What is Form DPT 3, who should file it and due date of filing Form DPT 3

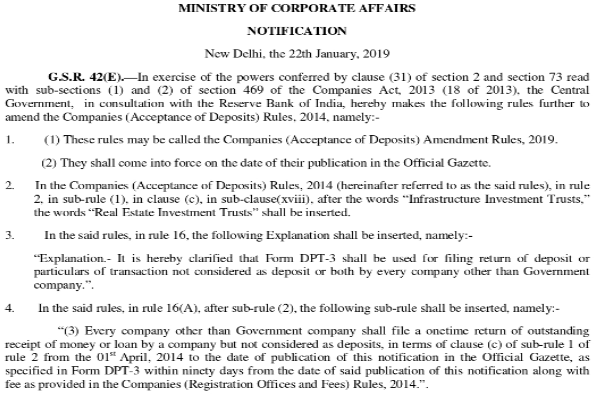

In order to safeguard the interest of deposit holders or creditors of the Company, the Central Government in consultation with the Reserve Bank of India (RBI) notified in the Companies (Acceptance of Deposits) Amendment Rules, 2019 to amend the Companies (Acceptance of Deposits) Rules, 2014.

What is the due date of filing Form DPT 3?

Due date of filing of one time form DPT 3 is 29th June 2019, while for annual return DPT 3 is 30th June 2019.

Who should file Form DPT 3?

The MCA has made it necessary for all companies registered in India other than Government Company to file Form DPT-3. Accordingly if you are falling under any category, you should file Form DPT 3. Small companies also are required to file form DPT 3.

- Private Limited Company

- Public Limited Company

- One Person Company (OPC)

- Small Company

Below is the screenshot of MCA notification issued on 22nd January, 2019.

What are the fees for Filing Form DPT 3?

DPT 3 form filing fees depend on the paid up capital.

What if E Form DPT 3 is not filed in time?

Company will have to pay additional fees if DPT 3 is filed beyond due date. Get in touch with us to know your late fees.

Additionally, if a company does not file DPT-3 and still accepts deposits then following are the consequences on company as well as officers of the company:

On Company: A fine of minimum INR. 1 crore or twice the amount of deposit so accepted, whichever is lower, which may extend to INR.10 crore, and

On the officers of the Company: Who is in default: imprisonment up to seven years and with a fine of not less than INR. 25 lakh which may extend to INR.2 crore.

What are the documents required to file E Form DPT 3?

- Auditor’s certificate

- Latest Audited Balance Sheet

What is the period of outstanding receipt of money or loan which should be shown in Form DPT 3?

Total loans received by company during the period from 01/04/2014 and 31/03/2019 and outstanding as on 31/03/2019) should be reported in Form DPT 3.

If loan/money has been received any time after 01.04.2014 and repaid before 31.03.2019then also information is required to be furnished?

No, information only about the outstanding loan/money as on 31st March 2019 is required to be furnished.

If loan/money has been received before 01.04.2014 and still outstanding in the balance sheet, then also information is required to be furnished?

Yes, information about any loan/money outstanding in the balance sheet of every Company except Government Company as on 31.03.2019 is required to be furnished in Form DPT-3.

Are small companies exempted from filing Form DPT 3?

No, there is no exemption as such. Only government Companies are not required to file Form DPT-3.

About EbizFiling.com: EbizFiling.com is a motivated and progressive concept conceived by like-minded people, which helps small, medium and large businesses to fulfill all compliance requirements of Indian Laws. Get in touch for a free consultation on info@ebizfiling.com or call 9643203209.

(Republished with amendments on 28.05.2019)

When the government has made income tax filling date as 31st oct 2019. and until I Dont file my returns for income tax. How do I come to a conclusion of my loans. The government is looking at making money from every corner possible. Instead should have DPT filling dates after the income tax date. Which is also common sense.

If a company does not have any external deposits but has loan from Director? Does it have to file DPT-3 form?

do we have to file DPT-3 twice in this FY 2018-19? once for one time declaration and one for regular / every year filing which was due on 30 jun? please clarify on this aspect.

companies registered in FY 2018-19 AND HAVING NO TURNOVER ( ZERO TRANSACTIONS ,, SALE PURCHASE , LOAN , DEPOSIT ALL ZERO “0”) REQUIRED TO FILE DPT 3 ?

In form DPT-3, it is mentioned that the details should be provided as per the latest audited balance sheet preceding the date of the return. Since the the ITR for the fy 18-19 is not filed, can we use the details of fy 17-18 ?

What contain in Auditor certificate

The due date for filing onetime return Form DPT-3 is 29th June 2019.

The due date for filing onetime return Form DPT-3 is within 90 days from 31st March 2019, i.e. 29th June 2019 as per Companies (Acceptance of Deposits) Second Amendment Rules, 2019 dated 30th April 2019. Kindly clarify and confirm as it varies from what you have mentioned in the article.