The introduction of Goods and Services Tax (GST) is a significant reform in the field of indirect taxes in our country. Multiple taxes levied and collected by the Centre and states would be replaced by one tax called Goods and Services Tax (GST). GST is a multi-stage value added tax on consumption of goods or services or both.

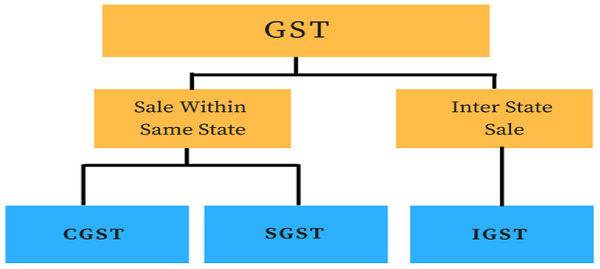

2. A “dual GST” model has been adopted in view of the federal structure of our country. Centre and States will simultaneously levy GST on every supply of goods or services or both which takes place within a State or Union territory. Thus, there shall be two components of GST as under: –

i. Central tax (CGST):

(levied & collected under the authority of CGST Act, 2017 passed by the Parliament)

ii. State tax (SGST)

(levied & collected under the authority of SGST Act, 2017 passed by respective State)

Why the third tax in the name of IGST?

3. Before discussing the IGST Model and its features it is important to understand how inter-state trade or commerce is being regulated in the present indirect tax system. It is significant to note that presently the Central Sales Tax Act, 1956 regulates the inter-state trade or commerce (hereinafter referred to as “CST”) the authority for which is constitutionally derived from Article 269 of the Constitution. Further as per article 286 of the Constitution of India, no State can levy sales tax on any sales or purchase of goods that takes place outside the State or in the course of the import of the goods into, or export of the goods out of, the territory of India Only Parliament can levy tax on such transaction. The Central Sales Tax Act was enacted in 1956 to formulate principles for determining when a sale or purchase of goods takes place in the course of interstate trade or commerce. The Act also provides for the levy and collection of taxes on sale of goods in the course of interstate trade

4. The CST suffers from following shortcomings:

i. CST is collected and retained by the origin state, which is an aberration. Any indirect tax, by defini-tion is a consumption tax, the incidence of which is borne by the consumer. Logically, the tax should ac-crue to the destination state having jurisdiction over such consumer.

ii. Input Tax Credit (ITC) of CST is not allowed to the buyer which results in cascading of tax (tax on tax) in the supply chain.

iii. Various accountal forms are required to be filed in CST viz., C Form, E1, E2, F, I, J Forms etc. which adds to the compliance cost of the business and im-pedes the free flow of trade.

iv. Another negative feature of CST is the opportunity it provides for “arbitrage” because of the huge differ-ence between tax rates under VAT and CST being levied on intra-State sales and inter-State sales re-spectively

5. The IGST model would remove all these deficiencies. IGST is a mechanism to monitor the inter-state trade of Goods and services and further to ensure that the SGST component accrues to the consumer state. It would maintain the integrity of Input Tax Credit (hereinafter referred to as “ITC”) chain in inter-state supplies. The IGST rate would broadly be equal to CGST rate plus SGST rate. I G S T would be levied by the Central Government on all inter-State transactions of taxable goods or services.

IGST rate= CGST rate + SGST rate ( more or less)

6. Cross-utilization of credit requires transfer of funds between respective accounts. The utilization of credit of CGST & SGST for payment of IGST by “B” would require transfer of funds to IGST accounts. Similarly, the utilization of IGST credit for payment of CGST & SGST by “C” would necessitate transfer of funds from IGST account. As a result, CGST account and SGST (Rajasthan) would have Rs 1300/- each, whereas, there will not be any amount left in IGST and SGST (Maharashtra) after transfer of ITC.

7. Prescribed order of utilization of IGST/CGST/ SGST credit:

The IGST payment can be done by utilizing ITC. The amount of ITC on account of IGST is allowed to be utilized towards payment of IGST, CGST and SGST in that order.

8. Nature of Supply

It is very important to determine the nature of supply – whether it is inter-state or intra state, as the kind of tax to be paid (IGST or CGST+SGST) depends on that.

i. Inter- state Supply:

Subject to place of supply provisions, where the location of the supplier and the place of supply are in––

a) two different States;

a) two different Union territories; or

a) a State and a Union territory,

Such supplies shall be treated as a supply of goods or services in the course of inter-State trade or commerce.

