The Ministry of Corporate Affairs, through its Registrar of Companies in Gujarat, Dadra & Nagar Haveli, has adjudicated a penalty against Ganesh Green Bharat Limited for violations of Section 135(5) of the Companies Act, 2013. This penalty stems from the company’s failure to transfer unspent CSR funds within the stipulated time frame.

Ganesh Green Bharat Limited, registered under the Companies Act, 2013, was found in default regarding its Corporate Social Responsibility (CSR) obligations for the financial years 2021-22 and 2022-23. The adjudicating officer, Shri Keerthi Thej N., examined submissions from both the company and its directors, assessing the extent of non-compliance and mitigating factors presented.

The company’s representatives, including Mr. Nirav Soni of Nirav Soni & Co., argued on behalf of the company, citing genuine oversight and subsequent rectification of the CSR non-compliance. Despite the company’s rectification efforts and contributions to a charitable trust, the adjudicating officer imposed penalties as per the provisions of Section 135(7) of the Companies Act, 2013.

In conclusion, the adjudication order emphasizes the importance of timely adherence to CSR obligations under the Companies Act, 2013. The penalty, totaling Rs. 1,02,47,548 for the company and Rs. 4,00,000 for Mr. Rajendrakumar Narsinhbhai Patel, stands as a deterrent against future non-compliance. Parties aggrieved by the decision have the option to appeal within sixty days from the date of receipt of the order, ensuring due process in corporate governance.

This adjudication highlights the meticulous enforcement of corporate regulations by the Ministry of Corporate Affairs, reinforcing accountability and transparency within corporate entities.

*****

GOVERNMENT OF INDIA

MINISTRY Of CORPORATE AFFAIRS

OFFICE OF THE REGISTRAR OF COMPANIES,

GUJARAT, DADRA & AGAR HAVELI

ROC Bhavan, Opp. Rupal Park,

Nr. Ankur Bus Stand, Naranpura, Ahmedabad (Gujarat) – 380013.

Tel. No.: 079-27438531, Fax : 079-27438371

Website : www.mca.gov.in E-mail : roc.ahmedabad@mca.gov.in

No. ROC-GJ/203/ADJ-Order/Sec. 454/ GANESH GREEN/2024-25/ Dated: 11 JUL 2024

BEFORE ITIE ADJUDICATING OFFICER

REGISTRAR OF COMPANIES, GUJARAT, DADRA & NAGAR HAVELI

ORDER FOR PENALTY FOR DEFAULT OF SECTION 135(5) OF THE COMPANIES ACT, 2013 IN THE MATTER OF GANESII G1REEN BHARAT LIMITED (U31900G12019PLC108417)

Date of hearing- 10.07.2024

PRESENT :

1. Shri Keerthi Thej N. (ROC), Adjudicating, Officer

2. Ms. Rupa Sutar (DROC), Presenting Officer

3. Shri Vijay S. Tiwari (STA)

Appointment of Adjudication Authority:-

1. The Ministry of Corporate Affairs vide its Gazette Notification No. A-42011/112/2014-Adil dated 24.03.2015 has appointed the undersigned as Adjudicating Officer in exercise of the powers conferred under section 454 of the Companies Act, 2013 (hereinafter known as Act) read with Companies (Adjudication on of Penalties) Rules, 2014 (Notification No. GSR 254(E) dated 31.03.2014) for adjudging penalties under the provisions of Act.

Company:

2. The company viz. GANESH GREEN BHARAT LIMITED (herein after referred to as “Company”) is a registered Company under the provisions of the Companies Act, 2013 (hereinafter referred to as “Act’) In the State of Gujarat having its registered office at “F – 202.S.G. Business S.G. Highway, NA, Ahmedabad, Gujarat-382470, India “. The CIN of the Company is U31900 J2019PI,C108417. The Financial and other detail, of the subject company for the year ended 31.03.2023 as available on MCA21 portal is stated as under:

| S. No. | Particulars | Details |

| 1. | Paid up capital as per master data/ later audited Financial Statement | Rs 18,21,00,000 |

| 2. | Turnover as per later audited Financial Statement | Rs. 85,32,41,856 |

| 3. | Holding Company | No |

| 4. | Subsidiary Company | No |

| 5. | Whether Company registered under section 8 of the Act? | No |

| 6. | Whether Company registered under any other special Act? | No |

| 7. | Whether Company is a small Company | No |

| 8. | Whether section 446B is applicable to the Company (lesser penalties for certain companies)? | No |

Facts of the case

3. The company and Applicants namely Mr. Ketanbhai Narsinhbhai Patel, Rajendrakumar Narsinhbhai Patel and Shri Niravkurnar Sureshbhai Patel, Directors of the Company have filed a joint application dated 03.06.2024 under Sec ion 454 of the Companies Act, 2013 citing default Section 135 of the Companies Act, 2013 received in this office on 04.i. 6.2024. The company has also submitted online application in GNL-1 vide S 1NJ F93170694 dated 11.03.2024 under the MCA21 portal in the matter.

