Reserve Bank of India

Date : Apr 07, 2021

Statement on Developmental and Regulatory Policies

This Statement sets out various developmental and regulatory policy measures on (i) liquidity management and support to targeted sectors; (ii) regulation and supervision; (iii) debt management; (iv) payment and settlement systems; (v) financial Inclusion; and (vi) external commercial borrowings.

I. Liquidity Measures

1. TLTRO on Tap Scheme – Extension of Deadline

With a view to increasing the focus of liquidity measures on revival of activity in specific sectors that have both backward and forward linkages and having multiplier effects on growth, the RBI had announced the TLTRO on Tap Scheme on October 9, 2020 which was available up to March 31, 2021. In addition to the five sectors announced under the scheme on October 21, 2020, 26 stressed sectors identified by the Kamath Committee were also brought within the ambit of sectors eligible under on tap TLTRO on December 4, 2020 and bank lending to NBFCs on February 5, 2021. Liquidity availed by banks under the scheme is to be deployed in corporate bonds, commercial paper, and non-convertible debentures issued by entities in these sectors; it can also be used to extend bank loans and advances to these sectors. Investments made by banks under this facility can be classified as held to maturity (HTM) even above the 25 per cent of total investment permitted to be included in the HTM portfolio. All exposures under this facility are exempted from reckoning under the large exposure framework (LEF). On a review, it has now been decided to extend the TLTRO on Tap Scheme by a period of six months, i.e., till September 30, 2021.

2. Liquidity Facility for All India Financial Institutions

To support the continued flow of credit to the real economy in the aftermath of the COVID-19 pandemic, special refinance facilities for a total amount of ₹75,000 crore were provided during April-August 2020 to all India financial institutions (AIFIs) – the National Bank for Agriculture and Rural Development (NABARD); the Small Industries Development Bank of India (SIDBI); the National Housing Bank (NHB); and the EXIM Bank. These facilities were available for a period of one year. NABARD, SIDBI and NHB will repay the facilities extended to them during April-May 2020. In consonance with the policy objective of nurturing the still nascent growth impulses, it has been decided to extend fresh support of ₹50,000 crore to the AIFIs for new lending in 2021-22. Accordingly, NABARD will be provided a special liquidity facility (SLF) of ₹25,000 crore for a period of one year to support agriculture and allied activities, the rural non-farm sector and non-banking financial companies-micro finance institutions (NBFC-MFIs). SLF of ₹10,000 crore will be extended to NHB for one year to support the housing sector. To meet the funding requirements of micro, small and medium enterprises (MSMEs), SIDBI will be sanctioned ₹15,000 crore under this facility for a period of upto one year. All these three facilities will be available at the prevailing policy repo rate.

II. Regulation and Supervision

3. Enhancement of limit of maximum balance per customer at end of the day from ₹1 lakh to ₹2 lakh for Payments Banks

The extant “Guidelines for Licensing of Payments Banks” issued on November 27, 2014 allow payments banks to hold a maximum balance of ₹ 1 lakh per individual customer. Based on a review of performance of payments banks and with a view to encourage their efforts for financial inclusion and to expand their ability to cater to the needs of their customers, including MSMEs, small traders and merchants, it has been decided to enhance the limit of maximum balance at end of the day from ₹1 lakh to ₹2 lakh per individual customer. A circular in this regard shall be issued separately.

4. Asset Reconstruction Companies – Constitution of a Committee

After enactment of Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act in 2002, regulatory guidelines for Asset Reconstruction Companies (ARCs) were issued in 2003 to enable development of this sector and to facilitate smooth functioning of ARCs. Since then, while ARCs have grown in number and size, their potential for resolving stressed assets is yet to be realised fully. It is, therefore, proposed to constitute a Committee to undertake a comprehensive review of the working of ARCs in the financial sector ecosystem and recommend suitable measures for enabling such entities to meet the growing requirements of the financial sector. Details of the constitution of the committee and its terms of reference will be announced separately.

5. Permitting banks to on-lend through NBFCs

Recognizing the role played by NBFCs in providing credit at the bottom of the pyramid to the sectors which contribute significantly to the economic growth in terms of export and employment, and with a view to augment the liquidity position of the NBFCs, it was decided in August 2019 to allow banks to classify lending to registered NBFCs (other than MFIs) as Priority Sector Lending (PSL) up to 5 per cent of a bank’s total PSL, for on-lending to Agriculture/MSME/Housing till March 31, 2020. This dispensation was later extended up to March 31, 2021. An amount of around ₹37,000 crore has been lent by banks to NBFCs for on-lending to the specified priority sectors by December 2020. With a view to ensure continued availability of credit to these sectors to aid faster economic recovery, it has been decided to extend the PSL classification for lending by banks to NBFCs for ‘on-lending’ to the above sectors for six months, i.e. up to September 30, 2021.

