Office of the Principal Additional Director General of Systems & Data Management

GST and Central Excise, GST Bhavan,

No. 26/1, Mahathma Gandhi Road, Nungambakkam, Chennai -34

C.No: DGSYS/APP/CZU/RGM0/1/2020-ADD/ JD-III

Date: 15-05-2023

Registration Advisory no. 23/2023

Sub: New functionality to view Aadhaar authentication status, to view/ download e-KYC documents for new registration applications and to upload e-KYC documents in PV report-reg.

*****

As per section 25 of the CGST Act, 2017, for new registration applications, GSTN has introduced the mandate of Aadhaar authentication for all Constitutions of Business (CoB) like proprietorship, partnership, limited company, etc., except for four CoBs viz. Government Department, Public Sector Undertaking, Local Authority and Statutory Body. The applicants of new registration are required to authenticate Aadhaar in (1+1) form i.e., any one key person among the proprietors/partners/promoters and the primary authorised signatory among the signatories. A new registration application and subsequently the GSTIN (on approval of the application) is considered as Aadhaar authenticated only if Aadhaar authentications of both, one proprietor/partner/promoter and the primary authorised signatory, in case these are different persons, are completed successfully on the GST portal while filing the new registration application. In case where a proprietor/partner/promoter is also the primary authorised signatory, Aadhaar authentication of the one person is sufficient. Further, GSTN has enabled the applicants to upload E-KYC documents as on alternative and viable means of identification when the Aadhaar authentication is not or could not be successfully completed.

2. These changes are now integrated in the CBIC-ACES-GST application and are deployed to production. (Screenshots enclosed)

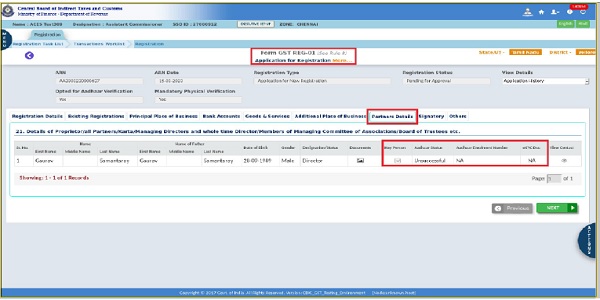

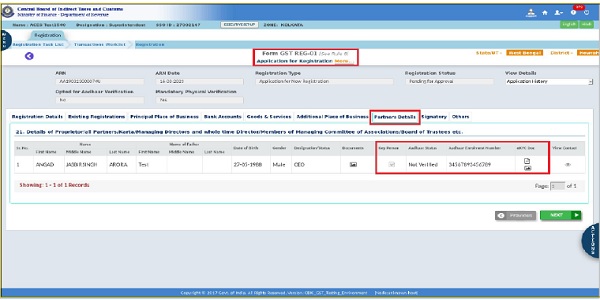

3. Accordingly, CPC officers and tax officers initiating PV or submitting PV report can now view the Aadhaar authentication status of the applicant (screenshot nos. 1.1, 1.2, 2.1 and 2.2) and view/download the E-KYC documents submitted, if any, (screenshot nos. 1.3, 1.4) in the ‘Partners Details’ and ‘Signatory’ tabs of the new registration application. Tax officers can do the same in the REG-Ol form after the application is approved and jurisdiction is assigned. CPC officers can now raise e-KYC related queries (screenshot nos. 10.2 and 10.3) under a new section name ‘E-KYC Documents’ (screenshot no. 10.1) under ‘Authorised signatory’ and ‘Promoters/Partners’ tab names (screenshot no. 10).

4. Further, a new functionality is introduced, as on optional one, in ‘Document’ tab of form REG-30 (PV report) using which tax officers carrying out physical verification (PV officer, in short) can upload multiple e-KYC documents of the proprietors/partners/promoters and the primary authorised signatory in .jpeg, .jpg and .pdf formats of up to 1 MB each (screenshot no. 3) for perusal by CPC officers. In this functionality, PV officer can select proprietor/partner/promoter or primary authorised signatory under ‘Partner/Signatory’ column (screenshot no. 4) and the type of e-KYC document to be uploaded under ‘E-KYC Document’ column (screenshot no. 5). If there are multiple partners/ promoters, PV officer can select a name in the drop down under ‘Name of the person’ column for which e-KYC document is to be uploaded, in the ‘Document’ column by clicking in ‘Choose file’. Once all the 4 columns are filled, officer needs to click on the ‘Add’ button to add the record to the PV report (screenshot nos. 6 and 7). Without adding, the record will not form a part of the PV report. All the four columns would be mandatory to add a record successfully. Officer can add multiple records. Officer can delete any added record or clear an ongoing record by clicking on the ‘delete’ icon (screenshot nos. 8 and 9). No change can be done after the submission of the PV teport.

5. The vendor (Wipro) is required to rectify the defects/errors/bugs, noticed if any, in the functionality after its deployment to production. It is therefore requested that this advisory may be circulated among all the concerned officers for their guidance, and issues, if any, in performance of the functionality may immediately be reported to helpdesk@icegate.gov.infor necessary resolution. Copy of the communication with ticket details and error screenshots may also be forwarded to this office at reg.dgschennai@icegate.gov.in for further follow up.

S.K. VIMALANATHAN

Pr. Additional Director General

To

1. All the Pr. Chief Commissioners/Chief Commissioners of GST Zones.

2. The Pr. DG/DG, DGGI/DGGST/DG (Audit)/DG (TPS).

3. The Commissioner, GST (Policy Wing).

4. All the Pr. Commissioners/Commissioners of GST.

5. The Pr. ADGs/ADGs of Systems, New Delhi/ Bengaluru / Kolkata.

Copy submitted to.

The Pr. Director General, Systems & Data Management, New Delhi for information

Screenshots

1) Aadhaar and e-KYC details in Partners Details’ tab in REG-01 application:

1.1) Scenario 1: When Aadhaar authentication is opted for but is not successful and no e- KYC document is uploaded:

1.2) Scenario 2: When Aadhaar authentication is opted for and is successful, and e-KYC document is not required:

1.3) Scenario 3: When Aadhaar authentication is not opted for and e-KYC documents are submitted along with Aadhaar enrolment number:

1.4) e-KYC documents can be viewed and downloaded: