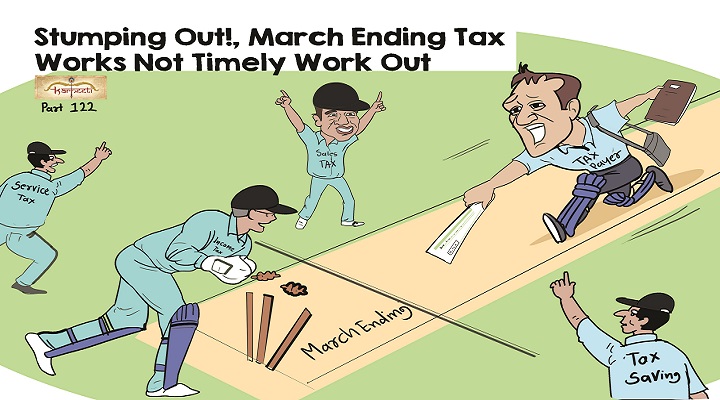

Arjuna (Fictional Character): Krishna, Currently the T-20 Cricket World Cup is on. The Financial Year’s end, i.e. March end has arrived. Keeping this in mind, what should the taxpayers do, so that he will not get stumped?

Krishna (Fictional Character): Arjuna, the matches was really exciting and thrilling. Synonymous to the game of cricket, the crease line i.e. tax deadline is 31st March, players batting are the taxpayers, and wicket keeper and fielders are the tax officers. You would be stumped out if you do not reach the crease line in time, similarly if taxpayers do not follow the deadline of 31st March, then they can be stumped out. That is if tax is not paid within time, then one has to pay interest, penalty, late fees, etc. according to various laws. Scrutiny, enquiry, assessments, notices are generally issued to those taxpayer who do not follow tax rules in time.

Arjuna: Krishna, What work should taxpayers complete before 31st March, related to Income Tax, so that they will not get stumped?

Krishna: Arjuna, Taxpayers should follow following things, to not get stumped:

1) To claim deduction under section 80C e.g. provident fund, insurance, etc., investment should be made before 31st March.

2) Salaried persons should provide the details of investments to employer, so that less TDS will be deducted in the month of March.

3) If advance tax is not paid before 15th March, then it should be paid before 31st March, so that less interest will be levied.

4) If Income Tax return of March 2019 is not filed, then it can be filed before 31st March 2020.

5) If there is a difference in 26AS and Income as per income tax return, enquiry may come.

6) If turnover of business is more than 1 crore, then tax audit is required to be done.

7) Taxpayers should maintain the details of interest received, paid and TDS thereon.

8) Payment made to a person in a day should not be more than Rs.10,000/-

9) Taxpayers to whom tax audit is applicable, TDS is to be deducted on specific businesses.

10) Income tax related all information is available on www.incometaxindia.gov.in website.

Many more works are there as per the category of the assessee. So please take care.

Arjuna: Krishna, What tasks should taxpayers complete before 31st March related to GST?

Krishna: Arjuna, Taxpayers should follow following things, to not get stumped:annual return 18-19

1) If services are provided for more than Rs.20 Lakhs, then GST is applicable.

2) Annual Return for FY 2018-19 is 31 March, 2020.

Arjuna: Krishna, What work should Taxpayer in Business complete before 31st March, so as to avoid stumping?

Krishna: Arjuna, Taxpayers should follow following things, to not get stumped:

1) Closing Stock: In business world Profit and Loss account has great importance. Closing Stock is the base of this Profit and Loss Account. It is useful for Cash Credits with Banks, Insurance, and in many other business related work.

2) Taxpayer should reconcile the Debtors and Creditors balance. That is, taxpayer should verify the balance of his books of accounts with that of balance confirmation statement provided by them.

3) Bank and Loan Statement Reconciliation: It is very important that, taxpayers should reconcile all the bank and loan accounts at March end.

4) Taxpayer should prepare projected and comparative balance sheet and profit and loss account, so that they can know previous year’s turnover, profit, loss, expenses, etc.

Arjuna: Krishna, What should we learn from March ending’s work pending, otherwise stumping?

Krishna: Arjuna, through-out the year, taxpayers work really hard to earn money and perform monetary transactions, and constant efforts and time to repay loans. In this competitive world, he is playing his household and business responsibilities. If tax related work remains pending, and not completed within time, taxpayers will face stumping. This inadvertently results in a loss of the hard earned money via penalties, etc due to tax not paid within time. What happened to Bangladesh, should not happen with taxpayers, and therefore they should cross crease line within time, i.e. follow tax rules!

Republished with Amendments

i had filled the dvat return for third quarter till 31.12.2015..now the fourth quarter is not showing,can u plz help

Thanks for sharing…..