6. Priority Sector Lending (PSL) guidelines- Enhancement of Loan limit against eNWR/NWR

With a view to encourage farm credit to individual farmers against pledge/hypothecation of agricultural produce and leverage the inherent safety of Negotiable Warehouse Receipts (NWRs)/electronic-NWRs(e-NWRs) issued by the warehouses registered and regulated by Warehousing Development and Regulatory Authority (WDRA), it has been decided to enhance the loan limit from ₹50 lakh to ₹75 lakh per borrower against the pledge/hypothecation of agricultural produce backed by NWRs/(e-NWRs) issued by warehouses registered and regulated by WDRA. The Priority Sector loan limit backed by other Warehouse Receipts will continue to be ₹50 lakh per borrower. The circular in this regard will be issued separately.

III. Debt Management

7. Review of Way and Means Advances (WMA) limits for the State Governments/UTs

An Advisory Committee (Chairman: Shri Sudhir Shrivastava) was constituted by the Reserve Bank in August 2019 to review the Ways and Means Advances (WMA) limits for State Governments/UTs and examine other related issues. The Committee has recommended an overall revised limit of ₹47,010 crore for all states, as against the current limit of ₹32,225 crore (fixed in February 2016), representing an increase of about 46%. The committee also recommended the continuation of the enhanced interim WMA limit of ₹ 51,560 crore (60 per cent increase in the current limits allowed by the Reserve Bank during the last fiscal to help states/UTs to tide over the difficulties faced by them during the pandemic) for a further period of six months i.e., from April 1, 2021 up to September 30, 2021. The Reserve Bank has accepted both the recommendations.

IV. Financial Inclusion

8. Financial Inclusion Index

Financial Inclusion has been viewed as a key enabler for achieving inclusive and sustainable development worldwide. This has been a thrust area for Government, Reserve Bank and other regulators, with a number of steps having been taken and significant progress made over the years. To measure the extent of financial inclusion in the country, the Reserve Bank will construct and periodically publish a “Financial Inclusion Index” (FI Index). The FI Index would be based on multiple parameters and shall reflect the broadening and deepening of financial inclusion in the country. To begin with, the FI Index will be published annually in July for the financial year ending previous March.

V. Payments Systems

9. Centralised Payment Systems (CPS), viz- RTGS and NEFT – Membership for entities other than banks

Membership to the RBI-operated Centralised Payment Systems (CPSs) – RTGS and NEFT – are so far limited to banks, with a few exceptions, such as specialised entities like clearing corporations and select development financial institutions. Over the last few years, the role of non-bank entities in payment space (e.g. Prepaid Payment Instrument (PPI) issuers, Card Networks, White Label ATM (WLA) operators, Trade Receivables Discounting System (TReDS) platforms), has grown in importance and volume, as they have innovated by leveraging technology and offering customised solutions to users. To reinforce this trend and encourage participation of non-banks across payment systems, it is proposed to enable, in a phased manner, payment system operators, regulated by the Reserve Bank, to take direct membership in CPSs. This facility is expected to minimise settlement risk in the financial system and enhance the reach of digital financial services to all user segments. These entities will, however, not be eligible for any liquidity facility from the Reserve Bank to facilitate settlement of their transactions in these CPSs. Necessary instructions will be issued separately.

10. Interoperability of Prepaid Payment Instruments (PPIs), and Increase in account limit to ₹ 2 lakh

To promote optimal utilisation of payment instruments (like cards, wallets etc.), and given the constraint of scarce acceptance infrastructure (like PoS devices, ATMs, QR codes, bill-payment touch points, etc.), Reserve Bank of India has been stressing on the benefits of interoperability amongst the issuing and acquiring entities alike, banks or non-banks. The Master Direction on Issuance and Operation of PPIs dated October 11, 2017 laid down a road-map for a phased implementation of interoperability amongst PPIs issued by banks and non-banks. Thereafter, the guidelines issued in October 2018 enabled interoperability, albeit on a voluntary basis, insofar as the PPIs were full-KYC (they met all Know Your Customer requirements). Despite a passage of two years, migration towards full-KYC PPIs, and therefore interoperability, is not significant. It is, therefore, proposed to make interoperability mandatory for full-KYC PPIs and for all acceptance infrastructure. To incentivise the migration of PPIs to full-KYC, it is proposed to increase the limit of outstanding balance in such PPIs from the current level of ₹1 lakh to ₹2 lakh. Necessary instructions will be issued separately.

