The National Financial Reporting Authority (NFRA) is mandated by the Companies Act, 2013, to monitor and enforce compliance with accounting standards. NFRA’s FRQRR of PSP Projects Ltd. highlighted significant compliance issues, especially in the areas of initial measurement and impairment loss allowance. The company is directed to rectify these discrepancies to ensure adherence to accounting standards. This analysis underscores the importance of transparent and accurate financial reporting in maintaining the integrity of companies in the market.

Financial Reporting Quality Review Report (FRQRR)

Company: PSP Projects Limited

CIN: L45201GJ2008PLC054868

Financial Reporting for the Financial Year: 2019-20

Financial Reporting Framework: Indian Accounting Standards (Ind AS)

Report No: NF- 20011/51/2021

Date of Report: 23.02.2023

Page Contents

List of Abbreviations and Acronyms

| Ind AS | Indian Accounting Standards notified under Companies (Indian Accounting Standard) Rules 2015 and amended from time to time |

| Company/PSP | PSP Projects Limited |

| FRQR | Financial Reporting Quality Review |

| FRQRR | Financial Reporting Quality Review Report |

| FY | Financial Year |

| NFRA/ Authority | National Financial Reporting Authority, Government of India |

List of Indian Accounting Standards applicable for the Financial Year 2019-20

| Sl. No. |

Ind AS Title |

| 1 | Indian Accounting Standard (Ind AS) 101, First-time adoption of Ind AS (Ind AS 101) |

| 2 | Indian Accounting Standard (Ind AS) 102 Share-based Payment (Ind AS 102) |

| 3 | Indian Accounting Standard (Ind AS) 103, Business Combinations (Ind AS 103) |

| 4 | Indian Accounting Standard (Ind AS) 104, Insurance Contracts (Ind AS 104) |

| 5 | Indian Accounting Standard (Ind AS) 105, Non-current Assets Held for Sale and Discontinued Operations (Ind AS 105) |

| 6 | Indian Accounting Standard (Ind AS) 106, Exploration for and Evaluation of Mineral Resources (Ind AS 106) |

| 7 | Indian Accounting Standard (Ind AS) 107, Financial Instruments: Disclosures (Ind AS 107) |

| 8 | Indian Accounting Standard (Ind AS) 108, Operating Segments (Ind AS 108) |

| 9 | Indian Accounting Standard (Ind AS) 109, Financial (Ind AS 109) |

| 10 | Indian Accounting Standard (Ind AS) 110, Consolidated Financial Statements (Ind AS 110) |

| 11 | Indian Accounting Standard (Ind AS) 111, Joint Arrangements (Ind AS 111) |

| 12 | Indian Accounting Standard (Ind AS) 112, Disclosure of Interests in Other Entities (Ind AS 112) |

| 13 | Indian Accounting Standard (Ind AS) 113, Fair Value Measurement (Ind AS 113) |

| 14 | Indian Accounting Standard (Ind AS) 114, Regulatory Deferral Accounts (Ind AS 114) |

| 15 | Indian Accounting Standard (Ind AS) 115, Revenue from Contracts with Customers (Ind AS 115) |

| 16 | Indian Accounting Standard (Ind AS) 116, Leases (Ind AS 116) |

| 17 | Indian Accounting Standard (Ind AS) 1, Presentation of Financial Statements (Ind AS 1) |

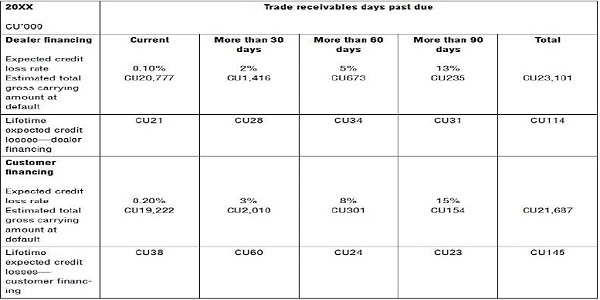

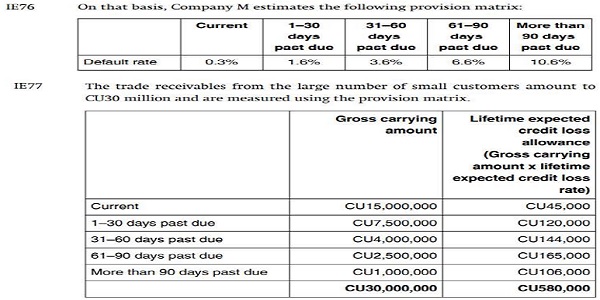

| 18 | Indian Accounting Standard (Ind AS) 2, Inventories (Ind AS 2) |

| 19 | Indian Accounting Standard (Ind AS) 7, Statement of Cash Flows (Ind AS 7) |

| 20 | Indian Accounting Standard (Ind AS) 8, Accounting Policies, Changes in Accounting Estimates and Errors (Ind AS 8) |

| 21 | Indian Accounting Standard (Ind AS) 10, Events after the Reporting Period (Ind AS 10) |

| 22 | Indian Accounting Standard (Ind AS) 12, Income Taxes (Ind AS 12) |

| 23 | Indian Accounting Standard (Ind AS) 16, Property, Plant and Equipment (Ind AS 16) |

| 24 | Indian Accounting Standard (Ind AS) 19, Employee Benefits (Ind AS 19) |

| 25 | Indian Accounting Standard (Ind AS) 20, Accounting for Government Grants and Disclosure of Government Assistance (Ind AS 20) |

| 26 | Indian Accounting Standard (Ind AS) 21, The Effects of Changes in Foreign Exchange Rates (Ind AS 21) |

| 27 | Indian Accounting Standard (Ind AS) 23, Borrowing Costs (Ind AS 23) |

| 28 | Indian Accounting Standard (Ind AS) 24, Related Party Disclosures (Ind AS 24) |

| 29 | Indian Accounting Standard (Ind AS) 27, Separate Financial Statements (Ind AS 27) |

| 30 | Indian Accounting Standard (Ind AS) 28, Investments in Associates and Joint Ventures (Ind AS 28) |

| 31 | Indian Accounting Standard (Ind AS) 29, Financial Reporting in Hyperinflationary Economies (Ind AS 29) |

| 32 | Indian Accounting Standard (Ind AS) 32, Financial Instruments: Presentation (Ind AS 32) |

