Important information : NRI Taxpayer Registration.

- NRI Tax Payer will login through the link www.nriservices.tdscpc.gov.in

- NRI Tax Payer will be able to perform the following activities through the portal:

- Registration

- View/Download Form 26AS

- Download /Correction Form 16B

- Manage profile, change password

Brief Steps : NRI Registration

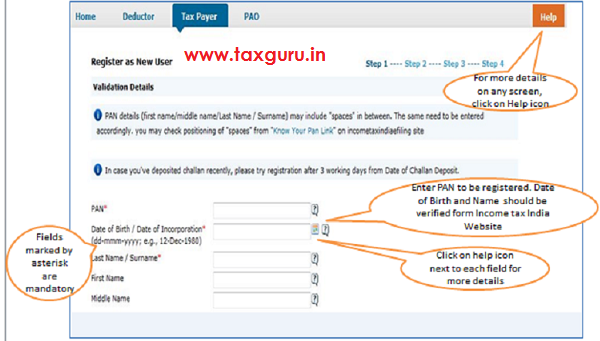

- To register at TRACES, Taxpayer need to click on “Register as New User-Taxpayer”.

- Step 1: Taxpayer need to provide PAN Number, Date of Birth , Name (First, Middle and Surname) after verifying the same from www.incometaxefiling.gov.in

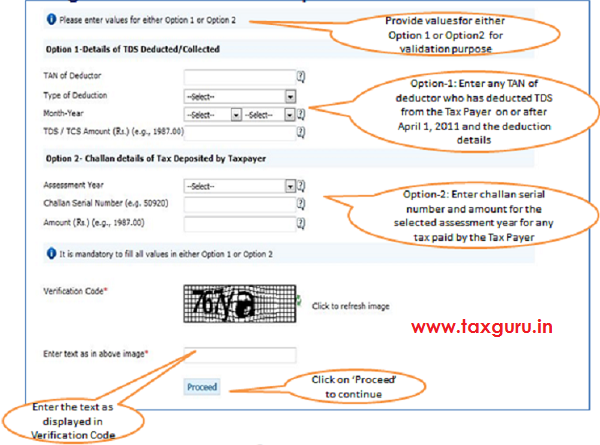

- Taxpayer is required to fill details in either Option 1 or Option 2

- Option 1 details can be filled from 26AS and Form 16/16A provided by the deductor

- Option 2 details can be filed from the challan paid by the Taxpayer for Self Assessment Tax, Advance Tax and TDS on property

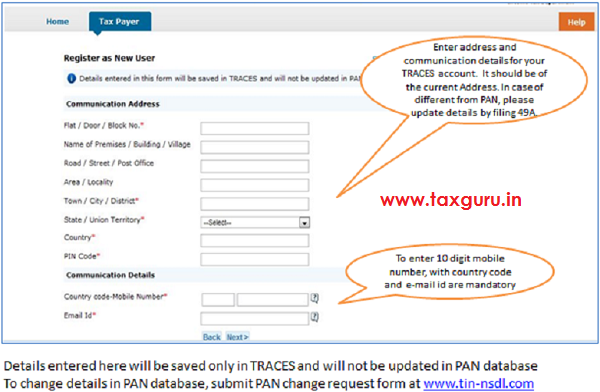

- Step 2: Taxpayer is required to fill Communication taxguru.in Address and Details such as House Number, Block, Mobile Number and Email id to proceed to Step 3

- Step 3 : Taxpayer is required to create password followed by the security question to proceed to step 4

- Step 4 : Taxpayer can see all the details filled earlier and can edit the details if required or else can confirm the same to proceed further

- After completion of all above steps, Taxpayer will receive activation link followed by activation codes on registered email id, which can be used taxguru.in for activation of account, in case of incorrect verification data registration failure mail will be sent to taxpayer