11. Permitting Cash Withdrawal from Full-KYC PPIs issued by Non-banks

Presently, cash withdrawal is allowed only for full-KYC PPIs issued by banks and this facility is available through ATMs and PoS terminals. Holders of such PPI, given the comfort that they can withdraw cash as required, are less incentivised to carry cash and consequently more likely to perform digital transactions. As a confidence-boosting measure, it is proposed to allow the facility of cash withdrawal, subject to a limit, for full-KYC PPIs of non-bank PPI issuers as well. The measure, in conjunction with the mandate for interoperability, will give boost to migration to full-KYC PPIs and would also complement the acceptance infrastructure in Tier III to VI centres. Necessary instructions will be issued separately.

VI. External Commercial Borrowings

12. Relaxation in the period of parking of External Commercial Borrowing (ECB) proceeds in term deposits

Under the extant ECB framework, ECB borrowers are allowed to place ECB proceeds in term deposits with AD Category-I banks in India for a maximum period of 12 months. In view of the difficulty faced by borrowers in utilizing already drawn down ECBs due to Covid-19 pandemic induced lockdown and restrictions, it has been decided to relax the above stipulation as a one-time measure, with a view to provide relief. Accordingly, unutilised ECB proceeds drawn down on or before March 1, 2020 can be parked in term deposits with AD Category-I banks in India prospectively up to March 1, 2022. Guidelines in this regard will be issued separately.

(Yogesh Dayal)

Chief General Manager

Press Release: 2021-2022/17

**********

Resolution of the Monetary Policy Committee (MPC) April 5-7, 2021

On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (April 7, 2021) decided to:

- keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 4.0 per cent.

Consequently, the reverse repo rate under the LAF remains unchanged at 3.35 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 4.25 per cent.

- The MPC also decided to continue with the accommodative stance as long as necessary to sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth.

The main considerations underlying the decision are set out in the statement below.

Assessment

Global Economy

2. Since the MPC’s meeting in February, lingering effects of the slowdown in the global economy in Q4 of 2020 have persisted, although recent arrivals of high frequency indicators suggest that a gradual but uneven recovery may be forming. The much anticipated boost to economic activity from the vaccination rollouts is being somewhat held back by new mutations of COVID-19, second and third waves of infections across countries and unequal access to vaccines more generally. World trade activity improved in Q4:2020 and January 2021. There are, however, concerns due to COVID-19-related fresh lockdowns and depressed demand in a few major economies, escalation in shipping charges and container shortages. Inflation remains benign in major advanced economies (AEs), although highly accommodative monetary policies and large fiscal stimuli have added to concerns around market-based indicators of inflation expectations, unsettling bond markets globally. In a few emerging market economies (EMEs), however, inflation is ruling above targets, primarily driven by firming global commodity prices. This has even prompted a few of them to raise policy rates. Equity and currency markets have been turbulent with the increase in long-term bond yields and the steepening of yield curves. More recently, however, calm has returned and major equity markets have scaled new peaks in March, while currencies are trading mixed against a generally firming US dollar. With the bond markets sell-offs, EME assets came under selling pressure and capital outflows imposed depreciating pressures on EME currencies in March.

Domestic Economy

3. The second advance estimates for 2020-21 released by the National Statistical Office (NSO) on February 26, 2021 placed India’s real gross domestic product (GDP) contraction at 8.0 per cent during the year. High frequency indicators – vehicle sales; railway freight traffic; toll collections; goods and services tax (GST) revenues; e-way bills; and steel consumption – suggest that gains in manufacturing and services activity in Q3:2020-21 extended into Q4. Purchasing managers’ index (PMI) manufacturing at 55.4 in March 2021 remained in expansion zone, but lower than its level in February. The index of industrial production slipped into marginal contraction in January 2021, dragged down by manufacturing and mining. Core industries also contracted in February. The resilience of agriculture is evident from foodgrains and horticulture production for 2020-21, which are expected to be 2.0 per cent and 1.8 per cent higher respectively than the final estimates of 2019-20.

4. Headline inflation increased to 5.0 per cent in February after having eased to 4.1 per cent in January 2021. Within an overall food inflation print of 4.3 per cent in February, five out of twelve food sub-groups recorded double digit inflation. While fuel inflation pressures eased somewhat in February, core inflation registered a generalised hardening and increased by 50 basis points to touch 6 per cent.

5. System liquidity remained in large surplus in February and March 2021 with average daily net liquidity absorption of ₹5.9 lakh crore. Driven by currency demand, reserve money (RM) increased by 14.2 per cent (y-o-y) as on March 26, 2021. Money supply (M3) grew by 11.8 per cent as on March 26, 2021 with credit growth at 5.6 per cent. Corporate bond issuances at ₹6.8 lakh crore during 2020-21 (up to February 2021) were higher than ₹6.1 lakh crore during the same period last year. Issuances of commercial paper (CPs) turned around since December 2020 and were higher by 10.4 per cent during December 2020 to March 2021 than in the same period of the previous year. India’s foreign exchange reserves increased by US$ 99.2 billion during 2020-21 to US$ 577.0 billion at end-March 2021, providing an import cover of 18.4 months and 102 per cent of India’s external debt.