Any supply of goods or services in the taxable territory, not being an intra-State supply shall be deemed to be a supply of goods or services in the course of inter-State trade or commerce. Supplies to or by SEZ are defined as inter-State supply. Further supply of goods imported into territory of India till they cross the customs frontiers of India or supply of services imported into the territory of India shall be treated as supplies in the course of inter-State trade or commerce. Even supplies to international tourists are to be treated as inter-state supplies.

ii. Intra-State supply:

It has been defined as any supply where the location of the supplier and the place of supply are in the same State or Union territory.

| Intra state supply | Interstate supply |

| > Supply of goods within the state or union terri- tory.

> Supply of ser-vices within the state or union territory

|

> Supply of goods from one state or union territory to other state or union territory.

> Supply of service from one state or union territory to other state or union territory. > Import of goods till they cross customs frontier > Import of service. > Export of goods or service. ♦ Supply of goods/services to/by SEZ. > Supplies to international tourists > Any other supply in the tax-able territory which is not intra state supply |

Thus, the nature of the supply depends on the location of the supplier and the place of supply. Both these terms have been defined in the IGST Act.

9. Location of Supplier broadly is the registered place of busi-ness or the fixed establishment of the supplier from where the supply is made. Sometime, a service provider has to go to client location for providing service. However, such place would not be considered as the location of supplier. It has to be either regular place of business or fixed establishment which is having sufficient degree of permanence and suit-able structure in terms of human and technical resources.

10. Place of supply

10.1 Place of supply provisions have been framed for goods & services keeping in mind the destination/consumption prin-ciple. In other words, place of supply is based on the place of consumption of goods or services. As goods are tangi-ble, the determination of their place of supply based on the consumption principle is not difficult. Generally the place of delivery of goods becomes the place of supply. However, the services being intangible in nature, it is not easy to de-termine the exact place where services are acquired, enjoyed and consumed. In respect of certain categories of services, the place of supply is determined with reference to a proxy.

10.2 A distinction has been made between B2B (Business to Business) & B2C(Business to Consumer) transactions as B2B transactions are wash transactions as ITC is availed by such registered person (recipient) and no real revenue accrues to the Govt.

10.3 Separate provisions for supply of goods and services have been made for determination of their place of supply. Sep-arate provisions for determination of place of supply in re-spect of domestic supplies and cross border supplies have been framed.

A. Place of Supply of Goods other than import and export [Section- 10]

| S.No. | Nature of supply | Place of Supply |

| 1 | Where the supply involves movement of goods, whether by the supplier or the recipient or by any other person. |

Location of the goods at the time at which the movement of goods terminates for delivery to the recipient. |

| 2 | where the goods are delivered to recipient or any person on the direction of third person by way of transfer of title or otherwise, it shall be deemed that third person has received the goods |

The principal place of business of such person |

| 3 | where there is no movement of goods either by supplier or recipient | Location of such goods at the time of delivery to recipient |

| 4 | where goods are assembled or installed at site | The place where the goods are assembled or installed |

| 5 | where the goods are supplied on board a conveyance, like vessel, aircraft, train or motor vehicle | The place where such goods are taken on board the conveyance |

| 6 | Where the place of supply of goods cannot be determined in terms of sub-section (2), (3), (4) and (5) | It shall be determined in such manner as may be prescribed |

B. Place of supply of goods in case of import &Export [ Section -11]

| S.No. | Nature of supply of goods |

Place of Supply |

| 1 | Import | location of importer |

| 2 | Export | location outside India |

C. Place of supply of services in case of domestic supplies:

(section12)

(Where the location of supplier of services and the location of the recipient of services is in India.)

i. In respect of following 12category of services, the place of supply is determined with reference to a proxy. Rest of services are governed by a default pro-vision.

| S.No | Nature of service | Place of supply |

| 1 | Immovable prop- erty related services including hotel ac- commodation, | Location at which the im-movable property or boat or vessel is located or in-tended to be located.

If located outside India: Location of the recipient. |

| 2 | Restaurant and ca- tering services, per- sonal grooming, fitness, beauty treatment, health service, | Location where the ser- vices are actually per- formed. |

| 3 | Training and perfor- mance appraisal , | B2B : Location of such registered person;

B2C: Location where the services are actually performed. |

| 4 | Admission to an event or amusement park | Place where the event is actually held or where the park or such other place is located. |

| 5 | Organization of an event. | B2B : Location of such registered person;

B2C: Location where the event is actually held. If event is held outside India :Location of the re-cipient |

| 6 | Transportation of goods including mails | B2B : Location of such registered person;

B2C : Location at which such goods are hand- ed over for their transpor-tation |

| 7 | Passenger transpor- tation. | B2B : Location of such registered person;

B2C : Place where the passenger embarks on the conveyance for a con-tinuous journey |

| 8 | Services on board a conveyance | Location of the first sched-uled point of departure of that conveyance for the journey. |

| 9 | Telecommunication services. | Services involving fixed line, circuits, dish etc., place of supply is location of such fixed equipment. In case of mobile/ inter-net post-paid services, it is location of billing address of the recipient. In case of sale of pre-paid voucher, place of supply is place of sale of such vouchers. In other cases it is address of the recipient in records. |

| 10 | Banking and other financial services, | Location of the recipient of services on the records of the supplier.