The submission made by the Applicants are as under:

a. The offence committed by the company pertains to non transfer of unspent amount of Rs. 19,36,064.00 pertaining to financial year 2021-22 to a Fund specified in Schedule VII to the Companies Act, 2013 within a period of six months of the expiry of the financial year in co7iiance with second proviso to sub-Section 135 of the Companies Act, 2013″.

b. The offence committed by the company pertains to non transfer of unspent amount of Rs. 23,31,842.00 pertaining to financial year 2022-23 to a Fund specified in Schedule VII to the within a period of six months of the expiry of Companies Act, 2013 the financial year in compliance with second proviso to sub-Section 135 of the Companies Act, 2013″. The Applicant has paid all the shortfall of F.Y. 2021-22 and 2022-23 towards CSR expenditure by way of contribution of Rs. 42;67,906.00 to the Shree Brahmani Charitable Trust on 5th December, 2013.

c. Applicant has filed the Suo-moto application of Adjudication for Section 135 of the Companies Act, 2023.

d. It is stated that the aforesaid contravention had arisen only due to Ala fide motive and it is oversight of the Directors. It was without any unintentional. The company further declares that the nature of offence is such that it has not affected public interest in any way.

e. The aforesaid default was without any mala fide intention or vested purpose and had no deliberate intention in viol ting the provisions of Section 135 of the Act.

f. There is no undue gain either to the Applicant Company or to the – Director because all the said default. Hence, with a view to put the matter to rest, this application is preferred.

g. The offence is adjudication under Section 454 of the Act.

h. The application has -been made bonafide and in the interest of justice.

i. The Applicant further declare that no enquiry, inspection or investigation has ever been initiated under the Companies Act, 2013 against the company or any of its directors.

Show Cause Notice & reply of the Company:-

4. Pursuant to the application dated 04.06.2024 received in this office under Section 451 of the Act read with Companies (Adjudication of Penalty) Rules, 2014, this office had issued Adjudication Hearing Notice to Company and Whole Time Director Mr. Rajendrakumar Narsinhbhai Patel on 10.06.2024 fixing the date of hearing on 19.06.2024 at 03.00 P.M. with directions to serve the aforesaid Notice to all the members/ Board of Directors and all principal Officers of the Company to ensure due compliance of the Companies Act, 2013 and to submit a reply to this office.

5. An e-mail dated 18.06.2024 received from Mr. Nirav Soni, Proprietor of Nirav Soni & Co. Company Secretaries, Authorised representative of the Company/Officers in the 0/0 ROC, Ahmedabad. Ile submitted in the aforesaid mail that “Due to unavoidable circumstances I am no able to present before you as mentioned the Date and time, I hereby request you kindly allow me the Date after 10/15 days for the next appearance”. Accordingly, the date of the hearing was rescheduled to 10.07.2024 at 11.30 AM in the best interest of justice. Accordingly, an intimation regarding the hearing was sent vide e-mail dated 27.6.2024 to the Authorised representative oft e Company/Officers.

6. On the scheduled date of hearing i.e. 10.07.2024, Mr. Nirav Soni, Proprietor of Nirav Soni & Co., Company Secretaries, Authorised representative of the Company/Officers appeared before the Adjudicating Authority Mr. Keerthi Thej N., ROC, Presenting Officer Ms. Rupa Sutar, DROC and Mr. V.S. Tiwari, STA and submitted that “the company had filed the application in E-form GNL-3 for particulars of person(s) charged for the purpose of sub-clause (iii) or (iv) of clause 60 of Section 2 pursuant under the Rule 1 (3) of the Companies (Registration Offices and Fee) Rules, 2014 and Authorised to charge to Mr. RAJENDR4KUMAR NARSINHBHAI PATEL (one of the A applicant) for the all the provisions of the Companies Act, 2013, the consent for charged signed on 7th July 2022″. He further requested to adjudicate the non compliance of Section 135(5) of the Companies Act, 2013.