Outlook

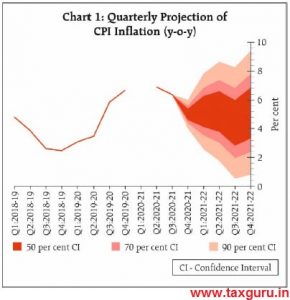

6. The evolving CPI inflation trajectory is likely to be subjected to both upside and downside pressures. The bumper foodgrains production in 2020-21 should sustain softening of cereal prices going forward. While the prices of pulses, particularly tur and urad, remain elevated, the incoming rabi harvest arrivals in the markets and the overall increase in domestic production in 2020-21 should augment supply which, along with imports, should enable some softening of these prices going forward. While edible oils inflation has been ruling at heightened levels with international prices remaining firm, reduction of import duties and appropriate incentives to enhance productivity domestically could work towards a better demand-supply balance over the medium-term. Pump prices of petroleum products have remained high. Reduction of excise duties and cesses and state level taxes could provide some relief to consumers on top of the recent easing of international crude prices. This could slow down the propagation of second-round effects. The impact of high international commodity prices and increased logistics costs are being felt across manufacturing and services. Finally, inflation expectations of urban households one year ahead showed a marginal increase than over the three months ahead horizon according to the Reserve Bank’s March 2021 survey. Taking into consideration all these factors, CPI inflation is now projected as 5.0 per cent in Q4:2020-21; 5.2 per cent in Q1:2021-22, 5.2 per cent in Q2, 4.4 per cent in Q3 and 5.1 per cent in Q4, with risks broadly balanced (Chart 1).

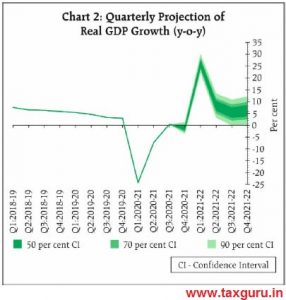

7. Turning to the growth outlook, rural demand remains buoyant and record agriculture production for 2020-21 bodes well for its resilience. Urban demand has been gaining strength on the back of normalisation of economic activity and should get a fillip with the ongoing vaccination drive. The fiscal stimulus from increased allocation for capital expenditure under the Union Budget 2021-22, expanded production-linked incentives (PLI) scheme and rising capacity utilisation (from 63.3 per cent in Q2 to 66.6 per cent in Q3:2020-21) should provide strong support to investment demand and exports. Firms engaged in manufacturing, services and infrastructure polled by the Reserve Bank in March 2021 were optimistic about a pick-up in demand and expansion in business activity into 2021-22. Consumer confidence, on the other hand, has dipped with the recent surge in COVID infections in some states imparting uncertainty to the outlook. Taking these factors into consideration, the projection of real GDP growth for 2021-22 is retained at 10.5 per cent consisting of 26.2 per cent in Q1, 8.3 per cent in Q2, 5.4 per cent in Q3 and 6.2 per cent in Q4 (Chart 2).

8. The MPC notes that the supply side pressures on inflation could persist. It also notes that demand-side pull remains moderate. While cost-push pressures have risen, they could be partially offset with the normalisation of global supply chains. On imported inflation from global commodity prices, urgent concerted and coordinated policy actions by Centre and States can mitigate domestic input costs such as taxes on petrol and diesel and high retail margins. The renewed jump in COVID-19 infections in certain parts of the country and the associated localised lockdowns could dampen the demand for contact-intensive services, restrain growth impulses and prolong the return to normalcy. In such an environment, continued policy support remains necessary. Taking these developments into consideration, the MPC decided to continue with the accommodative stance as long as necessary to sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward.

9. All members of the MPC – Dr. Shashanka Bhide, Dr. Ashima Goyal, Prof. Jayanth R. Varma, Dr. Mridul K. Saggar, Dr. Michael Debabrata Patra and Shri Shaktikanta Das – unanimously voted for keeping the policy repo rate unchanged. Furthermore, all members of the MPC voted to continue with the accommodative stance as long as necessary to sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward.

10. The minutes of the MPC’s meeting will be published on April 22, 2021.

11. The next meeting of the MPC is scheduled during June 2 to 4, 2021.

(Yogesh Dayal)

Chief General Manager

Press Release: 2021-2022/16

****

Governor’s Statement, April 7, 2021

The Monetary Policy Committee (MPC) met on 5th, 6th and 7th April, 2021 and deliberated on current and evolving macroeconomic and financial developments, both domestic and global. The MPC voted unanimously to leave the policy repo rate unchanged at 4 per cent. It also unanimously decided to continue with the accommodative stance as long as necessary to sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward. The marginal standing facility (MSF) rate and the bank rate remain unchanged at 4.25 per cent. The reverse repo rate stands unchanged at 3.35 per cent.

2. Let me start by laying out briefly the MPC’s decision and its underlying rationale. Since its last meeting, headline inflation, after moderating close to the target rate in January 2021, firmed up to 5.0 per cent in February 2021, primarily due to an adverse base effect. Looking ahead, the evolving CPI inflation trajectory is likely to be subjected to both upside and downside pressures. The bumper foodgrains production in 2020-21 should result in softening of cereal prices going forward. Mitigation of price pressures on key food items such as protein-based components and edible oils would also depend on supply-side measures and easing of international prices. The MPC noted that underlying inflation pressures emanate from high international commodity prices and logistics costs. The softening in crude prices seen in recent weeks, if it sustains, can assuage input cost pressures.

3. The National Statistical Office (NSO) in its update on February 26, 2021 placed the contraction in real GDP at 8.0 per cent for 2020-21. Prospects for 2021-22 have strengthened with the progress of the vaccination programme. The recent surge in infections has, however, imparted greater uncertainty to the outlook and needs to be closely watched, especially as localised and regional lockdowns could dampen the recent improvement in demand conditions and delay the return of normalcy. Against this backdrop, the MPC judged that monetary policy should remain accommodative to support and nurture the recovery. In other words, the stance of monetary policy will remain accommodative till the prospects of sustained recovery are well secured while closely monitoring the evolving outlook for inflation.

Assessment of Growth and Inflation

Growth

4. Global growth is gradually recovering from the slowdown, but it remains uneven across countries and is supported by ongoing vaccination drives, sustained accommodative monetary policies and further sizeable fiscal stimulus. World output is projected by the Organisation for Economic Co-operation and Development (OECD) to reach its pre-pandemic level by mid-2021, though it will be largely contingent on the pace of vaccine distribution and its efficacy against emerging variants of the virus. Stronger external demand should support India’s exports and investment demand.

5. In the domestic economy, the focus must now be on containing the spread of the virus as well as on economic revival – consolidating the gains achieved so far and sustaining the impulses of growth in the new financial year (2021-22). A key aspect of this strategy will be to strengthen the bedrock of macroeconomic stability that has anchored India’s revival from the pandemic. This will help stakeholders in taking efficient spending decisions over longer horizons, thereby improving the investment climate. Public investment in key infrastructure sectors is a force multiplier with historically proven ability to revive the broader economy by directly enhancing capital stock and productivity, and by attracting private investment. The focus of the Union Budget 2021-22 on investment-led measures with increased allocations for capital expenditure; the expanded production-linked incentives (PLI) scheme; and rising capacity utilisation (from 63.3 per cent in Q2:2020-21 to 66.6 per cent in Q3:2020-21) will reinforce the process of economic revival. In fact, firms engaged in manufacturing, services and infrastructure sector polled by the Reserve Bank in March 2021 are optimistic about a pick-up in demand and expansion of business activity into financial year 2021-22.

6. Juxtaposition of high frequency lead and coincident indicators reveals that economic activity is normalising in spite of the surge in infections. Rural demand remains buoyant and record agriculture production in 2020-21 bodes well for its resilience. Urban demand has gained traction and should get a fillip with the ongoing vaccination drive.

7. The recent surge in COVID-19 infections, however, adds uncertainty to the domestic growth outlook amidst tightening of restrictions by some state governments. In India, we are now better prepared to meet the challenges posed by this resurgence in infections. Fiscal and monetary authorities stand ready to act in a coordinated manner to limit its spillovers to the economy at large and contain its fallout on the ongoing recovery. There is concern around rising cases of infections but as Martin Luther King Jr had said and I quote: “We must accept finite disappointment, but never lose infinite hope1”.

8. The increase in international commodity prices since the February policy and recurrence of global financial market volatility like the bout experienced in late February accentuates the downside risks. The upside risks, however, come from (i) the vaccination programme being speeded up and increasingly extended to the wider segments of the population; (ii) the gradual release of pent-up demand; and (iii) the investment-enhancing and growth-supportive reform measures taken by the Government. Taking these factors into consideration, the projection of real GDP growth for 2021-22 is retained at 10.5 per cent consisting of 26.2 per cent in Q1; 8.3 per cent in Q2; 5.4 per cent in Q3; and 6.2 per cent in Q4.

Inflation

9. While headline inflation at 5.0 per cent in February 2021 remains within the tolerance band, some underlying constituents are testing the upper tolerance level.