| 33 | Indian Accounting Standard (Ind AS) 33, Earnings per Share (Ind AS 33) |

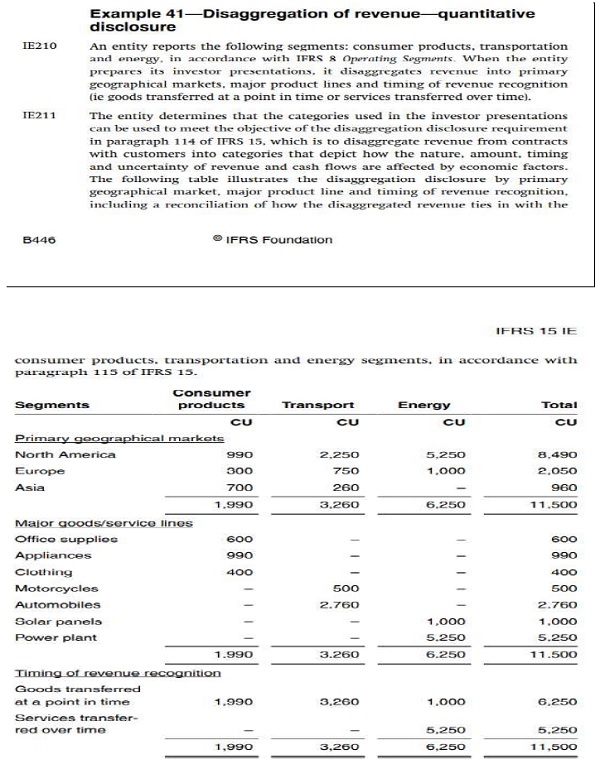

| 34 | Indian Accounting Standard (Ind AS) 34, Interim Financial Reporting (Ind AS 34) |

| 35 | Indian Accounting Standard (Ind AS) 36, Impairment of Assets (Ind AS 36) |

| 36 | Indian Accounting Standard (Ind AS) 37, Provisions, Contingent Liabilities and Contingent Assets (Ind AS 37) |

| 37 | Indian Accounting Standard (Ind AS) 38, Intangible Assets (Ind AS 38) |

| 38 | Indian Accounting Standard (Ind AS) 40, Investment Property (Ind AS 40) |

| 39 | Indian Accounting Standard (Ind AS) 41, Agriculture (Ind AS 41) |

Executive Summary of the FRQRR

1. NFRA is mandated, under Section 132(2)(b) of the Companies Act, 2013 (the Act) to monitor and enforce compliance with accounting standards. Rule 7 of the NFRA Rules, 2018, provides for monitoring and enforcing compliance with accounting standards, NFRA may inter alia review the Financial Statements of the Company; direct such Company or its auditor by written notice to provide further information or explanation or any relevant documents relating to such Company. In exercise of these powers, NFRA undertook the Financial Reporting Quality Review of the Standalone Financial Statements of PSP Projects Ltd. (the Company) on the basis of NFRA’s statistical sampling approach. PSP Ltd. is a multidisciplinary construction Company listed on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) and offers a diversified range of construction and allied services across industrial, institutional, government, government residential and residential projects in India. It provides its services across the construction value chain, ranging from planning and design to construction and post-construction activities, including mechanical, engineering and plumbing (MEP) work and other interior fit outs to private and public sector enterprises.

2. The review was conducted through the examination of the Financial Statements and the responses of the PSP Projects Ltd. to a questionnaire sent by NFRA. After detailed examination, a Draft Financial Reporting Quality Review Report (FRQRR) was sent to the Company and an in-person discussion on the matter was held before finalising this FRQRR. The observations in this FRQRR are classified into two categories: those having High Impact and those with Low Impact.

3. The FRQR is limited to some specific areas and does not cover the entire gamut of Financial Reporting by the Company and, therefore, is not to be treated as an overall rating tool or expressing opinion on the Financial Statements.

4. Key observations categorized as ‘High Impact’

4.1. The Company’s disclosure of the initial measurement policy with respect to Trade Receivables (which is a material item, being 23.35% of the Total Assets) is not in accordance with Ind AS 109, Financial Instruments (Para 10 to 14).

4.2. The Company has not made impairment allowance using Expected Credit Loss (ECL) approach, as required by Ind AS 109 in respect of Contract Assets and Other Financial Assets such as deposits with banks, and other deposits, which constituted 19% and 22.95% respectively of the Total Assets (Para 15 to 30).

4.3. The disclosure made by the Company in relation to Credit Risk Exposure of its Financial Instruments is not in accordance with the requirements of Para 35M and Para 35N of Ind AS 107 as it does not give information of the provision matrix used for computing impairment loss allowance for Trade Receivables and the credit risk grades used for managing the credit risk of Other Financial Assets (Para 31 to 36).

4.4. The full particulars of the terms and conditions of the loans to related parties have not been disclosed in the Financial Statements as per requirements of Section 186(4)1 of Companies Act 2013 and Schedule III of the Companies Act, 2013 (Para 37 to 41).

4.5. The Company’s disclosures with regard to Ind AS 115 are not adequate and clear. This standard requires an entity to disclose the significant payment terms (for example 30 to 90 days etc.) and the basis of determination of the existence of a significant financing component (Para 42 to 48).

4.6. The Company has not adhered to the disclosure requirements of Para 1142 and Para B87-B89 of Ind AS 115, which requires the Company to disaggregate revenue (Para 49 to 54).

4.7. The Company has not adequately complied with the disclosure requirements of Fair Value of the Financial Instruments, as required by Ind AS 107 (Para 55 to 59).

5. Key observations categorized as ‘Low Impact’

5.1. The Company has not fully complied with disclosure requirements of its leasing arrangements, as required by Indian Accounting Standards (Ind AS)116, Leases, (Para 60 to 62).

5.2. The disclosure provided by the Company in its Financial Statements regarding regrouping/reclassification is superfluous (Para 63 to 66).

5.3. The Company has not disclosed whether its owners or others have the power to amend the Financial Statements after issue, as required by Ind AS 10, Events after the reporting period (Para 67 to 71).

Introduction and the Legal Framework of Financial Reporting Quality Review (FRQR)

6. As mandated under Section 132(2)(b) of the Companies Act, 2013 (the Act), the National Financial Reporting Authority (NFRA) shall inter alia, monitor and enforce compliance with accounting standards in such manner as may be prescribed. Rule 7 of the NFRA Rules, 2018, provides that for monitoring and enforcing compliance with accounting standards under the Act, NFRA may–

(a) review the Financial Statements of the Company;

(b) direct such Company or its auditor by written notice to provide further information or explanation or any relevant documents relating to such Company; and

(c) require the personal presence of the officers of the Company and its auditor for seeking additional information or explanation in connection with the review of Financial Statements of such Company.