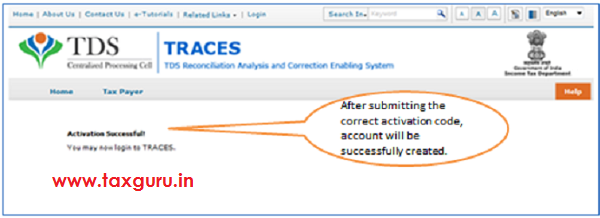

- After activation of account, user will be able to Login on TRACES

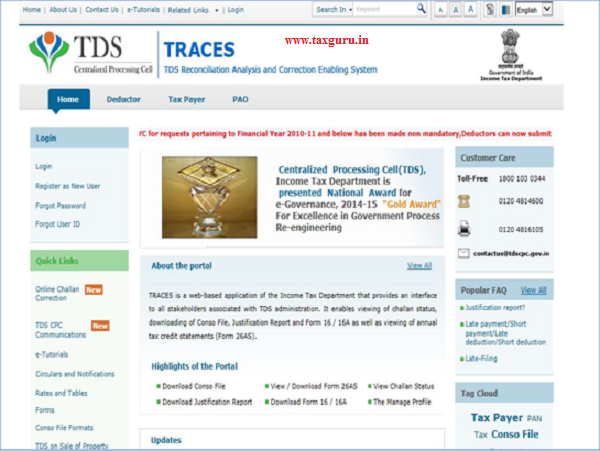

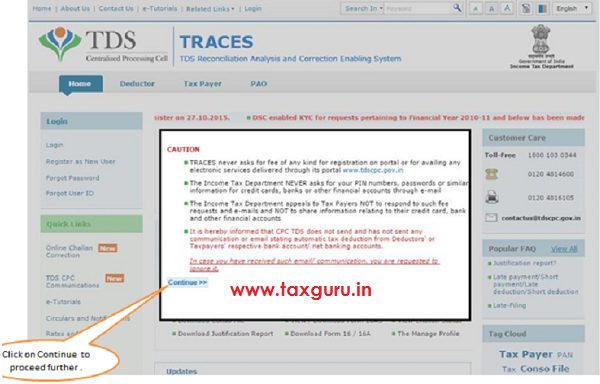

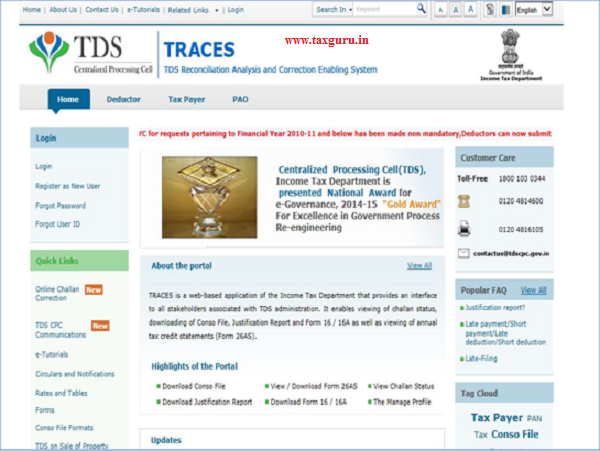

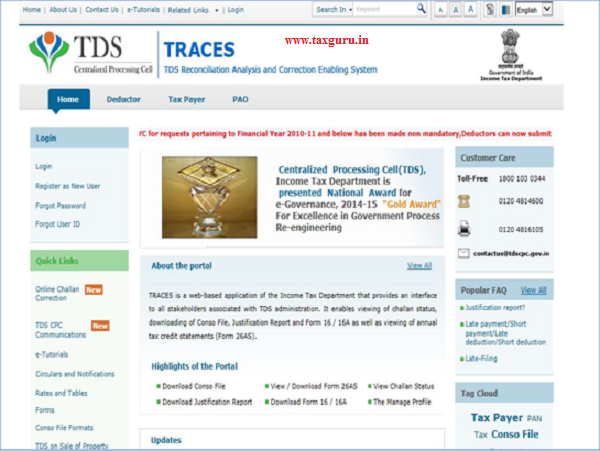

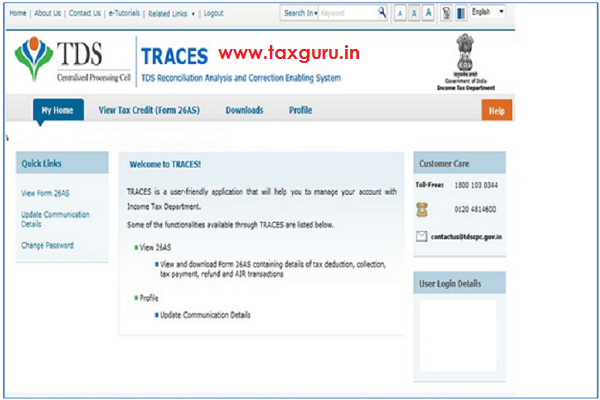

TRACES Home Page

–

–

Register as New User –Step 1: Validation Details

–

Register as New User – Step 1: Important Notes

- In Step-1 – First Name & Middle Name and surname must be entered

- In case PAN Details provided as per PAN card are shown as invalid on TRACES, then please verify the PAN details from www.incometaxindiaefiling.gov.in

