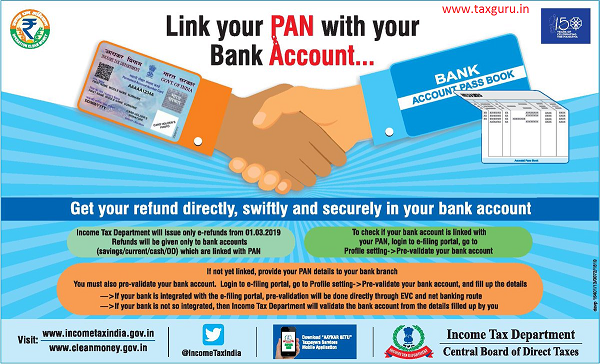

Link your PAN with your Bank Account…

Get your refund directly, swiftly and securely in your bank account

Income Tax Department will Issue only e-refunds from 01.03.2019 Refunds will be given only to bank accounts (savings/current/cash/OD) which are linked with PAN.

To check if your bank account is linked with your PAN, login to e-filing portal, go to Profile setting → Pre-validate your bank account

If not yet linked, provide your PAN details to your bank branch

You must also pre-validate your bank account. Login to e-filing portal, go to Profile setting → Pre-validate your bank account, and till up the details

→ If your bank is integrated with the e-filing portal, pre-validation will be done directly through EVC and net banking route

→ If your bank is not so integrated, then Income Tax Department will validate the bank account from the details filled up by you

Request you to share the public advisory / notification issued by the tax department in this regard.

bank a/c to be linked with pan is not possible for all persons . though i request to review matter

I tried but it says, Requested bank is not linked with e-filing. Try another account.

However this my main bank account at HSBC

Till date there is no such option of bank account pre-validation available in e-filing accounts of non individual assessees.

Whether refunds will be processed? Only time will tell.

How to claim