10. Going forward, the food inflation trajectory will critically depend on the temporal and spatial progress of the south-west monsoon in its 2021 season. Second, some respite from the incidence of domestic taxes on petroleum products through coordinated action by the Centre and States could provide relief on top of the recent easing of international crude prices. Third, a combination of high international commodity prices and logistics costs may push up input price pressures across manufacturing and services. Taking into consideration all these factors, the projection for CPI inflation has been revised to 5.0 per cent in Q4:2020-21; 5.2 per cent in Q1:2021-22; 5.2 per cent in Q2; 4.4 per cent in Q3; and 5.1 per cent in Q4, with risks broadly balanced.

11. On March 31, 2021, the Government retained the inflation target at 4 per cent with the lower and upper tolerance levels of 2 per cent and 6 per cent, respectively, for the next five years (April 2021-March 2026). An inflation rate of 4 per cent over the medium term has now been successfully entrenched in the economic landscape. The experience with efficaciously maintaining price stability and the gains in credibility for monetary policy since the beginning of the inflation targeting framework in 2016 are reinforced by the retention of the target and the tolerance band. From the time after the Monetary Policy Committee (MPC) was constituted in September 2016, average CPI inflation for the period October 2016 to February 2020 – prior to the onset of the COVID-19 pandemic – was 3.8 per cent, down from the average of 7.3 per cent during January 2012 to September 2016. Our research suggests that trend inflation has moderated during the flexible inflation targeting period to around 4 per cent in recent times. The experience during the COVID-19 period has testified to the flexibility of the framework to respond to sharp growth-inflation trade-offs and extreme supply-side shocks over the course of the business cycle. Monetary policy over the next five years would aim at consolidating and building upon the credibility gains of the first 5 years of flexible inflation targeting.

Liquidity Guidance

12. In my statements over the past few policy announcements, I have been reiterating the Reserve Bank’s commitment to ensuring ample system liquidity in consonance with the accommodative stance of the MPC. When I say ample liquidity, I mean a level of liquidity that would keep the system in surplus even after meeting the requirements of all financial market segments and the productive sectors of the economy. From that perspective, our endeavour has been to conduct liquidity management operations conducive for promoting orderly market conditions. This approach has yielded dividends. It has facilitated the successful completion of central and state government borrowing programmes of close to ₹22.0 lakh crore at record low costs with elongated maturity during 2020-21. It has also facilitated significant amount of private borrowing through corporate bonds, commercial paper and debentures.

13. It would be worthwhile to note that despite the recommencement of 14-day variable rate reverse repo (VRRR) auctions since January 15, 2021, liquidity absorbed through the fixed rate reverse repo has steadily increased from a fortnightly average of ₹4.3 lakh crore during January 16-29 to ₹4.9 lakh crore during January 30-March 31, 2021. Reflecting the surplus liquidity, reserve money rose by 14.2 per cent(YoY) as on March 26, 2021 driven by currency demand, while money supply (M3) grew by 11.8 per cent (YoY) (as on March 26), with bank credit growth at 5.6 per cent (YoY) (as on March 26). In view of the success of VRRR and given the rising level of surplus liquidity, it has now been decided to conduct VRRR auctions of longer maturity as indicated in the Revised Liquidity Management Framework announced on February 06, 2020. The amount and tenor of these auctions will be decided based on the evolving liquidity and financial conditions. This is a part of RBI’s liquidity management operations and should not be read as liquidity tightening. In fact, by paying a higher rate of interest on liquidity absorptions through the VRRR auctions, the RBI is indirectly expanding liquidity.

14. Since mid-February this year, global financial markets have increasingly turned volatile, driven by a surge in sovereign bond yields over inflation concerns stemming from the edging up of international commodity prices as well as expectations of stronger growth. Bond market volatility and strengthening of the US dollar spilled over to emerging markets. Expectations of a reflationary cycle in the US led to a retrenchment of portfolio flows to emerging market economies (EMEs) which continued through March.

15. Given the strong inter-connectedness of financial markets across borders and progressive integration into the global financial cycle, there was an upsurge of investor unease in India, despite repeated assurances and forward guidance on liquidity given by the RBI. The benchmark 10-year yield, which traded at 5.93 per cent (on an average) during April 2020-January 2021, spiked to 6.25 per cent on March 10, 2021 before coming down again. In sync with G-sec yields, corporate bond yields also hardened across issuers and rating categories in the recent period. Since end-January 2021, AAA corporate bond yields of 3-year and 5-year maturities have firmed up by 30 bps and 31 bps, respectively, by March 31, 2021. Reflecting these developments, corporate bond issuance in February at ₹45,685 crore has moderated from its peak of ₹88,130 crore recorded in December 2020.

