The Directorate of Income Tax (Systems) has released an important communication addressing key functionalities on the Insight Portal. FAQs delve into the details provided in the official notification dated 29th November 2023, covering topics such as Profile Views, I-Search, Verification, Faceless Assessment, Business Intelligence, Data Management, and more.

Directorate of Income Tax (Systems),

ARA Centre, Ground Floor, E-2, Jhandewalan Extension,

New Delhi – 110055

F.No. DGIT(S)-ADG(S)-2/Profile View Access/Misc/ FAQ /1242 Date: 29.11.2023

To,

All Principal Chief Commissioner(s) of Income Tax/ CCsIT

All Principal Director Generals(s) of Income Tax / DGsIT

All Principal Commissioner(s) of Income Tax/ CsIT/ CsIT (Admin & TPS)/ CsIT (TDS)

All Principal Director (s) of Income Tax / DsIT

Sir / Madam,

Sub: – Insight Portal functionalities FAQs— reg.

Kindly refer to the above.

2. Insight portal provides various functionalities such as Profile View, Verification, I-search, Business Intelligence, Data Management, Lensetc.

3. Various queries received on helpdesk, mails as well as queries received during trainings conducted have been compiled and an FAQ has been prepared accordingly.

4. The FAQ annexed herewith may be widely circulated among officers to enhance user experience on the Insight portal.

Yours faithfully,

(MANISH MISHRA)

Addl. Director General (Systems)-2

Copy to:

1. PPS to Chairman, Member (IT &Rev), Member (Admin.& Faceless Scheme), Member (L& S), Member (Inv.), Member (TPS), Member (A&J), CBDT and DGIT(Systems)-2, New Delhi for information.

2. ITBA, Insight i-Library.

Addl. Director General (Systems)-2

Frequently Asked Questions related to Functionalities on Insight Portal

I. Profile Views

Q 1. What is Profile View?

Ans: Profile Views are the consolidated, aggregated, and interrelated views related to taxpayers, deductors, and reporting entities. Information from various departmental and external sources is presented in the profile views to enable a comprehensive view of an entity’s profile, transactions, relationships, and alerts for effective compliance management.

Q 2. How to access Profile View?

Ans: Profile view can be accessed in the following path:

Insight>> Profile>>Taxpayer Profile View

Q 3. What are the types of Access to Profile Views?

Ans: Access to information on Insight Portal is either assignment based or Role Based, or request based.

i. Assignment based access: If a user is assigned a case on Insight the profile view related to the case PAN is automatically available to the user. For instance, JAOs with 148A/NMS/other cases assigned to them can access profile view of the PAN of the case.

ii. Role based access: If a user is from Investigation Directorate, then he or she has access to profile views of all PANs.

iii. JAO Access: JAO’s (of all ranks) can access profile view of PANs within their jurisdiction by submitting Access for Specified Reason code (Recovery of Demand or Pending proceeding as per Income Tax Act 1961) (Path for Seeking Access: Insight>>Profile>>Taxpayer Profile View>>Enter PAN>>Access Request>>Enter Reason Code>>Submit). Once the reason code is entered profile view of the PAN would be immediately granted. For PANs outside jurisdiction the Request based access as mentioned in 3(iv) would be available to users (Please refer to Insight Instruction no.68 attached)

iv. Request based access: If any user desires access to profile view of any PAN he or she can enter the PAN in taxpayer profile view and seek access through the Access request form. The JC/AddlCIT or higher authority is the competent authority to grant approval for such a request. ( Path for Seeking Access: Insight>> Profile>>Taxpayer Profile View>>Enter PAN>>Access Request Form) (B. Path for Granting Access: Insight>>Workspace>>Access Requests>>Pending for Action/Action Taken)

Q 4. What access does JAO have?

Ans: JAO’s have access based on jurisdiction, please refer to Q3 Ans (iii).

Q 5. For any given PAN, how would access be available?

i. If User is an Investigation User, access would be available to all PANs

ii. If a Case is Assigned on Insight, access would be available for that particular PAN

iii. If no case is assigned and the user is not an Investigation user, access can be sought with Approval

iv. If any PAN is entered in Taxpayer profile view basic information of PANs such as Name, DoB/DoI, Address and Jurisdiction is available to all users. Path for basic information access of any PAN: Insight>>Profile>>Taxpayer Profile View>>Enter PAN>>Click PAN

Q6. How to see Confidential Information?