- Date of birth should be entered in correct format (dd-mmm-yyyy) as per calendar provided

- Amount should be entered in two decimal places (e.g., 1234.56)

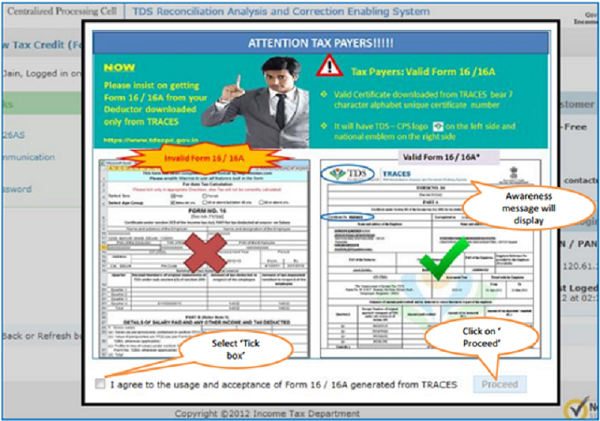

- Option 1 details can be filled from 26AS and Form 16/16A provided by the deductor

- In option-1 Taxpayer has to select the taxguru.in month in which Tax has been deducted instead of Tax deposited

- For Example : TDS deducted in month of December and deposited in the month of January than user has to select December month

- Option 2 details can be filed from the challan paid by the Taxpayer for Self Assessment Tax, Advance Tax and TDS on property

Register as New User –Step 2: Address & Communication Details

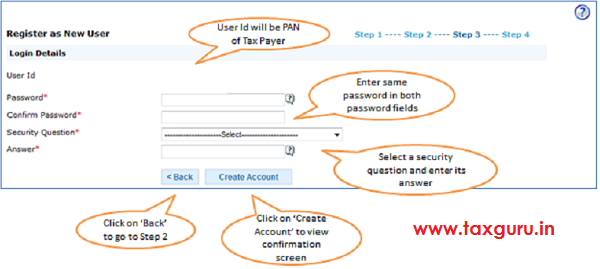

Register as New User –Step 3: Login Details

- Details entered in Step 3 will not be lost if user navigates to Step 2

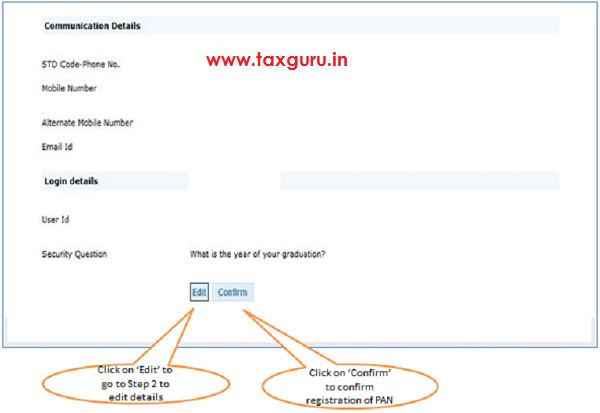

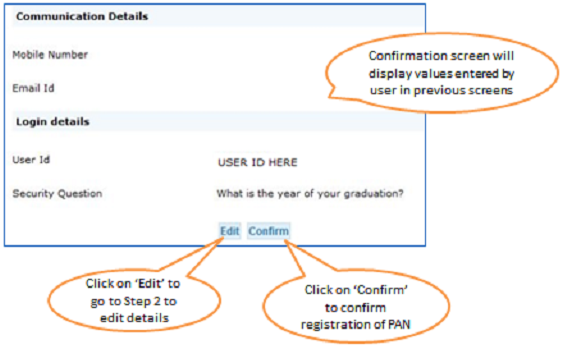

Register as New User –Step 4: Confirmation Screen

–

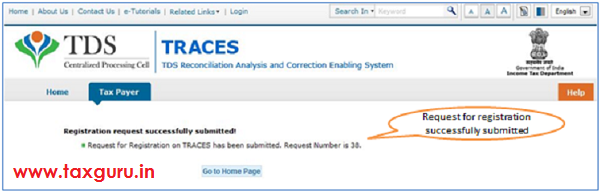

Register as New User –Success Message

- Validations in the form will be checked by TRACES (internally)

