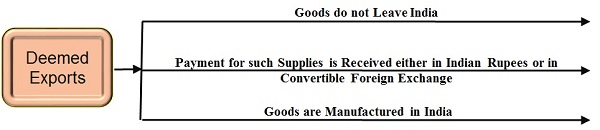

Deemed export has been defined under Section 2(39) of CGST Act, 2017 as supplies of goods as may be notified under section 147 of the said Act. As per Sec 147 of CGST Act, the Government may, on the recommendations of the Council, notify certain supplies of goods as deemed exports, where goods supplied do not leave India, and payment for such supplies is received either in Indian rupees or in convertible foreign exchange, if such goods are manufactured in India.

However, the notification is released after so much of wait; demand and pressure from all corners. Government released a Notification No. 48/2017-Central Tax, on 18th October, 2017 declaring certain categories of supplies as Deemed Exports.

As per the Notification following supplies are treated as Deemed Exports:

- Supply of goods by a registered person against Advance Authorization as per Chapter 4 of FTP

- Supply of capital goods by a registered person against Export Promotion Capital Goods (EPCG) Authorization as per Chapter 5 of FTP

- Supply of goods by a registered person to Export Oriented Unit as per Chapter 6 of FTP

- Supply of gold by a bank or Public Sector Undertaking specified in the notification No. 50/2017-Customs, dated the 30thJune, 2017 (as amended) against Advance Authorization.

Further Government released Two other Notifications related to Refund of Taxes Paid.

Notification No. 47/2017–Central Tax, 18th October, 2017

Notification No. 49/2017-Central Tax, 18th October, 2017

GST Refund of Deemed Exports Supply can be claimed by either Recipient or Supplier:

Vide Notification No. 47/2017–Central Tax, 18th October, 2017, Central Goods and Services Tax (Tenth Amendment) Rules, 2017 was introduced. They shall come into force on the date of their publication in the Official Gazette. Through this notification in rule 89, in sub-rule (1), for third proviso, the following proviso shall be substituted, namely:-

“Provided also that in respect of supplies regarded as deemed exports, the application may be filed by, –

(a) the recipient of deemed export supplies; or

(b) the supplier of deemed export supplies in cases where the recipient does not avail of input tax credit on such supplies and furnishes an undertaking to the effect that the supplier may claim the refund”;

Before this notification in respect of supplies regarded as deemed exports, the application shall be filed by the recipient of deemed export supplies only, but now either Supplier or Recipient can file application for refund. Supplier can claim for refund only in case where the Recipient does not avail of input tax credit on such supplies and furnishes an undertaking to the effect that the supplier may claim the refund.

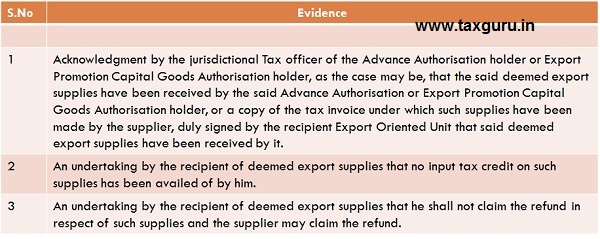

Evidences Required to be produced by Supplier of Deemed Export for Claiming Refund :

For claiming refund under Rule 89(2)(g) of the CGST rules, 2017, evidences as below are required to be produced by the supplier of deemed export supplies for claiming refund:

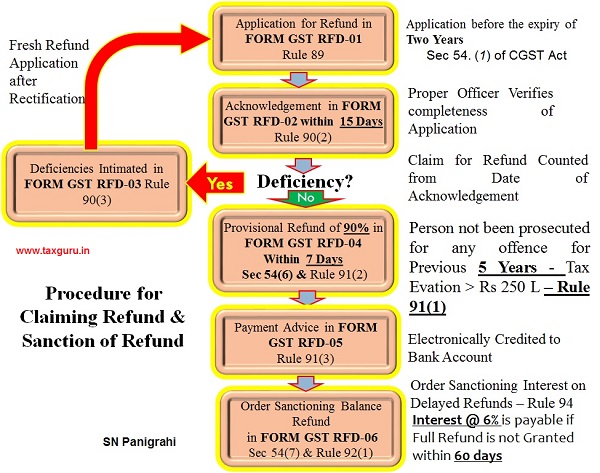

Other Procedures Related to Refund are Similar Like in case of Direct Exports:

All other procedures as prescribed under Rules 89 to 94 of CGST Rules are similar to Direct Exports. The sequence of Procedures is described below :

- Application for Refund in FORM GST RFD-01 shall be made as per Rule 89, before the expiry of Two Years as per Sec 54. (1) of CGST Act

- Proper Officer Verifies completeness of Application and Acknowledgement in FORM GST RFD-02 shall be sent within 15 Days as per Rule 90(2)

- Deficiencies if any shall be intimated in FORM GST RFD-03 Rule 90(3) then a Fresh Refund Application shall be filed after Rectification.

- Claim for Refund shall be Counted from Date of Acknowledgement in case no deficiencies are intimated.

- Provisional Refund of 90% in FORM GST RFD-04 shall be granted Within 7 Days as per Sec 54(6) & Rule 91(2) provided Person not been prosecuted for any offence for Previous 5 Years – for any Tax Evation more than Rs 250 L – Rule 91(1)

- Payment Advice in FORM GST RFD-05 shall be made as per Rule 91(3)

- Payment shall be Electronically Credited to Bank Account of the applicant

- Order Sanctioning Balance Refund in FORM GST RFD-06 shall be made as per Sec 54(7) & Rule 92(1)

- Interest @ 6% is payable if Full Refund is not Granted within 60 days – Rule 94

Comments :

♣ Narrow Definition of Deemed Exports :

As per Para 7.02 of Foreign Trade Policy 2015-20,

A. Supply by manufacturer:

(a) Supply of goods against Advance Authorisation / Advance Authorisation for annual requirement / DFIA;

(b) Supply of goods to EOU / STP / EHTP / BTP;

(c) Supply of capital goods against EPCG Authorisation;

(d) Supply of marine freight containers by 100% EOU (Domestic freight containers-manufacturers) provided said containers are exported out of India within 6 months or such further period as permitted by customs;

And

B. Supply by main / sub-contractor (s) as enumerated are treated as Deemed Exports.

Where as in GST supplies only against Advance Authorization; against Export Promotion Capital Goods (EPCG) Authorization; to Export Oriented Unit; Supply of gold by a bank or Public Sector Undertaking against Advance Authorization are treated as Deemed Exports

♣ Supplies of Registered Supplier only treated as Deemed Exports and not of un-registered suppliers.

As a result of this supplies against DFIA, Supplies against International bidding etc and supplies of un-registered person are not treated as Deemed Exports and denied the Deemed Export Benefits.

♣ Deemed Export Refund – Virtually No Benefit:

Normally the recipient of deemed supply prefer to claim Input Put Tax credit and utilize the same towards tax liability of outward domestic supplies rather interested to claim refund which takes longer time. Only in case the recipient has predominantly more exports than domestic sales only in such situations he may claim refund.

Disclaimer : The views and opinions; thoughts and assumptions; analysis and conclusions expressed in this article are those of the authors and do not necessarily reflect any legal standing.

Author : SN Panigrahi, GST Consultant, Practitioner, Corporate Trainer & Author

Can be reached @ snpanigrahi1963@gmail.com

i am the supplier of goods to EOU. the EOU is not taking refund on the inward supplies. i want to file the deemed export refund and which authority i have to file the refund before custom oe centre or state.

Sir,

We are supplying the goods on Deemed export. Now we are try to file Refund but we confused in which head we claim refund:-

1. Export the goods on LUT

2. Inverted Rax Supply

3. Recipient of Deemed export

4. Excess balance in Tax ledger

We are supplying the goods to EOU (deemed export) with GST but there is no option in RFD-01 to claim the refund of the GST by the supplier

Kindly clarify the procedures of claiming the refund

Sir, I have one query about deemed export. Buyer has GSTIN. Invoice type is Deemed Export. then IGST will charged on transaction. but while uploading JSON file portal shows Error that if sales is Intrastate then there must be SGST & CGST. Kindly reply as soon as possible

Supplies to ONGC against Contract awarded under International Competitive Bidding ( ICB ) is qualifies as Deemed Exports.

In such cases if the items are procured from Registered Manufacturer can avail the items without payment of GST. Please advise