Ans: Access to Confidential information can be sought on Access Request basis as mentioned in Q 3 Ans iv. The approving authority to grant access to confidential information is DIT/CIT/PCIT/PDIT.

Path for seeking access: Insight>>Profile>>Taxpayer Profile View>>Enter PAN>>Access Request Form Path for Granting Access: Insight>>Workspace>>Access Requests>>Pending for Action/Action Taken

Q 7. How to access AIS statement and data related to TDS of the assessee in Insight?

Ans: The AIS statement view of Taxpayer is visible at Insight where the user can view the details of TDS deducted. Path to view the details is available as under: Taxpayer Profile Views>>Annual Summary (TAS). User needs to click on AIS button available at above path to navigate to AIS of the Taxpayer.

II. I-Search

Q1. What is the i-search functionality on Insight?

Ans: i-Search functionality enables users to search tax payers based on Entity, Account, Contact, Address, STR etc. Entity Search provides users the functionality to search PANs of entities based on Name, DoB(DoI) and Address.

Q2. Where do I access I-Search on Insight Portal?

Ans: The path to access I-search is as follows: : Insight>>I-search

Q3. Who can use i-Search functionality on Insight?

Ans: Entity Search module within i-Search is available to all users. Other modules including STR search, contact search etc are available to Investigation users. Verification Unit Users also have access to these modules except STR Search.

Q4. What needs to be done if I-search functionality shows “Service unavailable”.

Ans: This is a technical error, ITD users can raise ticket on insight portal, or they can mail helpdesk@insight.gov.in with their user ID (eg U180999).

Q5. I am not able to click on the contact search hyper link.

Ans: Please use the latest version of google chrome and if you are currently using the updated version, please clear browser history, cache, and cookies.

Q6. What is Website Search?

Ans: This feature provides functionality to the user to search website related content by entering the Key

words of any website.

III. Verification Module

Q1. What is the Verification module?

Ans: – Verification module contains the cases disseminated to the user as per user position, for necessary action. For instance, Investigation users will have STR cases for Verification, whereas JAO will have 148A for verification etc.

Q2. Where do I access Verification module on insight?

Ans: Verification module is available on: Insight Portal>>Verification>>Verification.

Q3. What Functions are available for cases under Verification?

Ans: – Verification module provides MIS and overview of Under Verification and Verified status of the cases pending for verification with the user. The user can check pendency of each case type assigned to him/her. On entering a particular case type, the user can see a detailed list of cases pending for that particular category. For instance, “Verification >> High Risk CRIU/VRU Information >> Cases” through this path JAO can see list of cases and their status here.

IV. Faceless Assessment Officer FAQs

Q1. How to initiate reference to VU in Non-CASS Scrutiny Cases.

Ans: – To ‘initiate reference’ from Non-CASS cases, please navigate to following path: – Access the Case at Insight Portal>> Verification Module >> Taxpayer Section >> Verification Stage >>

– Select Case Type “Non-CASS Scrutiny Cases.”

– Perform Case Level Activity View Initiate Reference.

Q2. How can AU download the Reference report submitted by VU?

Ans: – Reference report submitted by VU can be downloaded by navigating to the following path: Open the relevant case (from which reference was initiated) >>Internal Request >> Outward Reference >> Click on Verified hyperlink.

Q3. What is the path for generating the approved request initiated for new reference/ reference report?

Ans: – Please refer the below path: –

–Navigate to Workspace>>Activity approval>>Pending for Action

– Select the relevant reference and click on the count hyperlink

– Click on Activity hyperlink to view details of activity and click on button “Generate Approved Request”.

Q4. Can reference be initiated to VU where entity id is TAN/ITDREIN.

Ans: – As per existing functionality, reference cannot be initiated on ‘TAN/ ITDREIN’. To initiate such references, PAN of TAN/ ITDREIN can be fetched through Deductor/ Reporting Entity profile views (Path – Insight>> Profiles). If still PAN is not available, reference (other than Non-Responsive Reference) can be initiated by mentioning “NOPANFOUND”. Then relevant VU can generate notice u/s 133(6) on non-PAN also.

Q5. Can we generate notice u/s 133(6) to Reporting Entity without ITDREIN.

Ans: -As per current functionality, notice u/s 133(6) to reporting entity can only be issued if entity is registered with Income Tax Department as Reporting Entity and have ITDREIN. Hence ITDREIN is mandatory to issue notice u/s 133(6) to RE. However, notice u/s 133(6) can also be issued to PAN by selecting recipient option as ‘Other Taxpayer’.