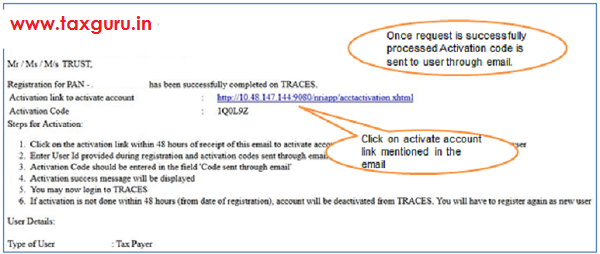

- On successful Registration, Activation link and Code will be sent to user’s registered email address within 48 hours

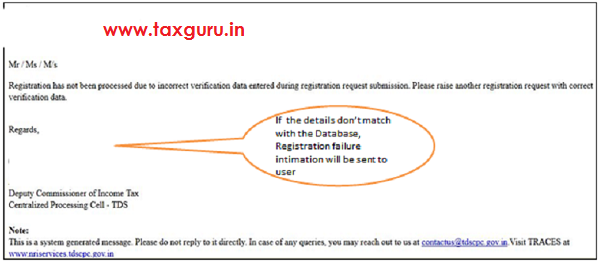

- In case if validation fails, information will be sent to user’s registered e-mail address within 48 hours

- If validation will be approved by TRACES (internally), e-mail for activation of account will be sent to user

- If user does not activate the link within 48 hours of receipt of email, user account in TDS CPC would be deactivated and all data entered by user during taxguru.in registration will be removed from system

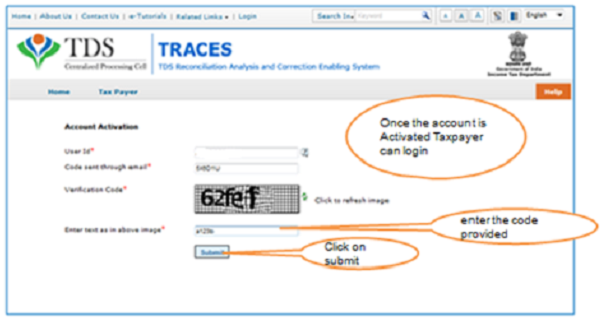

Activation to be done within 48hours of Receiving the Link

Note: Within 48 hours of receipt of e-mail for success message of registration, click on activate account link mentioned in the email and enter the code provided.

Account Activated

Non Completion of Registration –Rejection Message

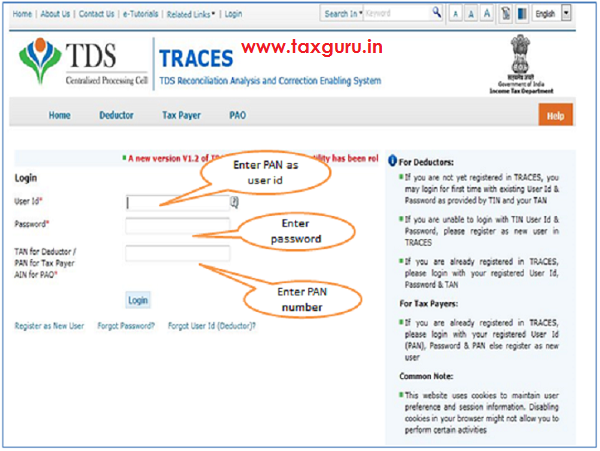

Login to TRACES

NRI Tax Payer Forgot Password

Important Information : NRI Taxpayer Forgot Password

- PAN should be registered on TRACES

- Pan details entered while resetting the password must be same as mentioned at the time of registration

- Amount should be entered in two decimal places (e.g., 1234.56)

- For PAN holders, user id will be PAN Number only.

