to share !

courtesy

Admn.

Another imp. comment posted y.’day remains to be displayed !

“………a new sub-section (5A) in section 45 of the Act has been inserted through Finance Act,2017 so as to provide that in case of an assessee BEING INDIVIDUAL OR HINDU UNDIVIDED FAMILY…….” (FONT supplied0

Sorry for volunteering an unsolicited intrusion ; ordinarily / normally, the author of any such write-up or a website ADMN., if it is a fee-free ‘service’, for obvious or reasons of own, do not make it a point to help and provide an answer to any query, such as yours, howsoever simple that be.

Be that as it may, don’t you think you will find an answer to your doubt, in the above highlighted words of the section itself!

courtesy

Does the Section 2(47) of the Income Tax Act, 1961

Section 45 of the Income Tax Act,1961, a new sub-Section (5 A) in section 45 are also Applicable in case Where Land Owner is Registered Trust Public Trust Act ( Mumbai)