7. The Company’s Management and Board of Directors are responsible for preparation and presentation of Financial Statements. The Statutory Auditors of the Company are responsible for the audit of Financial Statements and expressing opinion whether the Financial Statements give a true and fair view. The NFRA undertakes FRQR in pursuance of its functions under section 132 (2) of the Act to monitor and enforce compliance with accounting standards and to oversee the quality of service of the professions associated with ensuring compliance with such standards and suggest measures required for improvement in quality of service. The objective of the FRQR by NFRA is to assess and evaluate how well the information presented in the Financial Statements meets the key aspects of presentation and disclosure requirements of the applicable Financial Reporting Framework and guide the companies to improve the quality and transparency of financial reporting in their statutory obligation to comply with the accounting standards. The FRQR is not intended to duplicate the functions of the management and the auditors or to provide any assurance that these stakeholders are required to provide by statute. This FRQR is primarily based on review of presentations and disclosures made in published Financial Statements by the preparers who remain responsible for the correctness of the information contained therein.

8. FRQR of PSP Projects Ltd:

Under the above mandate, NFRA selected the Standalone Financial Statements of PSP Projects Ltd. for the FRQR on the basis of NFRA’s statistical sampling approach. PSP Projects Ltd. is a Company listed on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) and is a multidisciplinary construction company offering a diversified range of construction and allied services across industrial, institutional, government, government residential and residential projects in India. It provides its services across the construction value chain, ranging from planning and design to construction and post-construction activities, including mechanical, engineering and plumbing (MEP) work and other interior fit outs to private and public sector enterprises. As part of this FRQR, NFRA reviewed certain significant aspects of the Financial Statements. The review is limited to the specific areas and do not cover the entire gamut of Financial Reporting by the Company. The FRQRR is, therefore, not to be treated as an overall rating tool or expressing opinion on the Financial Statements of PSP Projects Ltd. The observations in this FRQRR are classified into two categories as ‘High Impact’ and ‘Low Impact’.

9. Documents were sought from the Company, on 15.04.2021 and these were furnished by the Company

vide communication dated 11.05.2021. After a preliminary examination of the Financial Statements of the Company for the Financial Year 2019-20, NFRA sent a questionnaire dated 17.08.2021, based on observations made on the Financial Statements. The Company vide its email dated 16.09.2021 responded to the questionnaire. After detailed examination, a Draft Financial Reporting Quality Review Report (FRQRR) was sent to the company on 12.10.2022. The Company’s written response dated 10.11.22 to the Draft FRQRR has been taken on record. Further, an in-person discussion on the matter was afforded by the Executive Body (EB) of NFRA to the Company on the 03.02.2023. This FRQRR has been finalised after taking into account the position explained by the Company.

Observations Classified as ‘High Impact’

Initial measurement policy for Trade Receivables

10. Note 2.12 (page no.128 of Annual Report) relating to Financial Instruments states that “all financial assets are initially recognized at fair value. Transaction costs that are directly attributable to the acquisition of financial assets, which are not at fair value through profit or loss, are adjusted to the fair value on initial recognition. Purchase and sale of financial assets are recognised using trade date accounting.”

11. NFRA observes that the above accounting policy for initial measurement of Financial Assets, constituting 23.35% of total assets, which is a material item of the Balance Sheet, is contrary to initial measurement requirements as detailed in Para 5.1.3 read with Para 5.1.1 of Ind AS 109, which is reproduced below:

Para 5.1.1 of Ind AS 109: – Except for trade receivables within the scope of Para 5.1.3, at initial recognition, an entity shall measure a financial asset or financial liability at its Fair Value plus or minus, in the case of a financial asset or financial liability not at fair value through profit or loss, transaction costs that are directly attributable to the acquisition or issue of the financial asset or financial liability.

Para 5.1.3 of Ind AS 109:- Despite the requirement in Para 5.1.1, at initial recognition, an entity shall measure trade receivables at their transaction price (as defined in Ind AS 115) if the trade receivables do not contain a significant financing component in accordance with Ind AS 115 (or when the entity applies the practical expedient in accordance with Para 63 of Ind AS 115).

It can be observed that the requirement of Ind AS 109 is that the Financial Assets in the form of Trade Receivables have to be measured at Transaction Price and not at Fair Value as incorrectly stated by the Company.

12. The Company stated that Note no. 2.12 describes the expected lifetime losses to be recognised from initial recognition of the receivables. The Company uses historical default rates to determine impairment loss on the portfolio of trade receivables. At every reporting date these historical default rates are reviewed and changes in the forward-looking estimates are analysed. The Company submitted that they had disclosed the accounting policy related to Trade Receivables and its measurement criteria.

The Company also referred to paragraph 2 of note 2.15 Revenue Recognition: Revenue from Contracts with Customers (page no. 130 of Annual Report):

“For contracts where the aggregate of contract cost incurred to date plus recognised profits (or minus recognised losses as the case may be) exceeds the progress billing, the surplus is shown as contract asset and termed as “Due from customers”. For contracts where progress billing exceeds the aggregate of contract costs incurred to-date plus recognised profits (or minus recognised losses, as the case may be), the surplus is shown as contract liability and termed as “Due to customers”. Amounts received before the related work is performed are disclosed in the balance sheet as contract liability and termed as “Advances from customer”. The amounts billed on customer for work performed and are unconditionally due for payment i.e., only passage of time is required before payment falls due, are disclosed in the balance sheet as trade receivables. The amount of retention money held by the customers pending completion of performance milestone is disclosed as part of contract asset and is reclassified as trade receivables when it becomes due for payment.”

13. The Company in its final reply and in-person discussion stated that the initial measurement of Trade Receivables is done at transaction value only, which is an indicative measure of the fair value of the same. The Company submitted that there is no impact on the recognition of any Financial Asset on account of this practice and that it shall make an additional disclosure on this point to bring out more clarity about the same going forward.

14. NFRA concludes that the Company’s initial measurement policy for Trade Receivables is not in accordance with the requirements of Para 5.1.1 and Para 5.1.3 of Ind AS 109 and the Company is directed to correct the error in disclosure in the Financial Statements, as assured by the Company in its submissions to NFRA.