Submission of Presenting Officer:

7. The Presenting Officer submitted the relevant provisions of Section 135 of the Companies Act, 2013 as under:

(5) The Board of every company referred to in sub-section (I), shall ensure that the company spends, in every financial year, at least two per cent. of the average net profits of the company made during the three immediately preceding financial year, or where the company has no completed the period of three financial years since its incorporation, during such immediately preceding financial years, in pursuance of its Corporate Social Responsibility Policy:

Provided that the company shall give preference to the local area and areas around it where it operates, for spending the amount earmarked for Corporate Social Responsibility activities:

Provided further that if the company fails to spend such amount, the Board shall in it report made under clause (o) of sub-seed (3) of section 134 specify the reasons for not spend the amount and, unless the unspent amount relates to any ongoing project referred to in sub-section (6), transfer such unspent mount to a Fund specified in Schedule VII, within a period of six months o, the expiry of the financial year.

(7) If a company is in default in complying with the provisions of sub-section section ( 6), the company shall be liable to a penalty of twice the amount required to be transferred by the company t the Fund specified in Schedule 11 or the Unspent Corporate Social Responsibility Account, as the case may be, oi- one crone rupees, whichever is less, and ever officer of the company who is in default shall be liable to a penalty of one-tenth of the amount required to be trap (erred by the company to such Fund specific. in Schedule VII, or the Unspent Corporate Social Responsibility Account; as the case may be, or two lakh rupees whichever is less.

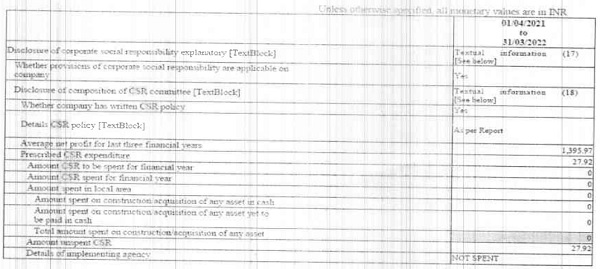

8. The presenting officer further submitted that Total SR obligation for the financial ear 2021-22 was Rs. 27,91,932.00, whereas in the application the Applicants have submitted that the offence committed by the company pertains t(1) non transfer of unspent amount of Rs. 19,36,064 for the Financial year 2021-22.

In view of the above, it appears that in the application wrongly mentioned as Rs. 19,36,064 instead of Rs. 27,91,932. Hence the unspent amount of CSR should be reckoned for the F.Y. 2021-22 as Rs. 27,91,932 instead of 19,36,064. The Company has contributed the unspent CSR amount of Rs. 19,36,064 and Rs. 23,31,842 for the financial year 2021-22 and 2022-23 on 05.12.2023 respectively, so the Company and its officers have violated the provisions of the aforesaid Rules. liable to be penalized under section 135(7) of the Companies Act, 2013.

9. The details of Directors showing in the MCA21 portal records are under:

| DIN/PAN | NAME | Current Designation | Date of appointment at current designation | Date of Cessation |

| 07498377 | NIRAVKUMAR SURESHBHAI PATEL | Director | 30.05.2019 | 24.10.2023 |

| 07498377 | NIRAVKUMAR SURESHBHAI PATEL | Wholetime Director | 25.10.2023 | |

| 07498445 | RAJENDRAKUMAR NIRAVKUMAR PATEL | Director | 30.05.2019 | 24.10.2023 |

| 07498445 | RAJENDRAKUMAR NIRAVKUMAR PATEL | Wholetime Director | 25.10.2023 | |