16. Taking note of the market’s discomfort and in consonance with our commitment to ensure ample liquidity and orderly market conditions, the Reserve Bank scaled up its open market operations (OMOs) in February and conducted five special OMOs (operation twists) in February and March; increased the amount for the operation twist (OT) auction on March 4, 2021 from ₹10,000 crore to ₹15,000 crore; and adopted an innovative asymmetrical special OMO (purchase of ₹20,000 crore and sale of ₹15,000 crore) on March 10, 2021 to reinforce the compression of term premia as well as to inject liquidity which drew a favourable market response. These were clear signals that the Reserve Bank will support the market with adequate liquidity through various instruments in its toolkit. The liquidity impact of OMOs could be gauged from the fact that we made net outright purchases amounting to ₹3.13 lakh crore during 2020-21.

17. For the year 2021-22, drawing on this experience, we have decided to put in place what is termed as a secondary market G-sec acquisition programme or G-SAP 1.0, to give it a distinct character. Under the programme, the RBI will commit upfront to a specific amount of open market purchases of government securities with a view to enabling a stable and orderly evolution of the yield curve amidst comfortable liquidity conditions. The endeavour will be to ensure congenial financial conditions for the recovery to gain traction. For Q1 of 2021-22, therefore, it has been decided to announce a G-SAP of ₹1 lakh crore. The first purchase of government securities for an aggregate amount of ₹25,000 crore under G-SAP 1.0 will be conducted on April 15, 2021.

18. The positive externalities of G-SAP 1.0 operations need to be seen in the context of those segments of the financial markets that rely on the G-sec yield curve as a pricing benchmark. In addition, the extension of Held-to-Maturity (HTM) dispensation opens up space for investments of more than ₹4.0 lakh crore. We will also continue to deploy our regular operations under the LAF, longer-term repo/reverse repo auctions, forex operations and open market operations including special OMOs to ensure liquidity conditions evolve in consonance with the stance of monetary policy and financial conditions are supportive for all stakeholders.

19. While laying out the liquidity management strategy for 2021-22, let me unequivocally state that the Reserve Bank’s endeavour is to ensure orderly evolution of the yield curve, governed by fundamentals as distinct from any specific level thereof. Our objective is to eschew volatility in the G-sec market in view of its central role in the pricing of other financial market instruments across the term structure and issuers, both in the public and private sectors. This is a necessary prerequisite for the nascent and hesitant recovery to firm up and become durable. Needless to add, two-way movements in bond yields consistent with the fundamentals are quite normal from a market perspective; however, such movements should not be abrupt and disruptive if financial stability has to be preserved.

20. The Reserve Bank will of course continue to do whatever it takes to preserve financial stability and to insulate domestic financial markets from global spillovers and the consequent volatility. I would urge market participants to take heed of our actions, communication and signals in a balanced manner. Together, we can overcome the challenges and lay the foundations for a durable recovery beyond the pandemic. Let us prepare for our tryst with our potential firmly.

Additional Measures

21. Against this backdrop, and with a view to nurture the recovery, certain additional measures are being announced. The details of the measures are set out in the statement on developmental and regulatory policies (Part-B) of the Monetary Policy Statement.

TLTRO on Tap Scheme – Extension of Deadline

22. With a view to increasing the focus of liquidity measures on revival of activity in specific sectors, the TLTRO on Tap Scheme announced on October 9, 2020 which was made available up to March 31, 2021, is now being further extended by a period of six months i.e., upto September 30, 2021.

Liquidity Facility for All India Financial Institutions

23. Special refinance facilities of ₹75,000 crore were provided to All India Financial Institutions (AIFIs) like NABARD, SIDBI, NHB and EXIM bank during April-August 2020. To nurture the still nascent growth impulses, it is felt necessary to support continued flow of credit to the real economy. Accordingly, liquidity support of ₹50,000 crore for fresh lending during 2021-22 will be provided to AIFIs: ₹25,000 crore to NABARD; ₹10,000 crore to NHB; and ₹15,000 crore to SIDBI.

Enhancement of Limit of Maximum Balance for Payments Banks

24. With a view to furthering financial inclusion and to expand the ability of payments banks to cater to the growing needs of their customers, the current limit on maximum end of day balance of ₹1 lakh per individual customer is being increased to ₹2 lakh with immediate effect.

Asset Reconstruction Companies – Constitution of a Committee

25. Asset Reconstruction Companies (ARCs) play an important role in the resolution of stressed assets. Their potential, however, is yet to be fully realised. It is, therefore, proposed to constitute a committee to undertake a comprehensive review of the working of ARCs and recommend measures to enable these entities to meet the growing requirements of the financial sector.

Permitting Banks to On-lend through NBFCs

26. Recognising the key role played by NBFCs in making credit available to the last mile, bank lending to registered NBFCs (other than MFIs) for on-lending to Agriculture, MSME and Housing was permitted to be classified as Priority Sector lending (PSL). This dispensation which was available from August 13, 2019 till March 31, 2021 is being further extended for another six months up to September 30, 2021.