Non-provision of the Impairment loss allowance in respect of Financial Assets and Contract Assets

15. NFRA observes that there is no impairment loss allowance, as required by Ind AS 109, against the Financial Assets and Contract Assets which constituted 22.95% and 19% of the total assets respectively as on 31.03.2020.

16. The key requirements of Ind AS 109 regarding the recognition and measurement of Expected Credit Loss (ECL) are highlighted below:

17. Para 5.5.1 of Ind AS 109 makes it mandatory to recognise a loss allowance for expected credit losses on a financial asset specified in the said para. Similarly, para 5.5.3 makes it mandatory at each reporting date, to measure the loss allowance for a financial instrument at an amount equal to the lifetime expected credit losses if the credit risk on that financial instrument has increased significantly since initial recognition.

18. Para 5.5.4 stipulates that the entity shall consider all reasonable and supportable information, including that which is forward-looking, while assessing credit risk. This forward-looking information consists of an estimate of expected recovery patterns, probability of default, time of recovery, the amount expected to be recovered from collaterals, credit rating reports, economic factors and so on. If reasonable and supportable forward-looking information is available without undue cost or effort, an entity cannot rely solely on past due information when determining whether credit risk has increased significantly since initial recognition. To determine whether there has been a significant increase in credit risk, Ind AS 109 requires a comparison of the risk of default estimated on initial recognition with the risk of default estimated at the reporting date, using the change in the risk of a default occurring over the expected life.

19. Para 5.5.5 makes it mandatory that if the credit risk on a financial instrument has not increased significantly since initial recognition, an entity shall measure the loss allowance for that financial instrument at an amount equal to 12-month expected credit losses. Para 5.5.15 mandates that despite paragraphs 5.5.3 and 5.5.5, an entity shall always measure the loss allowance at an amount equal to lifetime expected credit losses for trade receivables.

20. Para 5.5.17 stipulates the conditions to be satisfied in the measurement of expected credit losses. It requires that an entity shall measure expected credit losses of a financial instrument in a way that reflects:

(a) an unbiased and probability-weighted amount that is determined by evaluating a range of possible outcomes.

(b) the time value of money; and

(c) reasonable and supportable information that is available without undue cost or effort at the reporting date about past events, current conditions, and forecasts of future economic conditions.

21. The Notes to accounts (Note 2.12) give the Company’s accounting policy for impairment of Financial Assets as reproduced below-

“Financial Assets:

c) Impairment of financial assets:

In accordance with Ind AS 109, the Company uses ‘Expected Credit Loss’ (ECL) model, for evaluating impairment of financial assets other than those measured at fair value through profit and loss (FVTPL).

Expected credit losses are measured through a loss allowance at an amount equal to:

i) The 12-months expected credit losses (expected credit losses that result from those default events on the Financial Instrument that are possible within 12 months after the reporting date); or

ii)Full lifetime expected credit losses (expected credit losses that result from all possible default events over the life of the financial instrument)

For Trade Receivables Company applies ‘simplified approach’ which requires expected lifetime losses to be recognised from initial recognition of the receivables. The Company uses historical default rates to determine impairment loss on the portfolio of Trade Receivables. At all reporting dates, these historical default rates are reviewed and changes in the forward-looking estimates are analysed.

For other assets, the Company uses 12-month ECL to provide for impairment loss where there is no significant increase in credit risk. If there is significant increase in credit risk, full lifetime ECL is used.

22. The Company in Note 36 has stated that it maintains exposure in cash and cash equivalents, term deposits with banks and loans to subsidiary companies. The Company has diversified portfolio of investment with various counterparties which have secure credit ratings hence the risk is reduced. Cumulative allocation limits are set for each category of asset class. Credit limits and concentration of exposures are actively monitored by the finance department of the Company.’

23. The Company’s Financial Statements disclosed the following types of Financial Assets which are subject to impairment loss recognition and measurement of Ind AS 109.

Deposits

Non-Current

Deposits with Banks (Maturity more than 12 months): ₹5,386.90 lakhs

Security deposits: ₹409.20 lakhs

Current

Bank Balances: ₹15,552.17

Other Deposits: ₹611.05 lakhs

24. With respect to Deposits with Banks (Maturity more than 12 months): ₹5,386.90 lakhs, PSP Projects Ltd. in its final reply dt.10.11.2022 stated that these deposits are with the banks which are members of a Consortium with State Bank of India as lead banker. The consortium member banks are either nationalized bank backed by the Government or private sector banks listed on stock exchange in India with decent credit rating between AAA to A2 or scheduled banks with credit rating of A2 and good CRAR and financials. Further, major portion of deposits are placed with banks as lien against overdraft facility, bank guarantee facility and other non-fund-based facilities. The Company places its funds in bank deposits after reviewing the bank’s financial stability and credit rating from reputed credit agencies, which is reviewed from time to time.

25. With respect to Security deposits: ₹409.20 lakhs: The Company stated that the same is made up of ₹87.83 lakhs deposits for utilities, ₹279.55 lakhs long term security deposits with Government clients and ₹41.80 lakhs deposit with the Government entity as security against various licenses. All these are deposits for security purpose and would be refunded when claimed by Company. Hence, the rights for such contractual deposits remained with the Company, and thus no impairment was created on these security deposits. With respect to Balances: ₹15,552.17 lakhs: PSP Projects stated that it was made up of balance for unpaid dividend account of ₹2.96 lakhs and ₹15,549.21 lakhs as deposits with bank with maturity from 3 months to 12 months. With respect to Other Deposits: ₹611.05 lakhs: PSP Stated that this was made up of (a) ₹56.02 lakhs short term deposits with a statutory authority for ₹56.02 lakhs etc, on which the default risk would be rare, and thus no impairment was required, (b) ₹486.27 lakhs as current Deposits with Subsidiary and Joint Venture, repayable on demand, (c) ₹68.75 lakhs in the form of Earnest Money Deposits (EMD) made by the Company at the time of filing tender documents with various clients. As per tender terms, the same would be converted either into security deposit or refunded within specified time.

26. The Company’s position (Refer Note 36 of Financial Statements) that the credit risk is reduced due to its diversified portfolio of investment with various counterparties which have secure credit ratings is not fully in accordance with principles and concepts of Expected Credit Loss (ECL) approach for impairment loss recognition and measurement under Ind AS 109. The banks in which the Financial Assets are kept in the form of balances also have the potential to default on their repayment/credit obligations, as there have been many instances of heightened credit risk due to bank failures in India and abroad.