- Success message will be displayed. Email will also be sent at registered email id intimating the change of password.

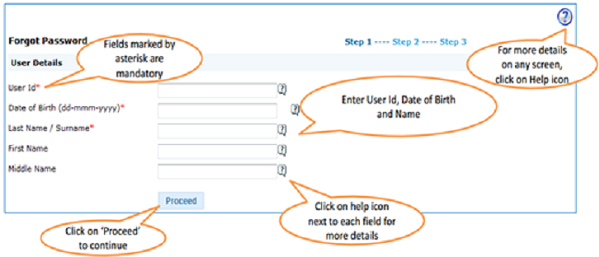

Brief Steps for Forgot Password : NRI Taxpayer

- To reset the password at TRACES, Taxpayer need to click on “Forgot Password” under “Login” tab

- Step 1: Taxpayer need to provide User id (PAN Number),Date of Birth , Name (First, Middle and Surname). In case PAN Details provided as per PAN card are shown as invalid on TRACES, then please verify the PAN details from www.incometaxindia.gov.in

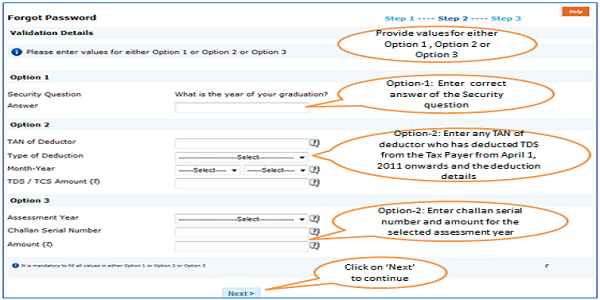

- Step 2 : Taxpayer is required to enter value for either Option 1 or Option 2 or Option 3.

Option 1 : Details for Security Question & Answer.

Option 2 : Details from 26AS and Form 16/16A provided by the deductor

Option 3 : Details of self assessment tax, advance tax or TDS on Sale of Property

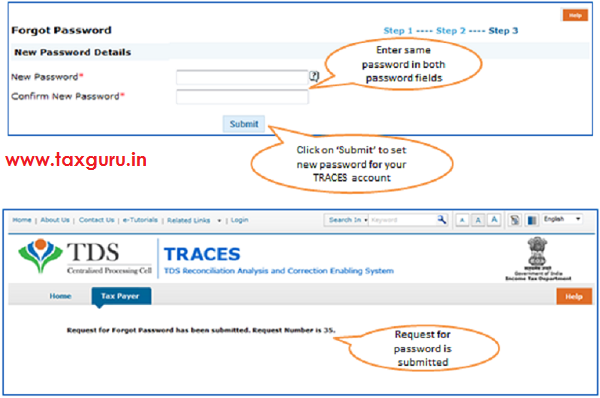

- Step 3 : User can reset the password

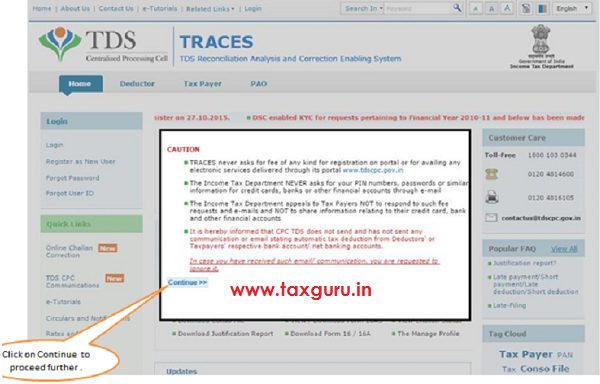

TRACES Home Page

–

Forgot Password

Forgot Password-Step 1:User Details

Forgot Password –Step 2

Forgot Password Step-3

Forgot Password request processed successfully

On successfully password changed, activation link and code will be sent to user’s registered email address within 48 hours

Forgot Password request failed

In case of rejection, information will be sent to user’s registered e-mail address within 48 hours

NRI Tax Payer –Downloading Form 26AS

Important information on 26AS download

- Tax Payer can view/download 26AS from TRACES from A.Y 2009-10 onwards

- 26 AS is available to view Online in HTML Format.