Q6. How to issue notice in case of “no digital footprint” cases?

Ans: VU can issue Notice by using “Issue Notice functionality” available in No Digital Footprint Reference Cases

Q7. The AU in a reference initiated to the VU wants to communicate with the VU regarding what things it wants to focus through physical verification of the case. in these cases, how can AU communicate with VU and vice-versa?

Ans: AU can communicate to VU through Internal Communication. Link to Internal Communication is available under Internal Request Tab of Relevant case on click of hyperlink of Reference ID.

Q8. How to open the downloaded documents from Insight? How to install Seclore?

Ans: The documents can be downloaded from Insight Profile Views and Documents Tab under relevant Case. For opening any document, Seclore is required to be installed in the system. For downloading Seclore. For support regarding installation of Seclore, Installation User Guide and Quick Reference Guide are available at Insight under i-Library option.

Q9. Sometimes the information available on Insight is insufficient wrt third parties related to the assessee. How can we get information from the third parties like SRO through Insight? Whether 133(6) can be issued directly through Insight?

Ans: The third-party data is sent to the Insight as per the section 285 of the IT Act and MOUs with the third parties. The information available in the Insight Portal may only be treated as prima facie information, which is shared by various entities, both internal and external. Wherever required the AO may independently verify and cross examine the information from assessee and related third parties.

The third-party information can be verified by issuing 133(6). On Insight, the VU user can issue 133(6) using the following path.

Path – Taxpayer Verification case (VU Case)>> Case Details>>Select Activity “Issue Notice (PDF)”. Select Notice u/s/ 133(6). Search and Select Relevant Reporting Entity from whom Information is required.

Sometimes it is noticed that there is no available PAN for third parties. In such cases, physical verification reference can still be initiated by mentioning ‘NOPANFOUND’ in Entity ID field. In such cases, VU officer will be able to generate notice without PAN. However, unlike other notices such notices, where PAN is not available, will not be available on Compliance portal to recipient and relevant notice must be served offline e.g., through Speed Post etc. The path for notice generation will remain the same.

V. Lens

Q1. What is Insight Lens?

Ans: Insight Lens is a functionality in Business Intelligence module of Insight through which user can design queries and execute the same to filter out a list of potential entities for further Verification. Users can filter and generate list of entities based on region, nature of taxpayer, financial ratios, turnover etc.

Q2. How to access Insight Lens?

Ans: Step 1 Go to the Insight portal at https://insight.gov.in/

Step 2 Use the username (same as in ITBA) and password to log in. Step 3 Under Business Intelligence tab click on the Insight Lens Tile Step 4 User will be Navigated to Insight Lens Home Page.

Q3. Who can access Insight Lens?

Ans: Investigation users can access Insight Lens.

Q4. What are the Key features of Insight Lens?

Ans-The Key features of Insight Lens are: –

1. Insight Lens allows users to query the complex database in a user-friendly manner to find out list of Entities.

2. The List of Entities can be further filtered to reach the potential list of Entities meeting the specific Search criteria.

3. The Output generated through Insight Lens can be viewed in a secure manner and can be further analyzed to reach a meaningful conclusion.

4. The Output can be downloaded in CSV Format for further analysis.

5. The query and underlying output can be shared with other specific users or with all users globally.

6. Data analytics Tools have been provided to perform analysis on 2 or more Queries or Output List

7. The Potential list of Entities can be posted to Actionable Insights for further Verification by Insight User

VI. Data management (Document Upload)

Q1. What is the functionality available in Data Management?

Ans: The functionality for Bulk Data upload has been provided for ITD Users under Data Management. User can upload Bulk data through CRIU and VRU Utility. Also, Verification Report can be uploaded one by one through “Verification Report Upload Screen”.

Q2. How do I access Data Management?

Ans: The path to Data management is as follows: : Insight>>Data Management

Q3. Who can use the Data Management modules?

Ans: Bulk Upload Functionality under Data Management can be accessed by any ITD User authorized to use the Insight Portal.

Q4. When can a user upload information through CRIU/VRU?

Ans: Information can be uploaded by ITD User at any time.

Q5. How do I track the information uploaded?

Ans: Information uploaded by ITD User under CRIU can be viewed by the person uploading the information under Data Management>>CRIU>>View Information Tab

Information uploaded by ITD User under VRU can be viewed by the person uploading the information under Data Management>>VRU>>View Uploaded Information Tab

Q6. Is it mandatory to upload a document with the information being uploaded?