27. NFRA reiterates that the Company should review its policy and provide for ECL in accordance with Ind As 109, including on balances due from banks, which cannot be viewed as free from the risk of default, and the deposits with other authorities, Subsidiary and Joint Ventures.

28. In respect of Contract Assets, the Company has reported an outstanding amount of ₹18,298.61 lakhs within Note 8-Other Financial Assets, which is a material component of the Balance Sheet comprising 19% of the Total Assets as on 31.03.2020.

Contract Assets

Non-Current

Contract Asset ₹6,066.29 lakhs

Current

Contract Asset ₹12,232.32 lakhs

Para 107 of Ind AS 115 says that an entity shall assess a Contract Asset for impairment in accordance with Ind AS 109. An impairment of a Contract Asset shall be measured, presented, and disclosed on the same basis as a Financial Asset that is within the scope of Ind AS 109. However, no impairment loss allowance has been recognized and measured by applying the Expected Credit Loss (ECL) method of Ind AS 109 against these contract assets.

29. With respect to Unbilled Revenue (Contract Assets) and Retention Money, the Company referred to Note No. 39 (b) and (d) of the Standalone Financial Statements wherein the Company has explained the temporary nature of the balances lying in Contract Assets and Retention Money which will eventually get converted as Trade Receivables on achievement of milestones. Such converted balances were covered under measurement of Expected Credit Losses as per the simplified approach followed by the Company for Trade Receivables.

30. On the basis of the replies submitted by the Company, it is observed that the Company has not calculated the ECL as required by Ind AS 109 for FY 2019-20. The Company’s policy, not to apply ECL to Contract Assets and Retention Money and apply the same only when they are billed and accounted for as Trade Receivables, was erroneous. This was not in compliance with the provisions of Ind AS 115 and Ind AS 109 and was explained during the in-person discussion held on 03.02.2023. As the provisions of Ind AS 109 are mandatory in nature, the Company is directed to comply with the requirements of Ind AS 109.

Inadequate disclosure regarding Credit Risk Exposure

31. The Company’s disclosures in respect of its credit risk exposure is not in accordance with Para 35M and Para 35N of Ind AS 107 as it does not give information of impairment loss allowance based on the provision matrix used for computing impairment loss allowance for Trade Receivables and based on credit risk grades used for other Financial Assets.

32. The Company in its Note 36-Financial Risk Management has only disclosed the movement in Expected Credit Loss allowance and described how it manages the credit risk. However, Para 35M and 35N of Ind AS 107, which are reproduced below, require certain disclosures, which the Company has not provided:

Para 35M (Credit risk exposure) of Ind AS 107 states-

To enable users of financial statements to assess an entity’s credit risk exposure and understand its significant credit risk concentrations, an entity shall disclose, by credit risk rating grades, the gross carrying amount of financial assets and the exposure to credit risk on loan commitments and financial guarantee contracts. This information shall be provided separately for financial instruments:

(a) for which the loss allowance is measured at an amount equal to 12-month expected credit losses;

(b) for which the loss allowance is measured at an amount equal to lifetime expected credit losses and that are:

(i) financial instruments for which credit risk has increased significantly since initial recognition but that are not credit-impaired financial assets;

(ii) financial assets that are credit-impaired at the reporting date (but that are not purchased or originated credit impaired); and

(iii) trade receivables, contract assets or lease receivables for which the loss allowances are measured in accordance with paragraph 5.5.15 of Ind AS 109.

(c) that are purchased or originated credit-impaired Financial Assets.

Para 35N of Ind AS 107 states-

For Trade Receivables, contract assets and lease receivables to which an entity applies paragraph 5.5.15 of Ind AS 109, the information provided in accordance with paragraph 35M may be based on a provision matrix (see paragraph B5.5.35 of Ind AS 109).

33. To illustrate the point, the Company was directed to refer to Ind AS Implementation Guidance-Guidance on implementing IFRS 7 Financial Instruments: Disclosure, IG20D, reproduced below for ready reference. This illustrates the disclosures required by Paragraph 35M and 35N in respect of credit risk exposure of Trade receivables.

Further, the Ind AS Implementation Guidance- Example 12-Provision Matrix of Illustrative Examples of IFRS 93 Financial Instruments (shown below), illustrates the disclosures required for impairment loss allowance of Trade Receivables.

34. PSP Projects limited stated that according to their understanding, Para 35M and Para 35N of Ind AS 107 require the use of provision matrix for computing impairment loss allowance for Trade Receivables and the credit risk grades used for managing the credit risk of other Financial Assets applies to financial instruments that are having a specific credit rating. They further stated that in their case, the financial assets held by the Company were not individually credit rated by credit rating agencies. The Company also stated that they understand this disclosure only applies to entities engaged in the financial sector.

35. With respect to observation in respect of Paragraph 35N of Ind AS 107, the Company reiterated their accounting policy in notes to standalone Financial Statements 2.12 (c) and also stated that Provision Matrix is only one of the methods or measurement tools. Further, they have reviewed financials of the five peer companies identified earlier, which are some of the leading companies in their segment, and all of them, except one, have provided only the movement of ECL during the year, which is in line with the Company’s disclosure of credit risk in their annual report. The Company further stated that they have disclosed the ageing of Trade Receivables as per the requirement of revised Schedule III of Companies Act, 2013.

36. During the in-person discussion held on 03.02.2023, it was explained that the disclosures required are to be based on the approach followed by the company and not necessarily based on credit rating given by the rating agencies. It was also explained that the absence of disclosures by other companies is not a valid reason for not complying with the requirements of Ind AS. NFRA therefore concludes that the Company has not complied with the disclosure requirements as explained in Ind AS guidance material (IE76 and IE77 of illustrative Examples of IFRS 9) on the application of the requirements of para 35M and 35N of Ind AS 107. The Company’s understanding regarding the requirements of Paragraph of 35M and 35N that it applies only in case of Financial Instruments with specific credit ratings is incorrect.

