Quarterly GST Return-2019

♣ In the 27th GST Council meeting, the Government announced a simpler GST return filing regime for small taxpayer.

♣ Under the new regime, person having GST registration and a turnover of less than Rs.5 Crore would be provided with option to file quarterly return instead of monthly return.

♣ From the Last FY data of return`s, it is analyzed by GSTIN council that 93% of Taxpayer registered under GST are having their turnover less than Rs.5 Crores, so it is necessary to simplified process of return filling. Which help in smooth functioning of GST compliance`s.

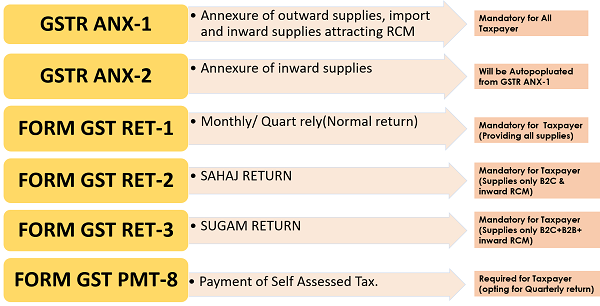

Applicability Chart

Note : Turnover means Aggregate Turnover which Defined as “As per section 2(6) of CGST Act, 2017 ‘aggregate turnover’ means the aggregate value of all taxable supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis), exempt supplies, exports of goods or services or both and inter-State supplies of persons having the same Permanent Account Number, to be computed on all India basis but excludes central tax, State tax, Union territory tax, integrated tax and cess”.

Total No. of Return require to be filled by Taxpayer in New GST Regime Return`s:

Analysis of GST ANX-1 : Outward Supplies

3A : Supplies made to Consumers and Unregistered Person

- Value shown under this part will net of Debit/ Credit note & Advances received.

- Negative value can be reported wherever applicable.eg (-100)

- Mandatory Fields require:

1. POS(Place of Supply)

2. Tax rate

3. Taxable Value

4. Tax amount

- Invoice value not required for supplies made Under this category

3B: Supplies made to Registered Person (Other than those Attracting RCM)

- Supplies made to Government Department (TDS registration) and through E-Commerce (TCS registration) will be disclosed under this part of Annexure.

- Supply of Goods from SEZ to DTA where bill of entry filled by recipient will not be declare here. Same will treated as Import for Recipient.

- Supplies of services from SEZ to DTA will reported here.

- All fields are mandatory except Shipping Bill/ Bill of Export.

3C&D: Export with Payment of Taxes and Without Payment of Taxes

- All the Export with payment of Taxes will reported in 3C and without payment of taxes will reported in 3D.

- Shipping bill/ Export bill is mandatory field in this part.

3E&F: Supplies made to SEZ unit with Payment of Taxes and Without Payment of Taxes

- All the SEZ supply made with payment of Taxes will reported in 3E and without payment of taxes will reported in 3F.

3G: Deemed Exports

- All the supplies which specified by Government as deemed export will disclosed here.

- For Ex.: Supplies made to Export Oriented Unit will be reported here.

3H : Inward Supplies attracting Reverse Charge

- To be reported by recipient, GSTIN wise for every supplier.

- To be reported net of Debit/ Credit note and advances paid , if any.

- In case of supplies from unregistered person liable under RCM, then PAN no. will be require in case of GSTIN no.

- Invoice wise detail not required.

3I: Import of Services

- It is to be reported net of Debit/Credit note and advances paid, if any.

- HSN mandatory , POS mandatory.

3J: Import of Goods

- All the goods imported will be reported here.

- Only Amount of IGST and Cess paid at the port of import reported here.

3K:Import of Goods from SEZ unit on BILL OF ENTRY

- Detail of Import of goods from SEZ unit on BILL OF ENTRY will reported here.

Analysis of Other Forms

To be continued in part 2…….

good article waiting for part 2