Introduction: Form 26QB is a crucial document for deducting tax at source (TDS) on property sales. However, errors and mistakes can occasionally occur in this form. If you find inaccuracies in your Form 26QB, don’t worry; you can correct them. This article serves as a comprehensive guide on how to correct Form 26QB.

How to correct Form 26QB

Form 26QB-TDS on Sale on Property

Form 26QB is an e-Form which is a a challan-cum-statement’ of deduction of tax under Section 194-IA of the Income Tax Act, 1961. Form 26QB needs to be filed electronically by the deductor (buyer of the property) at e-filing website of the department (www.incometax.gov.in) within 30 days from the end of the month in which tax was deducted.

Online correction in Form 26QB

Q.1. How to correct errors/mistakes in Form 26QB?

Ans: The errors/mistakes in Form 26QB can be corrected online by the deductor (buyer of the property) by logging in at the TRACES website. Relevant e-tutorials available on the home page of TRACES website may also be referred to the ease of using the 26QB correction functionality.

Q2. Who can apply for correction in Form 26QB?

Ans: The deductor (buyer of the property) registered at the TRACES website can submit request for “26QB” correction available under the Tab “Statements/Forms”.

Q3. What can be corrected in Form 26QB?

Ans: Correction can be made in critical (allowed twice only) and non-critical fields. Following are the critical and non-critical fields:

| Sl. No | Critical Fields | Non-Critical Fields |

| 1. | PAN of buyer | Major Head |

| 2. | PAN of seller | Address of buyer |

| 3. | Financial Year | Address of seller |

| 4. | Amount paid/credited | Email ID of buyer |

| 5. | Date of payment/credit | Mobile Number of buyer |

| 6. | Date of deduction | Email ID of seller |

| 7. | Property details | Mobile Number of seller |

| 8. | Total value of consideration | Date of Agreement/Booking |

| 9. | Payment Type | |

| 10. | Total Amount Paid/Credited in previous instalments. | |

| 11. | Total Stamp Duty Value of the Property |

Q4. What are the steps for the 26QB correction?

Ans: The steps for 26QB correction are provided as follows:

Step 1: The deductor (buyer of the property) has to login at the TRACES website as a Taxpayer with a registered User ID and Password.

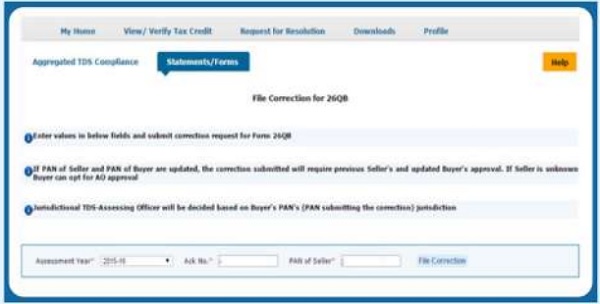

Step 2: Select the option “Request for Correction” under “Statements/ Forms” tab to initiate a correction request.

Step 3: Enter relevant “Assessment Year”, “Acknowledgement Number” and “PAN of Seller” according to filed 26QB, then Click on “File Correction” to submit a request for correction. A request number will be generated after the submission of the Correction Request.

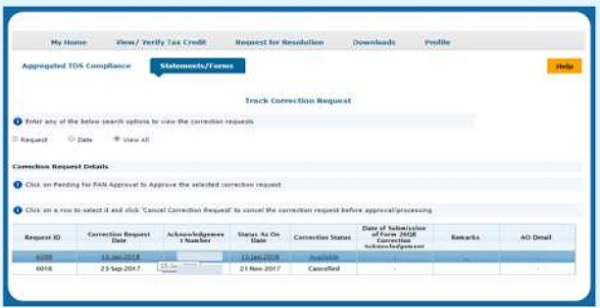

Step 4: Go to “Track Correction Request” option under the “Statements/ Forms” tab and initiate correction once the status is “Available”. Click on the “Available” status to continue.

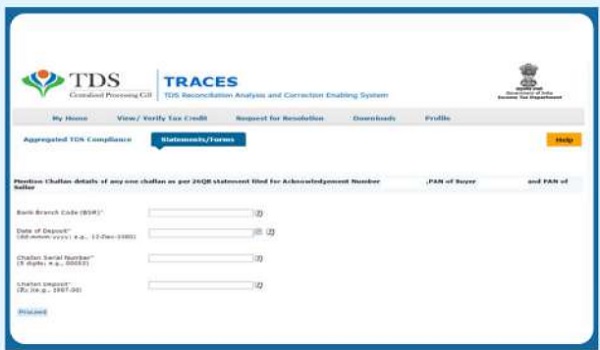

Step 5: Mention CIN details as per the 26QB statement filed, then click on “Proceed”.

Step 6: User can select the required field to edit details in 26QB. After clicking on the “Edit” tab, a message will pop up on the screen. Click on “Save” to save the updated details, then click on “Submit Correction Statement”.

The screen will display “Confirm details” after submission of the Correction Statement (Updated details will be highlighted in yellow).

Profile details will be populated as updated on Traces. Click on “Submit Request” to submit a correction request.

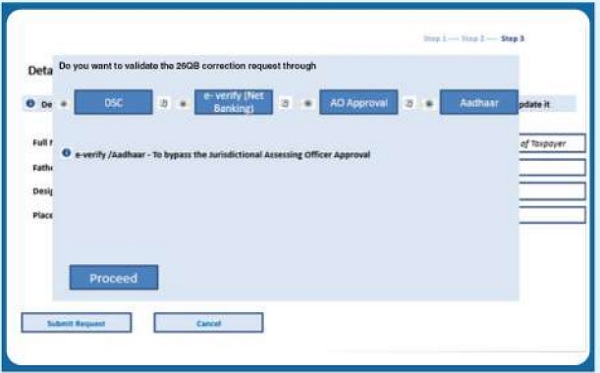

Step 7: After the submission, user is required to validate the Correction request. If DSC is registered, user can validate the request using the DSC. If DSC of the user is not registered, they can validate the correction request using the options e-verify (Net Banking), AO Approval and Aadhar OTP.

–

Remember

- After successful submission of correction, a Correction ID will be generated through which the status of correction can be tracked.

- If DSC is not registered, furnish a hard copy of the acknowledgment of form 26QB correction, Identity proof, PAN Card, the documents related to transfer of property and the proofs of payment, to the Jurisdictional AO (whose details appear against your correction request) for verification.

- The user can submit 26QB Correction statements without approval from Assessing Officer using e-Verify (Net-banking) /AADHAR/DSC validation.

- The e-verification option is not available for NRI Taxpayers.

Property of joint owner sold to a single buyer. Buyer had paid the purchase amount to both owner but had deducted TDS from only one seller account. Seller also claimed in only one account but the credit not given by the Department as the receipt/income was mismatching. Now if buyer want to rectify the form 26QB is it possible to file two separate form in the name of each seller dividing the amount. Amount from the seller whose account was taken earlier will be reduced and to be transferred to another seller’s account. Please guide