Non-disclosures regarding Related Party Loans

37. The Company has disclosed Loans amounting to ₹3,942.63 lakhs to Related Parties as mentioned below:

- Non-Current Loan to Related Parties ₹2,751.59 Lakhs

- Current Loan to Related Parties ₹1,163.44 Lakhs

38. The full particulars of the loan to Related Parties such as rate of interest, repayment terms, due date, collateral etc. have not been disclosed in the Financial Statements which is required as per Section 186(4)4 of Companies Act 2013 and Schedule III of the Companies Act, 2013. Schedule III of the Companies Act, 2013, General Instructions for Preparation of Balance Sheet and Statement of Profit and Loss of a Company requires disclosure of details of loans and advances to Related Parties.

39. The Company stated that they have disclosed the transactions done during the year and year end balances pertaining to loans and guarantees provided to related parties and interest income recognised under note no.37 pertaining to related party transactions. However, the reference of section 186(4) is not specifically disclosed. The Company stated that they would enhance their disclosure to be more specific about the requirement of Section 186(4) of Companies Act, 2013.

40. The Company, during the in-person discussion on 03.02.2023, stated that it has taken note of the observation made by NFRA and has improved the disclosures in the Financial Statements from 202122 as per the Companies Act, 2013 and Schedule III.

41. Going forward, the company is directed to disclose the loan tenure and collaterals, if any.

Non-disclosure of the general terms of payment of Trade Receivables and Contract Assets

42. The Company has disclosed ₹22,400 lakhs as Trade Receivables in Note 12, which is a significant amount (23.35% of the total assets of PSP Projects Ltd as on 31.03.2020). However, the Company has not disclosed the general terms of payment (for example 30 to 90 days etc.) and whether these Trade Receivables have significant financing component, as required by Ind AS 115.

43. The Company referred to para 60 and 63 of the Ind AS 115 (significant financing component) and stated that they had disclosed in the third Para of note no. 2.15 Revenue Recognition (page no.130 of Annual Report) that the “Payment terms agreed with a customer are as per business practice and the financing component, if significant, is separated from the transaction price and accounted as interest income.” Also, in second Para of Note 39(d), it is mentioned that “The amounts billed on customer for work performed and are unconditionally due for payment i.e., only passage of time is required before payment falls due, are disclosed in the Balance Sheet as Trade Receivables.”

44. In their written response, the Company stated that there are no significant financing components in the Trade Receivables. With respect to general terms of payment, Ind AS lists out the illustrative examples of terms and conditions to be disclosed and those terms are decided as per normal business practice and will be decided based on contract conditions with each client. As the contract terms varies for each client, the Company stated that they had not disclosed any generalized terms in the notes to the Financial Statements. Based on the above facts and explanation, the Company submitted that adequate disclosure in the accounting policy had been done.

45. NFRA observes that the disclosure made by the Company in Note 2.15 of Financial Statements, wherein it is stated that payment terms agreed with a customer are as per business practice, is a vague disclosure. It does not give the critical information useful to the users of financial statements, as to the basis to assess the ability of the entity to generate cash and cash equivalents. Thus, there is lack of clarity in the Company’s disclosure as the Company has not given details of Trade Receivables due for payment in less than a year, which justified application of Para 63 of Ind As 115. As regards the presence of significant financing component in the contracts with the customers, the Company has stated that there are no contract terms with the customers having significant financing component.

46. Para 129 of Ind AS 115 states, ‘If an entity elects to use the practical expedient in either paragraph 63 (about the existence of a significant financing component) or paragraph 94 (about the incremental costs of obtaining a contract), the entity shall disclose that fact.’. However, it is not clear how the Company assessed the fact that its contracts do not have significant financing component i.e., whether it has applied the practical expedient clause as laid down in Para 63 of Ind AS 115. This para states “As a practical expedient, an entity need not adjust the promised amount of consideration for the effects of a significant financing component if the entity expects, at contract inception, that the period between when the entity transfers a promised good or service to a customer and when the customer pays for that good or service will be one year or less.” However, the Company has not made the above disclosure in its Financial Statements. Therefore, NFRA concludes that PSP projects Ltd. has not adequately complied with disclosure requirements of Ind AS 115.

47. The Company in its response stated that even though it was not practically convenient to generalize terms, it has made disclosure of payment terms, which range from 7 to 120 days, in the Annual Report of FY 2021-22, along with the other terms of payment associated with contracts with customers.

48. During the in-person discussion held on 03.02.2023, the Company was informed that the disclosure requirement of Para 119 of Ind AS 115 is mandatory as it says that the “entity shall disclose” the significant payment terms, variable considerations, if any, and the presence or absence of significant financing component as the objective of Ind ASs is to enhance the quality of disclosures for better understanding of the users of the Financial Statements. The Company is therefore directed to comply with the requirements of Para 119 of Ind AS 115.

Non-fulfilment of disclosure requirements in respect of disaggregation of revenue from contracts

49. In Note 39, the Company has disclosed the disaggregation of revenue from contracts with customers by geographical area only. Para 114 of Ind AS 115 requires that “An entity shall disaggregate revenue recognised from contracts with customers into categories that depict how the nature, amount, timing and uncertainty of revenue and cash flows are affected by economic factors. An entity shall apply the guidance in Paras B87—B89 when selecting the categories to use to disaggregate revenue.”

50. The disclosure requirements of Para 114 of Ind AS 115 are intended to depict how the nature, amount, timing and uncertainty of revenue and cash flows are affected by economic factors. Para B89 of Ind AS 115 gives the following guidance for disaggregation of revenue:

(a) type of good or service (for example, major product lines);

(b) geographical region (for example, country or region);

(c) market or type of customer (for example, government and non-government customers);

(d) type of contract (for example, fixed-price and time-and-materials contracts);

(e) contract duration (for example, short-term and long-term contracts);

(f) timing of transfer of goods or services (for example, revenue from goods or services transferred to customers at a point in time and revenue from goods or services transferred over time); and

(g) sales channels (for example, goods sold directly to consumers and goods sold through intermediaries)

The disclosures of PSP Ltd. do not comply with the requirements of Ind AS 115.

51. The Company in its response stated that the guidance provided under Para B87-B89 of Ind AS 115 as referred to in Para 114 mentions that the criteria for disaggregation depends upon the risks and uncertainty and other economic factors. It does not specifically mention that the disaggregation has to be done on the basis of method of revenue recognition. The Company stated that they had made the following disclosures which refer to the timing of revenue recognition i.e., Revenue recognition at a point of time and revenue over period of time in compliance of Ind AS 115: –

Note no. 2.15 Revenue Recognition: “Revenue from Contracts with Customers: The Company recognises revenue from contracts with customers when it satisfies a performance obligation by transferring promised goods or service to a customer. The revenue is recognised to the extent of transaction price allocated to the performance obligation satisfied. Performance obligation is satisfied over time when the transfer of control of good or service to a customer is done over time and in other cases, performance obligation is satisfied at a point in time. For performance obligation satisfied over time, the revenue recognition is done by measuring the progress towards complete satisfaction of performance obligation. The progress is measured in terms of a proportion of actual cost incurred to date, to the total estimated cost attributable to the performance obligation.”