- 26AS is available for download in two formats:

a) PDF

b) Text

- 26AS can also be viewed by logging in other related sites which redirects Taxpayer to TRACES: – www. incometaxindiaefiling.gov.in

- Relevant Bank Account Internet facility: In this case Taxpayer need not to register on TRACES

- NOTE:-Password to open for Form 26AS in PDF/Text Format is “ Date of Birth of Taxpayer“ in DDMMYYYY format.

- Where transactions are 2000 or more than 26AS would be available only in text file. Deductee has to place the download request and need to convert it into excel.

Brief Steps to Download 26AS

- Login on TRACES.

- Taxpayer needs to mention PAN number as user id, password and then need to mention PAN number in the respective column (where TAN of the Deductor/ PAN of Taxpayer is asked) .

- Taxpayer needs to click on “ View Tax Credit(Form 26AS )” tab

- Taxpayer needs to select A.Y and Format for view/download 26AS

- Taxpayer needs to click on “ View/Download “ tab to download or view 26AS

TRACES Home Page

–

Login Page

Steps to download Form 26AS

Steps to download 26AS

–

–

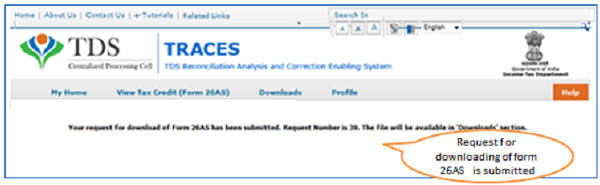

Submit request for Form 26AS (contd.)

Submit request for Form 26AS

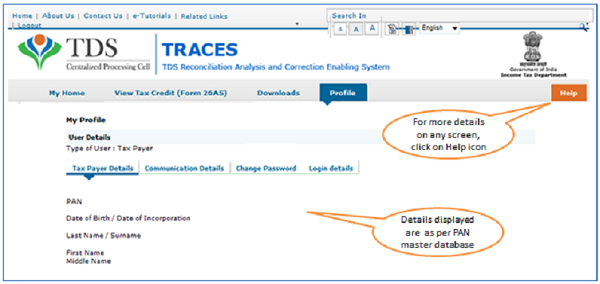

NRI Tax Payer –View and Update Profile

View and Update Profile

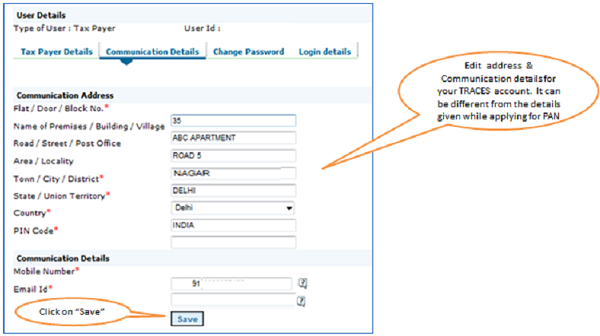

View and Update Profile –Address and Communication Detail

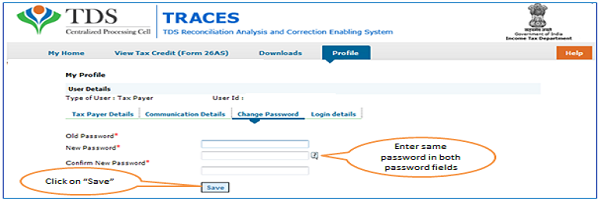

View and Update Profile –Change Password

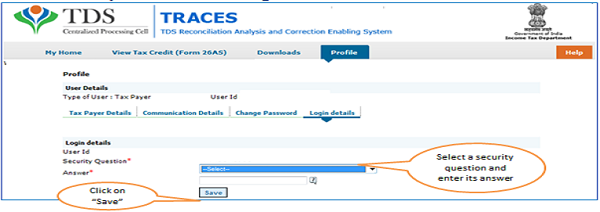

View and Update Profile -Login Details

Tried to register repeatedly but TRACES is failing to validate the Option 1. It looks like an “chicken or egg came first” issue as we have to submit information from Form 26AS in order to register to view Form 26AS.

Same her4e .. I have registered few times and also called TDSCPC.. nothing works and filing date is nearing. no email reply from contatus@tdscpc.gov.in also. Terrible!

This does not work – no activation link or any email from TRACES after going through above process. I have tried several times. Should I be doing something different?