Ans: It is mandatory to upload one document against each Information under VRU and one General Document in each packet in CRIU.

Q7. How large can be the upload packet size?

Ans: Upload Packets can be of Maximum 30 MB with 6 MB per document in the packet.

VII. Business Intelligence

Q1. What is Business Intelligence?

Ans: Business Intelligence module has transformed data into meaningful and useful information for decision making, performance management and risk monitoring.

Business Intelligence reports facilitate:

- Centralized view of data across departments to drive meaningful information.

- Multi-dimensional analysis and trends with drill-down, drill-up and drill-across facilities across different hierarchies and time dimensions.

- Monitoring of selected risk areas.

BI provides users the following tiles for MIS monitoring and other uses:

- Tax Collection

- Tax Base

- ITR Information

- Business Information

- Exemption

- Taxpayer Compliance

- TDS Information

- TDS Compliance

- International Transaction

- Third Party Information

- E-Verification

- Litigation and Demand Management

- Faceless Assessment

- BI List

Q2. How to access Business Intelligence Module?

Ans: User can access Business Intelligence from below path: –

Path for BI Module: Insight >> Business Intelligence >> Different Themes (Tax Collection, Tax Base, ITR Information, Business Information etc.)

Q3. Who can access Business Intelligence?

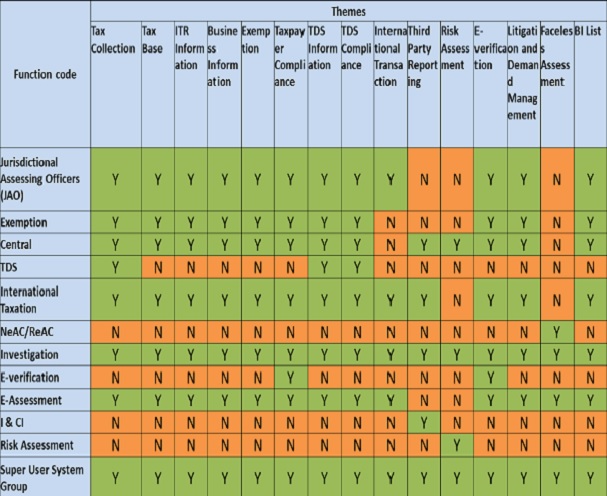

Ans: Role-based access has been provided to the field users. Position & function code to jurisdiction mapping has been taken from HRMS. Access Matrix is given below: –

Q4. How to view BI Dashboard data by JAO?

Ans: Jurisdictional Assessing Officers can view BI module through below mentioned path:

Path for BI Module: Insight >> Business Intelligence

In case of any troubleshoots required, you may raise a ticket at Insight portal along with the screenshot or email at helpdesk@insight.gov.in

Q5. While accessing BI module, in few themes it often prompts that ‘You are not authorized to access this report’. How to resolve this issue?

Ans: Different themes have been developed under Business Intelligence module based on different function codes such as Assessment, Exemption, TDS, International Taxation, Faceless Assessment etc. and access has been provided based on the access matrix as mentioned in Q3. In case users facing access issue, they can contact helpdesk team through email helpdesk@insight.gov.in

Q6. Which module provides refund related information?

Ans: Refund monitoring reports are available under:

Business Intelligence Module >> Tax Collection Theme and in Business Intelligence module >> ITR Information theme

Refund status can be checked in Taxpayer Profile view in Annual Summary module.

Path: – Taxpayer Profile >> Annual Summary >> Refunds

Q7. Is data of budget collection, tax collection or regular tax collection available for monitoring and submission of reports?

Ans: The above information is available in Tax collection reports displaying Current Year and Previous Year collection figures under Business Intelligence module. The above information is being updated in a timely manner for reporting purposes.

Q8. Are total demand data figures available at Insight?

Ans: In the Business Intelligence module, the above information is available in Arrear Demand & Current Demand reports available under Litigation and Demand Management theme.

VIII. Helpdesk

1. What is the Insight Helpdesk?

Ans: Insight Helpdesk is the centralized grievance redressal and technical assistance centre. Helpdesk helps users troubleshoot issues faced while using Insight portal.

2. How can I lodge a ticket on Helpdesk?

Ans: On Insight landing page (https://insight.gov.in/) click “Help”, then log in using the login credentials and lodge the ticket. The ticket and its status can also be tracked in this Helpdesk page. For email helpdesk can be reached at helpdesk@insight.gov.in.