Location of the supplier of services if the location of the recipient of services is not available |

| 11 | Insurance services | B2B : Location of such registered person;

B2C : Location of the recipient of services on the records of the supplier |

| 12 | Advertisement services to the Government | The place of supply shall be taken as located in each of such States Proportionate value in case of multiple state |

i. For the rest of the services other than those speci- fied above, a default provision has been prescribed as under.

| Default Rule for the Services other than twelve Speci- fied Services | ||

| S.No. | Description of supply | Place of supply |

| 1 | B2B | Location of such registered person |

| 2 | B2C | (i)Location of the recipient where the address on record exists, and

(ii) the location of the supplier of services in other cases. |

D. Place of supply of services in case of cross-border supplies 🙁 Section 13)

(Where the location of the supplier of services or the location of the recipient of services is outside India)

i. In respect of following category of services, the place of supply is determined with reference to a proxy.

Rest of the services are governed by a default provision.

| S.No | Nature of service | Place of supply |

| 1 | Services supplied in re- spect of goods that are required to be made physically available from a remote location by way of electronic means, (Not Applicable in case of goods that are temporarily imported into India for repairs and exported.) | the location where the services are actually performed, the location where goods are situated |

| 2 | services supplied to an individual which require the physical presence of the receiver | the location where the services are actually performed. |

| 3 | Immovable property re- lated services including hotel accommodation. | Location at which the immovable property is located. |

| 4 | Admission to or organi- sation of an event. | The place where the event is actually held. |

| 5 | If the said three services sup- plied at more than one location i.e.(i) goods & individual (ii) immovable property related(iii) event related | |

| 5.1 | at more than one loca- tion including a location in the taxable territory, | Its place of supply shall be the location in the taxable territory where the greatest proportion of the service is provided. |

| 5.2 | in more than one State | its place of supply shall be each such state in proportion to the value of services so provided in each State |

| 6 | Banking, financial in- stitutions, NBFC Inter- mediary services, hiring of vehicles services etc. | Location of the suppli-er of service |

| 7 | Transportation of goods. | The place of destination of the goods |

| 8 | Passenger transporta-tion. | Place where the pas-senger embarks on the conveyance for a continuous journey |

| 9 | Services on board a con- veyance. | The first scheduled point of departure of that conveyance for the journey. |

| 10 | online information and database access or retrieval services” | The location of recipi-ent of service. |

ii. For the rest of the services other than those specified above, a default provision has been prescribed as under.

| Default Rule for the cross border supply of Services other than nine Specified Services | ||

| S.No. | Description of supply | Place of supply |

| 1 | Any | Location of the Recipient of Service If not available in the ordinary course of business: The location of the supplier of service. |

11. Supplies in territorial waters:

Where the location of the supplier is in the territorial waters, the location of such supplier; or where the place of supply is in the territorial waters, the place of supply is be deemed to be in the coastal State or Union territory where the nearest point of the appropriate baseline is located.

12. Export /Import of services: a supply would be treated as Import or export if certain conditions are satisfied. These conditions are as under: –

| Export of Services | Import of Services |

| means the supply of any service where

(a) the supplier of service is located in India, (b) the recipient of service is located outside India, (c) the place of supply of service is outside India, (d) the payment for such service has been received by the supplier of service in convertible foreign exchange, and (e) the supplier of service and recipient of service are not merely establishments of a distinct person in accordance with explanation 1 of section 8; |

means the supply of any service, where

(a) the supplier of service is located outside India, (b) the recipient of service is located in India, and (c) the place of supply of service is in India; |

13. Zero rated supply: Exports and supplies to SEZ are considered as ‘zero rated supply’ on which no tax is payable.

However, ITC is allowed subject to such conditions, safeguards and procedure as may be prescribed, refund in respect of such supplies may be claimed by following either of these options:

i. supply made without payment of IGST under Bond and claim refund of unutilised ITC or

ii. supply made on payment of IGST and claim refund of the same.

14. Refund of integrated tax paid on supply of goods to tourist leaving India:

Section 15 of the IGST Act provides for refund of IGST paid to an international tourist leaving India on goods being taken outside India subject to such conditions and safeguards as may be prescribed. An international tourist has been defined as a non-resident of India who enters India for a stay of less than 6 months. IGST would be charged on such supplies as the same is in the course of export.

This Section was not made applicable from 1st July, 2017 and will be notified at a later date once the ecosystem for the same is ready.

******