Priority Sector Lending (PSL) – Enhancement of Loan Limit against eNWR/NWR

27. With a view to encouraging farm credit to individual farmers against pledge/hypothecation of agricultural produce, it has been decided to enhance the loan limit under priority sector lending (PSL) from ₹50 lakh to ₹75 lakh per borrower against the pledge/hypothecation of agricultural produce backed by Negotiable Warehouse Receipts (NWRs)/electronic-NWRs (e-NWRs) issued by warehouses registered with the Warehousing Development and Regulatory Authority (WDRA). For other Warehouse Receipts, the loan limit for classification under PSL will continue to be ₹50 lakh per borrower.

Financial Inclusion Index

28. Financial Inclusion has been a thrust area for the Government, the Reserve Bank and other regulators, with significant progress made over the years. To measure the extent of financial inclusion in the country, the Reserve Bank proposes to construct and publish a Financial Inclusion Index (FI Index) based on multiple parameters. This will be published in July every year for the financial year ending previous March.

Centralised Payment Systems (CPS) – viz RTGS and NEFT – Membership for Entities other than Banks

29. Membership to the RBI-operated Centralised Payment Systems (CPSs) – RTGS and NEFT – is currently limited to banks, with a few exceptions. It is now proposed to enable non-bank payment system operators like Prepaid Payment Instrument (PPI) issuers, card networks, White label ATM operators and Trade Receivables Discounting System (TReDS) platforms regulated by the Reserve Bank, to take direct membership in CPSs. This facility is expected to minimise settlement risk in the financial system and enhance the reach of digital financial services to all user segments.

Interoperability of Prepaid Payment Instruments (PPIs), and Increase in Account Limit to ₹2 lakh

30. The Reserve Bank had issued guidelines in October 2018 for adoption of interoperability on a voluntary basis for full-KYC Prepaid Payment Instruments (PPIs). As the migration towards interoperability has not been significant, it is now proposed to make interoperability mandatory for full-KYC PPIs and for all payment acceptance infrastructure. To incentivise the migration of PPIs to full-KYC, it is proposed to increase the current limit on outstanding balance in such PPIs from ₹1 lakh to ₹2 lakh.

Cash Withdrawal from Full-KYC PPIs issued by Non-banks

31. At present, cash withdrawal is allowed only for full-KYC PPIs issued by banks. As a confidence-boosting measure, and to bring uniformity across PPI issuers, it is now proposed to allow cash withdrawals for full-KYC PPIs of non-bank PPI issuers. This measure, in conjunction with the mandate for interoperability, will boost migration to full-KYC PPIs and would also complement the acceptance infrastructure in Tier III to VI centres.

Relaxation in the Period of Parking of External Commercial Borrowing (ECB) Proceeds in Term Deposits

32. Under the extant External Commercial Borrowing (ECB) framework, borrowers are allowed to place ECB proceeds in term deposits with AD Category-I banks in India for a maximum period of 12 months. In view of the difficulty faced by borrowers due to the Covid-19 pandemic, it has been decided to permit parking of unutilised ECB proceeds drawn down on or before March 1, 2020 in term deposits with AD Category-I banks in India prospectively up to March 1, 2022.

WMA limit for States/UTs

33. We have decided to accept the recommendations of an Advisory Committee constituted by the Reserve Bank to review the Ways and Means Advance (WMA) limits for State Governments/UTs and other related issues. Accordingly, it has been decided to enhance the aggregate WMA limit of states and UTs to ₹47,010 crore, an increase of about 46 per cent from the current limit of ₹32,225 crore which was fixed in February 2016. Further, it has also been decided to continue the enhanced interim WMA limit of ₹51,560 crore granted by RBI due to the pandemic for a further period of six months i.e., up to September 30, 2021.

Conclusion

34. In contrast to the previous year, the hope generated by vaccination drives in several countries at the start of the year 2021 has been somewhat offset by rising infections and new mutant strains worldwide. Yet, the speed and collective endeavour with which the world mobilised scientific energies to develop vaccines, and pandemic-related protocols, that have now become a way of life, give us hope and confidence that we will sail through this renewed second/third surge. Localised spurts in rates of infections will hopefully ebb with the COVID-19 vaccination drives. I truly believe in the indomitable spirit of the human race which confronted the trial by virus during 2020 with resilience and fortitude and the will to survive. Let 2021 be the harbinger of a new economic era for India. I conclude by a quote from Mahatma Gandhi, who continues to inspire us: “If patience is worth anything, it must endure to the end of time. And a living faith will last in the midst of the blackest storm”2.

Thank you. Stay safe. Stay well. Namaskar.

(Yogesh Dayal)

Chief General Manager

Press Release: 2021-2022/15

Source Link:-

1. https://rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=51382

2. https://rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=51381

3. https://rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=51380