FAQs on Cancellation of GST Registration

Q.1 Under which circumstances can a registered Taxpayer file an application for cancellation of GST registration?

Ans: A registered Taxpayer can file an application for cancellation of GST registration on the occurrence of any of the following events:

1. Discontinuance of business or closure of business.

2. Taxable person ceases to be liable to pay tax.

3. Transfer of business on account of amalgamation, merger, de-merger, sale, leased or otherwise.

4. Change in constitution of business leading to change in PAN.

5. Registered voluntarily, but did not commence any business within specified time.

6. Taxable person no longer liable to be registered under GST Act.

7. Death of sole proprietor

Q.2 Who all can file for an application cancellation of registration?

Ans: The following can file for an application cancellation of GST registration:

1. Existing Taxpayer

2. Migrated Taxpayer whose application for enrolment has been approved

3. Proper officer either on his motion or on application filed by the registered person or by his legal heirs in case of death of such person

Q.3 From where can I file for an application cancellation of GST registration?

Ans: Application for GST registration can be accessed from the GST Portal, after logging in.

The path is Services > Registration > Application for Cancellation of Registration.

Q.4. Who all cannot file for an application cancellation of registration?

Ans: The following people cannot file an application for cancellation of GST registration:

1. Persons registered as Tax Deductors / Tax Collectors

2. Persons to whom UIN has been allotted

Q.5 What is the precondition for cancellation of registration in case of amalgamation / merger / change in constitution of business?

Ans: In case of amalgamation / merger / change in constitution of business, the new entity (i.e. transferee entity) must be registered with the tax authority, and must have a valid GSTIN at the time of filing for cancellation of registration by the old amalgamated / merged / transferred entity.

Q.6 What is the implication of tax payable on stock while filing for cancellation of GST registration?

Ans: While filing the application for cancellation of registration, the Taxpayer needs to fill the value of stock and corresponding tax liability on the stock, and accordingly offset the liability (tax payable) from Electronic Cash Ledger / Electronic Credit ledger equivalent to the credit of input tax in respect of inputs held in stock and inputs contained in semi-finished goods or finished goods held in stock or capital goods or plant and machinery, on the day immediately preceding the date of such cancellation or the output tax payable on such goods, whichever is higher, calculated in such manner as may be prescribed.

In case of capital goods or plant and machinery, the person shall pay an amount equal to the input tax credit taken on the said capital goods or plant and machinery, reduced by such percentage points as may be prescribed or the tax on the transaction value of such capital goods or plant and machinery, whichever is higher.

In case of Nil or no amount to be entered by Taxpayer in value of stock and tax payable section, the Taxpayer can still submit the form.

Q.7 Why is the Submit button in form for cancellation of registration not getting active despite filling it out?

Ans: The Submit button gets activated once all the mandatory fields (other than signatures) are filled. Please check all the mandatory fields carefully and provide information for any field that you might have missed.

Q.8 What is the duration within which Taxpayers need to file for cancellation of GST registration?

Ans: Taxpayers need to file for cancellation of GST registration within 30 days from the date from which registration is liable to be cancelled, in case of voluntary cancellation.

Q.9 Is there any limitation on filing for GST registration by Taxpayers who had registered voluntarily?

Ans: No.

Q.10 Can I file for amendment of Core fields after applying for cancellation of GST registration?

Ans: No. Once you have submitted the application for cancellation of registration, and ARN has been generated, you will not be allowed to file for amendment of Core fields.

Q.11 Can I file for amendment of Non-Core fields after applying for cancellation of GST registration?

Ans: Yes. Once you have submitted the application for cancellation of registration, and ARN has been generated, you can file for amendment of Non-Core fields

Q.12 I was issued a temporary-ID by Suo Moto registration. Can I file for cancellation of this registration?

Ans: No. You cannot file for cancellation of Suo Moto registration. However, you can file an appeal against the issuance of Suo Moto registration to you at the appropriate forum, as provided in law.

Q.13 What will be status of GSTIN, in case of application for cancellation is submitted by taxpayer?

Ans: The existing GSTIN status will continue to show the status as ‘Active’. However, once the application of cancellation is filed, the following message will be displayed at the bottom of the screen “* Application of cancellation filed “.

Q.14 I have applied for registration on a voluntarily basis. Can I apply for cancellation of registration?

Ans: Yes, you can apply for cancellation of registration any time.

Q.15 Is it mandatory to give reasons for cancellation of registration?

Ans: Yes, it is mandatory to give reasons for cancellation of registration in the Reason for Cancellation field.

Q.16 How to cancel registration if I have issued any invoice and I am migrated taxpayer?