| 07499411 | KETANBHAI NIRAVKUMAR PATEL | Director | 30.05.2019 | 24.10.2023 |

| 07499411 | KETANBHAI NIRAVKUMAR PATEL | Managing Director | 25.10.2023 | |

| 08132442 | SAHIL BIPIN GALA | Director | 25.10.2023 | |

| 08467647 | DHANJIBHAI NIRAVKUMAR PATEL | Director | 30.05.2019 | 11.11.2019 |

| 10168539 | PALAK JAGATBHAI SHAH | Director | 25.10.2023 | |

| 10316276 | SHILPABEN KETANBAHI PATEL | Director | 25.10.2023 | |

| AFTPJ9217Q | PALAKBEN MAHESH JOSHI | Company Secretary | 25.10.2023 | |

| AMTPD5352M | KRUNALKUMAR DAYALJIBHAI SHAH | CFO(KMP) | 25.10.2023 |

10. The Presenting officer further stated that as per the submission made by Mr.Nirav Soni, PCS that Mr. Rajendrakumar Narsinbhai patel is only person who was the sole responsible for non-compliance of Section 135(5) of the Act may be considered as he had given his consent for char :e signed under Section 2(60) of the Companies Act, 2013 w.e.f. 07.07.2022 whereas the non-compliance of Section 135(5) was instituted from the period from 01.10 2022 and 01.10.2023 to 05.12.2.23 for the financial year 2021-22 and 2022- 3 respectively. Thus, the company and the responsible Personal Mr. Rajendrakumar Narsinhbhai Patel have themselves liable to penalize under section 135(7) of the Companies Act, 2013 for non-compliance of Section 135(5) of the Companies Act, 2013 from 01.10.2022 to up to 06.07.2022.

ORDER

1. While ad adjudging quantum of penalty under section 135(7) of the Act, the Adjudicating Officer shall have due regard to the following factors, namely;

a. The amount of disproportionate gain or unfair quantifiable, made as a result, of default.

b. The amount of loss caused to an investor as a result of the default.

c. Th repetitive nature of default.

2. With regard to the above factors to be considered while quantum advantage delay on available quantify it is noted that the disproportionate gain or unfair made by the noticee or loss caused to the in investor as a result of the the part of the notice to redress the investor grievance are not n the record. Further, it may also be added that it is difficult to e unfair advantage made by the noticee or the loss caused to the investor a default of this nature.

Penalty on company and Officers in Default for the aforesaid Default are as under:

| Nature of default | Name of the Company/ Director | Default for the Financial Year | Penalty Prescribed as per section 135(7) of the Act | Penalty Calculated pursuant to Section 135(7) of the Companies Act, 2013 | Penalty Imposed (In Rs.) |

| Violation of Section 135(5) of the Companies Act, 2013 | GANESH GREEN BHARAT LIMITED | 2021-22 | Twice the amount to be transferred or one crore which ever is less | 2*27,91,932=

55,83,864 or 01 crore whichever is less |

55,83,864 |

| 2022-23 | 2*23,31,842=

46,63,684 or 01 crore whichever is less |

46,63,684 | |||

| Total | Rs.1,02,47,548 | ||||

| Mr. Rajendra Kumar Narsinhhbhai Patel | 2021-22 | One- tenth of the amount or two lakh rupees, whichever is less | 27,91,932/10=

27,91,932.20 or 2 Lakhs whichever is less |

2,00,000 | |

| 2022-23 | 23,31,842/10=

2,33,144.20 20 or 2 Lakhs whichever is less |

2,00,000 | |||

| Total | Rs.4,00,000 | ||||

AO is of the opinion that penalty is commensurate with the aforesaid default committed by the Noticees:

4. The noticee shall pay the amount of penalty individually for the company and its officers from their personal sources/income by way of e-payment available on Ministry website mca.gov.in under “Pay miscellaneous fees” category in MCA fee and payment Services, under Rule 3(14) of Company (Adjudication of Penalties) (Amendment) Rules, 2019 within 90 days from the date of receipt of this order and copy of this adjudication order and Challan/SRN generated after payment of penalty through online mode shall be filed in INC-28 under the MCA portal without further reference.

5. Appeal against this order may be filed in writing; with the Regional Director, North Western Region, Ministry of Corporate Affairs, Roc Bhavan, opp. Rupal park, Nr. ANKUR BUS STAND, NARANAPURA, AI-IMEDAI3AD (GUJARAT)-380013 within a period of sixty days from the date of receipt of this order, in Form ADI setting forth the grounds of appeal and shall be accompanied by the certified copy of this order. [Section 454(5) & 454(6) of the Companies Act, 2013 read with the Companies (Adjudicating of Penalties) Rules, 2014 as amended by Companies (Adjudication of Penalties) Amendment Rules, 2019].

6. Your attention is also invited to Section 454(8)(i) and 454(8) (ii) of the Companies Act, 2013, which state that in case of lion-payment of penalty amount, the company shall be punishable with fine which shall not less than Twenty Five Thousand Rupees but which may extend to Five Lakhs Rupees and officer in default shall be punishable with Imprisonment which may extend to Six months or with fine which shall not, be less than Twenty Five Thousand Rupees by which may extend to one Lakhs Rupees or with both.

The adjudication notice stands disposed of with this order.

Registrar of Companies & Adjudicating Officer

Ministry of Corporate Affairs,

Gujarat, Dadra & Nagar Haveli