Note no. 39 Revenue from contracts with customers (Disclosure as per Ind AS 115)

“d) Performance obligation- The Company recognises revenue from contracts with customers when it satisfies a performance obligation by transferring promised good or service to a customer. The revenue is recognised to the extent of transaction price allocated to the performance obligation satisfied. Performance obligation is satisfied over time when the transfer of control of asset (good or service) to a customer is done over time and in other cases, performance obligation is satisfied at a point in time. For performance obligation satisfied over time, the revenue recognition is done by measuring the progress towards complete satisfaction of performance obligation.”

52. NFRA observes that the PSP Projects Ltd. in its annual report has stated that it executes projects which are categorized as Industrial, Institutional, Residential, Government and Government Residential. The Company is providing services across the construction value chain, ranging from planning and design to construction and post-construction activities, including mechanical, engineering and plumbing (MEP) work and other interior fit outs to private and public sector enterprises. These allied services represent separate business lines and hence disaggregation by ‘type of good or service’ ought to have been disclosed. Further, the Company is serving different categories of customers, hence disaggregation of revenue on the lines of principles laid down in Ind AS 115 was required but the PSP Projects have not complied with the disclosure requirements of Para 114 read with Para B89 of Ind AS 115. The Company is directed to refer to Ind AS Implementation Guidance-Example 41 of Illustrative Examples IFRS 155, as reproduced below:

53. PSP Projects Ltd. in its final reply dt.10.11.2022 has stated that the Company operates in a single business line of project-based construction activities. The principal business activity of the Company is end to end project based construction activities which includes planning, designing, post construction activities including MEP and interior fit out, and these services are catered as per the requirements of the clients. Work orders issued by clients are inclusive of construction activities and related services which cannot be segregated into multiple business verticals, as these are inseparable composite contracts as per the scope mutually agreed. Further, the type of goods or services offered to the client also fall under a single category of works contract services as per the classification issued by the Government. Moreover, the Company also directly operates in a single geography i.e., India. Considering the above facts, the Company’s operations are limited to a single business line and hence, disaggregation by ‘type of goods or service’ is not feasible amongst such services. Further, with regard to providing services to different categories of customers, the Company stated that their Company provides construction and allied services across various clients / industries which are internally classified as Industrial, Institutional, Residential, Government and Government Residential. This classification is just to explain their ability to cater services across various industries and clients. The nature, amount, timing and uncertainty of revenue and cash flow are similar across the revenue from all such contracts categorised based on nature and industry of client.

54. During the in-person discussion held on 03.02.2023, the rationale and the approach towards implementation of various types of disaggregation given under Para B89 of Ind AS 115 was explained. It was also emphasised that the Company should understand the underlying principle of disclosure illustrated at Ind AS Implementation Guidance- Example 41 of Illustrative Examples IFRS 15, as disclosed by other companies based on their business and product profile rather than literal interpretation of the same. The Company should consider disaggregating revenue based on market or type of customer (for example, government and non-government customers), type of contract (for example, fixed-price and time-and-materials contracts) and contract duration (for example, short-term and long-term contracts) .

Non-Compliance with the disclosure requirement of Fair Value Measurement hierarchy

55. In Note 34 in the Financial Statements, the Company has presented a table to disclose the information about the measurement bases of the carrying amounts of Financial Instruments in the Balance Sheet and their comparison with Fair Values, and the Fair Value measurement hierarchy. The disclosure in the table is made only in respect of the carrying amount (amortised cost) and the Company has simply presented the columns for various hierarchies and described the inputs to arrive at Fair Value measurement hierarchy (Level 1, Level 2, and Level 3) without giving any quantitative information about the Fair Value of each of these three hierarchies.

56. PSP Project Ltd.’s Financial Statements as on 31.03.2020 reflect substantial amount of Other Financial Assets amounting to ₹15,110.52 lakhs (21.21% of total Financial Assets) which are not of short-term nature. Hence their Fair Values would be different from the Balance Sheet carrying amounts. Therefore, the Company’s disclosures in this regard are not in compliance with the requirements of Para 25 of Ind AS 107 and Para 91 and 93 of Ind AS 113 (reproduced below):

Para 25 of Ind AS 107: Except as set out in paragraph 29, for each class of financial assets and financial liabilities (see paragraph 6), an entity shall disclose the fair value of that class of assets and liabilities in a way that permits it to be compared with its carrying amount.

Para 91 of Ind AS 113: An entity shall disclose information that helps users of its financial statements assess both of the following: (a) for assets and liabilities that are measured at fair value on a recurring or non-recurring basis in the balance sheet after initial recognition, the valuation techniques and inputs used to develop those measurements. (b) for recurring fair value measurements using significant unobservable inputs (Level 3), the effect of the measurements on profit or loss or other comprehensive income for the period.

Para 93 of Ind AS 113: To meet the objectives in paragraph 91, an entity shall disclose, at a minimum, the following information for each class of assets and liabilities (see paragraph 94 for information on determining appropriate classes of assets and liabilities) measured at fair value (including measurements based on fair value within the scope of this Ind AS) in the balance sheet after initial recognition:

(a)———–

(b) for recurring and non-recurring fair value measurements, the level of the fair value hierarchy within which the fair value measurements are categorised in their entirety (Level 1, 2 or 3).

(c) to (i)———–

57. The Company referred to the Note no. 2.12 Financial Instrument (page no. 128 of Annual Report) which contains the measurement criteria followed by the Company for the financial assets and liabilities and Note 34 of the Financial Statements (page no. 150 of Annual Report) which provided the information about the Fair Value (which is Amortised cost). The Company stated that as per Para 29 of Ind AS 107, the carrying amount is a reflection of the fair value for short term receivables and payables. The Company stated that since in their case, all financial assets and financial liabilities are initially and subsequently measured at amortized cost and as the carrying amount reflects the fair value, the valuation techniques and inputs developed and its impact on profit or loss would not make a considerable impact on the carrying value of financial assets and financial liabilities. The Company also referred to note no. 2.14 Fair Value which describes the fair value measurement methods followed by the Company for financial instruments. It also states the fair value hierarchy that categories into Level 1, Level 2, and Level 3. The Company submitted that it would review the disclosure requirements and explicitly state the fair values to enable the comparison with the carrying amount going forward to enhance compliance with Ind AS 107.