Ans: You can apply for cancellation of registration in Form GST-REG-16.

Q.17 How am I intimated about cancellation of registration? (via sms / mail? )

Ans: You will get a confirmation of the cancellation of provisional registration on your e-mail address.

Q.18 My registration has been cancelled. Can I still file return, for past period(s), during which my GSTIN was active?

Ans: Yes, you can file return for past period(s) for which your registration was active, till the effective date of cancellation.

Q.19 Can I submit application for cancellation of registration, in case Tax Official has already initiated, the suo-moto cancellation of Registration?

Ans: No, you cannot submit application for cancellation of registration, in case Tax Official has already initiated, suo-moto cancellation of Registration against your registration.

Q.20 I have saved the application for cancellation of registration. But, I am not able to submit the same. Why?

Ans: You cannot submit Application for Cancellation of Registration, in case suo-moto cancellation proceedings have been initiated by the Tax Official, against your registration.

Navigate to Dashboard > Services > User Services > View Additional Notices/Orders option to view the notice or order issued by the Tax Official.

Q.21 I am getting an error message that “A cancellation of registration proceeding has been initiated by Tax Official” while submitting the application for cancellation of Registration. Why?

Ans: You will get this error message, in case, suo-moto cancellation proceedings have been initiated by the Tax Official, against your registration.

Navigate to Dashboard > Services > User Services > View Additional Notices/Orders option to respond to the notice issued by the Tax Official for the same.

Q.22 Tax Official has initiated suo-moto cancellation of my Registration. What I need to do?

Ans: You need to respond to the notice issued by the Tax Official for the same.

Navigate to Dashboard > Services > User Services > View Additional Notices/Orders option to respond to the notice issued by the Tax Official.

Procedure for Cancellation of Registration

How can I file for cancellation of GST registration?

To file for cancellation of GST registration, please perform the following steps:

1. Visit the URL: https://www.gst.gov.in.

2. Login to the GST Portal with your user-ID and password.

3. Navigate to the Services > Registration > Application for Cancellation of Registration option.

4. The form – Application for Cancellation of Registration contains three tabs. Ensure that the Basic Details tab is selected by default.

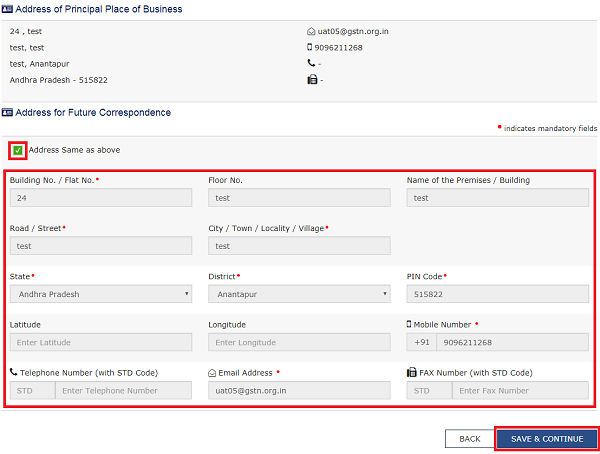

Note: The first tab contains pre-filled information in sections of Basic Details and Address of Principal Place of Business.

5. Either fill your Address for Future Correspondence manually, or check the option of Address same as above to copy the same address as in the Address of Principal Place of Business field.

6. Click the SAVE & CONTINUE button.

Notes:

- The tab Basic Details will change to blue colour and a tick mark will appear on it indicating that all the mandatory fields under this tab have been duly filled-in.

- The next tab Cancellation Details will get active, requiring you to make suitable selections and provide relevant information in corresponding fields.

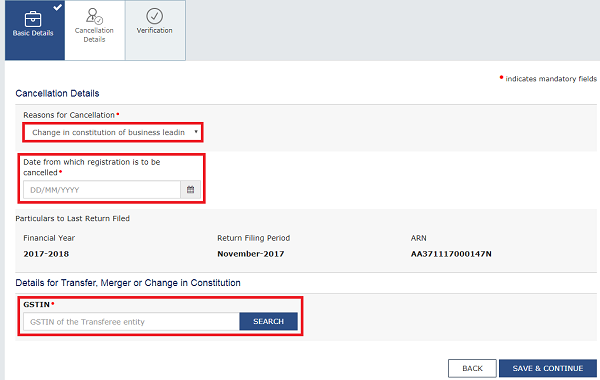

7. Select a suitable reason from the Reason for Cancellation drop-down list.

Notes: The following five reasons are available for selection:

a) Change in constitution of business leading to change in PAN

b) Ceased to be liable to pay tax

c) Discontinuance of business / Closure of business

d) Others

e) Transfer of business on account of amalgamation, merger, demerger, sale, leased or otherwise

Change in constitution of business leading to change in PAN:

a) Enter the date from which registration is to be cancelled.

b) Provide the GSTIN of the transferee entity under the Details for Transfer, Merger or Change in Constitution section. System will validate the same, and based upon it’s Legal Name of Business, will auto-populate the Trade Name.

Ceased to be liable to pay tax:

a) Enter the date from which registration is to be cancelled.

b) Enter the value of stock and the corresponding tax liability on the stock.

c) Basis the entered stock details, enter the value to offset the liability (tax payable) that you wish to offset from either the Electronic Cash Ledger, or the Electronic Credit Ledger, or both.

d) On submitting the form, the amount will be deducted from the respective Electronic Cash Ledger, or the Electronic Credit Ledger, or both, and debit entries will be made.

Discontinuance of business / Closure of business:

a) Enter the date from which registration is to be cancelled.

b) Enter the value of stock and the corresponding tax liability on the stock.

c) Basis the entered stock details, enter the value to offset the liability (tax payable) that you wish to offset from either the Electronic Cash Ledger, or the Electronic Credit Ledger, or both.

d) On submitting the form, the amount will be deducted from the respective Electronic Cash Ledger, or the Electronic Credit Ledger, or both, and debit entries will be made.

Others:

a) Specify the reason for cancellation.

b) Enter the value of stock and the corresponding tax liability on the stock.

c) Basis the entered stock details, enter the value to offset the liability (tax payable) that you wish to offset from either the Electronic Cash Ledger, or the Electronic Credit Ledger, or both.

d) On submitting the form, the amount will be deducted from the respective Electronic Cash Ledger, or the Electronic Credit Ledger, or both, and debit entries will be made.

Transfer of business on account of amalgamation, merger, demerger, sale, leased or otherwise:

a) Enter the date from which registration is to be cancelled.

b) Provide the GSTIN of the transferee entity under the Details for Transfer, Merger or Change in Constitution section. System will validate the same, and based upon it’s Legal Name of Business, will auto-populate the Trade Name.

8. Click the SAVE & CONTINUE button.

Notes:

- This will mark the second tab also as complete.

- The next tab, Verification will get activated.

9. Check the Verification statement box to declare that the information given in this form is true and correct, and that nothing has been concealed therefrom.

10. Select the name of the authorised signatory from the Name of Authorized Signatory drop-down.

11. Enter the Place of making this declaration.

Note: Notice that the system auto-populates the authorised signatory’s designation or status.

12. Sign the form by using either your Digital Signature Certificate (DSC), or the EVC option.

Notes:

- For the purpose of simplicity, this user manual has followed the EVC path.

- If using a DSC, you will be required to select your registered DSC from the emSigner pop-up window and then proceed from there accordingly.

13. Enter the OTP.

Notes:

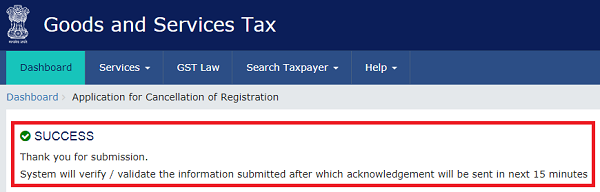

- On successfully filing the application for cancellation of registration, the system will generate the ARN and display a confirmation message.

- A confirmation message will also be sent by GST Portal on your registered mobile phone number and e-mail-ID.

- After this stage, the concerned Tax Official will review your application and take a decision accordingly.

14. To view the ARN, navigate to the Services > Registration > Track Application Status option.

15. Select Submission Period radio button.

16. Enter the From and To dates between which you filed for cancellation of registration.

17. Click the SEARCH button.

Note: The search result will display the ARN corresponding to your filed application.

How to Track GST Registration Application Status

(Republished with amendments)

****

Disclaimer: The contents of this article are for information purposes only and does not constitute an advice or a legal opinion and are personal views of the author. It is based upon relevant law and/or facts available at that point of time and prepared with due accuracy & reliability. Readers are requested to check and refer relevant provisions of statute, latest judicial pronouncements, circulars, clarifications etc before acting on the basis of the above write up. The possibility of other views on the subject matter cannot be ruled out. By the use of the said information, you agree that Author / TaxGuru is not responsible or liable in any manner for the authenticity, accuracy, completeness, errors or any kind of omissions in this piece of information for any action taken thereof. This is not any kind of advertisement or solicitation of work by a professional.

i was supplying via the amazon website, i.e. e-commerce business, how do I cancel my GST registration since I have taken up a job as an employee?