58. The Company’s statement that all Financial Assets and Financial Liabilities are initially and subsequently measured at Amortised Cost and as the Carrying Amount reflects the Fair Value is incorrect and not in accordance with the definitions of Amortised Cost and Fair Value in Ind AS 109 and Ind AS 113 respectively. Further, the disclosures made by PSP Projects Ltd in respect of Fair Value Measurement of Financial Assets, which constitute a significant part of the Balance Sheet, are inadequate. The Company has substantial amount of Financial Assets amounting to ₹15,110.52 lakhs (21.21% of total Financial Assets) which are not of short-term nature. Therefore, the response of PSP Projects Ltd. that the carrying amounts reflect Fair Value is not in accordance with Para 29 of Ind AS 107.

59. NFRA concludes that the response of PSP Projects Ltd. that the carrying amounts reflect Fair Value is not in accordance with Para 29 of Ind AS 107. However, NFRA takes note of the Company’s statement that it would review its disclosure requirements and directs the Company to review its disclosure practices comprehensively to ensure compliance with requirements of Ind AS 107 and Ind AS 113.

Observations Classified as ‘Low Impact’

Inadequate disclosure regarding Lease Rental Expenses

60. In Note 30, the Company has disclosed Rent Expense of ₹260.55 Lakhs. In Note 2.19 Lease Accounting given in the Financial Statements, the Company has disclosed that it has applied the standard to its leases with the cumulative impact recognised on the date of initial application (1st April 2019). “The lease term in future periods is reassessed to ensure that the lease term reflects the current economic circumstances. After considering the current and future economic conditions, the Company has concluded that no changes are required to lease period relating to existing lease contracts.”

61. NFRA observes that the Company has not disclosed the fact that it has applied the practical expedient in for accounting of short-term leases, i.e., it has recognised lease payments as expense as per Para 6 of Ind AS 116 instead of recognising the lease transaction as right of use asset with corresponding lease liability as required under Para 22 of Ind AS 116.

62. The Company has stated that going forward they will mention that they have elected for exemption for short term leases to enhance their disclosure with requirements of Ind AS 116.

Disclosures of regroupings/ re-classifications

63. Paragraph 41 of Ind AS 1 requires that:

If an entity changes the presentation or classification of items in its financial statements, it shall reclassify comparative amounts unless reclassification is impracticable. When an entity reclassifies comparative amounts, it shall disclose (including as at the beginning of the preceding period):

(a) the nature of the reclassification;

(b) the amount of each item or class of items that is reclassified; and

(c) the reason for the reclassification.

64. In Note 46, the Company has stated that the figures of previous year have been regrouped/reclassified wherever necessary to conform to current year’s presentation. NFRA observes that there are no details of regrouping/reclassification made to enable the users of the Financial Statements to understand the impact of the above reclassification/regroupings. Also, it is not clear whether these regroupings/reclassifications were due to correction of prior period errors as defined in Ind AS 8. If so, it is unclear whether these errors needed any restatement of amounts as required by Paragraph 42 of Ind AS 8 or the reclassifications due to changes in the presentation/classification of items under paragraph 41 of Ind AS 1.

65. The Company stated that they have not made any reclassification or regroupings in the Balance Sheet and Statement of Profit and Loss and that this was a standard disclosure given by all companies in their Financial Statements. The Company also stated that a comparative statement of figures of FY 18-19 as published in the Annual Report of FY 18-19 was done with the figures published of FY 2018-19 in the Annual report of FY 2019-20 supporting the fact that there have been no reclassification / regroupings made in FY 2019-20. The Company stated that hence, there is no need to evaluate the requirements of Ind AS 8.

66. The Company stated that they will review the relevance and requirement of this disclosure and bring more clarity to the readers in their future annual reports.

Non-disclosure regarding shareholders’ powers to amend the Financial Statements

67. Paragraph 17 of Ind AS 10 states that- An entity shall disclose the date when the financial statements were approved for issue and who gave that approval. If the entity’s owners or others have the power to amend the financial statements after issue, the entity shall disclose that fact.

68. NFRA observes that the Company has not disclosed that the shareholders have the power to amend the Financial Statements after the issue.

69. The Company replied that it has made disclosure for the approval of Financial Statements in Note No. 45 of the Financial Statements ‘The Standalone Financial Statements are approved for issue by the Audit Committee and Board of Directors at their meetings held on June 9, 2020.

70. PSP Projects further stated that apart from the above, Note 1 of the Financial Statements contains the fact that the Company has been incorporated under the provisions of the Companies Act. It is a publicly known fact that the companies incorporated under the Companies Act are governed by the provisions of the Companies Act. The powers to revise the Financial Statements flow from and already vested with the shareholders as per the provisions of section 130 (re opening of books of account on court’s or tribunal’s order) and section 131 (voluntary revision of Financial Statements or board’s report) of the Companies Act, 2013. There are various other powers also with the shareholders that emanate from the Companies Act, 2013, which for the want of irrelevance are not mentioned in the Financial Statements. Considering the reference of the Companies Act, the rights are already vested with the shareholders, and accordingly, no separate disclosure has been done for the same in the Financial Statements owing to irrelevance of the same.

71. The Company is directed to comply with the disclosure requirements of Ind AS 10.

Approved for issue by the Executive Body of NFRA

Vidlit Sood

(Secretary)

Notes:

1 Section 186 of Companies Act 2013- Loan and investment by Company.

2 Para 114 – Disaggregation of Revenue

3 https://indasaccess.icai.org/download/2019/asb052019/147/147BB2019_B_IFRS9%20Financial%20Instruments.pdf

4 Section 186(4) of Companies Act 2013, (“CA, 2013”) requires that “The Company shall disclose to the members in the Financial Statement the full particulars of the loans given, investment made, or guarantee given, or security provided and the purpose for which the loan or guarantee or security is proposed to be utilized by the recipient of the loan or guarantee or security.”

5 https://indasaccess.icai.org/download/2019/asb052019/152/152BB2019_B_IFRS15%20Revenue%20from%20C

ontracts%20with%20Customers.pdf