I took gst number for starting online advertising company , but not started due to some reason at 2 year before. At the time itself I want to close the gst . But tax advisor told it was closed automatically. I am not file any thing. But after 2 years also I received message about filing of gst. What can I do for cancel my gst

Sir We are apply for cancellation of GST Registration. As per our cancellation applied date is 28.09.2018. but we wrongly mentioned 01.07.2017., It is possible to correct this issue

Hello how to apply for cancellation of GST Registration in case of Tax Deductor if by mistake registered instead of tax payer. TIA

SIR,

i have credit amount of 150000 in my gst. Can i cancel my gst registration? If yes then how will my get refund? If no then please guide me for further steps.

Cancel of gst registraton any time limit and any time cancel gst registration by taxpayer person

Which Return need to file after surrender of GST Registration Certificate.

If the dealer has no transaction under GST Regime.

SIR PLEASE DISCUSS THE POINT OF MY GST NUMBER CANCEL IN CASE OF QUARTLY RETURN

after filling of cancellation of registration did i need to file Gst returns until the order for cancellation has been given by the proper officer.

i have not filed any GST return after date of cancellation of registration.what i do?

Hi,

I sent a request to cancel the GST number

07ADNPH4696K1ZW on 23/08/2018, I got an ARN

number AA070818027478P but it is still showing pending for Processing.Kindly deactivate this GST

number as quick as possible. I will not be liable to pay anything if it has not been deactivated.

Regards,

Syed Arshad Husain

i want to cancel gst registration ….i am govt tax deducter….but not shown cancel request on portal…how to cancel gst registration

Dear sir,

Cancellation for GST registration submitted on 04/06/2018 vide ARN No. AA0705180464930.

Request intimate status.

Sir, I have filed GSTR-1 for the Quarter Jan-Mar 2017 but did not file GSTR-3B for the period. Sales Shown Rs. 103750/- for the Qtr. Corresponding Purchases Rs. 104919 @12% Rate of GST. Total Turnover for FY 2017-2018 below the threshold limit. Now I want to Cancel GST Registration from w.e.f 01.01.2018. Purchases and Sales for Jan 2018 are Rs. 57876 and Rs. 57767 Respectively. Stock available on 01.01.2018 was Rs. 52500. Available ITC Rs. 300. Can I apply for Cancellation from 1st Jan 2018 or have to file GSTR-3B upto March 2018 ? Please advise in Detail.

Sir,

Today I know two GST Registration nos. was generated by GSTN portal for the same business and same PAN. I have used only firstly issued GST registration certificate and never used 2nd registration. Deptt. called me for cancellation of GST no. What I do please suggest me.

18/06/2018 it is my gst cancellation submission date,but no response.till today states field is “Clarification filed – Pending for Order “.I can not understand when it will done?

We cancelled GST Registration as our turnover remain below threshold limit but status of application is still under process from department. so what about GST return as from date of application for cancellation of registration we have not charged and not collected GST amount. if we filed NIL return then it looks that we have not raised any invoice but actually it is not. so what should i do? please suggest

Sir , we don’t have any Stock from our hand i.e nil stock…in which ,whether we need to give the inputs detail,tax paid detail or not..

hi do we need to file the gst nil return once the application is made for cancelation of gst number

Thanks ,Its very useful

after filling of cancellation of registration did i need to file Gst returns until the order for cancellation has been given by the proper officer.

We cancelled GST Registration as our turnover remain below threshold limit but status of application is still under process from department. so what about GST return as from date of application for cancellation of registration we have not charged and not collected GST amount. if we filed NIL return then it looks that we have not raised any invoice but actually it is not. so what should i do? please suggest

After clearing the tax liability through Credit ledger, how will the dealer get the refund of remaining credit present in ledger?

We have been collecting and paying Service Tax for our services till end June 2017. We migrated to GST in April 2017. Later we cancelled this registration in Oct 2017 since we don’t anticipate our yearly turnover more than twenty lakhs and as such we were not collecting any GST from July 2017 and that was the reason not filed GSTR-3B.

Please clarify that we are liable to pay GST for the period Jul to Sep 2017 for which period we did not collect GST and file GSTR-3B.

Truly useful article.Well explained.

VERY VERY USEFUL ARTICLE.

THANKS TO TaxGuru FOR SHARING SUCH KIND OF VERY USEFUL ARTICLES.

…

WELL DONE TAXGURU.

We can not cancel the registration of Existing taxpayer before completion of 1 year of registration. This message is shown when i click on the cancellation of registration.